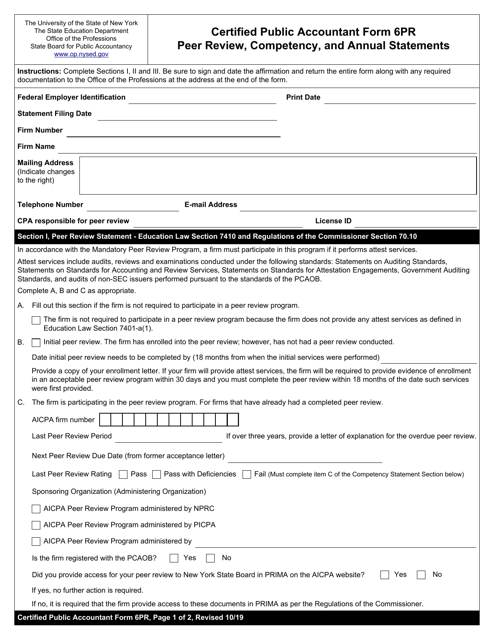

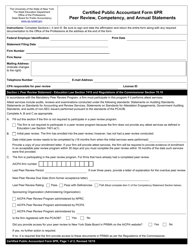

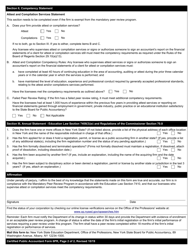

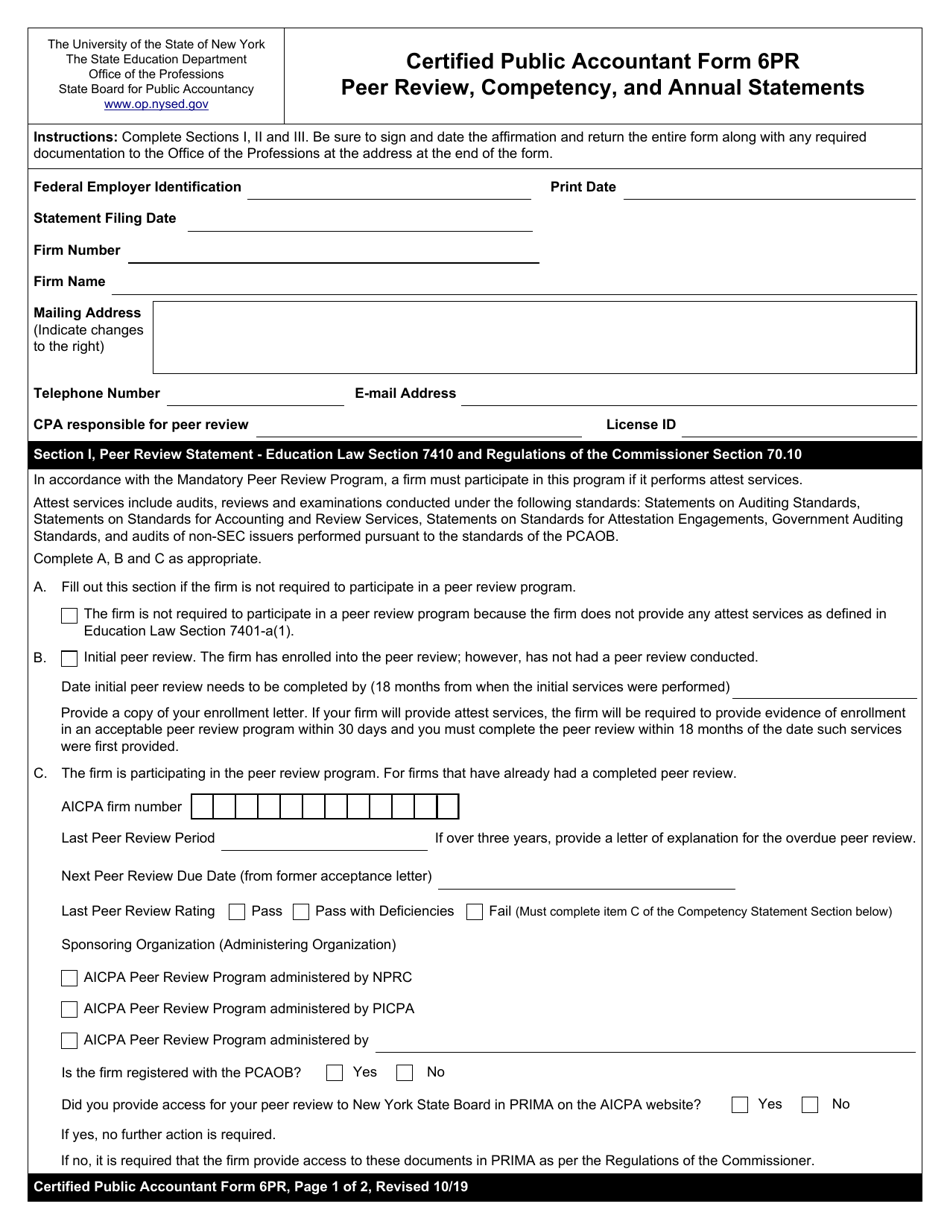

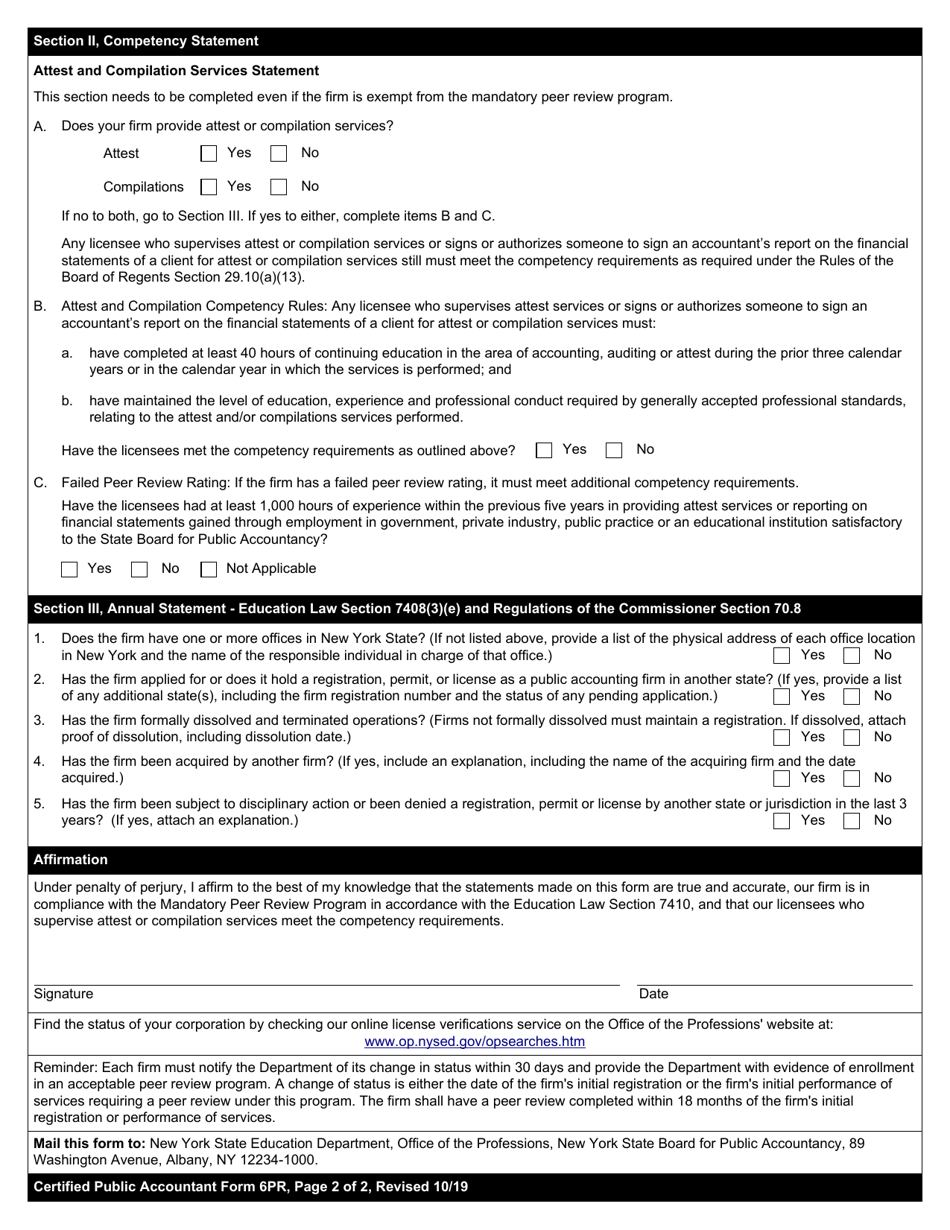

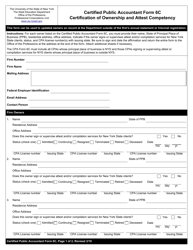

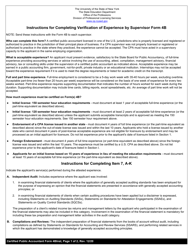

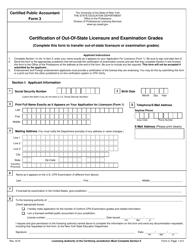

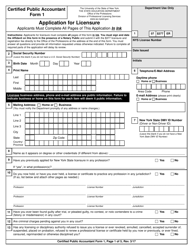

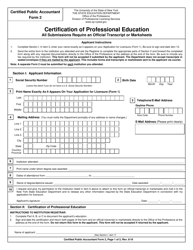

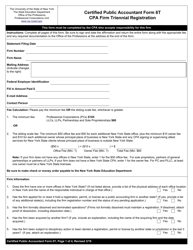

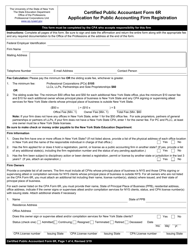

Certified Public Accountant Form 6PR Peer Review, Competency, and Annual Statements - New York

What Is Certified Public Accountant Form 6PR?

This is a legal form that was released by the New York State Education Department - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 6PR?

A: Form 6PR is a document used by Certified Public Accountants (CPAs) in New York for Peer Review, Competency, and Annual Statements.

Q: What is the purpose of Form 6PR?

A: The purpose of Form 6PR is to assess the professional competency and compliance of CPAs in New York.

Q: Who is required to submit Form 6PR?

A: CPAs in New York are required to submit Form 6PR if they meet certain criteria, including licensure and annual gross fees earned.

Q: What information is included in Form 6PR?

A: Form 6PR includes information about the CPA's practice, peer review, continuing education, and compliance with ethical requirements.

Q: When is Form 6PR due?

A: Form 6PR is typically due by June 30th each year for the preceding calendar year.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the New York State Education Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Certified Public Accountant Form 6PR by clicking the link below or browse more documents and templates provided by the New York State Education Department.