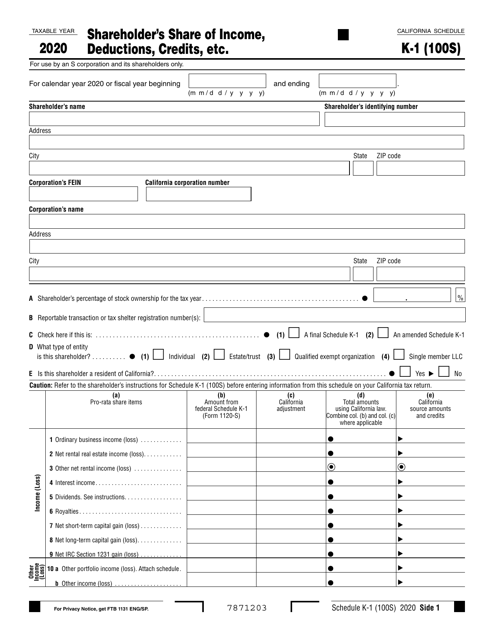

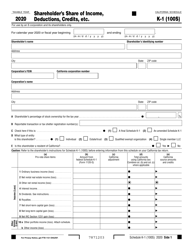

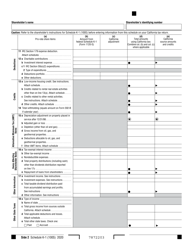

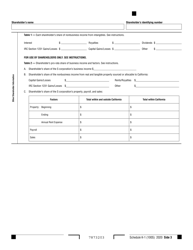

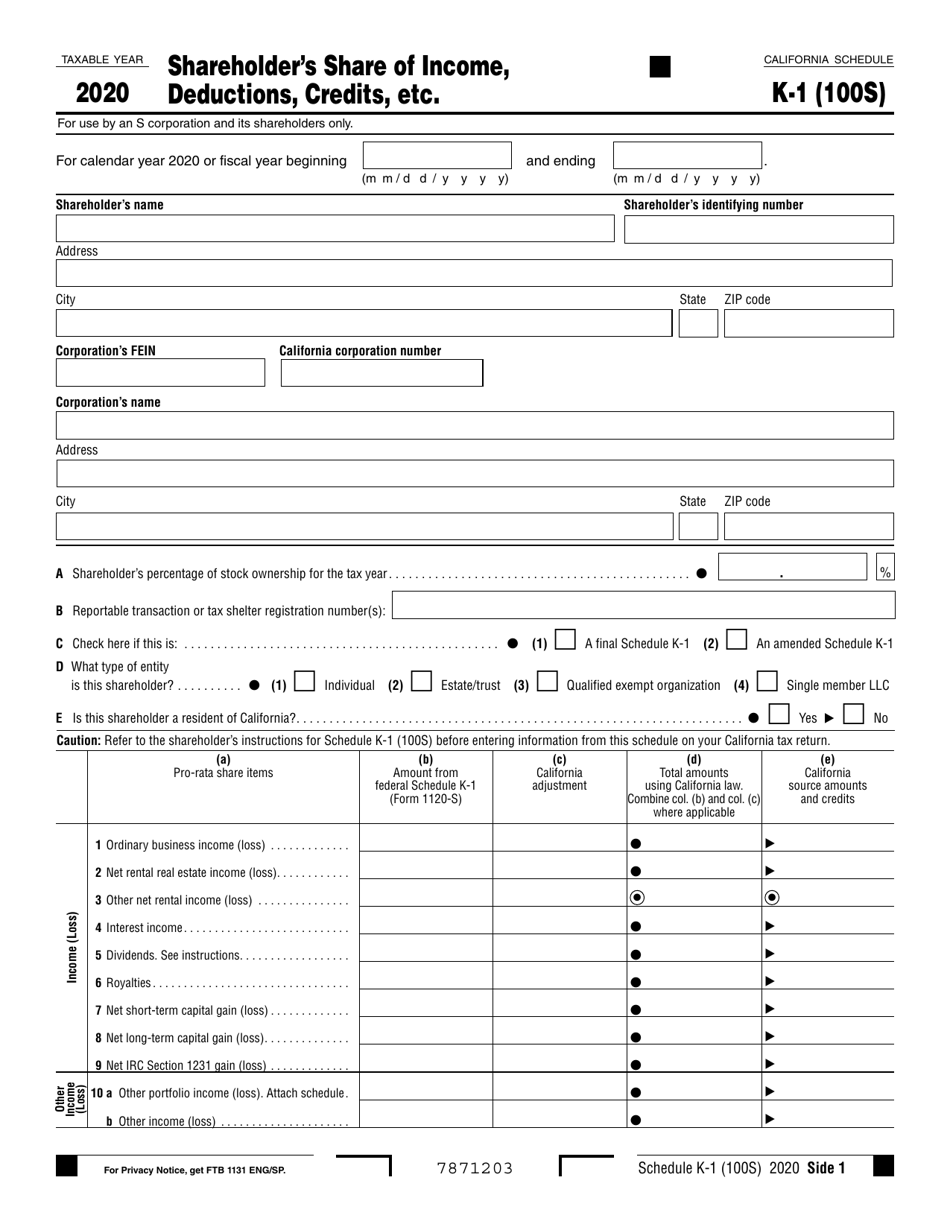

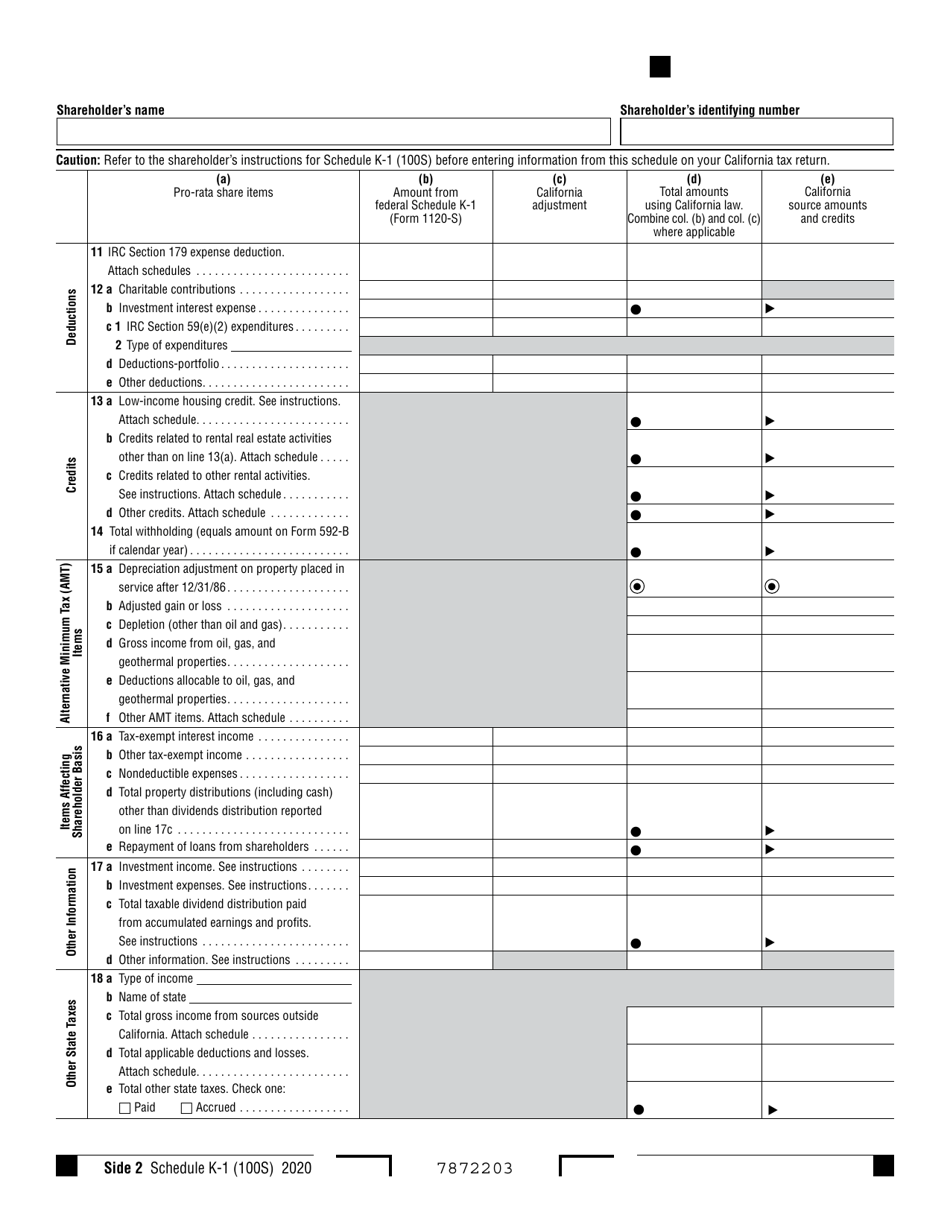

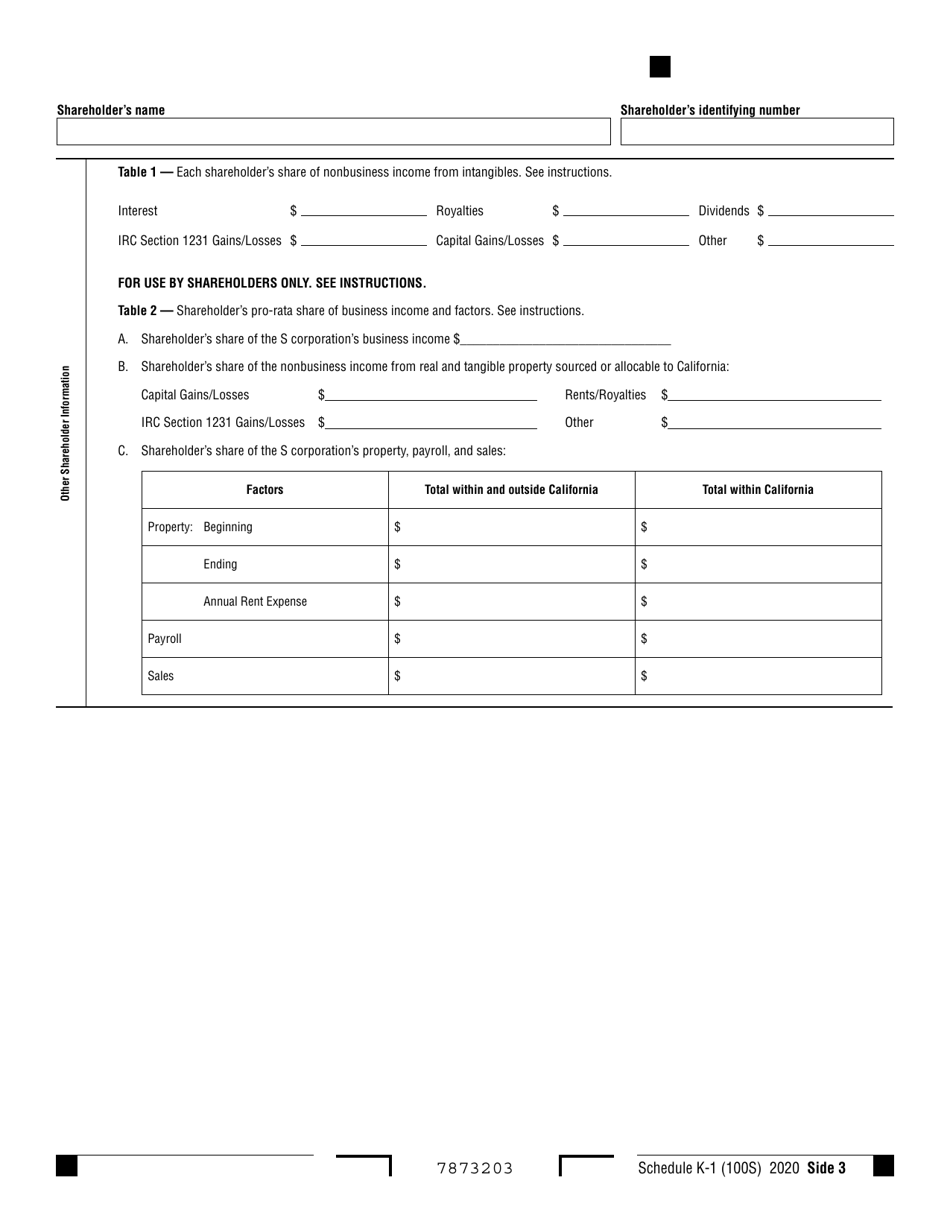

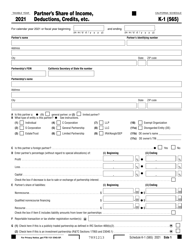

Form 100S Schedule K-1 Shareholder's Share of Income, Deductions, Credits, Etc. - California

What Is Form 100S Schedule K-1?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California.The document is a supplement to Form 100S, California S Corporation Franchise or Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 100S Schedule K-1?

A: Form 100S Schedule K-1 is a tax form used by shareholders of a California S corporation to report their share of income, deductions, credits, etc.

Q: Who needs to file Form 100S Schedule K-1?

A: Shareholders of a California S corporation need to file Form 100S Schedule K-1 to report their share of the corporation's tax information.

Q: What information does Form 100S Schedule K-1 report?

A: Form 100S Schedule K-1 reports the shareholder's share of the S corporation's income, deductions, credits, and other relevant tax information.

Q: When is the deadline for filing Form 100S Schedule K-1?

A: The deadline for filing Form 100S Schedule K-1 is generally the same as the deadline for filing the California S corporation's tax return, which is usually March 15th.

Q: Are there any penalties for not filing Form 100S Schedule K-1?

A: Yes, failing to file Form 100S Schedule K-1 or filing it late may result in penalties imposed by the California Franchise Tax Board.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 100S Schedule K-1 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.