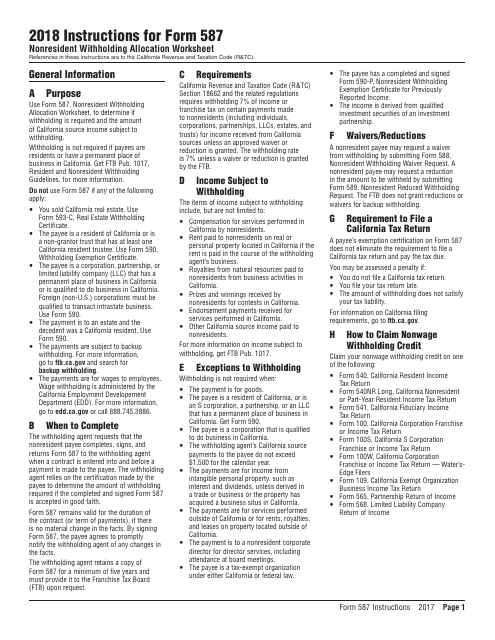

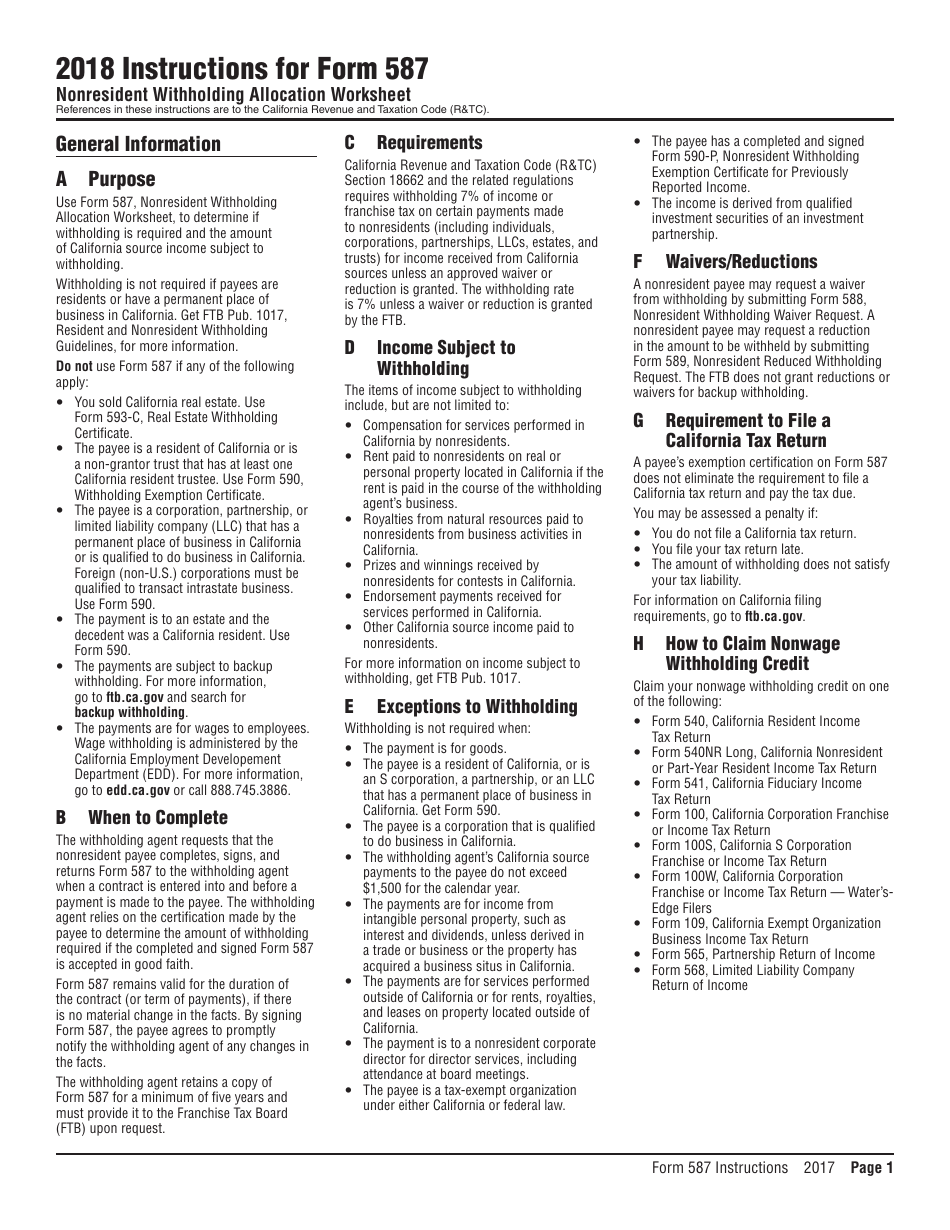

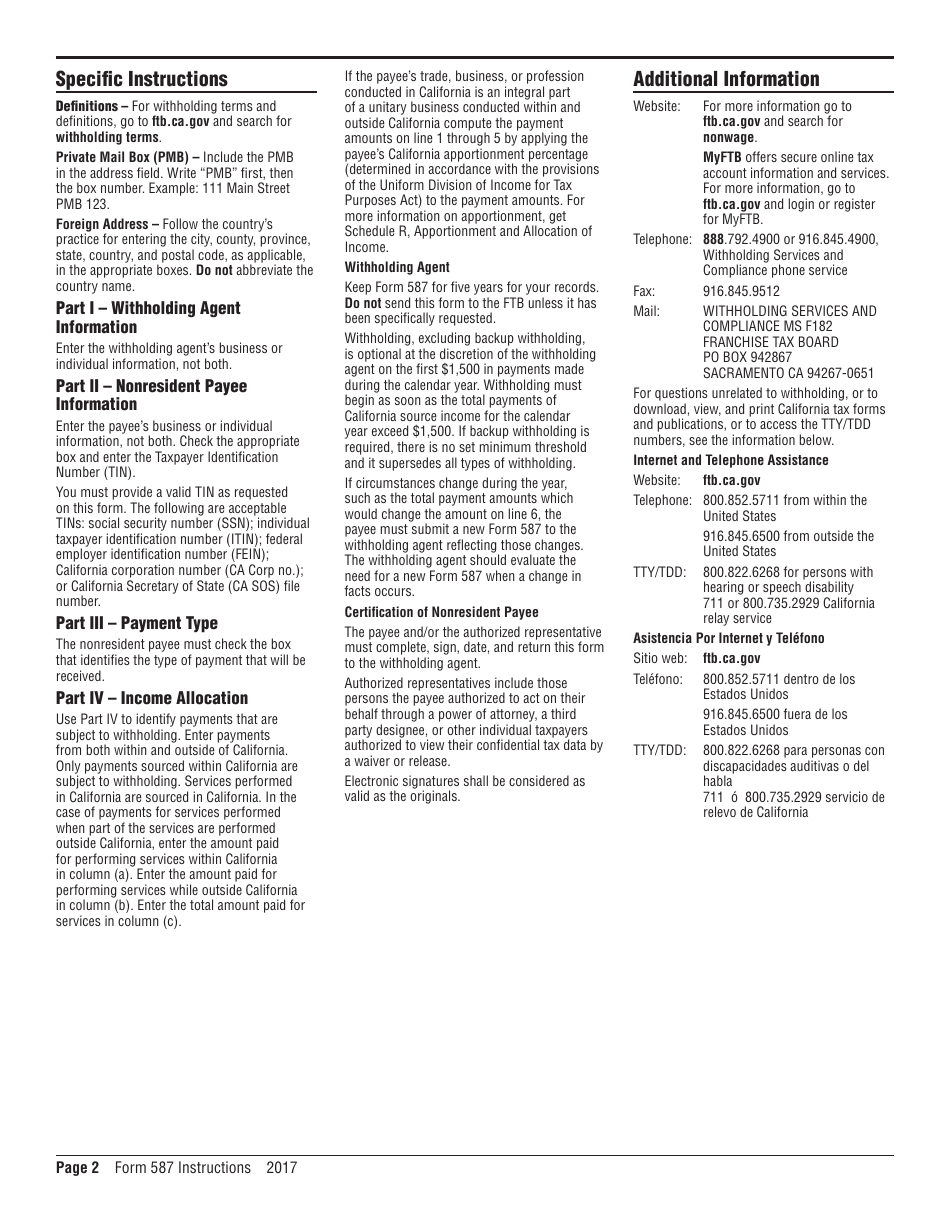

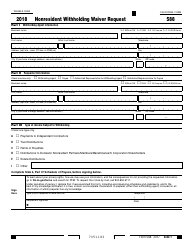

Instructions for Form 587 Nonresident Withholding Allocation Worksheet - California

This document contains official instructions for Form 587 , Nonresident Withholding Allocation Worksheet - a form released and collected by the California Franchise Tax Board.

FAQ

Q: What is Form 587?

A: Form 587 is the Nonresident Withholding Allocation Worksheet.

Q: What is the purpose of Form 587?

A: The purpose of Form 587 is to help nonresidents of California allocate their income and calculate the correct amount of withholding tax.

Q: Who needs to fill out Form 587?

A: Nonresidents of California who receive income from California sources and want to allocate their withholding tax need to fill out Form 587.

Q: Is Form 587 only for individuals?

A: No, Form 587 is not only for individuals. It can also be used by partnerships, estates, and trusts.

Q: What information do I need to fill out Form 587?

A: To fill out Form 587, you will need information about your total income, the income derived from California sources, and the total withholding tax amount.

Q: When is the deadline to submit Form 587?

A: The deadline to submit Form 587 is the same as the regular tax return due date, which is usually April 15th for individuals.

Q: What happens if I don't submit Form 587?

A: If you don't submit Form 587, the default allocation will be applied, and you may not receive the full benefit of any tax treaty or exemption provisions.

Q: Are there any penalties for incorrect or late Form 587 submission?

A: Yes, there may be penalties for incorrect or late Form 587 submission. It is important to accurately complete and submit the form on time.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Franchise Tax Board.