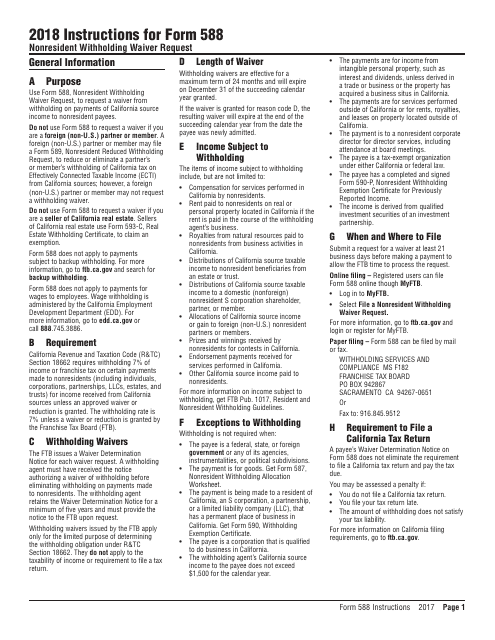

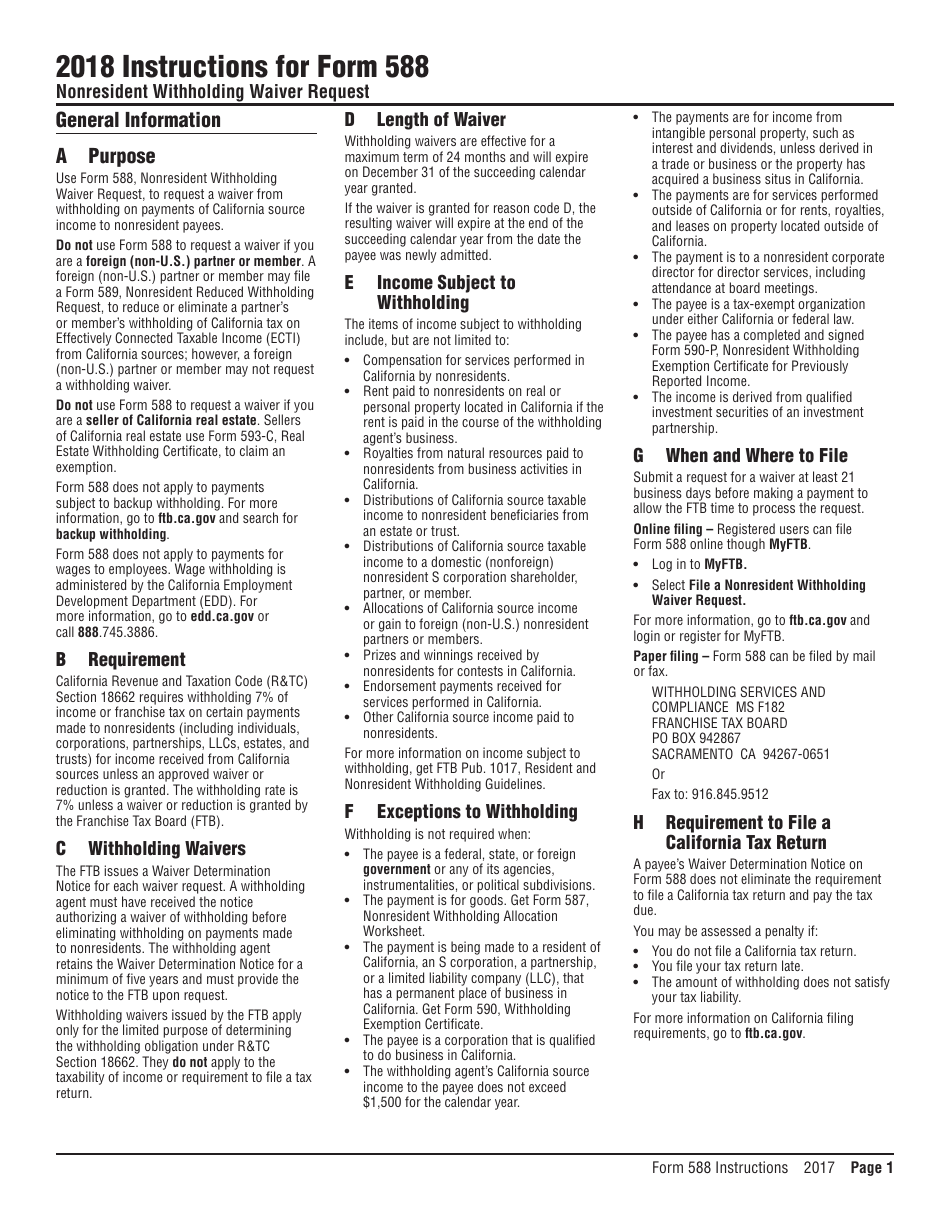

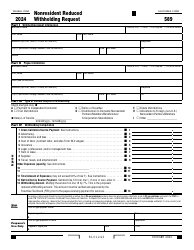

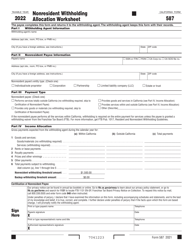

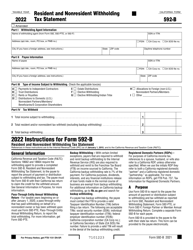

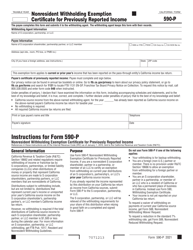

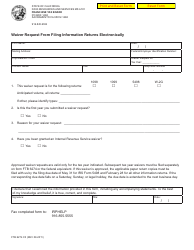

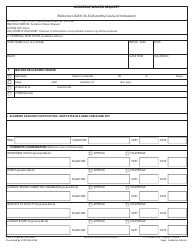

Instructions for Form 588 Nonresident Withholding Waiver Request - California

This document contains official instructions for Form 588 , Nonresident Withholding Waiver Request - a form released and collected by the California Franchise Tax Board. An up-to-date fillable Form 588 is available for download through this link.

