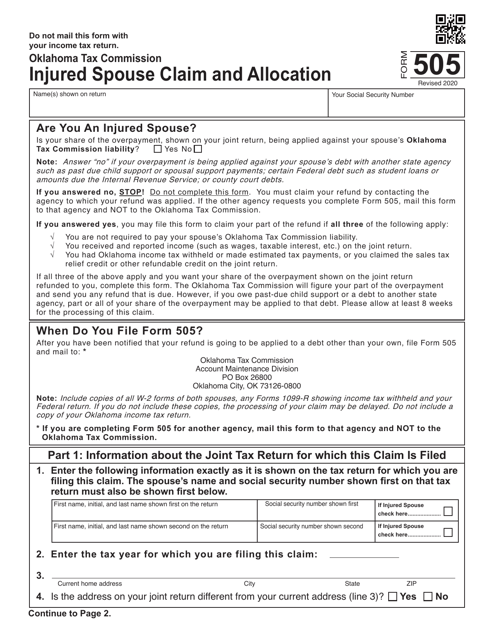

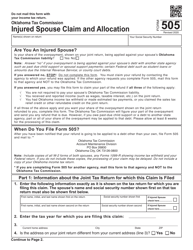

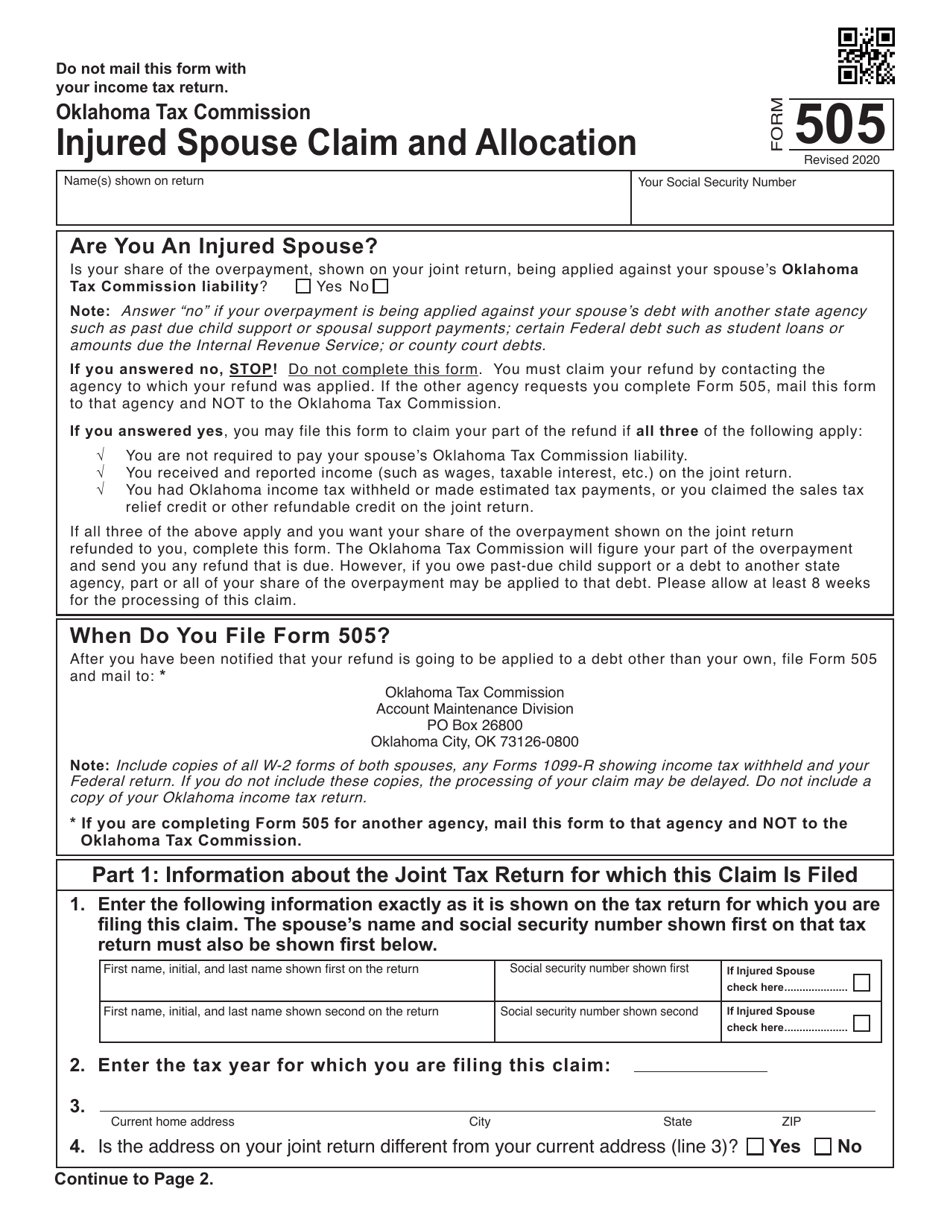

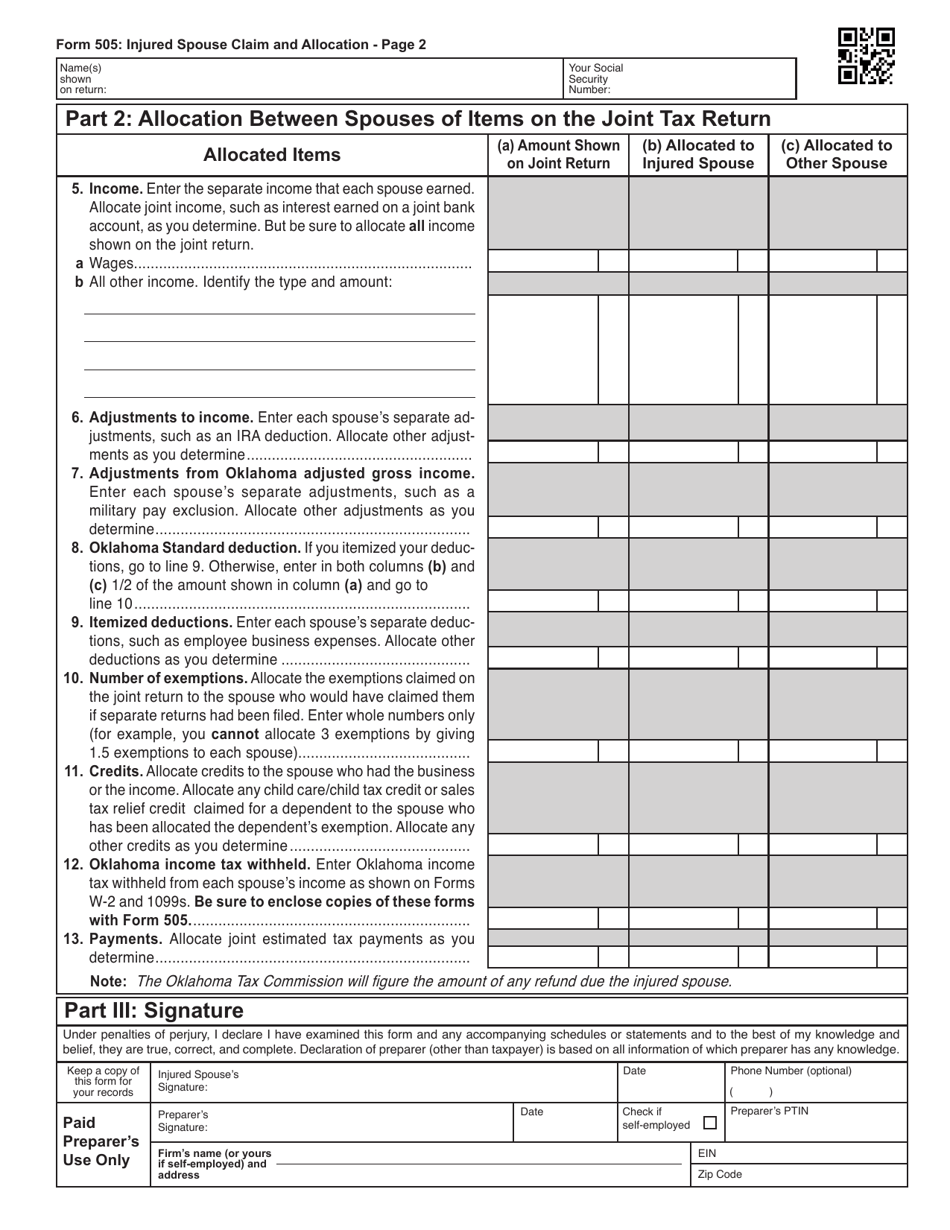

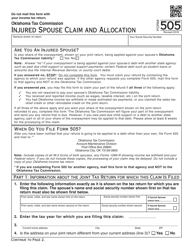

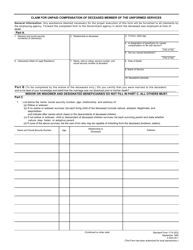

Form 505 Injured Spouse Claim and Allocation - Oklahoma

What Is Form 505?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 505?

A: Form 505 is the Injured Spouse Claim and Allocation form for Oklahoma.

Q: Who can use Form 505?

A: Form 505 is used by married taxpayers who file a joint return and want to protect their portion of the refund from being offset by the other spouse's delinquent debts.

Q: What is an injured spouse?

A: An injured spouse is a taxpayer who has had their portion of a joint tax refund offset due to the other spouse's delinquent debts.

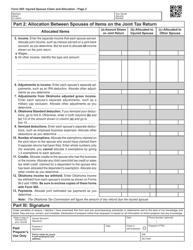

Q: What does Form 505 allow you to do?

A: Form 505 allows you to allocate the joint refund so that the injured spouse can receive their portion.

Q: Is there a fee to file Form 505?

A: No, there is no fee to file Form 505.

Q: What supporting documents are required for Form 505?

A: You will need to attach a copy of your federal income tax return and any other relevant documentation.

Q: Can Form 505 be filed electronically?

A: No, Form 505 must be filed by mail.

Q: When should I file Form 505?

A: You should file Form 505 as soon as you become aware that your joint refund may be offset.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 505 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.