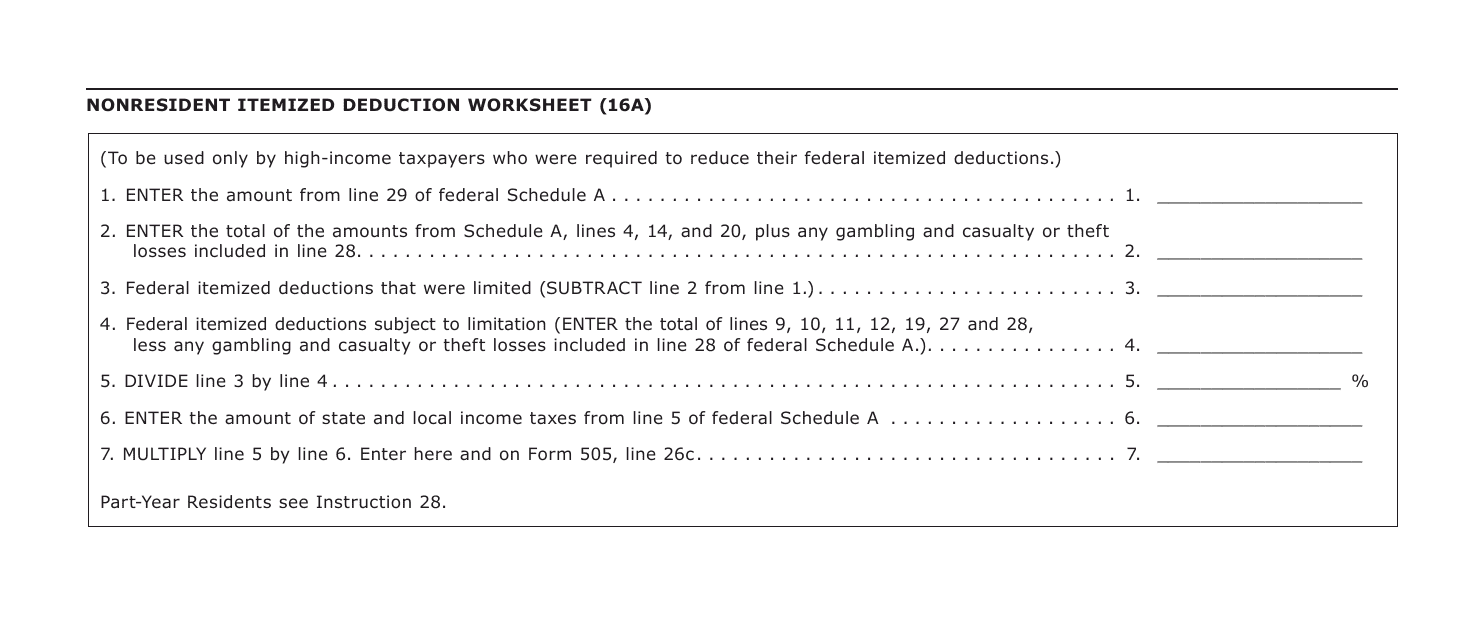

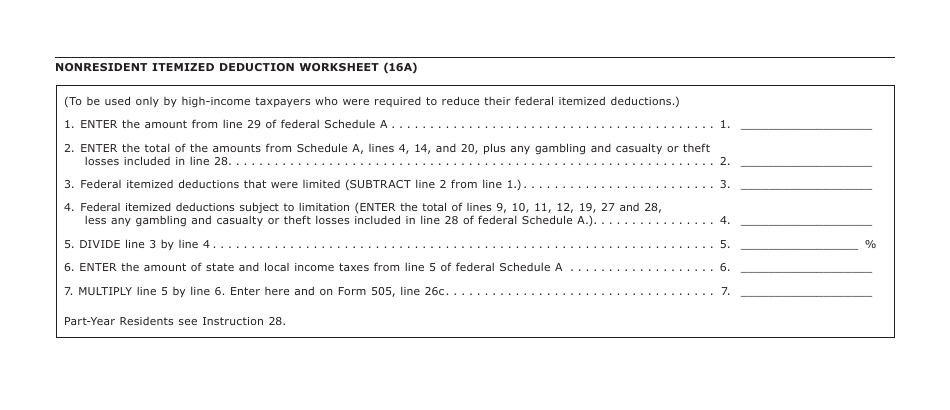

Form 16A Nonresident Itemized Deduction Worksheet - Maryland

What Is Form 16A?

This is a legal form that was released by the Comptroller of Maryland - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 16A?

A: Form 16A is the Nonresident Itemized Deduction Worksheet for Maryland.

Q: Who needs to file Form 16A?

A: Nonresident taxpayers who wish to claim itemized deductions in Maryland need to file Form 16A.

Q: What is the purpose of Form 16A?

A: Form 16A is used to calculate the amount of itemized deductions that nonresident taxpayers can claim in Maryland.

Q: What deductions can be claimed on Form 16A?

A: Some examples of deductions that can be claimed on Form 16A include medical expenses, charitable contributions, and mortgage interest.

Q: Are there any specific instructions for filling out Form 16A?

A: Yes, the form includes detailed instructions on how to calculate itemized deductions and what documentation is required to support the deductions claimed.

Q: When is the deadline to file Form 16A?

A: Form 16A must be filed by the due date of your Maryland income tax return, which is usually April 15th.

Q: Can I e-file Form 16A?

A: No, Form 16A cannot be e-filed and must be submitted by mail along with your Maryland income tax return.

Q: What should I do if I have questions or need assistance with Form 16A?

A: If you have questions or need assistance with Form 16A, you can contact the Maryland Taxpayer Service Division or consult a tax professional.

Form Details:

- The latest edition provided by the Comptroller of Maryland;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 16A by clicking the link below or browse more documents and templates provided by the Comptroller of Maryland.