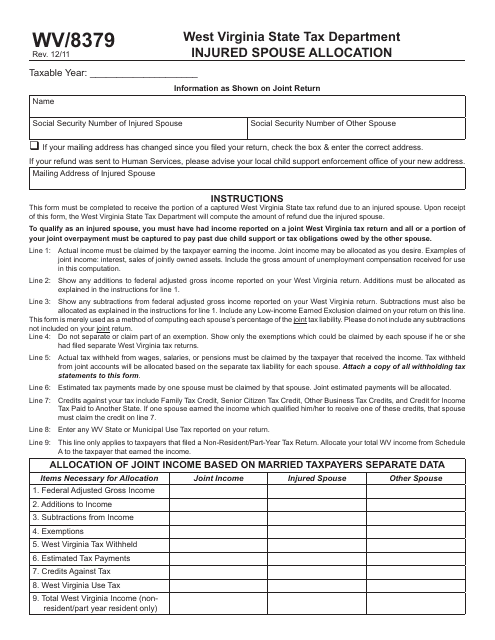

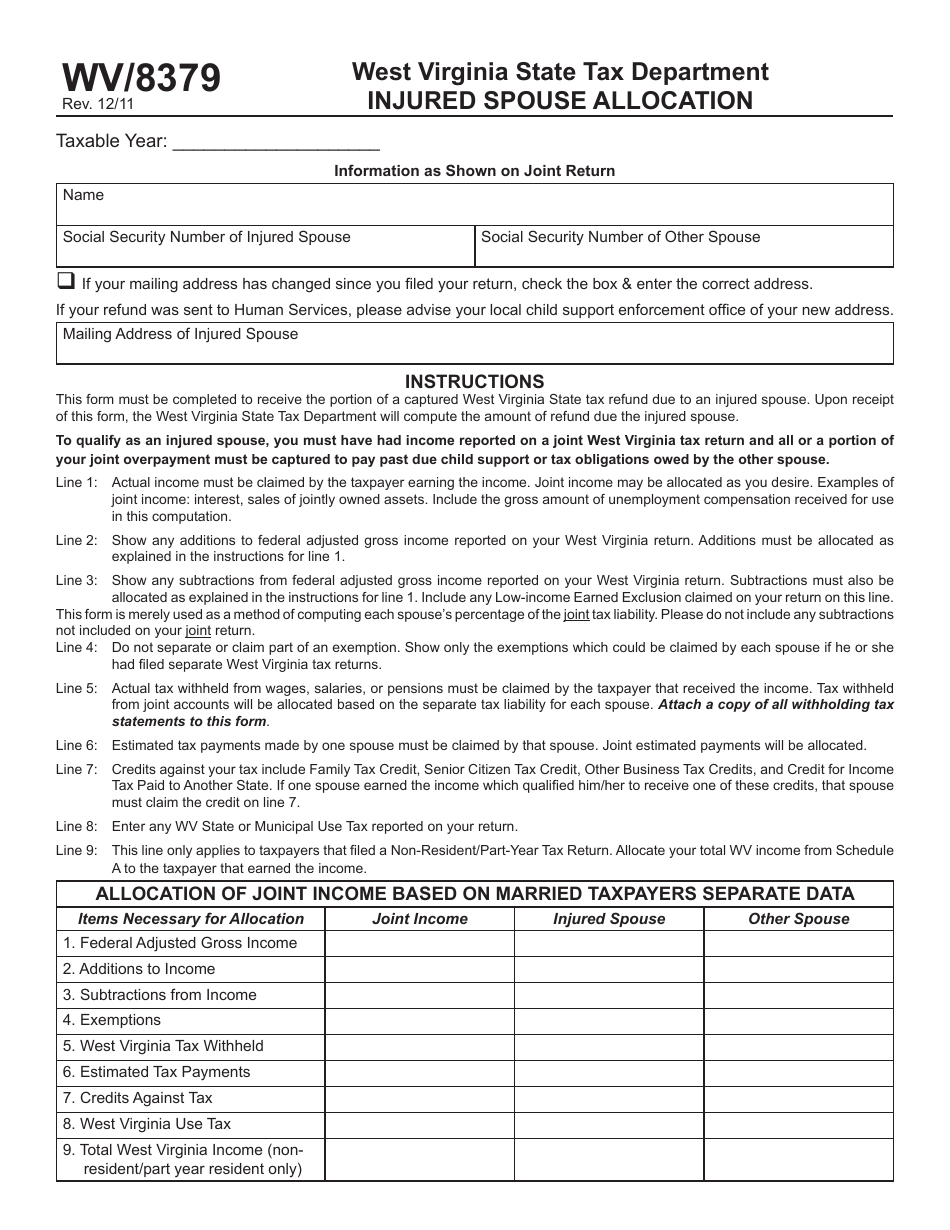

Form WV / 8379 Injured Spouse Allocation - West Virginia

What Is Form WV/8379?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WV/8379?

A: Form WV/8379 is the Injured Spouse Allocation form specifically for residents of West Virginia.

Q: What is the purpose of Form WV/8379?

A: The purpose of Form WV/8379 is to allocate a portion of the overpayment from a joint tax return to the injured spouse, if their share of the refund would be used to pay the other spouse's past-due obligations.

Q: Who can use Form WV/8379?

A: Only residents of West Virginia who are classified as an injured spouse can use Form WV/8379.

Q: What is an injured spouse?

A: An injured spouse is a taxpayer whose portion of a tax refund is being withheld to pay the past-due obligations of their spouse.

Q: When should Form WV/8379 be filed?

A: Form WV/8379 should be filed when the injured spouse wants to claim their portion of the tax refund and avoid having it applied to the other spouse's debts.

Q: Is there a deadline to file Form WV/8379?

A: Yes, Form WV/8379 must be filed within 3 years from the due date of the original return or 2 years from the date of overpayment, whichever is later.

Q: Does filing Form WV/8379 guarantee that the injured spouse will receive their portion of the refund?

A: Filing Form WV/8379 does not guarantee that the injured spouse will receive their portion of the refund. It depends on the specific circumstances and the amount of the other spouse's past-due obligations.

Q: Are there any fees associated with filing Form WV/8379?

A: No, there are no fees associated with filing Form WV/8379.

Q: Can Form WV/8379 be filed electronically?

A: No, Form WV/8379 cannot be filed electronically. It must be printed, filled out, and mailed to the West Virginia State Tax Department.

Form Details:

- Released on December 1, 2011;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/8379 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.