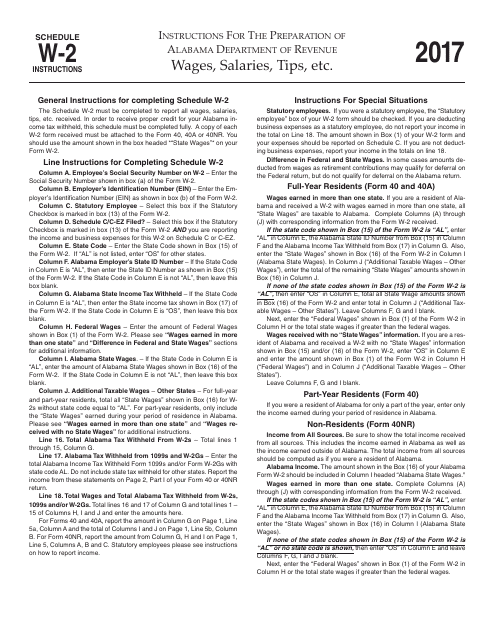

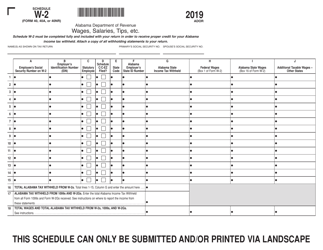

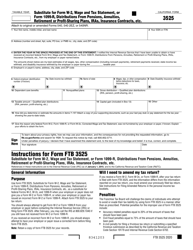

Instructions for Form W-2 Wages, Salaries, Tips, Etc. - Alabama

This document contains official instructions for Form W-2 , Wages, Salaries, Tips, Etc. - a form released and collected by the Alabama Department of Revenue.

FAQ

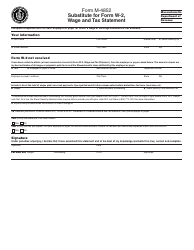

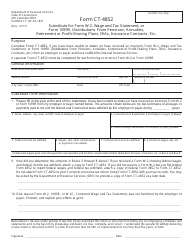

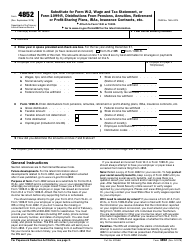

Q: What is Form W-2?

A: Form W-2 is a tax form that reports an individual's wages, salaries, tips, and other income.

Q: Why is Form W-2 important?

A: Form W-2 is important because it is used to calculate an individual's income tax liability.

Q: Who needs to fill out Form W-2?

A: Employers are required to fill out Form W-2 for each employee who has received wages, salaries, tips, or other compensation.

Q: When is the deadline to file Form W-2?

A: The deadline to file Form W-2 with the Social Security Administration is usually January 31st of the following year.

Q: What information is required on Form W-2?

A: Form W-2 requires information such as the employee's name, social security number, wages earned, and taxes withheld.

Q: Can I e-file Form W-2?

A: Yes, employers can e-file Form W-2 with the Social Security Administration.

Q: Do I need to attach Form W-2 to my tax return?

A: No, you do not need to attach Form W-2 to your tax return. However, you should keep it for your records.

Q: What should I do if there is an error on my Form W-2?

A: If there is an error on your Form W-2, you should contact your employer to have it corrected.

Q: Are there any penalties for not filing Form W-2?

A: Yes, there are penalties for not filing Form W-2. The penalties vary depending on how late the form is filed and the size of the employer.

Instruction Details:

- This 1-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Alabama Department of Revenue.