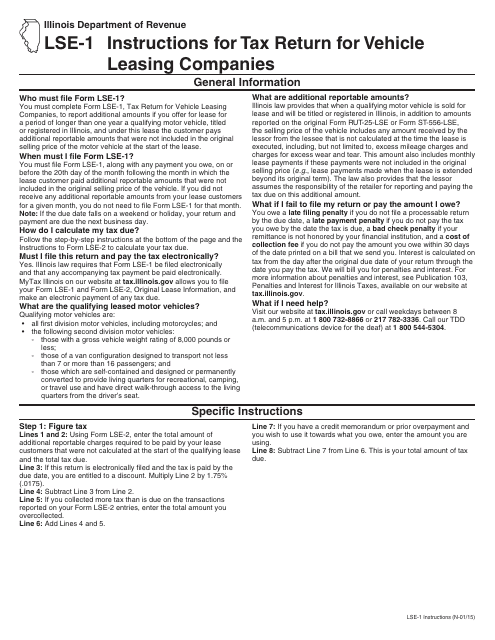

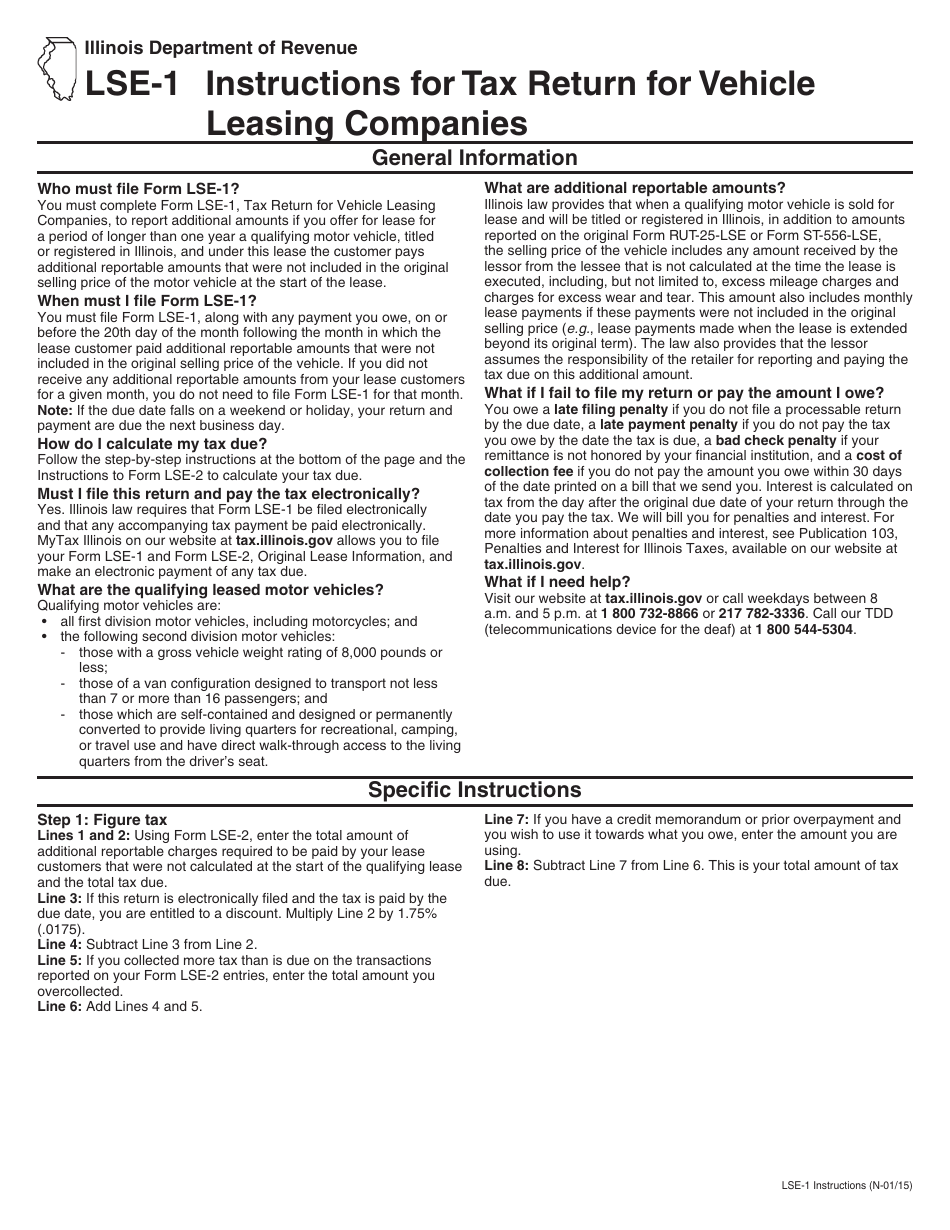

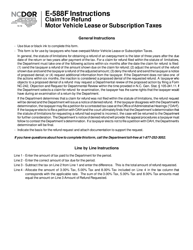

Instructions for Form LSE-1 Tax Return for Vehicle Leasing Companies - Illinois

This document contains official instructions for Form LSE-1 , Tax Return for Vehicle Leasing Companies - a form released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Form LSE-1?

A: Form LSE-1 is a tax return specifically designed for vehicle leasing companies in Illinois.

Q: Who should file Form LSE-1?

A: Vehicle leasing companies operating in Illinois should file Form LSE-1.

Q: What information is required on Form LSE-1?

A: Form LSE-1 requires information such as the company's name, address, gross receipts, and the number of vehicles leased in Illinois.

Q: How often should Form LSE-1 be filed?

A: Form LSE-1 should be filed annually.

Q: What is the purpose of filing Form LSE-1?

A: Filing Form LSE-1 allows vehicle leasing companies to report and pay the appropriate taxes owed to the state of Illinois.

Q: Are there any penalties for not filing Form LSE-1?

A: Yes, failure to file Form LSE-1 or paying the required taxes can result in penalties, interest, and potential legal consequences.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.