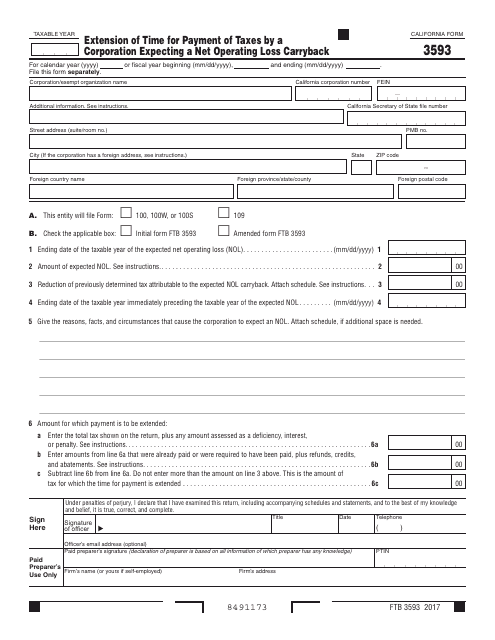

Form FTB3593 Extension of Time for Payment of Taxes by a Corporation Expecting a Net Operating Loss Carryback - California

What Is Form FTB3593?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3593?

A: Form FTB3593 is a California form that allows corporations expecting a net operating loss carryback to request an extension of time for payment of taxes.

Q: Who can use Form FTB3593?

A: Form FTB3593 can be used by corporations in California who anticipate a net operating loss carryback.

Q: What is a net operating loss carryback?

A: A net operating loss carryback occurs when a corporation's deductions exceed its income for a specific tax year and the corporation applies the loss to a previous year's income to obtain a tax refund.

Q: Why would a corporation need an extension of time to pay taxes due to a net operating loss carryback?

A: A corporation may need an extension of time to pay taxes due to a net operating loss carryback if it expects to receive a tax refund for a previous tax year and wants to use that refund to offset its current tax liability.

Q: How can a corporation request an extension of time for payment of taxes using Form FTB3593?

A: A corporation can request an extension of time for payment of taxes by completing and submitting Form FTB3593 to the California Franchise Tax Board.

Q: Is there a deadline for submitting Form FTB3593?

A: Yes, Form FTB3593 must be submitted on or before the original due date of the corporation's tax return, including extensions.

Q: Is there a fee for requesting an extension of time to pay taxes using Form FTB3593?

A: No, there is no fee for requesting an extension of time to pay taxes using Form FTB3593.

Q: Can a corporation still file its tax return before the extended due date?

A: Yes, a corporation can still file its tax return before the extended due date, even if it has requested an extension of time to pay taxes using Form FTB3593.

Q: What happens if a corporation does not pay the taxes by the extended due date?

A: If a corporation does not pay the taxes by the extended due date, it may be subject to penalties and interest.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FTB3593 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.