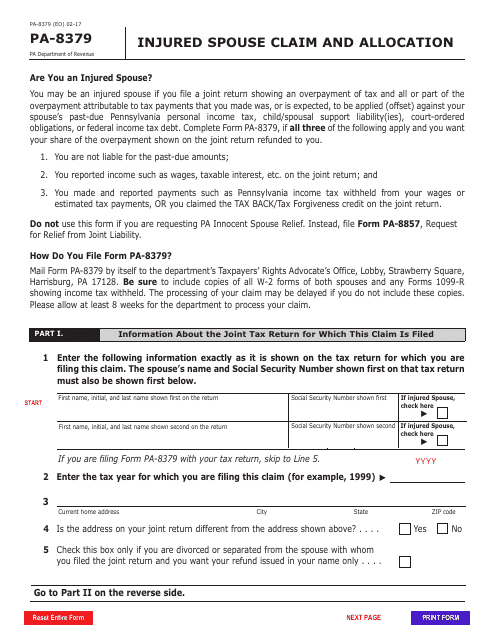

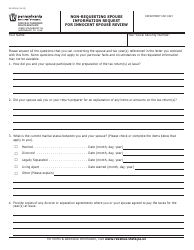

Form PA-8379 Injured Spouse Claim and Allocation - Pennsylvania

What Is Form PA-8379?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-8379?

A: Form PA-8379 is the Injured Spouse Claim and Allocation form used in Pennsylvania.

Q: What is the purpose of Form PA-8379?

A: The purpose of Form PA-8379 is to allow an injured spouse to claim their share of a joint tax refund if it is expected to be offset against the other spouse's past-due debts.

Q: Who can file Form PA-8379?

A: Form PA-8379 can be filed by a taxpayer who is considered an injured spouse, meaning their share of a joint tax refund may be affected by their spouse's unpaid taxes, federal agency debts, or state debts.

