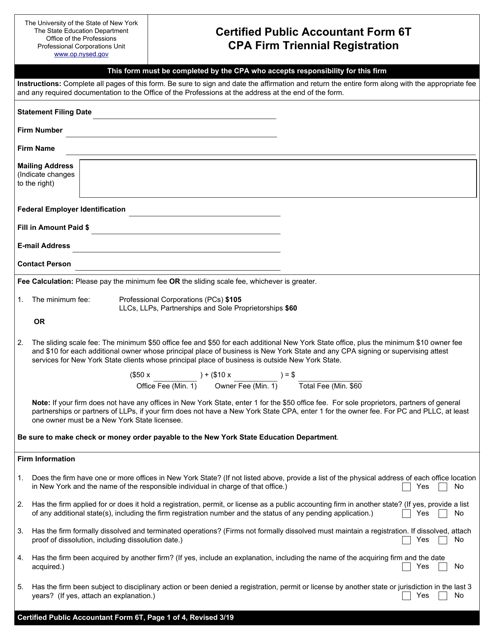

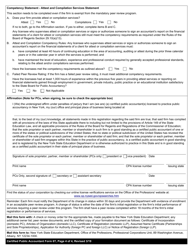

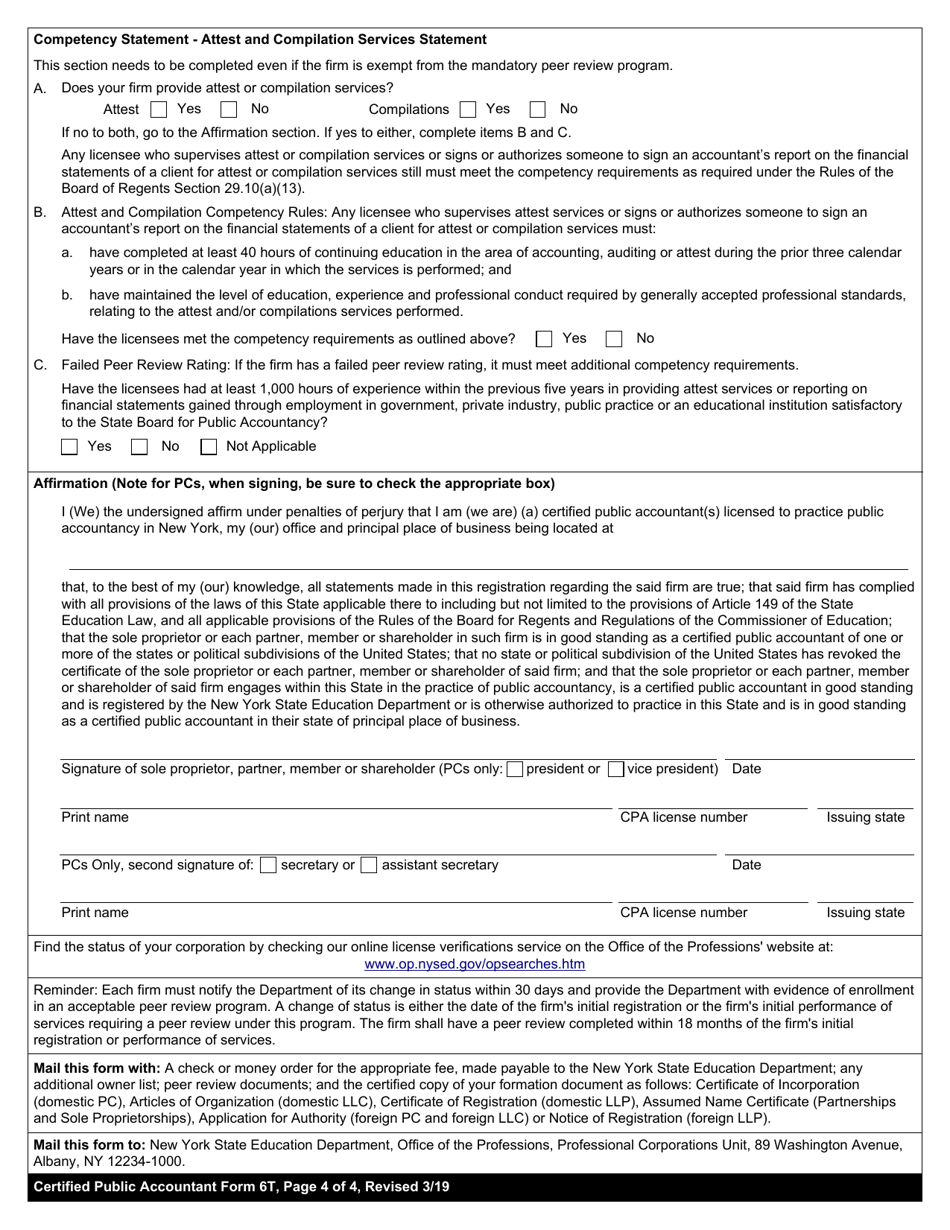

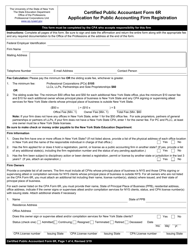

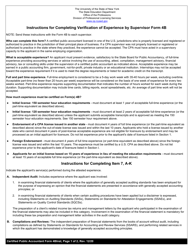

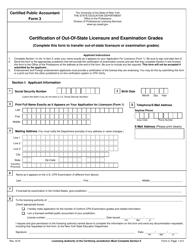

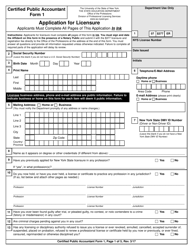

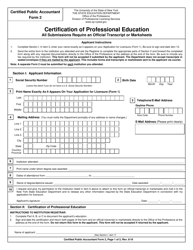

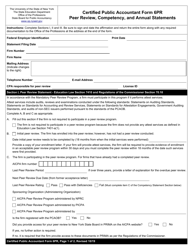

