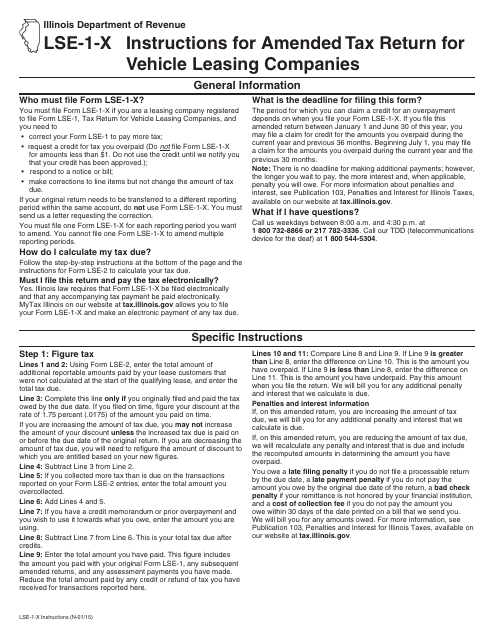

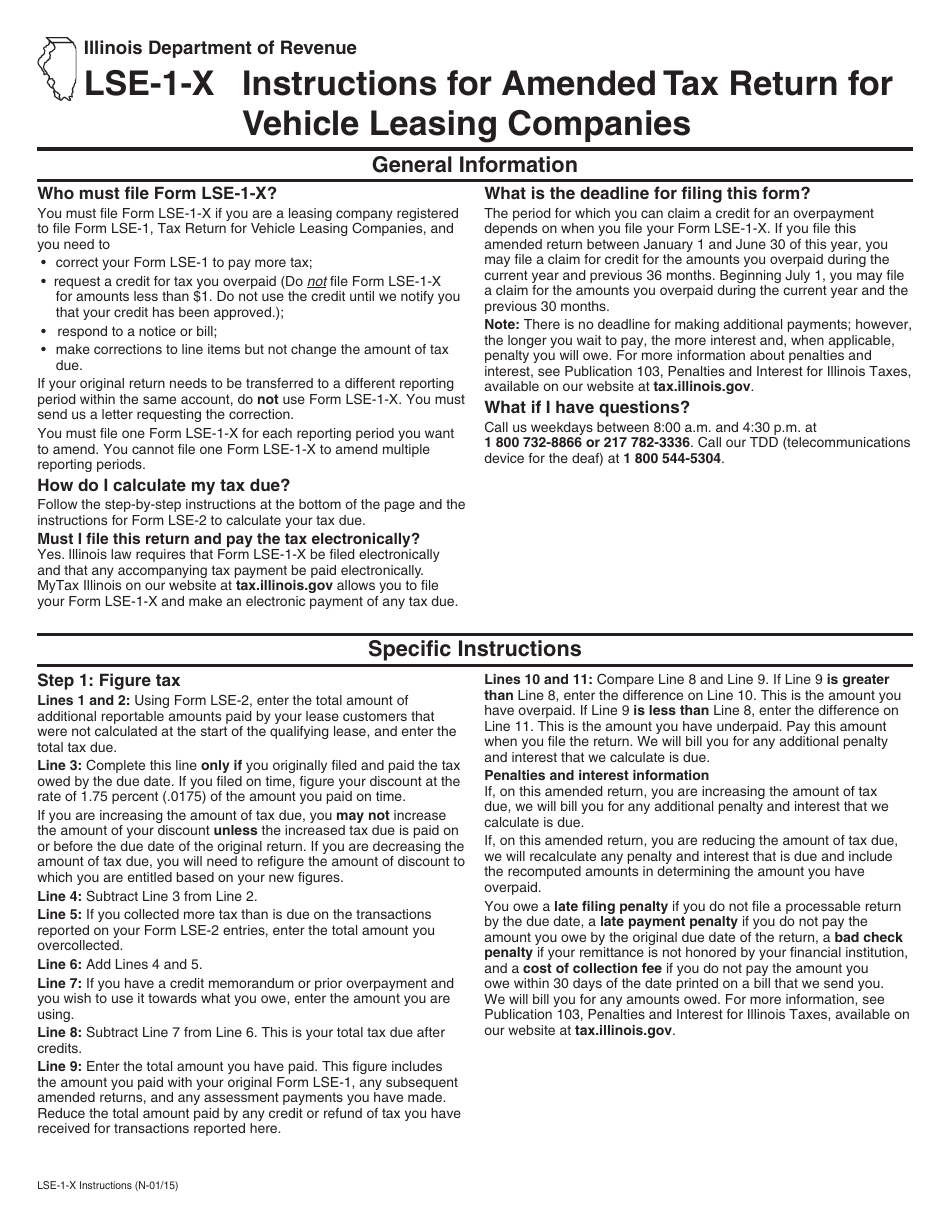

Instructions for Form LSE-1-X Amended Tax Return for Vehicle Leasing Companies - Illinois

This document contains official instructions for Form LSE-1-X , Amended Tax Return for Vehicle Leasing Companies - a form released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Form LSE-1-X?

A: Form LSE-1-X is an amended tax return for vehicle leasing companies in Illinois.

Q: Who should use Form LSE-1-X?

A: Vehicle leasing companies in Illinois should use Form LSE-1-X if they need to amend their tax return.

Q: What is the purpose of Form LSE-1-X?

A: The purpose of Form LSE-1-X is to report any changes or corrections to the original tax return filed by vehicle leasing companies.

Q: How do I fill out Form LSE-1-X?

A: You need to provide the corrected information for the applicable tax period and explain the changes made on the form.

Q: Are there any specific instructions for completing Form LSE-1-X?

A: Yes, the official instructions for Form LSE-1-X provide detailed guidance on how to complete the form correctly.

Q: Do I need to include supporting documents with Form LSE-1-X?

A: You may need to include supporting documents if required to substantiate the changes made on Form LSE-1-X.

Q: What is the deadline for filing Form LSE-1-X?

A: The deadline for filing Form LSE-1-X is generally the same as the original due date for the tax return, which is the last day of the month following the end of the tax period.

Q: Can I file Form LSE-1-X electronically?

A: No, electronic filing is not available for Form LSE-1-X. It must be filed by mail.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.