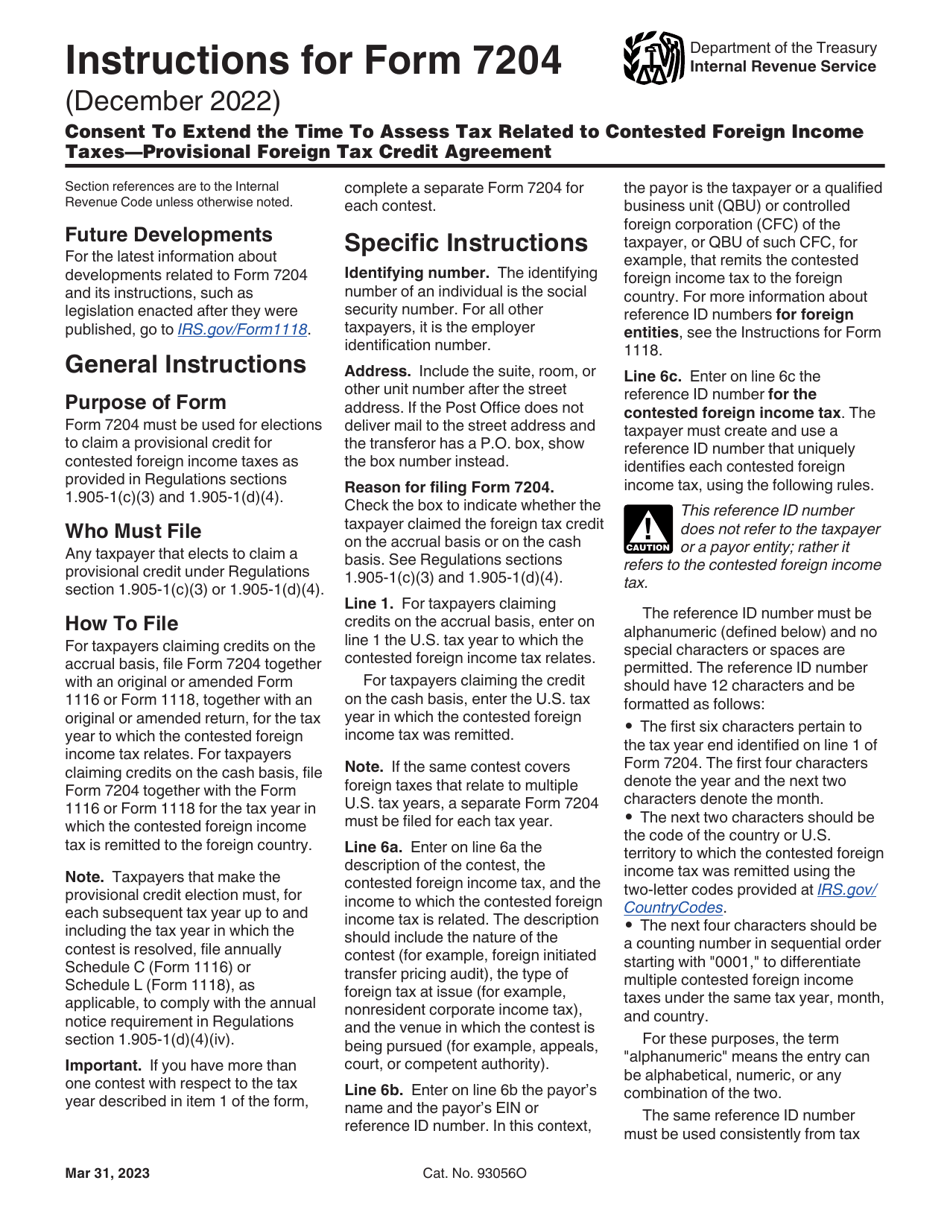

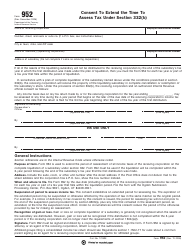

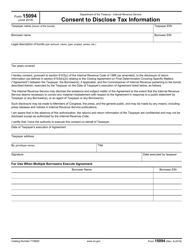

Instructions for IRS Form 7204 Consent to Extend the Time to Assess Tax Related to Contested Foreign Income Taxes - Provisional Foreign Tax Credit Agreement

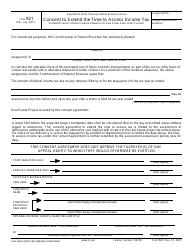

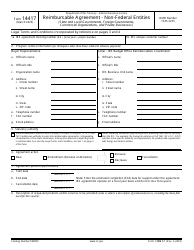

This document contains official instructions for IRS Form 7204 , Consent to Extend the Time to Assess Tax Related to Contested Foreign Tax Credit Agreement - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 7204 is available for download through this link.

FAQ

Q: What is IRS Form 7204?

A: IRS Form 7204 is a document used to request an extension of time for assessing tax related to contested foreign income taxes.

Q: What is the purpose of the form?

A: The purpose of IRS Form 7204 is to obtain consent from the taxpayer to extend the time for assessing tax related to contested foreign income taxes.

Q: What is a provisional foreign tax credit agreement?

A: A provisional foreign tax credit agreement is an agreement between the taxpayer and the Internal Revenue Service (IRS) to temporarily allow the taxpayer to claim a foreign tax credit.

Q: Who needs to file IRS Form 7204?

A: Taxpayers who want to request an extension of time for assessing tax related to contested foreign income taxes need to file IRS Form 7204.

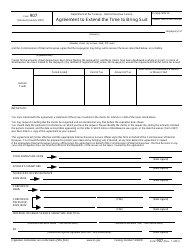

Q: What information is required on IRS Form 7204?

A: IRS Form 7204 requires the taxpayer's identifying information, details regarding the contested foreign income taxes, and the consent to extend the assessment period.

Q: Are there any fees associated with filing IRS Form 7204?

A: No, there are no fees associated with filing IRS Form 7204.

Q: How long does it take to process IRS Form 7204?

A: The processing time for IRS Form 7204 may vary, so it is best to check with the IRS for the most up-to-date information.

Q: What happens after filing IRS Form 7204?

A: After filing IRS Form 7204, the taxpayer's request for an extension of time for assessing tax related to contested foreign income taxes will be reviewed by the IRS.

Q: Can I file IRS Form 7204 electronically?

A: As of now, IRS Form 7204 cannot be filed electronically. It must be filed by mail or in person.

Instruction Details:

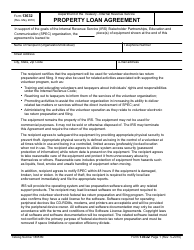

- This 2-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.