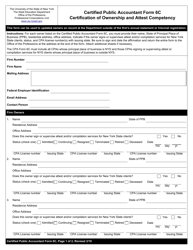

Certified Public Accountant Form 6T CPA Firm Triennial Registration - New York

What Is Certified Public Accountant Form 6T?

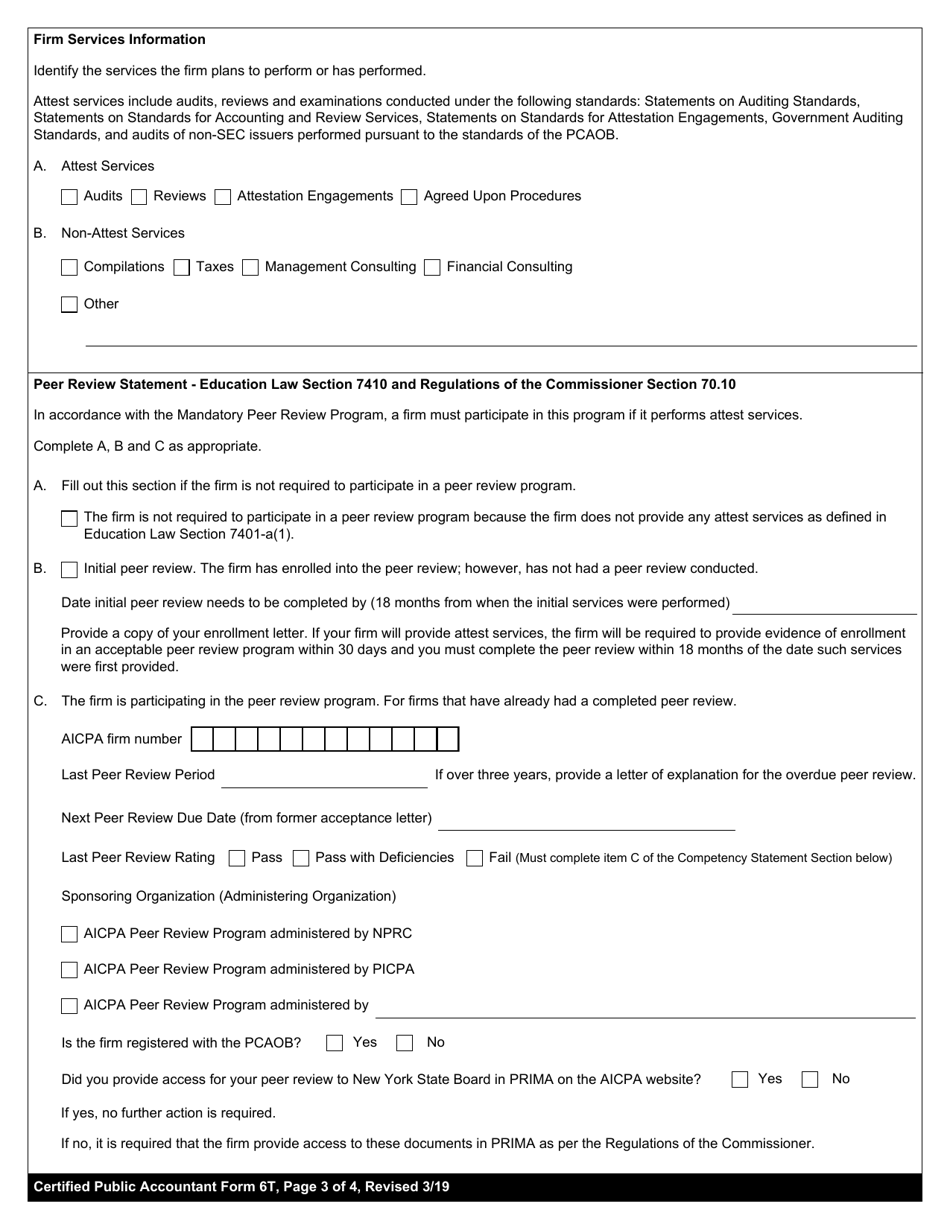

This is a legal form that was released by the New York State Education Department - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 6T?

