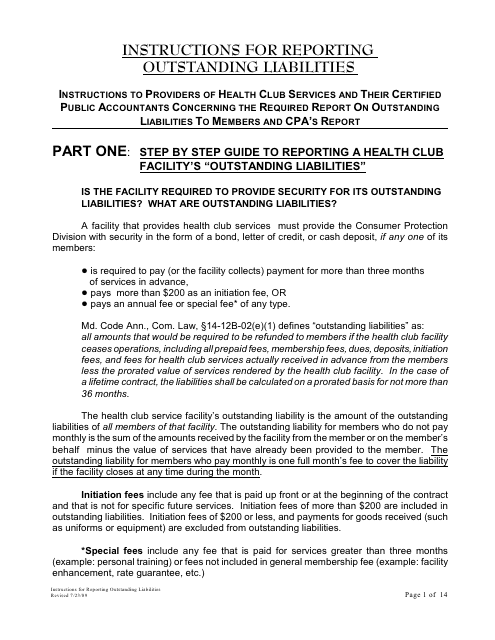

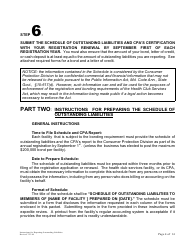

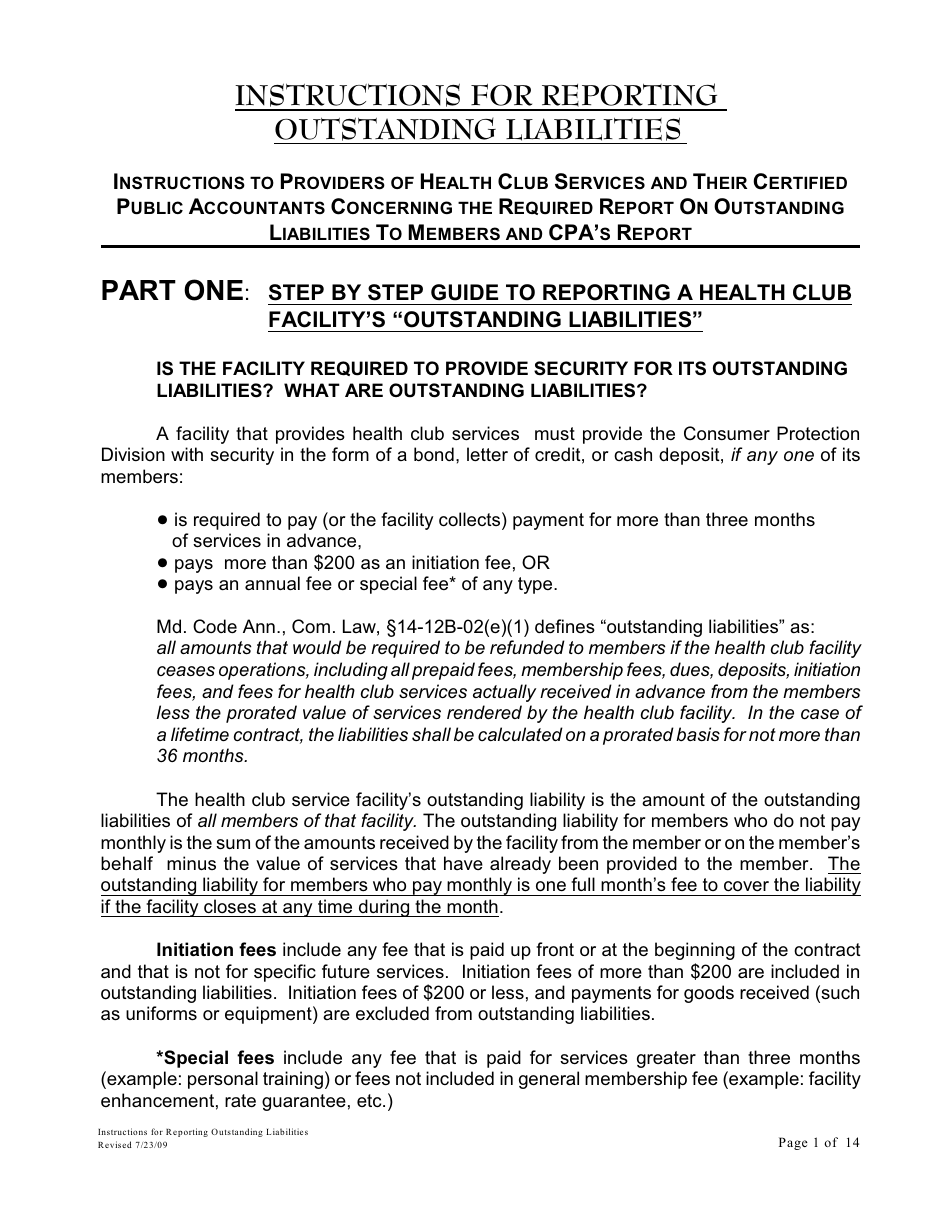

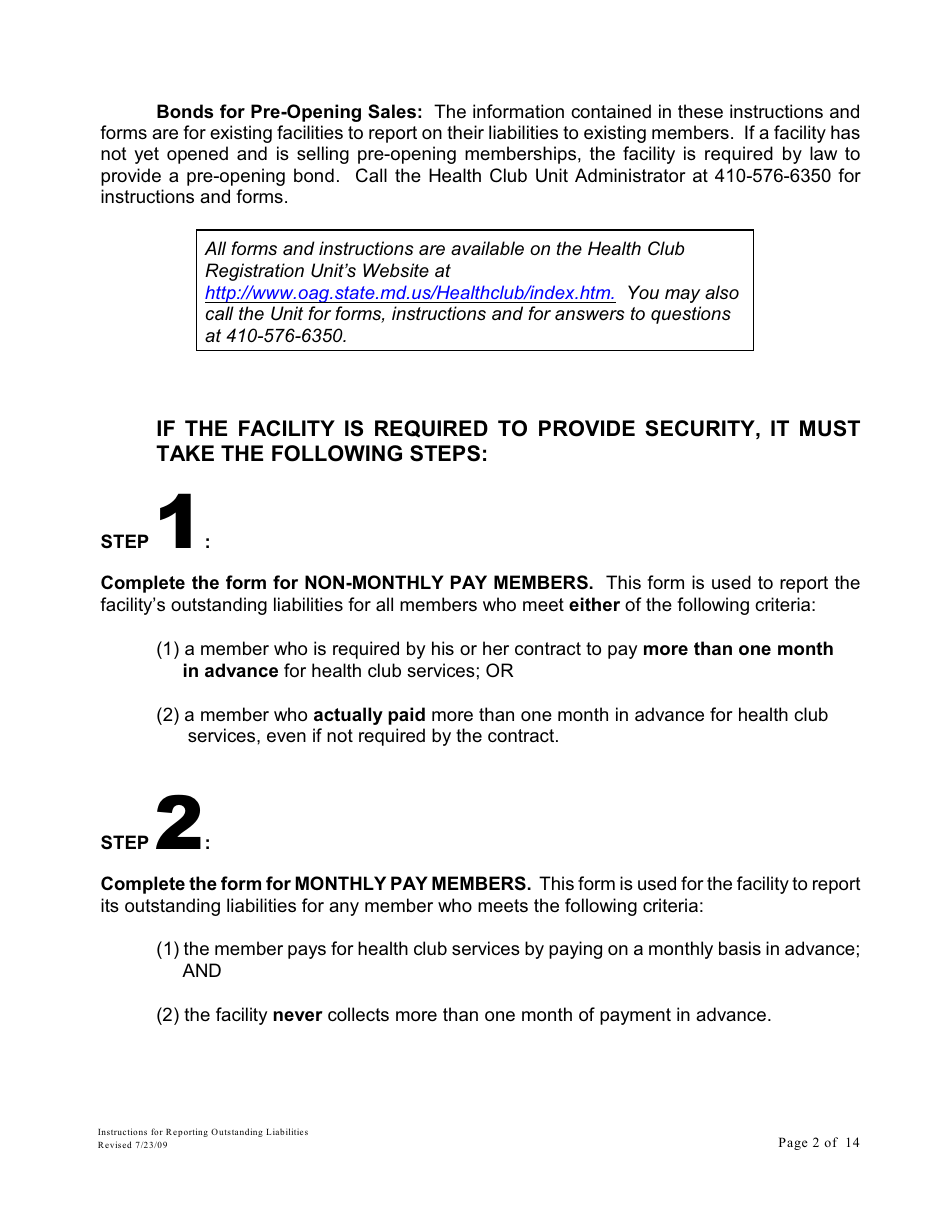

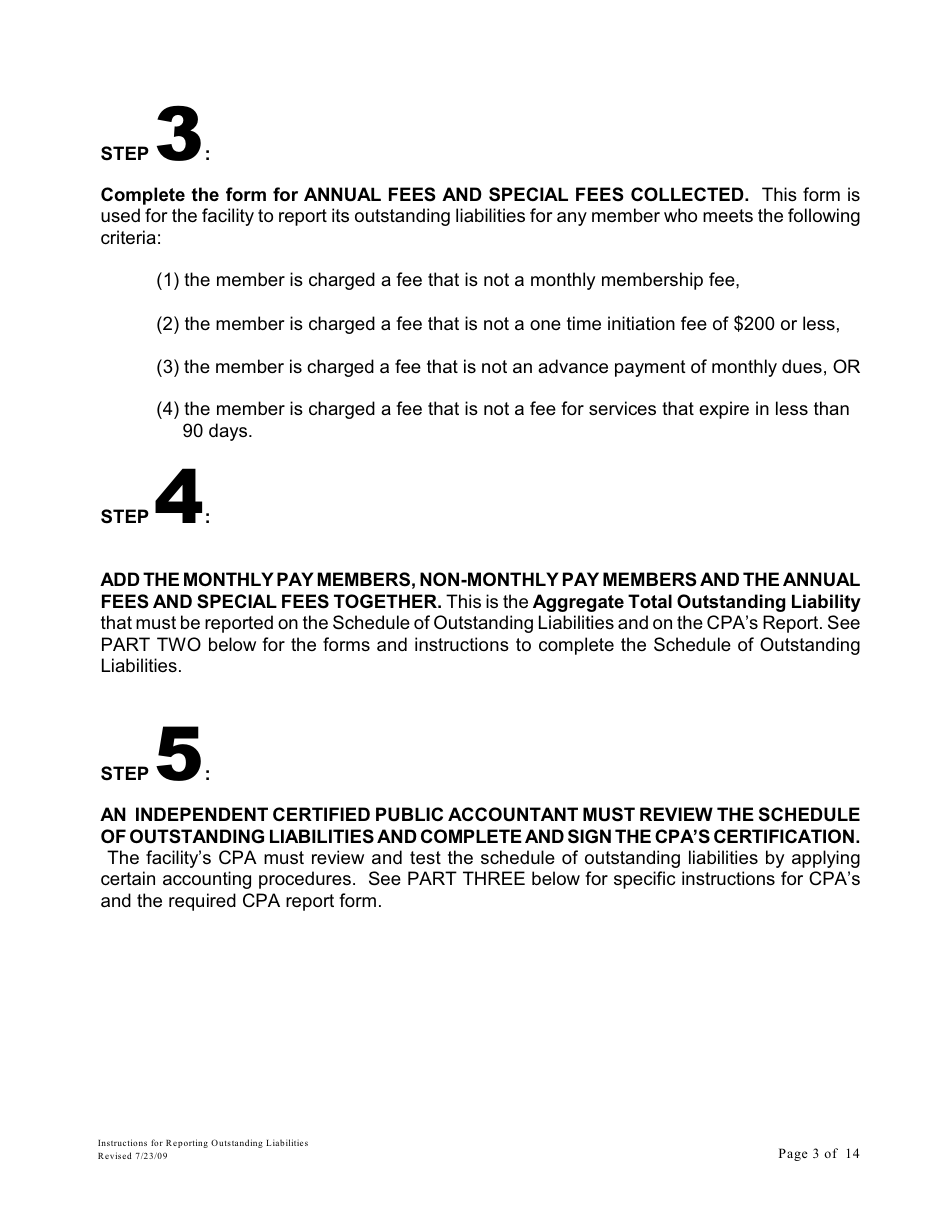

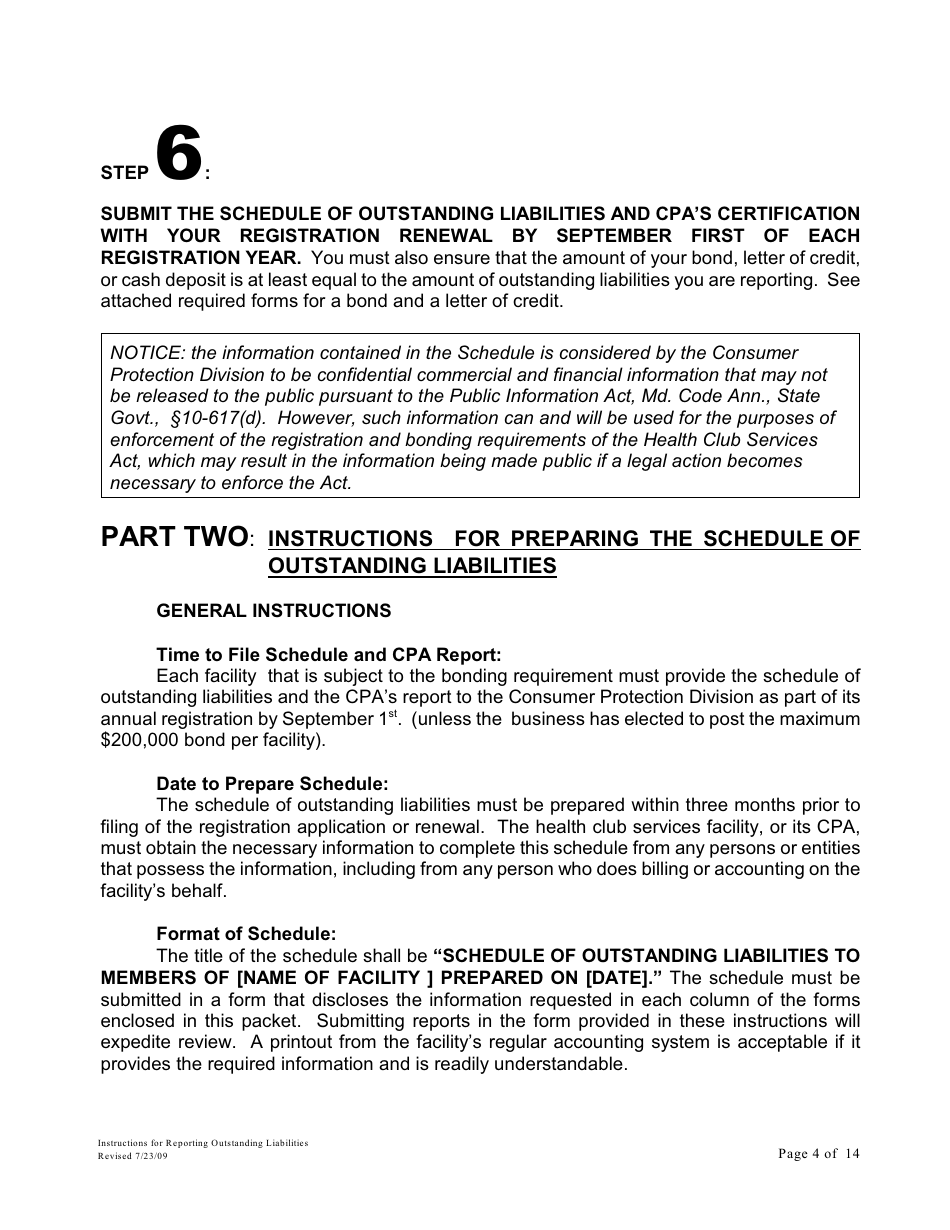

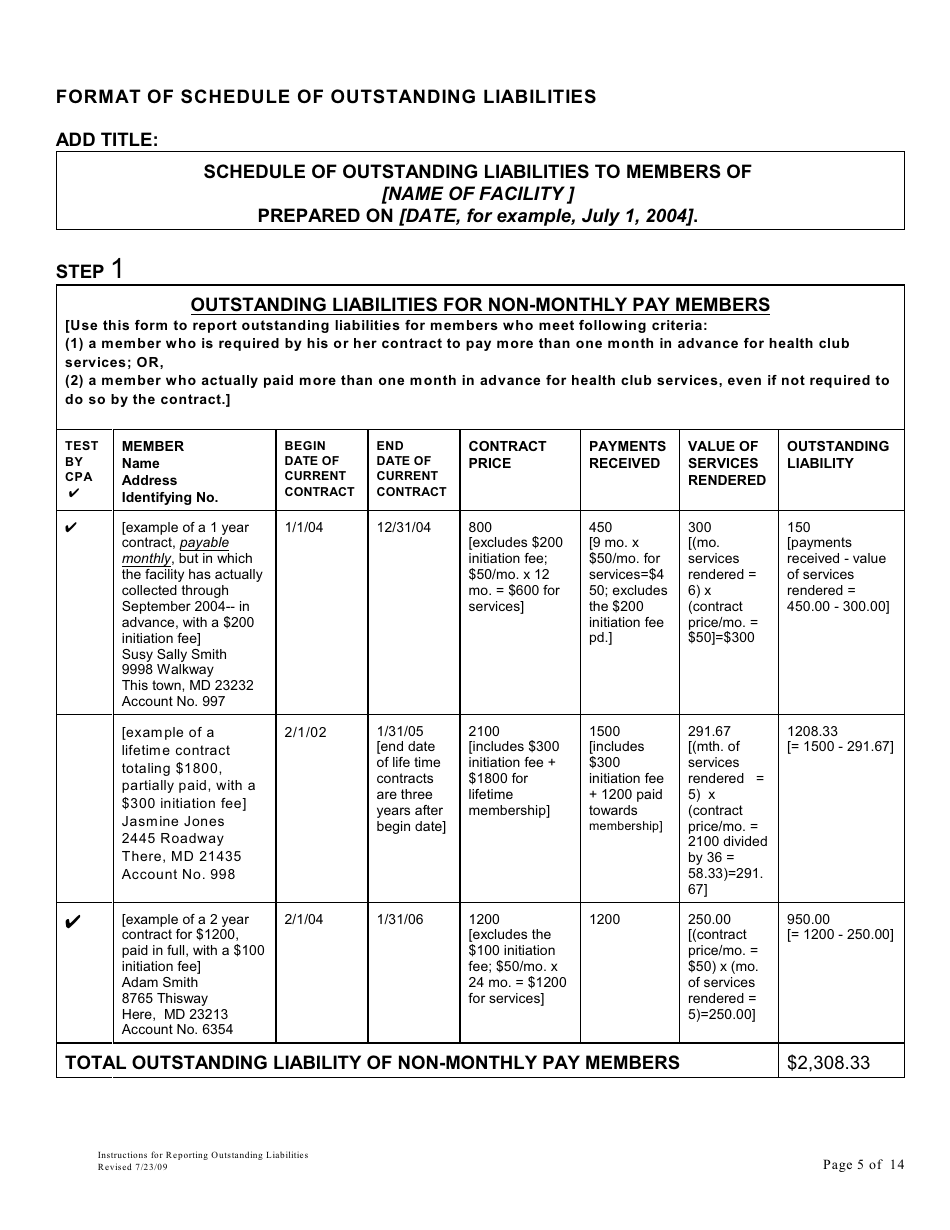

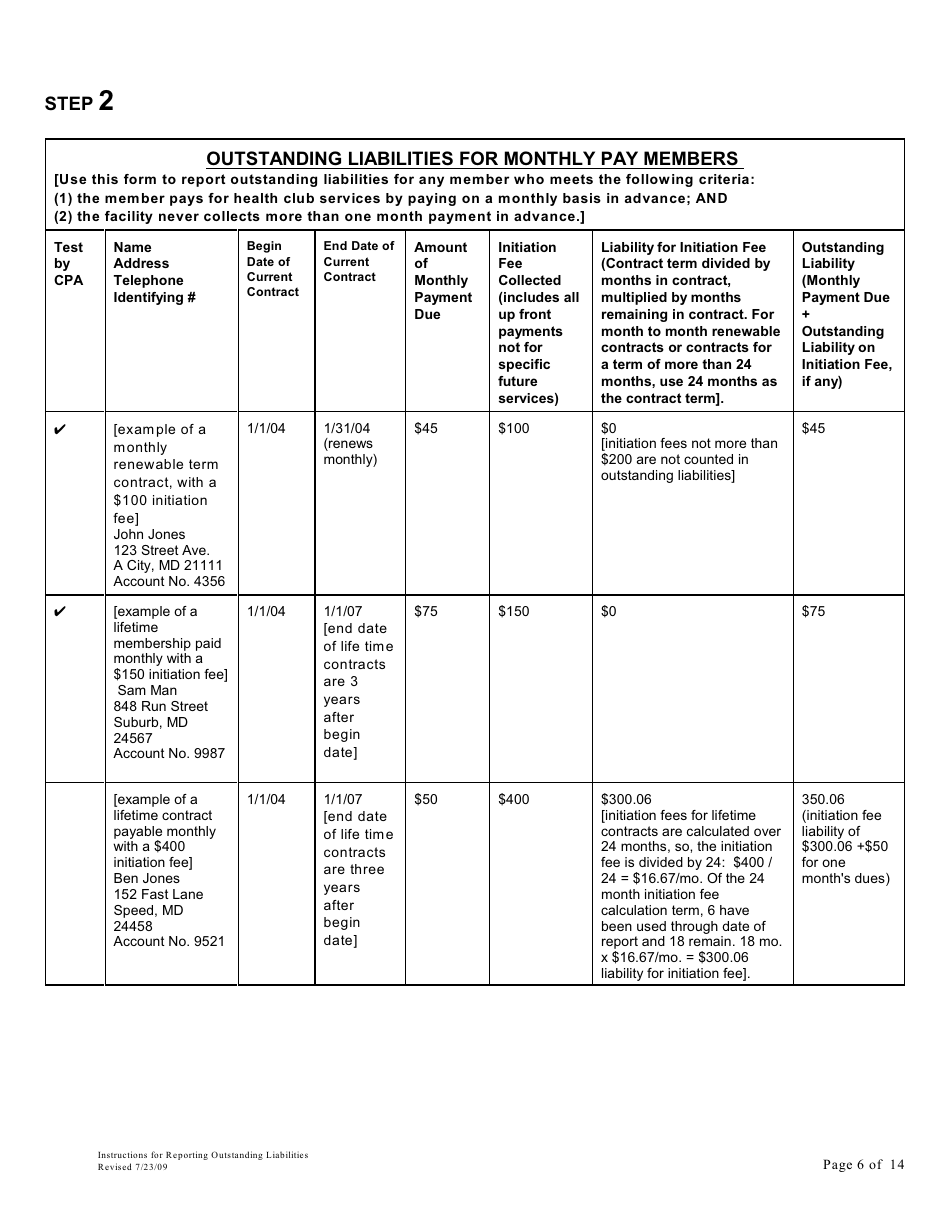

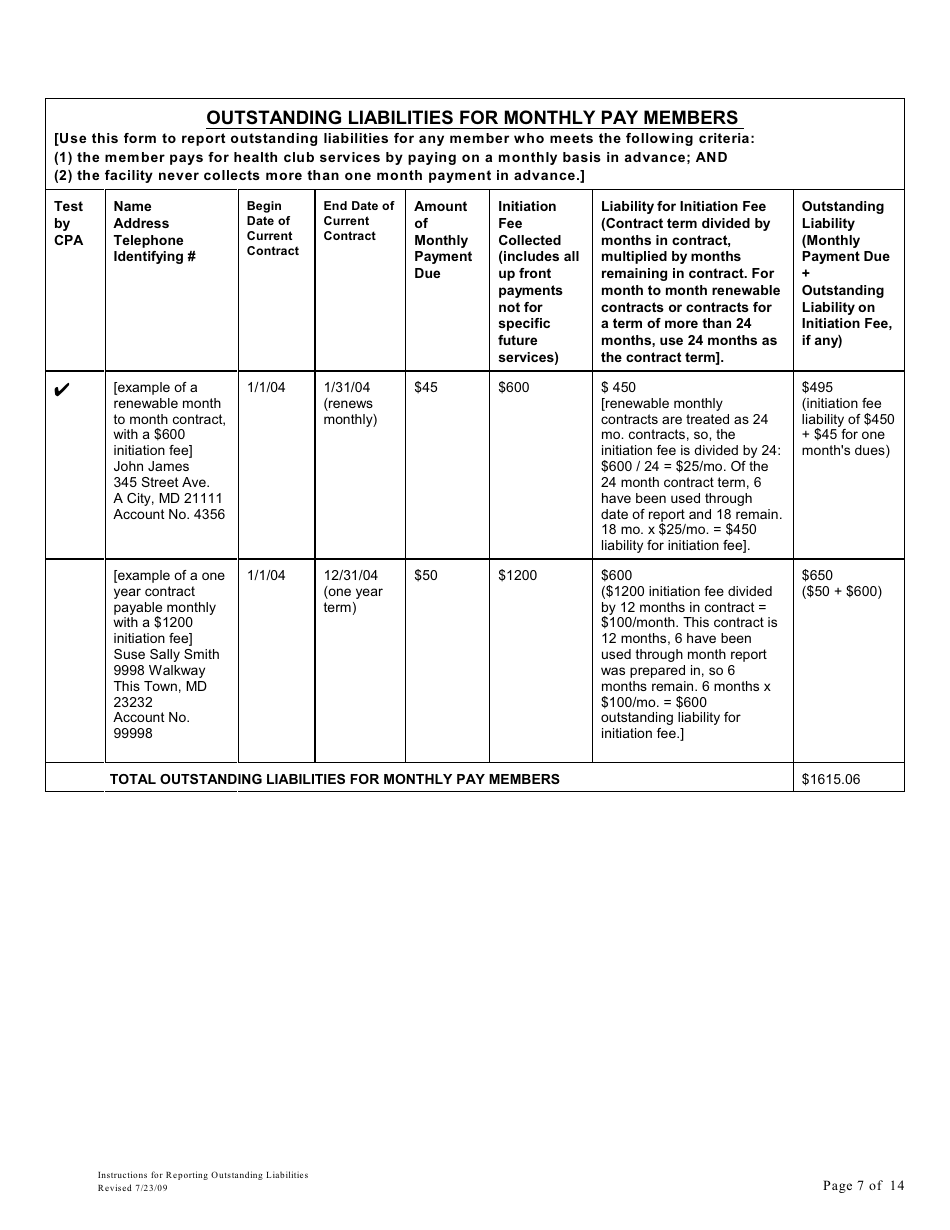

