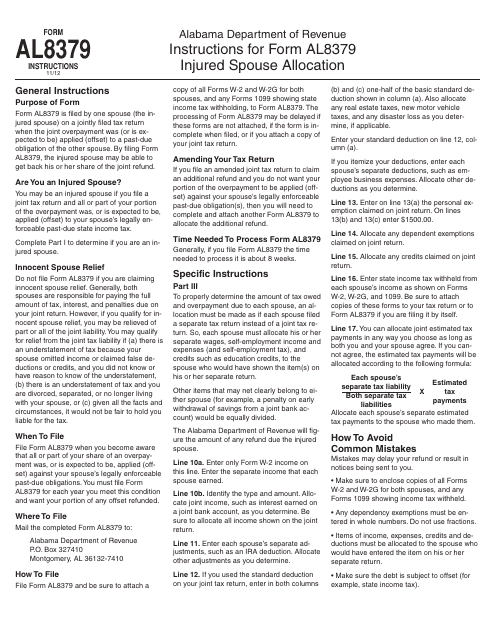

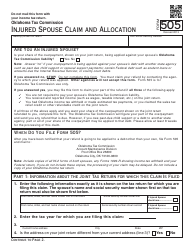

Instructions for Form AL8379 Injured Spouse Allocation - Alabama

This document contains official instructions for Form AL8379 , Injured Spouse Allocation - a form released and collected by the Alabama Department of Revenue.

FAQ

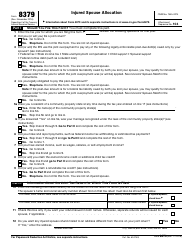

Q: What is Form AL8379?

A: Form AL8379 is the Injured Spouse Allocation form specific to Alabama.

Q: What is the purpose of Form AL8379?

A: The purpose of Form AL8379 is to allow an injured spouse to allocate their portion of a joint tax refund that would otherwise be applied to the other spouse's past-due debts.

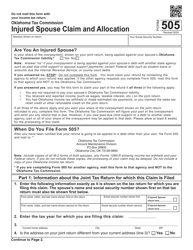

Q: Who should file Form AL8379?

A: An individual should file Form AL8379 if they are an injured spouse who wants to protect their portion of a joint tax refund.

Q: What does it mean to be an injured spouse?

A: Being an injured spouse means that your portion of a joint tax refund may be at risk of being applied to past-due debts owed by your spouse.

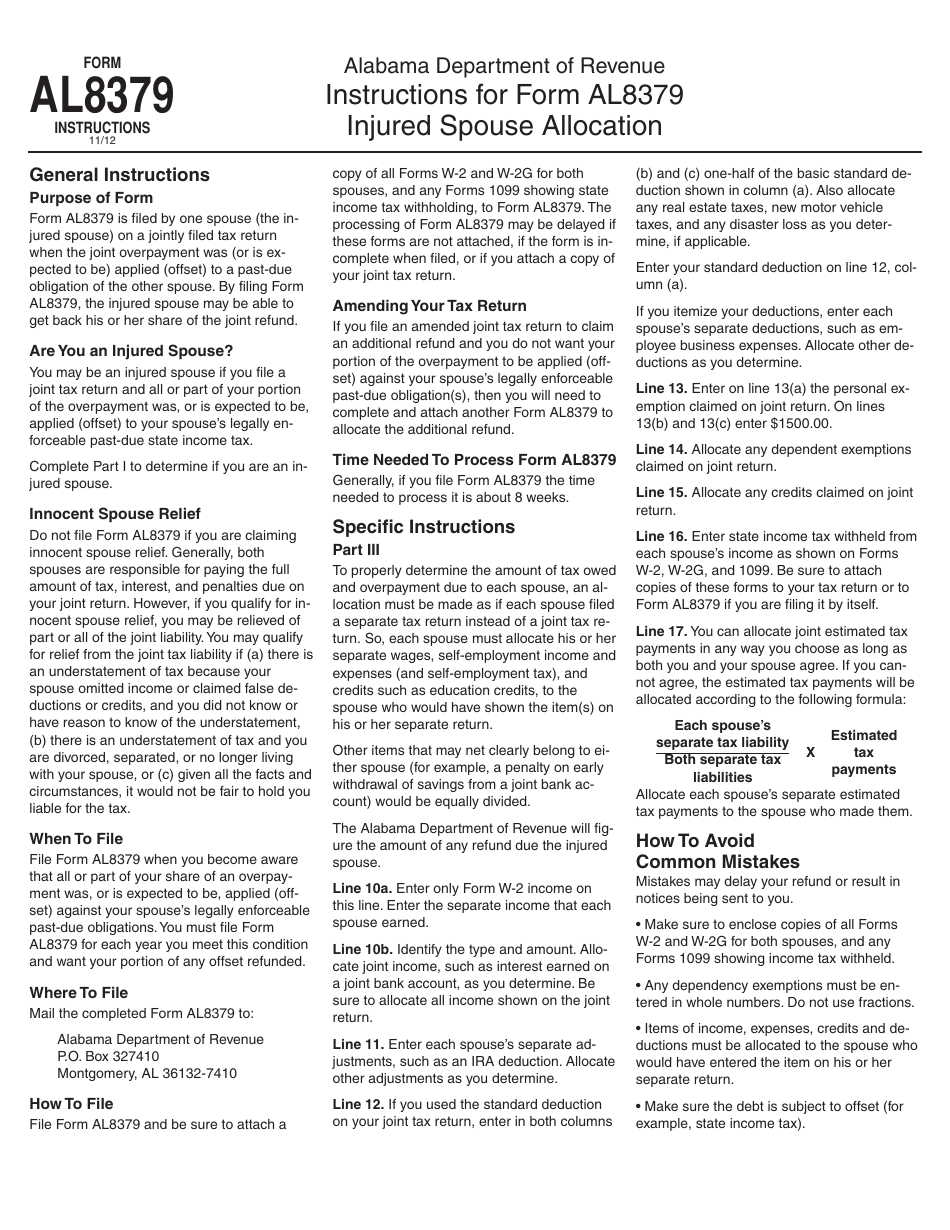

Q: What information is needed to complete Form AL8379?

A: To complete Form AL8379, you will need information such as your personal information, your spouse's personal information, and details about your joint tax return.

Q: When should I file Form AL8379?

A: You should file Form AL8379 as soon as you become aware of your portion of a joint tax refund being at risk of being applied to your spouse's past-due debts.

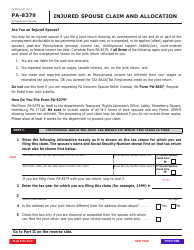

Q: Are there any fees associated with filing Form AL8379?

A: There are no fees associated with filing Form AL8379.

Q: Can Form AL8379 be e-filed?

A: No, Form AL8379 cannot be e-filed. It must be filed by mail.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Alabama Department of Revenue.