A: Form 6T is the Triennial Registration form for Certified Public Accountant (CPA) firms in New York.

Q: Who needs to fill out Form 6T?

A: CPA firms in New York are required to fill out Form 6T for triennial registration.

Q: What is the purpose of Form 6T?

A: The purpose of Form 6T is to register CPA firms in New York and update their information.

Q: When is Form 6T due?

A: Form 6T is due every three years. The specific due date will vary.

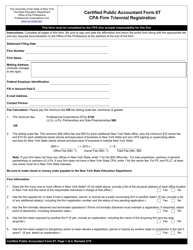

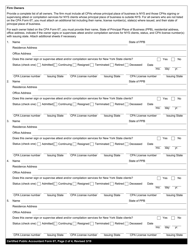

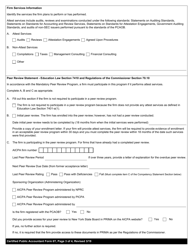

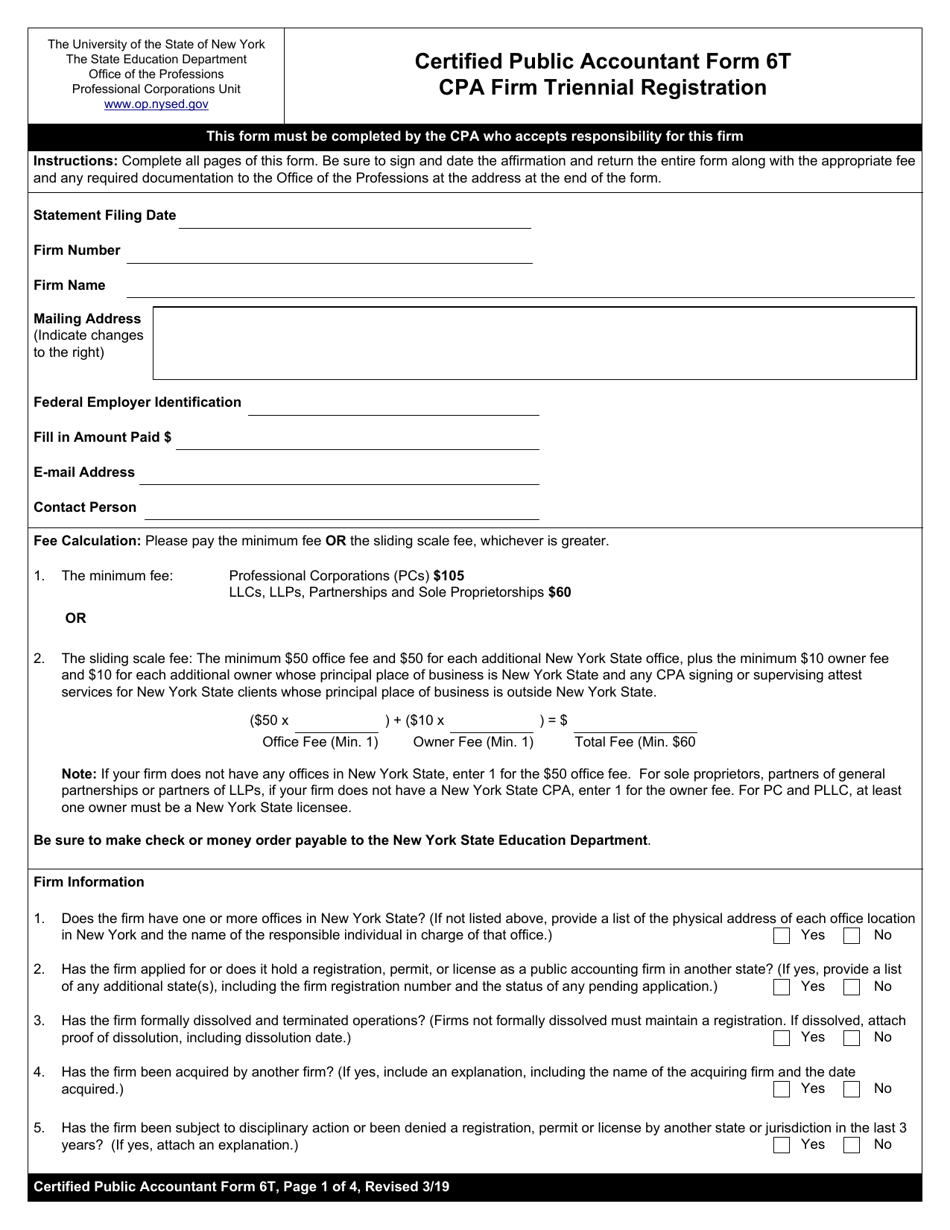

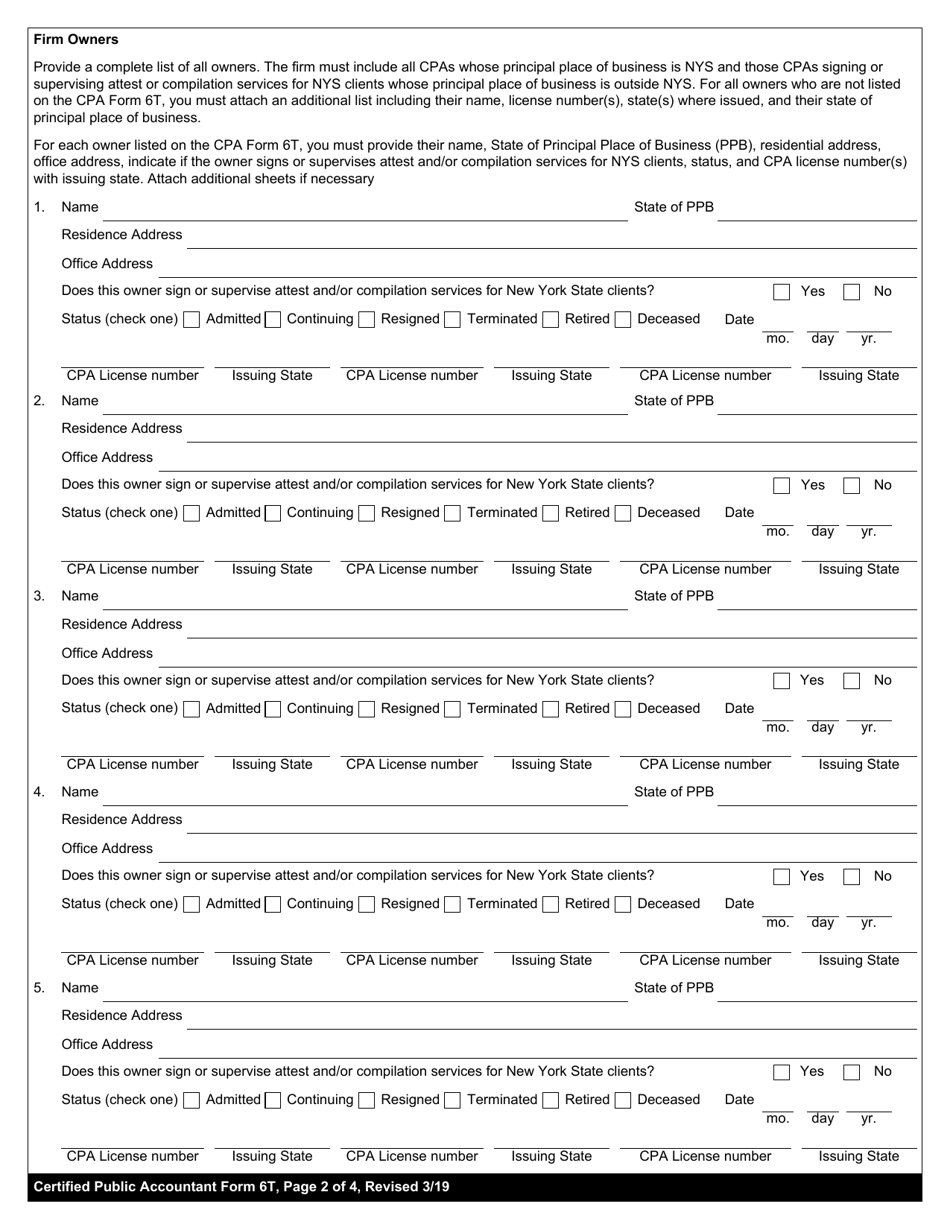

Q: What information is required on Form 6T?

A: Form 6T requires information about the CPA firm, including contact information and the names of partners and professional staff.

Q: Are there any fees associated with Form 6T?

A: Yes, there is a registration fee for filing Form 6T. The specific fee amount will vary.

Q: What happens if I don't file Form 6T?

A: Failure to file Form 6T can result in penalties and may affect the ability of the CPA firm to practice in New York.

Q: Can I make changes to Form 6T after submitting?

A: Yes, changes can be made to Form 6T after submitting. Amendments can be filed to update the information.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the New York State Education Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Certified Public Accountant Form 6T by clicking the link below or browse more documents and templates provided by the New York State Education Department.