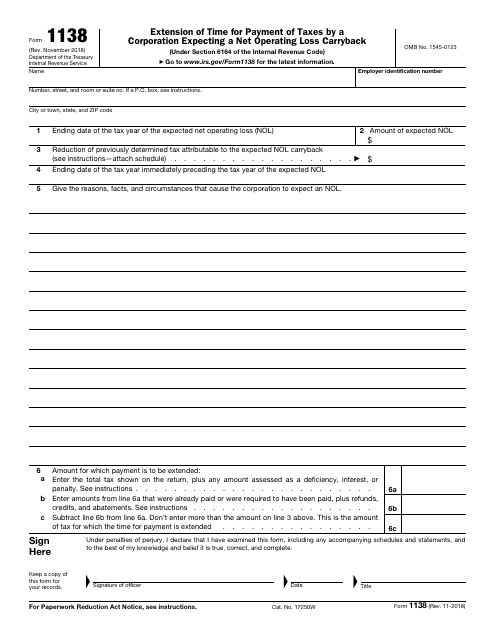

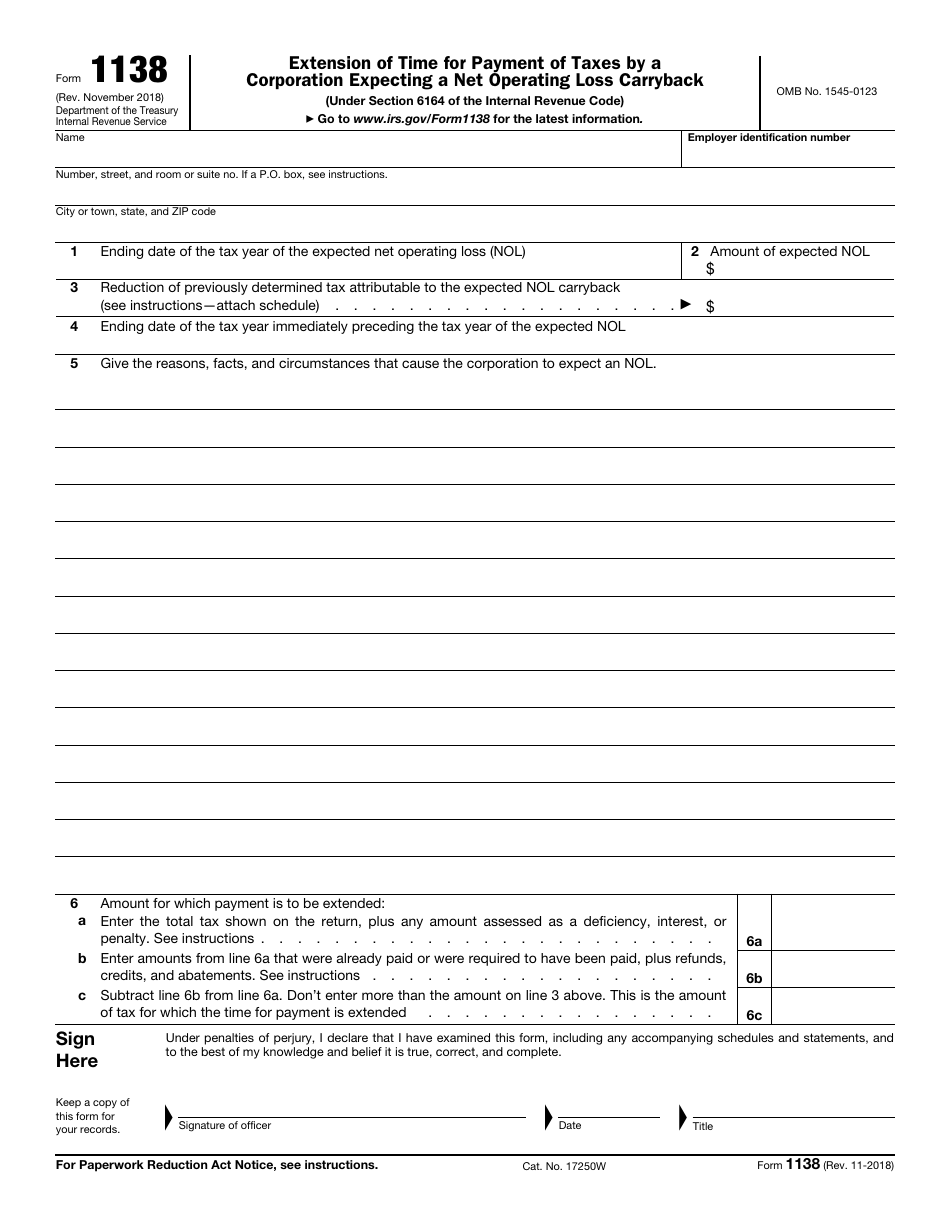

IRS Form 1138 Extension of Time for Payment of Taxes by a Corporation Expecting a Net Operating Loss Carryback

What Is IRS Form 1138?

