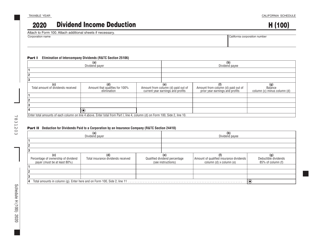

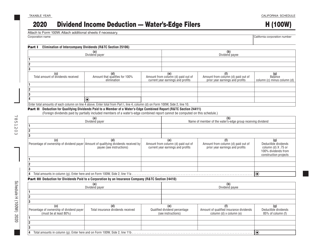

Instructions for Form 100 Schedule H Dividend Income Deduction - California

This document contains official instructions for Form 100 Schedule H, Dividend Income Deduction - a form released and collected by the California Franchise Tax Board.

FAQ

Q: What is Form 100 Schedule H?

A: Form 100 Schedule H is a form used by taxpayers in California to claim the Dividend Income Deduction.

Q: What is the Dividend Income Deduction?

A: The Dividend Income Deduction is a deduction that allows taxpayers in California to reduce their taxable income by a certain percentage of their qualified dividend income.

Q: Who is eligible for the Dividend Income Deduction?

A: Taxpayers who are residents of California and have received qualified dividend income are eligible for the deduction.

Q: What is qualified dividend income?

A: Qualified dividend income is income received from certain domestic and foreign corporations that meet certain criteria set by the IRS.

Q: How much is the Dividend Income Deduction?

A: The deduction is generally 50% of the taxpayer's qualified dividend income, but there are certain limitations and exceptions.

Q: How do I claim the Dividend Income Deduction?

A: To claim the deduction, you must complete Form 100 Schedule H and attach it to your California Form 100 tax return.

Q: Are there any other requirements or limitations for claiming the deduction?

A: Yes, there are certain requirements and limitations. It is recommended to review the instructions for Form 100 Schedule H for more information.

Q: Can I claim the Dividend Income Deduction if I don't live in California?

A: No, the Dividend Income Deduction is only available to taxpayers who are residents of California.

Q: Is the Dividend Income Deduction the same as the federal dividend tax rate?

A: No, the Dividend Income Deduction is a state-level deduction for California residents, while the federal dividend tax rate is a separate tax rate set by the IRS for qualified dividend income.

Instruction Details:

- This 1-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Franchise Tax Board.