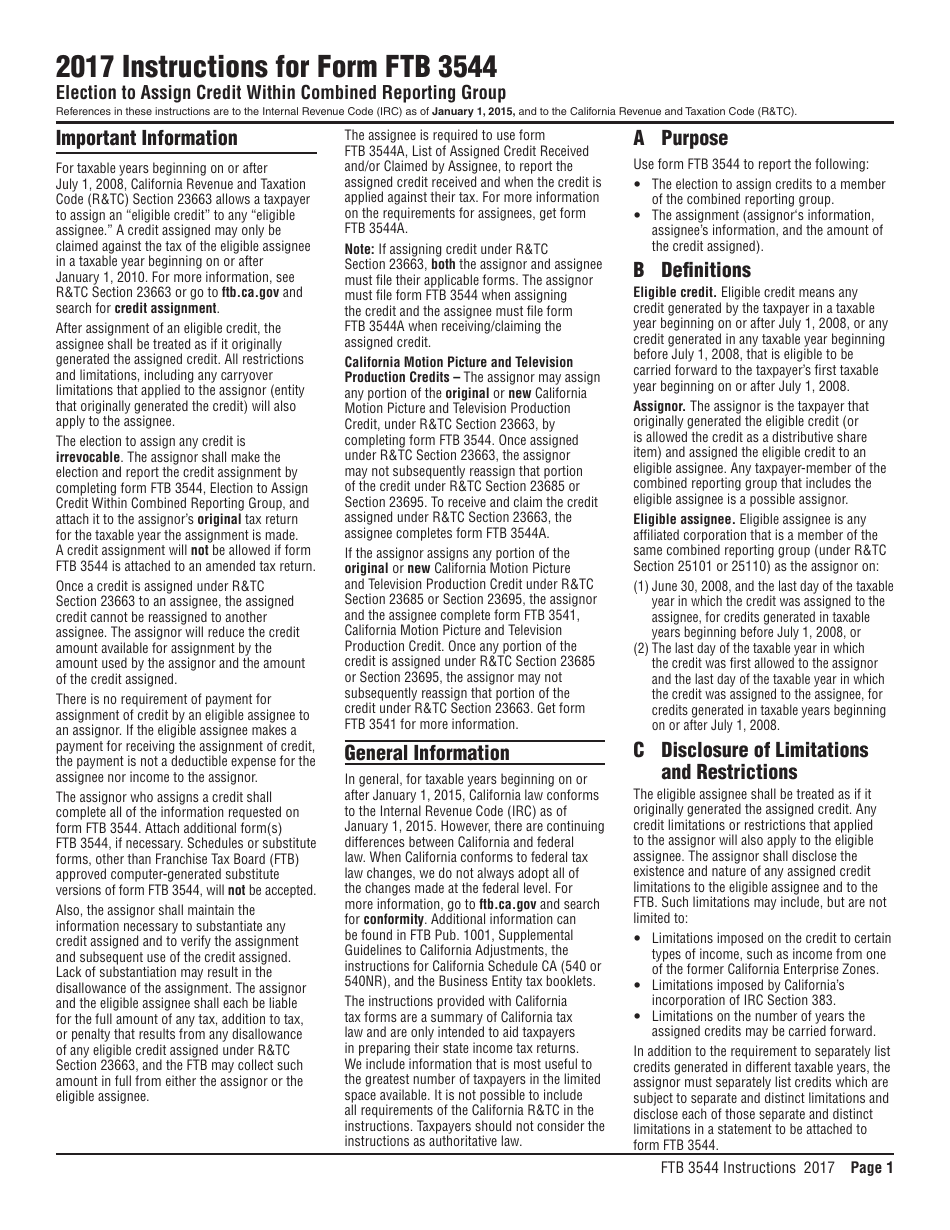

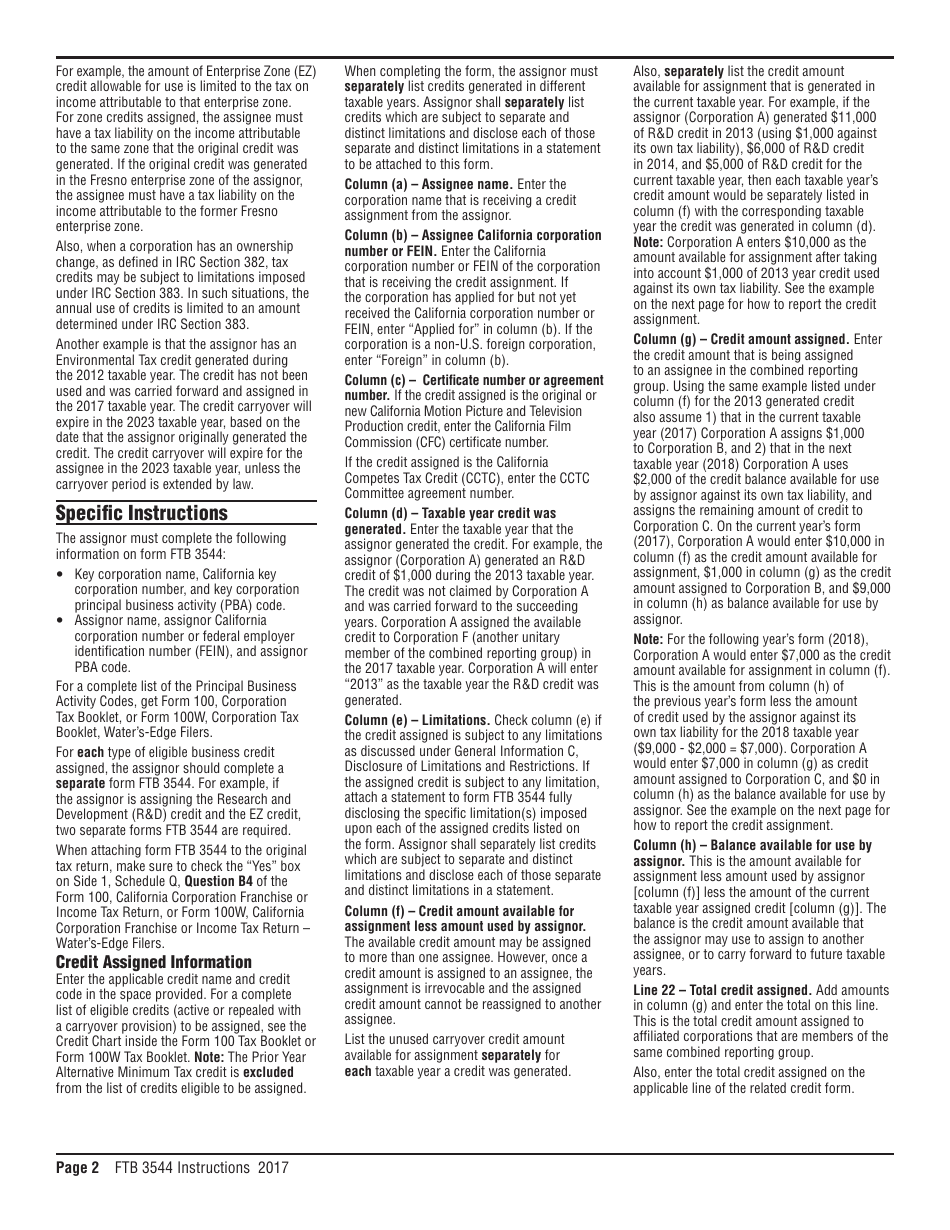

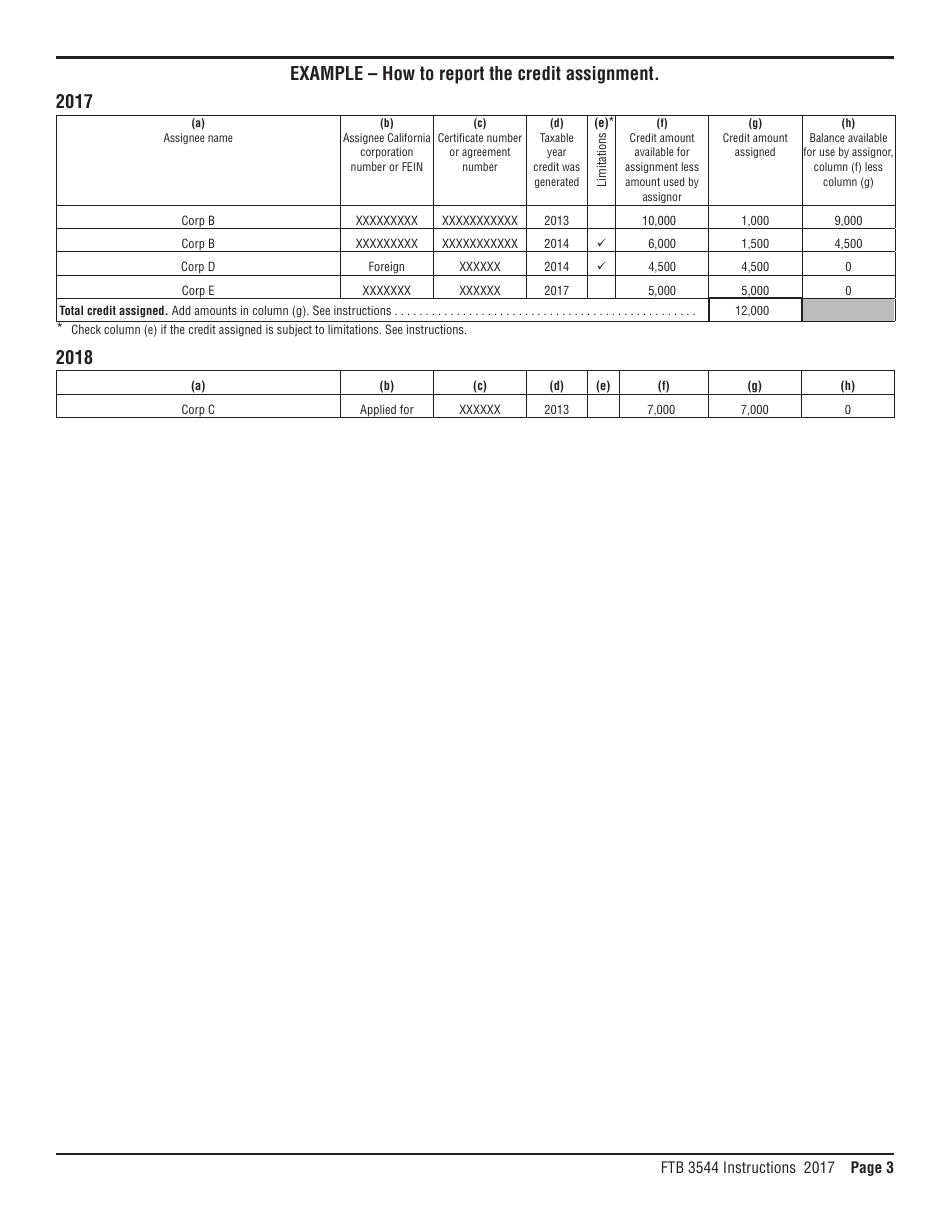

Instructions for Form FTB3544 Election to Assign Credit Within Combined Reporting Group - California

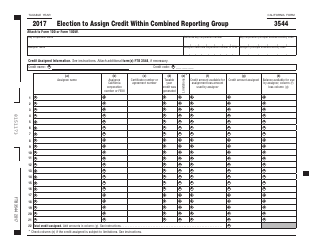

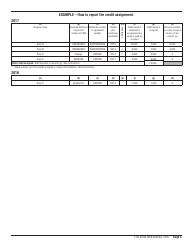

This document contains official instructions for Form FTB3544 , Election to Assign Credit Within Combined Reporting Group - a form released and collected by the California Franchise Tax Board. An up-to-date fillable Form FTB3544 is available for download through this link.

FAQ

Q: What is Form FTB3544?

A: Form FTB3544 is a form used for the election to assign credit within a combined reporting group in California.

Q: What is a combined reporting group?

A: A combined reporting group is a group of corporations that are required to file a combined report for California tax purposes.

Q: What is the purpose of Form FTB3544?

A: The purpose of Form FTB3544 is to allow corporations in a combined reporting group to assign credit among the members of the group.

Q: When should Form FTB3544 be filed?

A: Form FTB3544 should be filed by the due date of the California tax return for the taxable year the credit is taken.

Q: Who can file Form FTB3544?

A: Any member of a combined reporting group can file Form FTB3544, as long as they meet the requirements and have the necessary information.

Q: Are there any fees associated with filing Form FTB3544?

A: No, there are no fees associated with filing Form FTB3544.

Q: What happens after Form FTB3544 is filed?

A: After Form FTB3544 is filed, the California Franchise Tax Board will review the form and process the credit assignment accordingly.

Q: Can I amend a previously filed Form FTB3544?

A: Yes, you can amend a previously filed Form FTB3544 by filing a new form with the updated information.

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Franchise Tax Board.