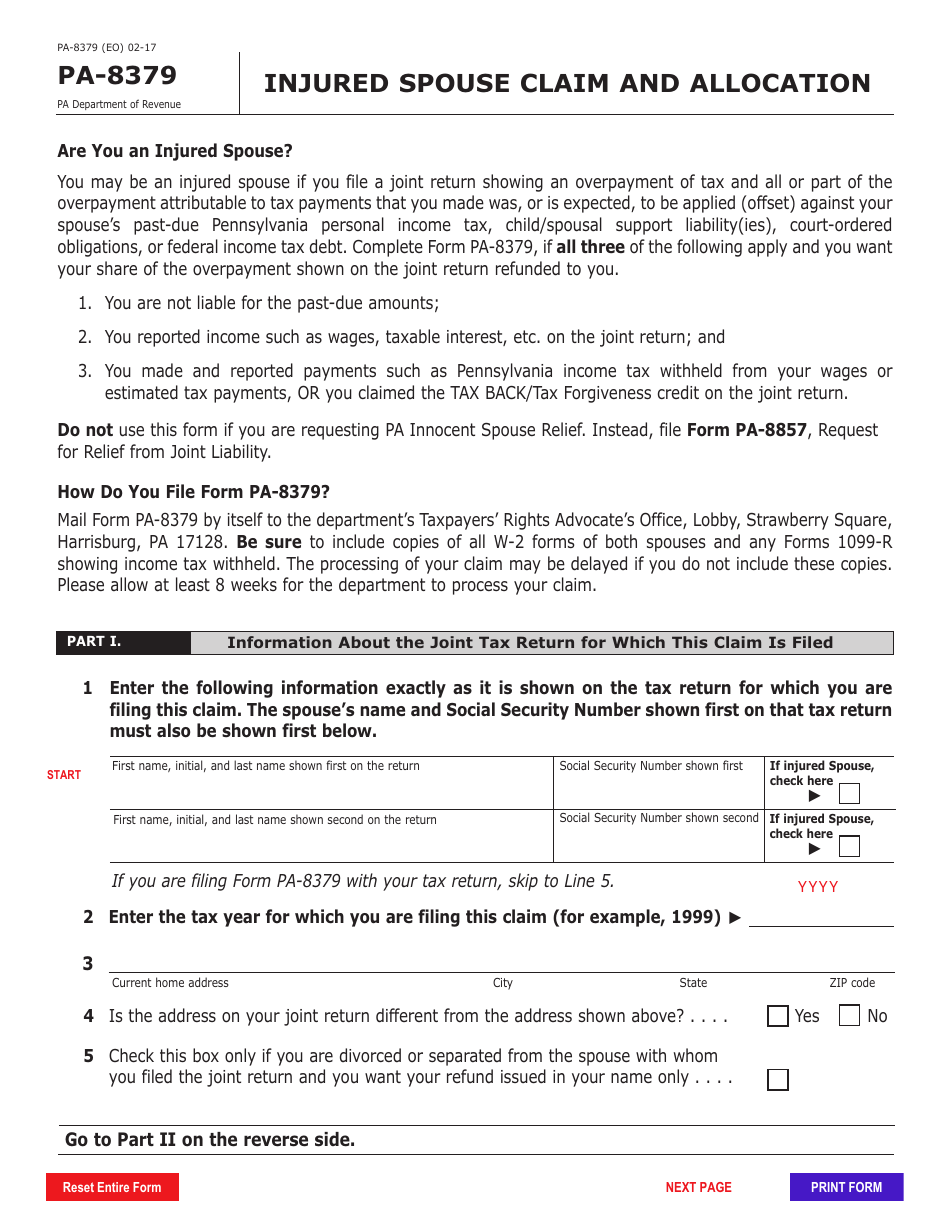

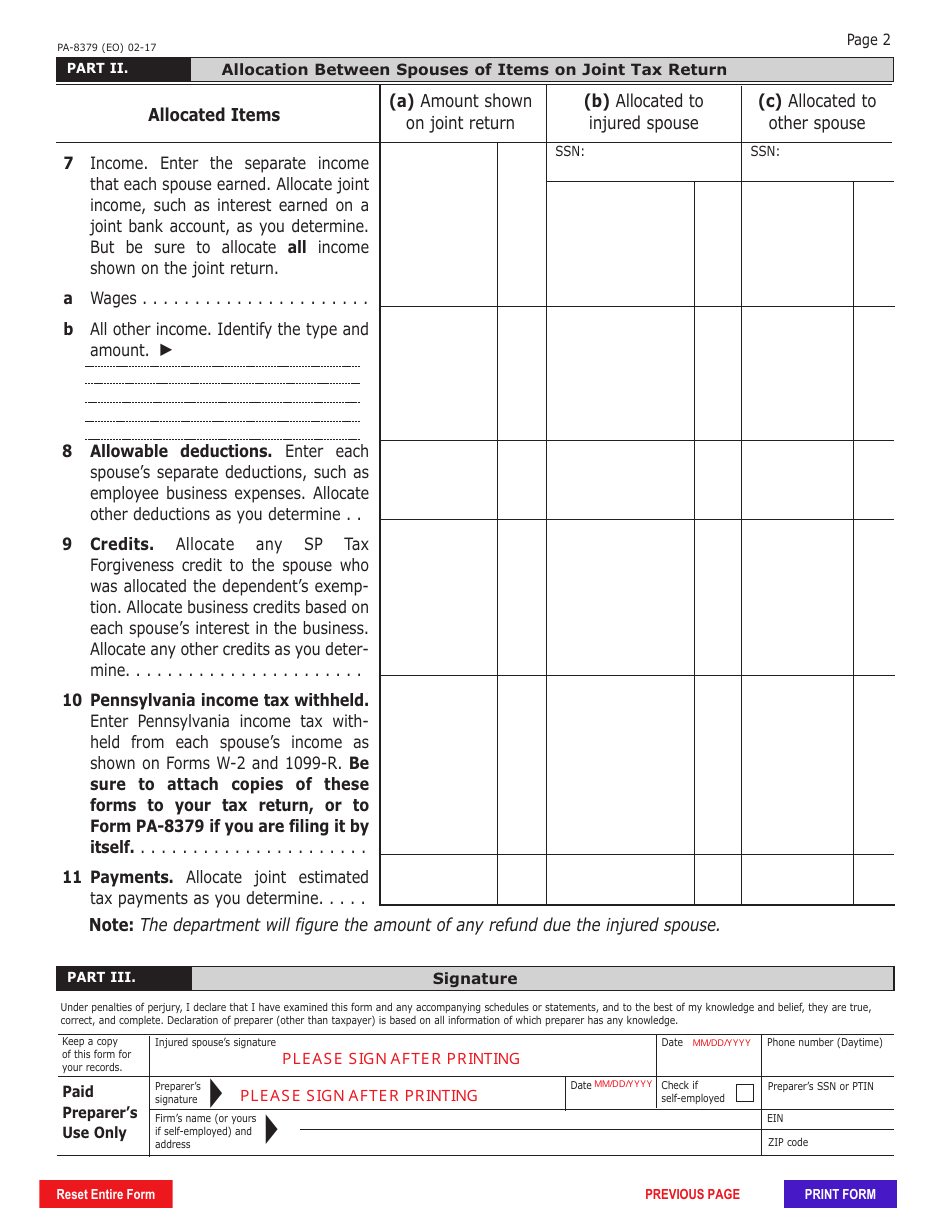

Q: How do I fill out Form PA-8379?

A: To fill out Form PA-8379, you will need to provide your personal information, including your name, Social Security number, and address, as well as your spouse's information, including their name and Social Security number. You will also need to indicate the income and deductions allocated to each spouse, as well as the amount of the expected refund. The form includes instructions on how to complete each section properly.

Form Details:

- Released on February 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-8379 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.