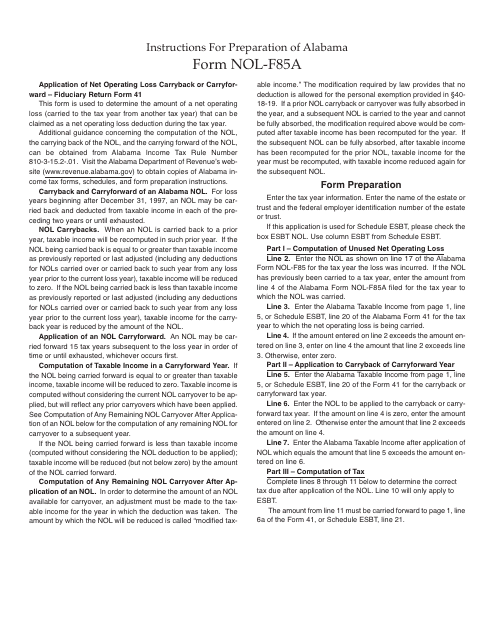

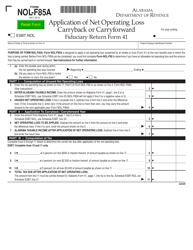

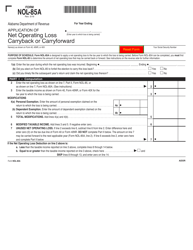

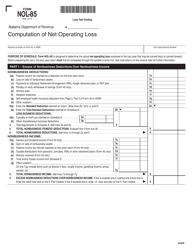

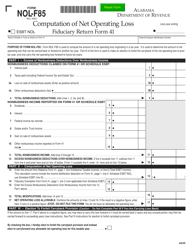

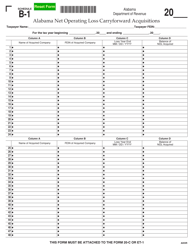

Instructions for Form NOL-F85A Application of Net Operating Loss Carryback or Carryforward Fiduciary Return Form 41 - Alabama

This document contains official instructions for Form NOL-F85A , Application of Net Operating Loss Carryback or Carryforward Fiduciary Return Form 41 - a form released and collected by the Alabama Department of Revenue. An up-to-date fillable Form NOL-F85A is available for download through this link.

FAQ

Q: What is Form NOL-F85A?

A: Form NOL-F85A is an application for net operating loss carryback or carryforward for fiduciary return form 41 in Alabama.

Q: Who should file Form NOL-F85A?

A: This form should be filed by fiduciaries who want to carryback or carryforward a net operating loss for Alabama Form 41.

Q: What is a net operating loss?

A: A net operating loss occurs when business deductions exceed taxable income.

Q: Can I use Form NOL-F85A for individual tax returns?

A: No, Form NOL-F85A is specifically for fiduciary returns on Alabama Form 41.

Q: How do I carryback or carryforward a net operating loss?

A: You can indicate your choice for carrying back or carrying forward the net operating loss on Form NOL-F85A.

Q: Are there any specific instructions for filling out Form NOL-F85A?

A: Yes, you should carefully follow the instructions provided on the form to ensure accurate completion.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Alabama Department of Revenue.