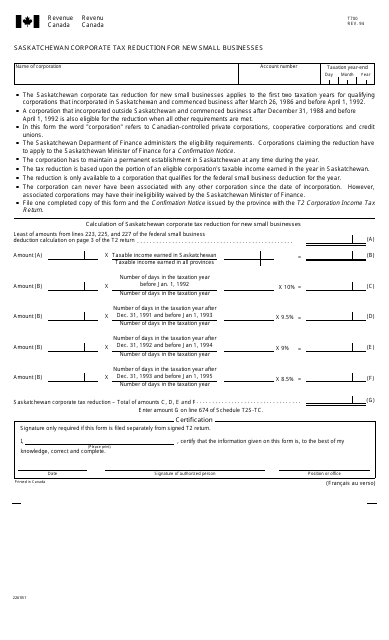

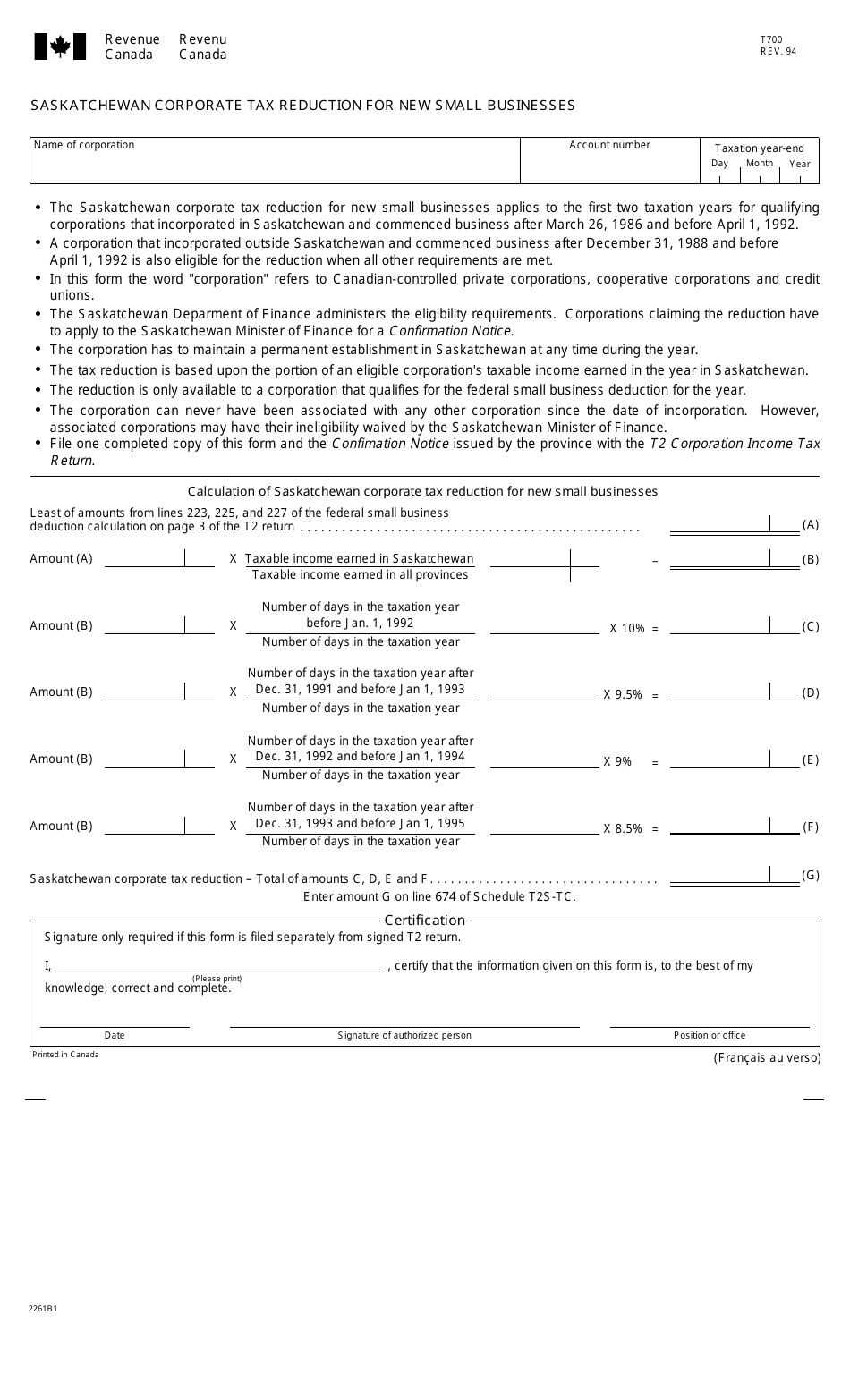

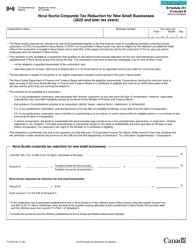

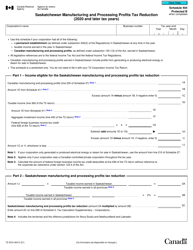

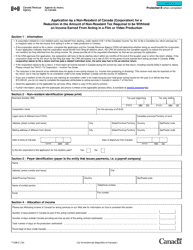

Form T700 Saskatchewan Corporate Tax Reduction for New Small Businesses - Canada

Form T700, Saskatchewan Corporate Tax Reduction for New Small Businesses, is a document used in Canada for eligible small businesses in Saskatchewan to apply for a reduction in corporate income tax. It allows new businesses to claim a reduction in their tax liability for the first three years of operation.

The Form T700 Saskatchewan Corporate Tax Reduction for New Small Businesses in Canada is typically filed by small businesses in the province of Saskatchewan.

FAQ

Q: What is Form T700?

A: Form T700 is a tax form used in Saskatchewan, Canada.

Q: What is the purpose of Form T700?

A: The purpose of Form T700 is to claim the Corporate Tax Reduction for New Small Businesses.

Q: Who can use Form T700?

A: Form T700 can be used by new small businesses in Saskatchewan.

Q: What is the Corporate Tax Reduction for New Small Businesses?

A: It is a tax reduction program for new small businesses in Saskatchewan.

Q: How do I qualify for the Corporate Tax Reduction?

A: To qualify, your business must meet certain criteria set by the government of Saskatchewan.

Q: When should I submit Form T700?

A: Form T700 should be submitted with your annual tax return.

Q: Is there a deadline to submit Form T700?

A: Yes, the deadline to submit Form T700 is usually the same as the deadline for filing your tax return.