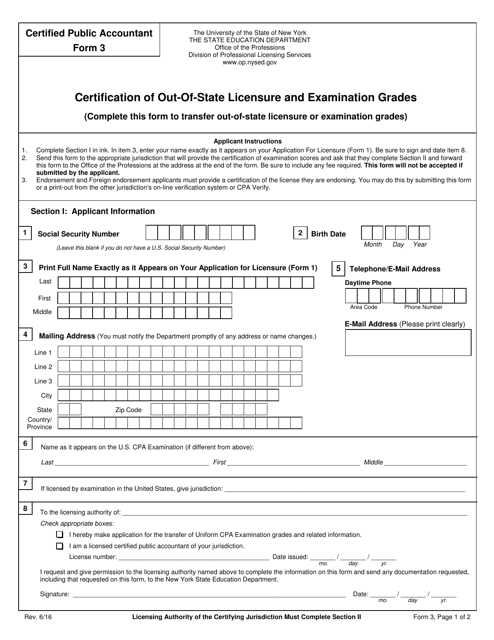

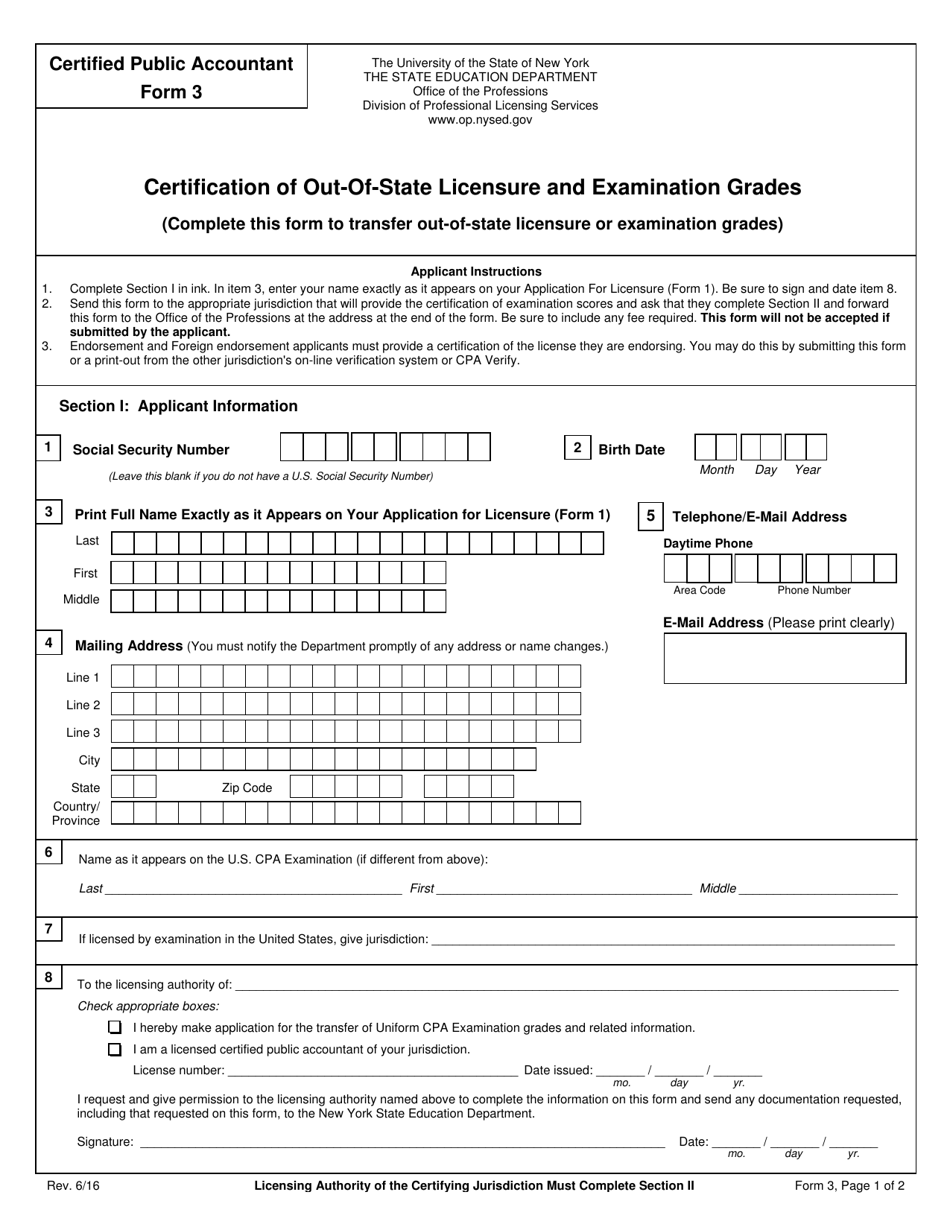

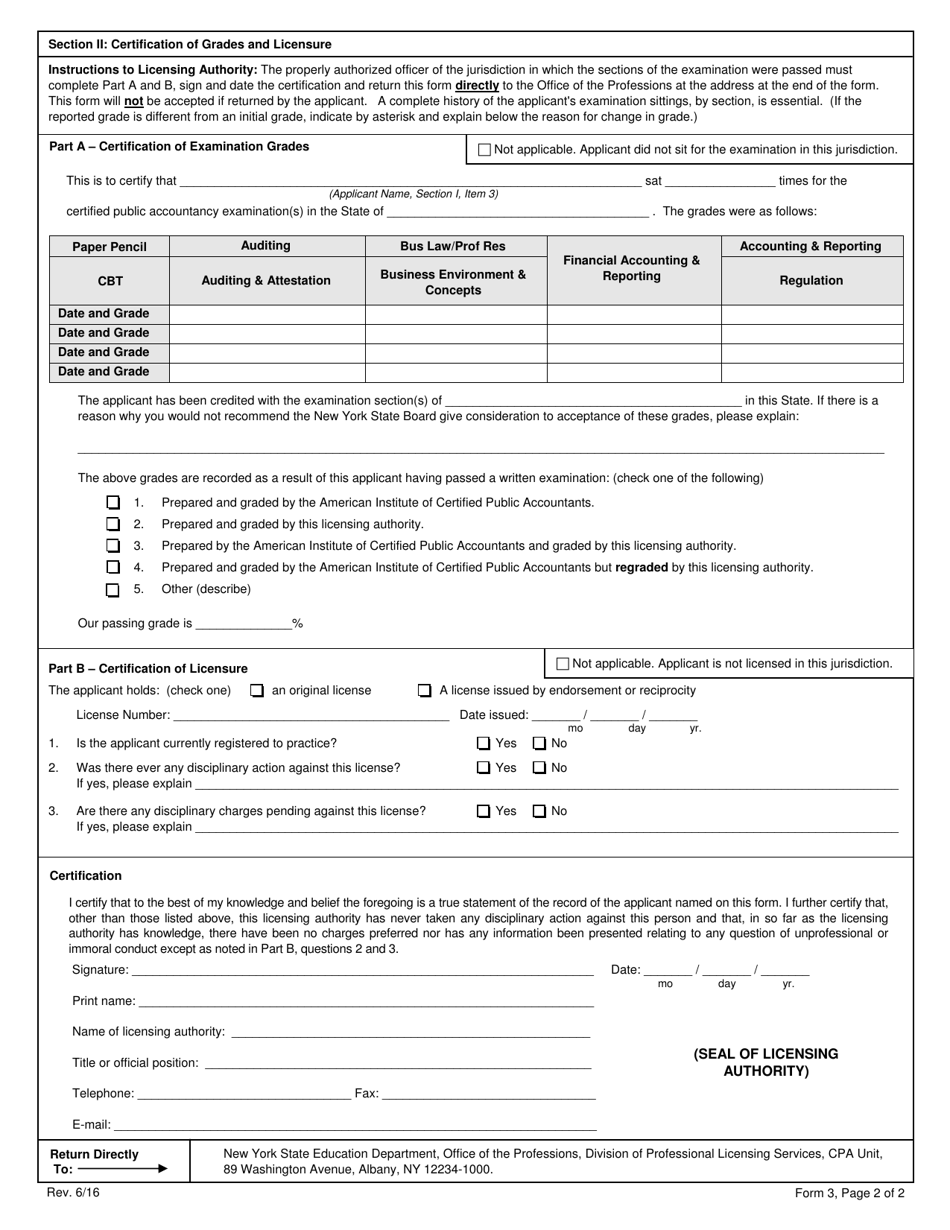

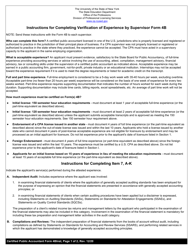

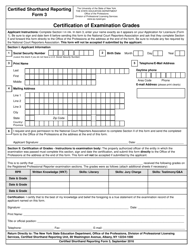

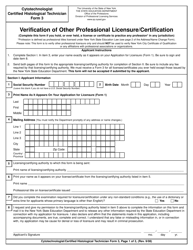

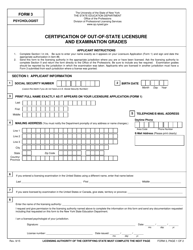

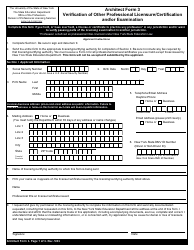

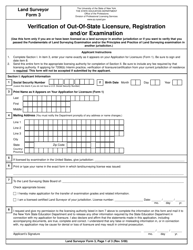

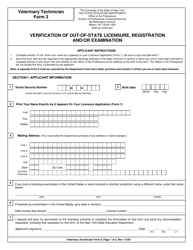

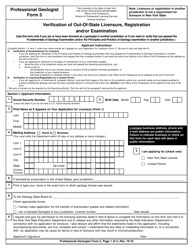

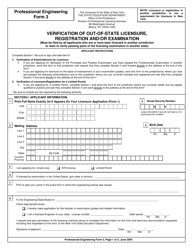

Certified Public Accountant Form 3 Certification of Out-of-State Licensure and Examination Grades - New York

What Is Certified Public Accountant Form 3?

This is a legal form that was released by the New York State Education Department - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3 Certification of Out-of-State Licensure and Examination Grades?