FAQ

Q: What is Form 588?

A: Form 588 is a Nonresident Withholding Waiver Request form.

Q: What is the purpose of Form 588?

A: The purpose of Form 588 is to request a waiver of nonresident withholding on California source income.

Q: Who needs to use Form 588?

A: Nonresident individuals or entities who want to request a withholding waiver for California source income.

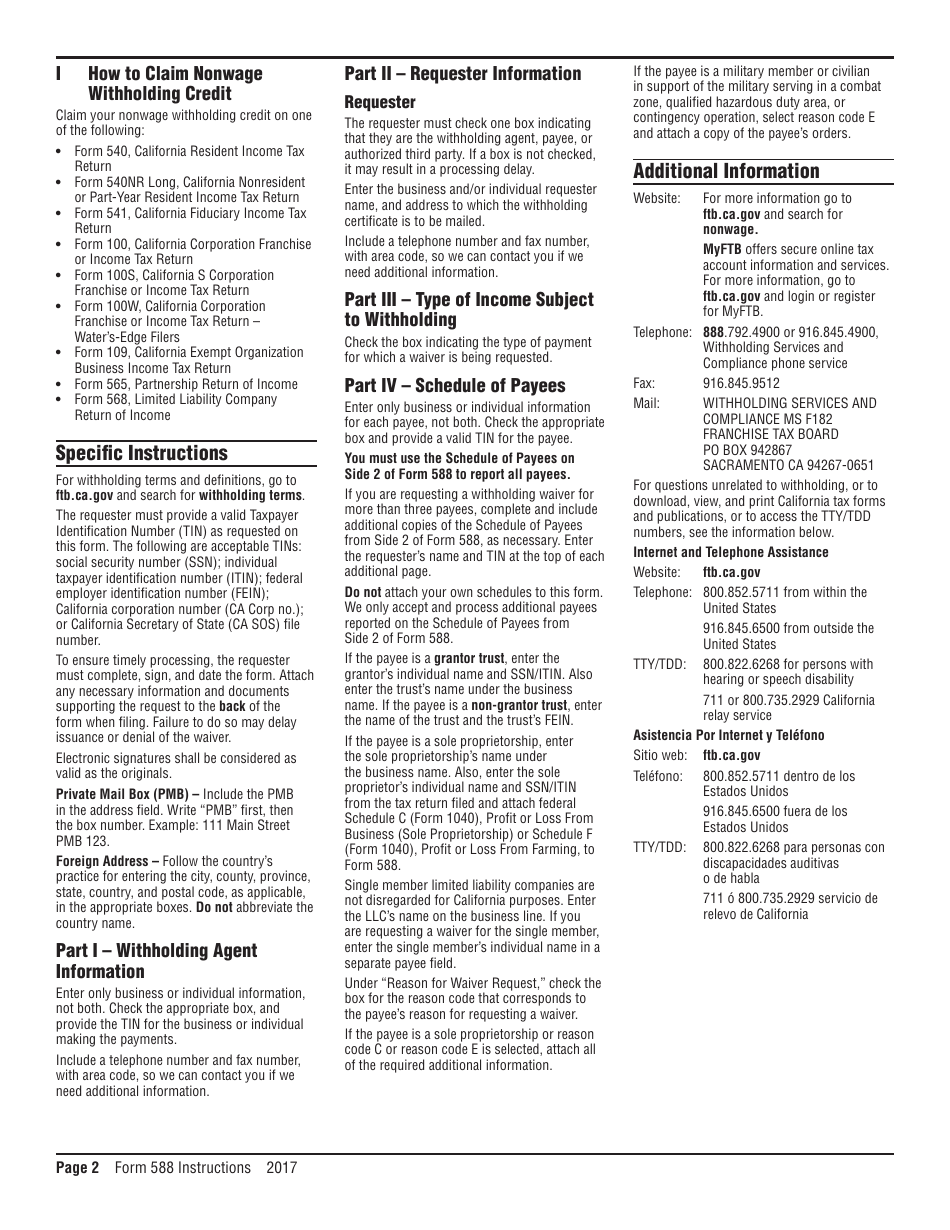

Q: How do I fill out Form 588?

A: You need to provide your personal information, income details, and reasons for requesting a withholding waiver.

Q: When should I submit Form 588?

A: You should submit Form 588 at least 30 days before the earliest payment or accrual of income subject to withholding.

Q: How long does it take to process Form 588?

A: Processing time can vary, but typically it takes about 30 days.

Q: What if my Form 588 is denied?

A: If your Form 588 is denied, withholding will be required on California source income.

Q: Do I need to include any supporting documents with Form 588?

A: No, you do not need to include any supporting documents with Form 588, unless specifically requested by the Franchise Tax Board.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Franchise Tax Board.