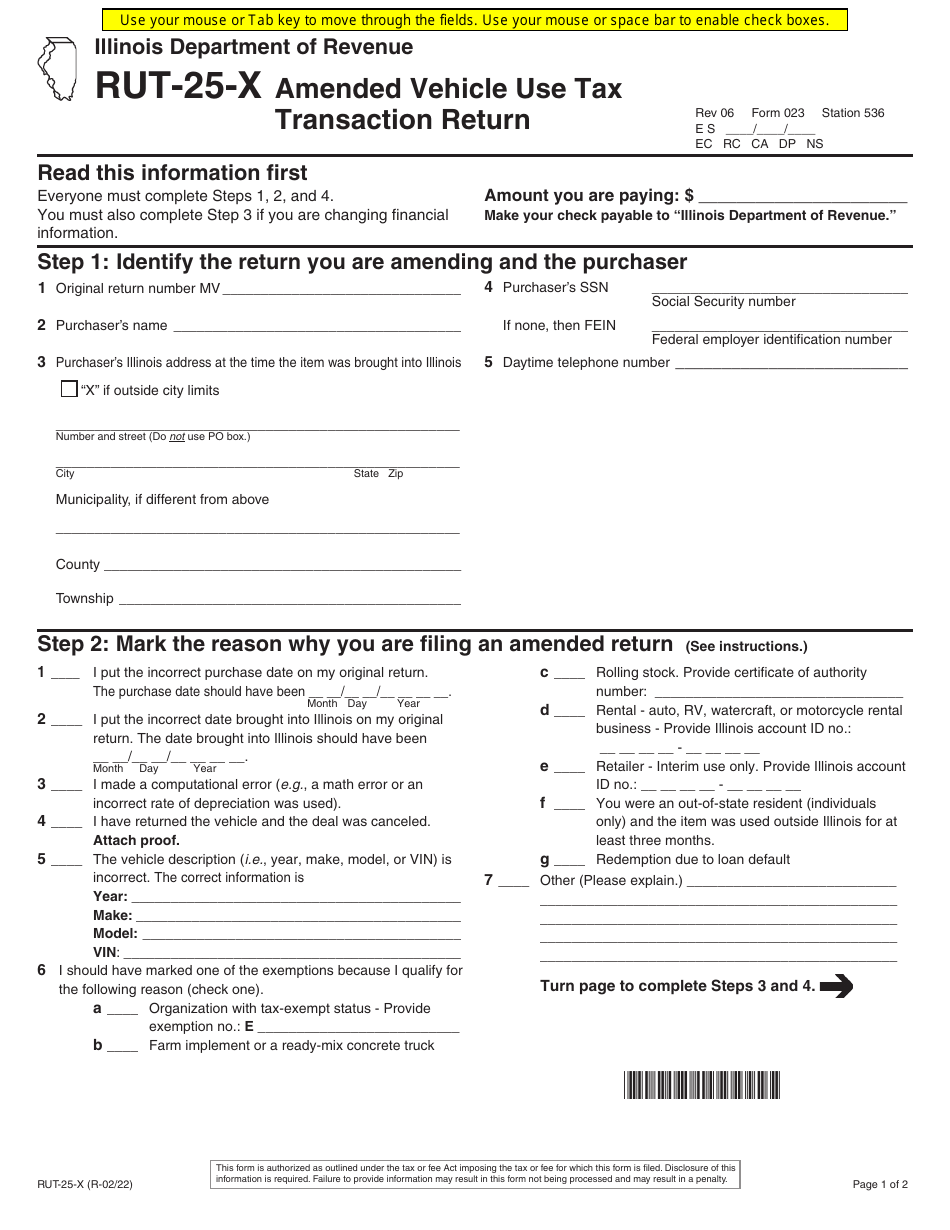

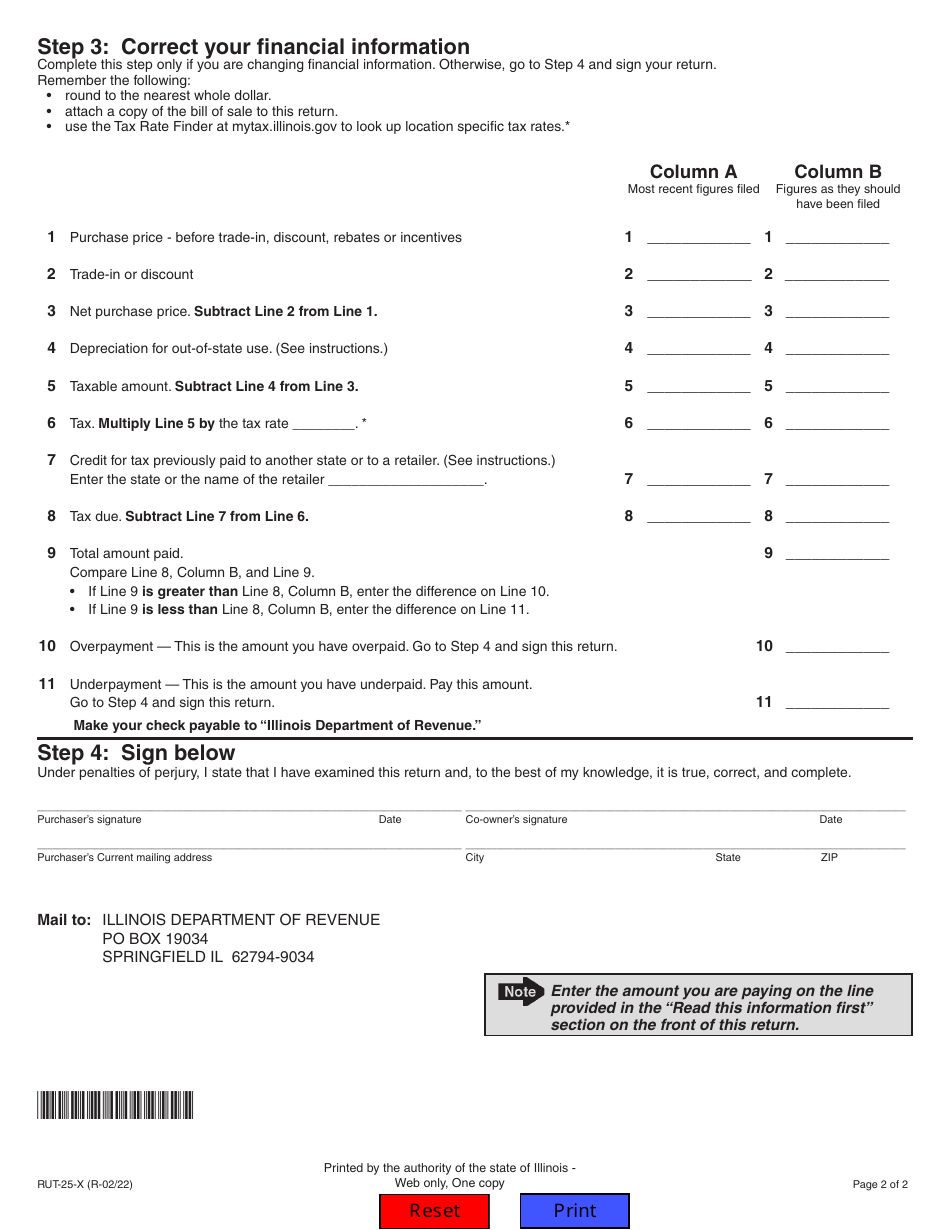

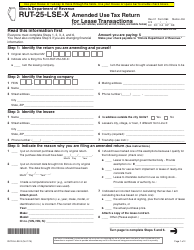

Form RUT-25-X (023) Amended Vehicle Use Tax Transaction Return - Illinois

What Is Form RUT-25-X (023)?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RUT-25-X (023)?

A: Form RUT-25-X (023) is the Amended Vehicle Use Tax Transaction Return in Illinois.

Q: What is the purpose of Form RUT-25-X (023)?

A: The purpose of Form RUT-25-X (023) is to report and pay any additional vehicle usetax due or request a refund for overpaid tax.

Q: Who should file Form RUT-25-X (023)?

A: Anyone who needs to amend their previously filed Vehicle Use Tax Transaction Return in Illinois should file Form RUT-25-X (023).

Q: When should Form RUT-25-X (023) be filed?

A: Form RUT-25-X (023) should be filed within three years from the original due date of the Vehicle Use Tax Transaction Return.

Q: Are there any fees associated with filing Form RUT-25-X (023)?

A: There are no fees associated with filing Form RUT-25-X (023), but you may be required to pay any additional taxes due.

Q: What if I make a mistake on Form RUT-25-X (023)?

A: If you make a mistake on Form RUT-25-X (023), you should file an amended return to correct the error.

Q: What supporting documents are required with Form RUT-25-X (023)?

A: You should include copies of any relevant documents, such as the original Vehicle Use Tax Transaction Return and any supporting documentation for the changes made.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RUT-25-X (023) by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.