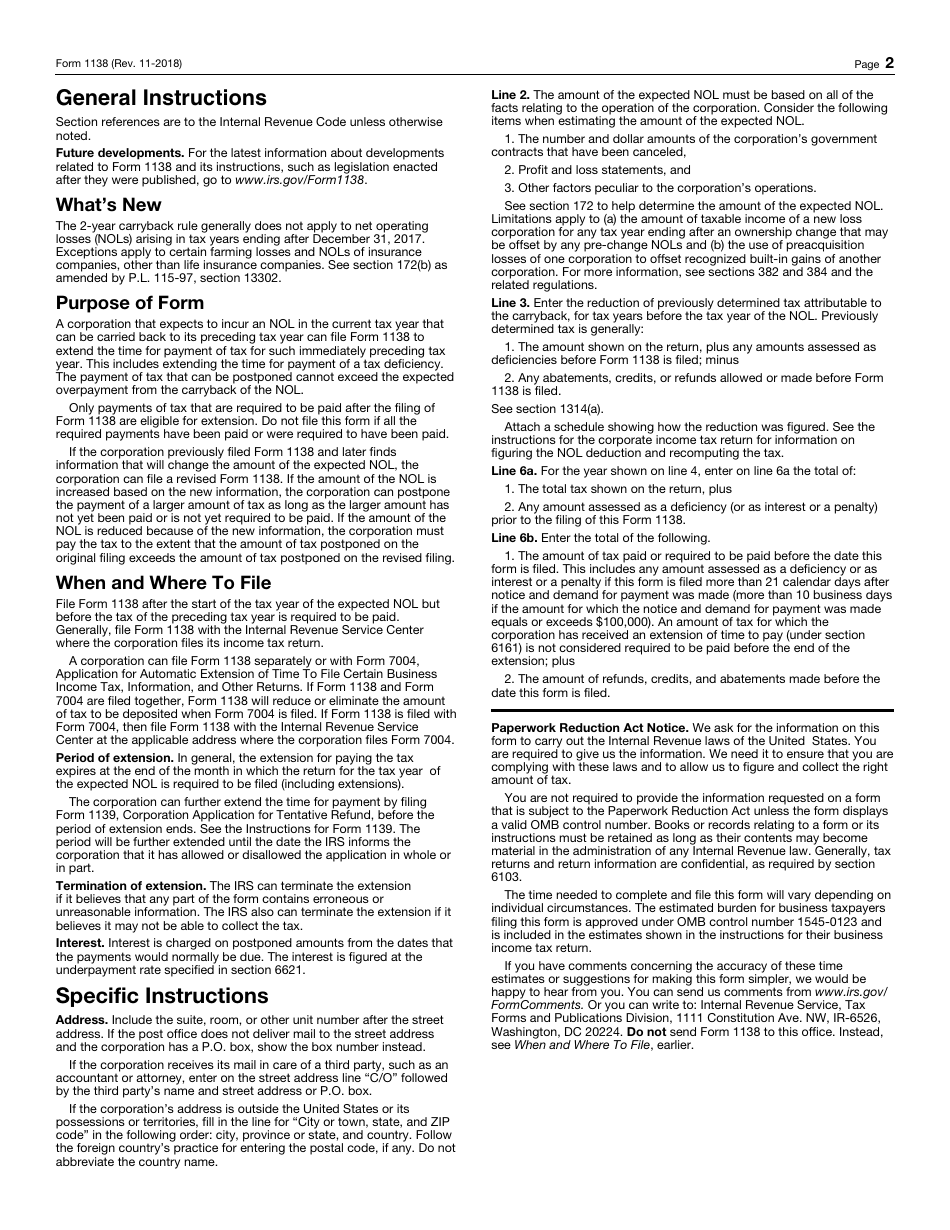

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1138?

A: IRS Form 1138 is a form for corporations to request an extension of time for payment of taxes when expecting a net operating loss carryback.

Q: What is a net operating loss carryback?

A: A net operating loss carryback is a provision that allows corporations to apply their current year's losses to previous years' income, potentially resulting in a tax refund.

Q: Who can use IRS Form 1138?

A: Corporations expecting a net operating loss carryback can use IRS Form 1138 to request an extension of time for payment of taxes.

Q: What is the purpose of filing IRS Form 1138?

A: The purpose of filing IRS Form 1138 is to request additional time to pay taxes when a corporation anticipates receiving a tax refund due to a net operating loss carryback.

Q: How do I file IRS Form 1138?

A: To file IRS Form 1138, corporations must complete the form with the necessary information and submit it to the IRS for approval.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1138 through the link below or browse more documents in our library of IRS Forms.