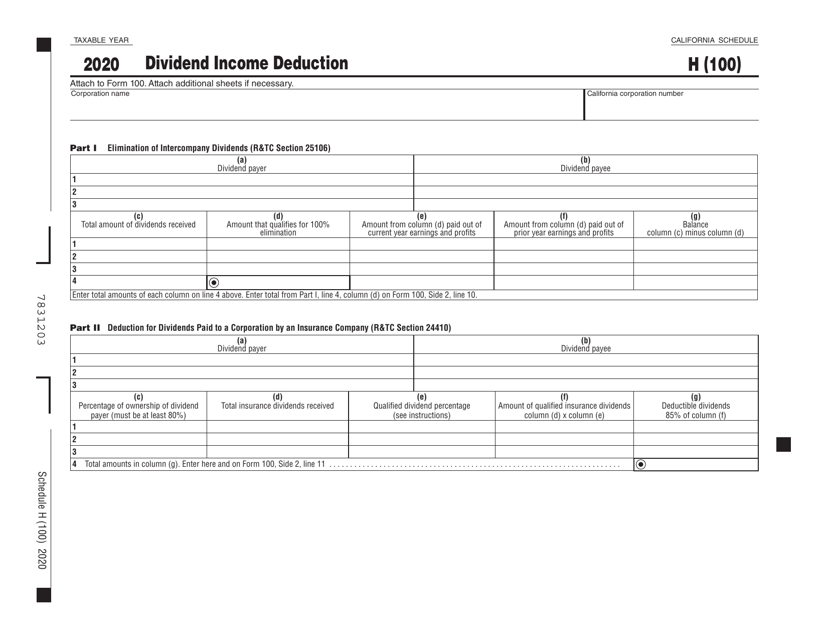

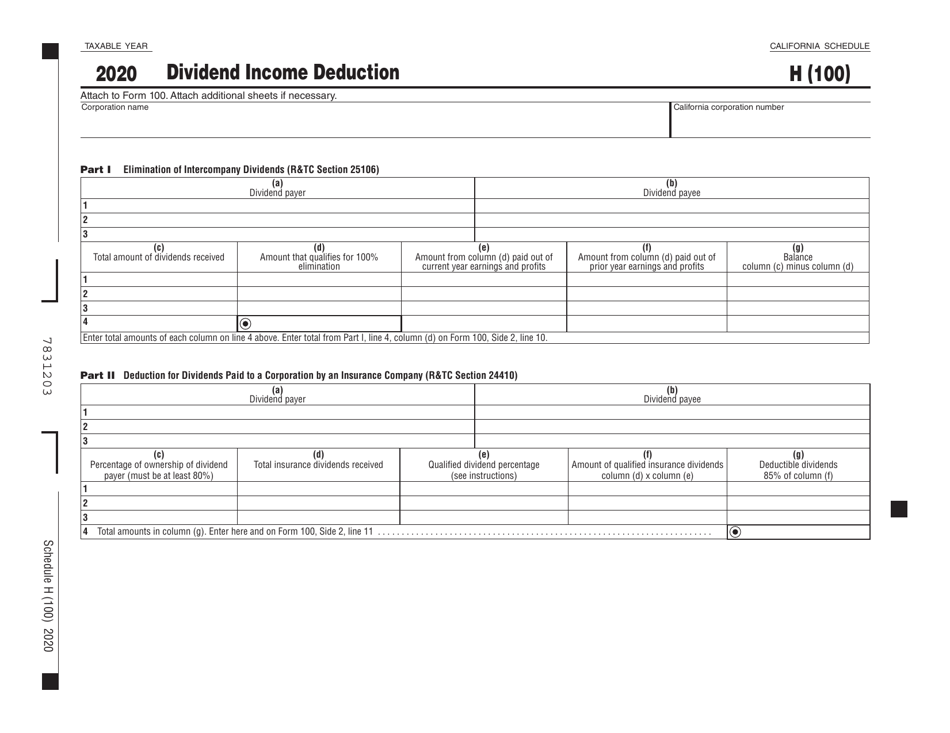

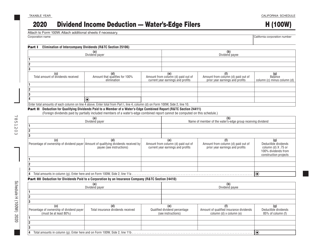

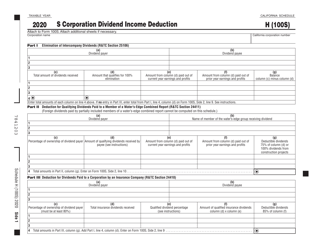

Form 100 Schedule H Dividend Income Deduction - California

What Is Form 100 Schedule H?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California.The document is a supplement to Form 100, California Corporation Franchise or Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 100 Schedule H?

A: Form 100 Schedule H is a California tax form used to claim the dividend income deduction.

Q: What is the dividend income deduction?

A: The dividend income deduction is a tax deduction that allows individuals and businesses to reduce their taxable income by a certain amount of dividend income.

Q: Who can claim the dividend income deduction?

A: Individuals and businesses who receive dividend income can claim the dividend income deduction.

Q: How much can you deduct for dividend income?

A: The amount that can be deducted for dividend income varies depending on various factors. It is advisable to refer to the instructions provided with Form 100 Schedule H for specific details.

Q: How do I file Form 100 Schedule H?

A: Form 100 Schedule H is filed as part of the California Form 100, which is the state tax return for corporations. It should be completed and attached to the main tax return.

Q: Are there any additional requirements for claiming the dividend income deduction?

A: Yes, there may be additional requirements such as providing supporting documentation or meeting certain criteria. Refer to the instructions for Form 100 Schedule H for more details.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 100 Schedule H by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.