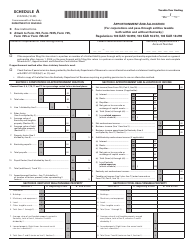

Instructions for Form R Apportionment and Allocation of Income - California

This document contains official instructions for Form R , Apportionment and Allocation of Income - a form released and collected by the California Franchise Tax Board.

FAQ

Q: What is Form R?

A: Form R is a tax form used in California for apportionment and allocation of income.

Q: What is apportionment and allocation of income?

A: Apportionment and allocation of income is the process of determining how much of a company's income is taxable in California.

Q: Who needs to file Form R?

A: Any business that has income from sources both inside and outside of California needs to file Form R.

Q: How do I determine my apportionment and allocation factor?

A: The apportionment and allocation factor is usually based on the percentage of a business's sales, payroll, and property located in California.

Q: Are there any exemptions or special rules for certain industries?

A: Yes, there are special rules and exemptions for industries such as transportation, financial institutions, and agricultural businesses.

Q: When is the deadline to file Form R?

A: The deadline to file Form R is usually on or before the 15th day of the fourth month following the close of the tax year.

Q: What happens if I don't file Form R?

A: Failure to file Form R or filing a late or incorrect form may result in penalties and interest charges.

Q: Do I need to keep a copy of Form R for my records?

A: Yes, it is recommended to keep a copy of Form R and all supporting documentation for at least four years.

Instruction Details:

- This 8-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Franchise Tax Board.