A: Form 3 is a certification form specifically for Certified Public Accountants (CPAs) who obtained their license and examination grades in another state.

Q: Who should use Form 3 Certification of Out-of-State Licensure and Examination Grades?

A: CPAs who obtained their license and examination grades in another state and want to practice in New York should use Form 3.

Q: What is the purpose of Form 3?

A: The purpose of Form 3 is to provide proof of licensure and examination grades from another state for CPAs who want to practice in New York.

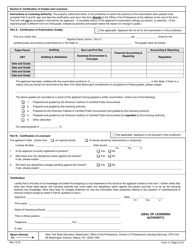

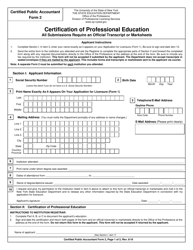

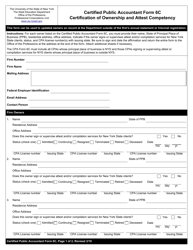

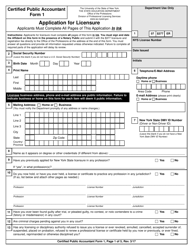

Q: What information should be included in Form 3?

A: Form 3 requires information such as the CPA's personal details, details of licensure and examination grades in another state, and a notarized statement.

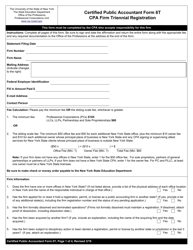

Q: Are there any fees associated with submitting Form 3?

A: Yes, there is a fee required when submitting Form 3.

Q: How long does it take to process Form 3?

A: The processing time for Form 3 can vary, but it generally takes a few weeks for the application to be reviewed and processed.

Q: Is it necessary to have Form 3 notarized?

A: Yes, Form 3 must be notarized by a notary public before submitting it.

Q: Are there any additional requirements to practice as a CPA in New York?

A: Yes, in addition to submitting Form 3, CPAs may need to meet other requirements such as completing the New York State specific education and experience requirements.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the New York State Education Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Certified Public Accountant Form 3 by clicking the link below or browse more documents and templates provided by the New York State Education Department.