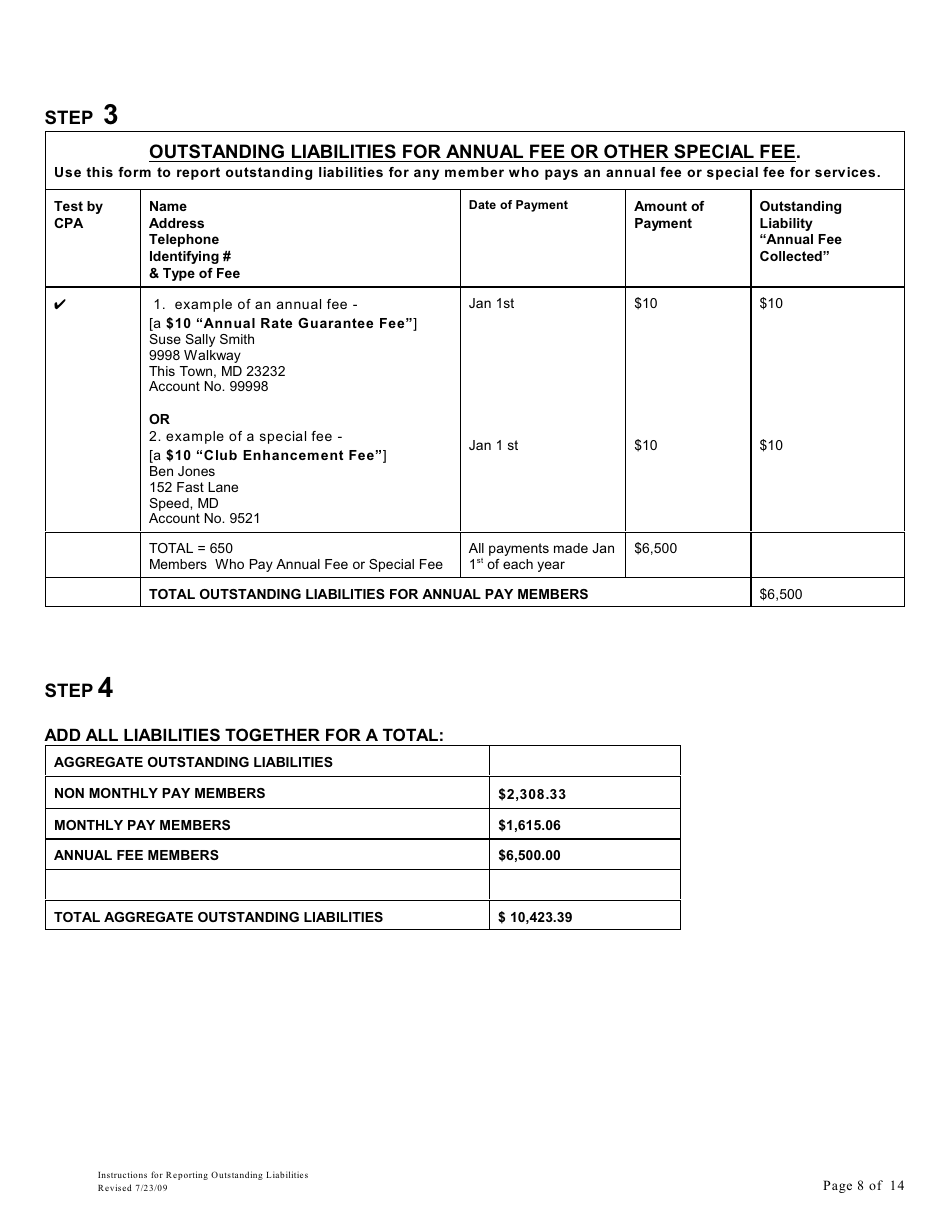

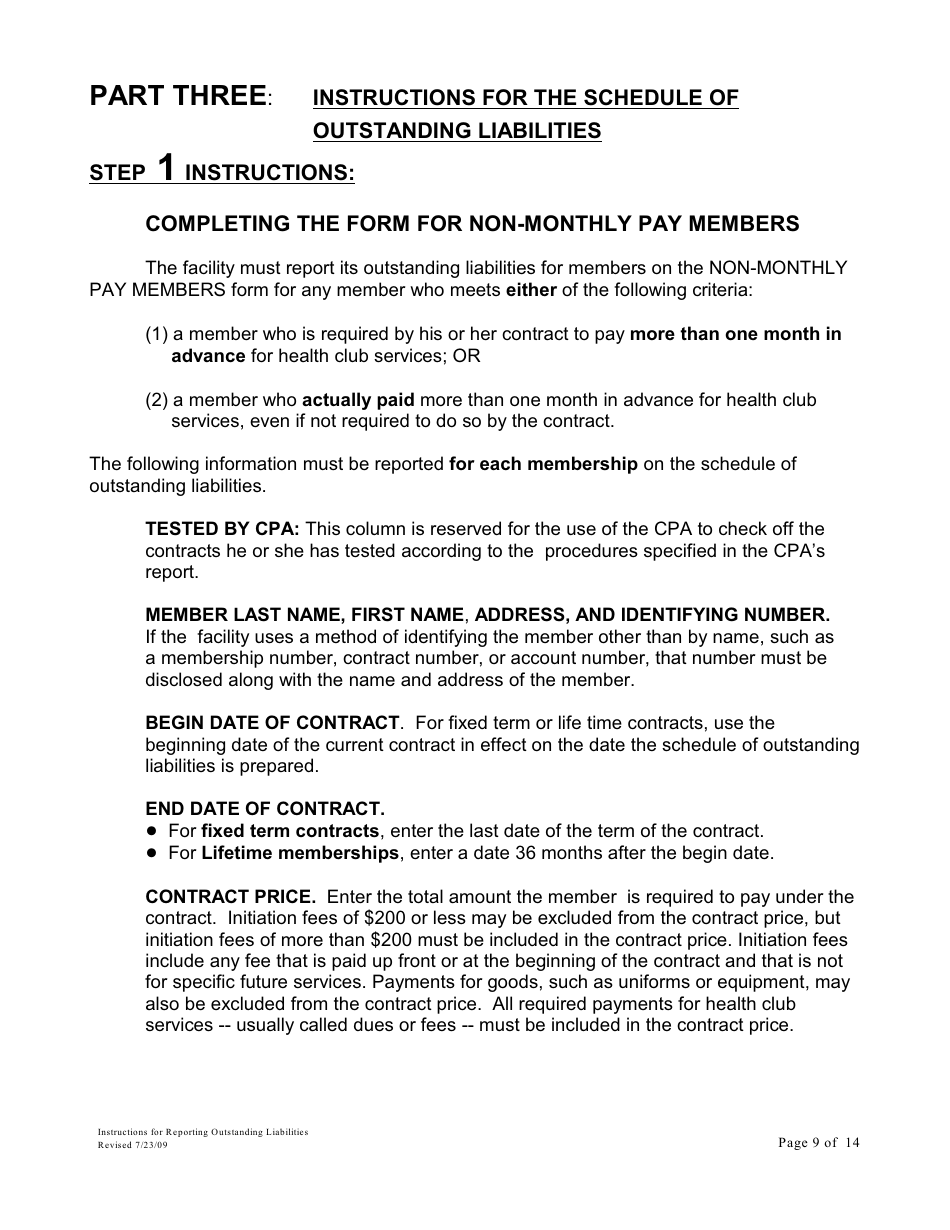

Instructions for Reporting Outstanding Liabilities and Instructions for the Report by a Certified Public Accountant - Maryland

This document was released by Maryland Attorney General and contains the most recent official instructions for Reporting Outstanding