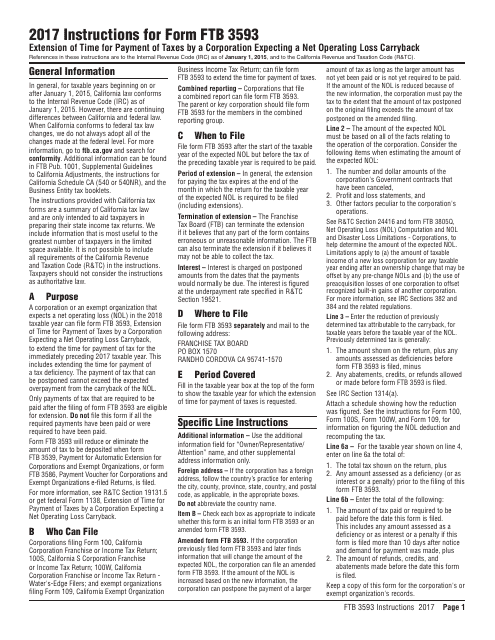

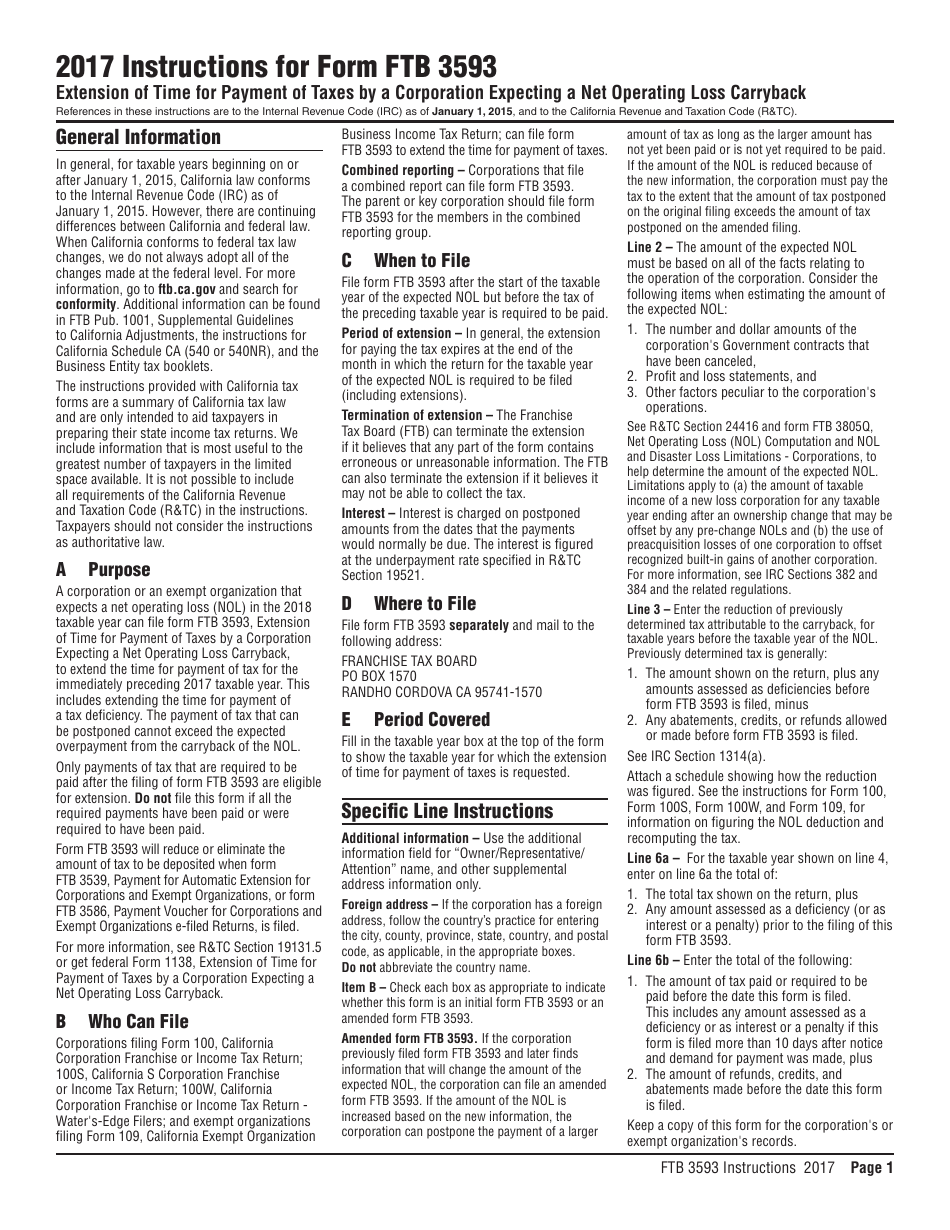

Instructions for Form FTB3593 Extension of Time for Payment of Taxes by a Corporation Expecting a Net Operating Loss Carryback - California

This document contains official instructions for Form FTB3593 , Extension of Time for Payment of Taxes by a Corporation Expecting a Net Operating Loss Carryback - a form released and collected by the California Franchise Tax Board.

FAQ

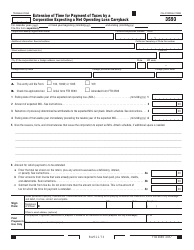

Q: What is Form FTB3593?

A: Form FTB3593 is a form used in California for corporations expecting a net operating loss carryback.

Q: What is the purpose of Form FTB3593?

A: The purpose of Form FTB3593 is to request an extension of time for payment of taxes by a corporation expecting a net operating loss carryback.

Q: Who should file Form FTB3593?

A: Corporations in California expecting a net operating loss carryback should file Form FTB3593.

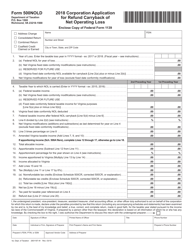

Q: What does a net operating loss carryback mean?

A: A net operating loss carryback is when a corporation applies a current year net operating loss to a prior year tax liability, resulting in a refund or credit for taxes paid in the prior year.

Q: Why would a corporation need an extension of time to pay taxes?

A: A corporation may need an extension of time to pay taxes if they are expecting a net operating loss carryback and need additional time to calculate and file their tax return.

Q: How can a corporation request an extension of time to pay taxes?

A: A corporation can request an extension of time to pay taxes by filing Form FTB3593 with the California Franchise Tax Board.

Q: What is the deadline for filing Form FTB3593?

A: The deadline for filing Form FTB3593 is the same as the corporation's tax return due date, including any extensions.

Q: Are there any penalties for late payment of taxes?

A: Yes, there may be penalties for late payment of taxes. It is important for corporations to file Form FTB3593 and pay their taxes by the deadline to avoid penalties.

Q: Is Form FTB3593 only applicable to corporations in California?

A: Yes, Form FTB3593 is specifically for corporations in California.

Instruction Details:

- This 1-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Franchise Tax Board.