Liabilities and Instructions for the Report by a Certified Public Accountant .

FAQ

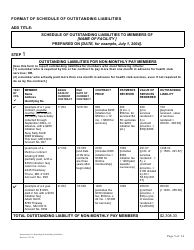

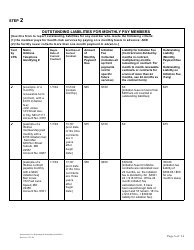

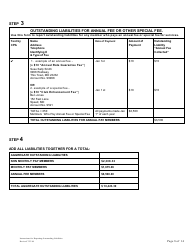

Q: What is the purpose of reporting outstanding liabilities?

A: The purpose is to provide information about debts that the organization owes.

Q: What are outstanding liabilities?

A: Outstanding liabilities are debts that are yet to be paid by the organization.

Q: Who should report outstanding liabilities?

A: The organization itself should report outstanding liabilities.

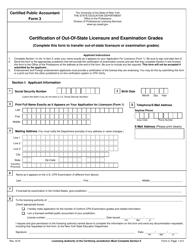

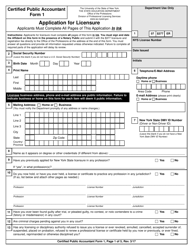

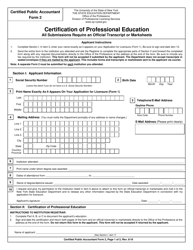

Q: What is a certified public accountant?

A: A certified public accountant is a professional accountant who has passed the required certification exams.

Q: When is a report by a certified public accountant required in Maryland?

A: A report by a certified public accountant is required in Maryland for certain types of financial statements.

Q: Who prepares the report by a certified public accountant?

A: The report is prepared by a certified public accountant.

Q: What is the purpose of the report by a certified public accountant?

A: The purpose is to provide an independent assessment of the organization's financial statements.

Q: What information does the report by a certified public accountant include?

A: The report includes the accountant's opinion on the fairness of the financial statements and any additional findings or recommendations.

Q: Who relies on the report by a certified public accountant?

A: Shareholders, investors, lenders, and other stakeholders rely on the report.

Q: Is the report by a certified public accountant mandatory?

A: In Maryland, it is mandatory for certain types of financial statements.

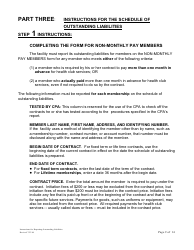

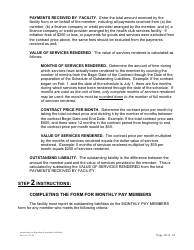

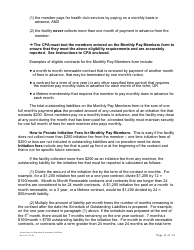

Instruction Details:

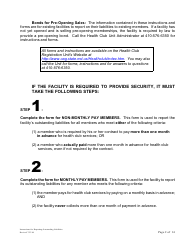

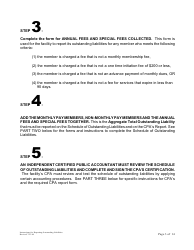

- This 14-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Maryland Attorney General.