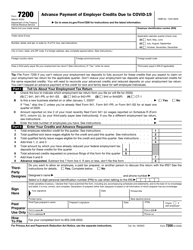

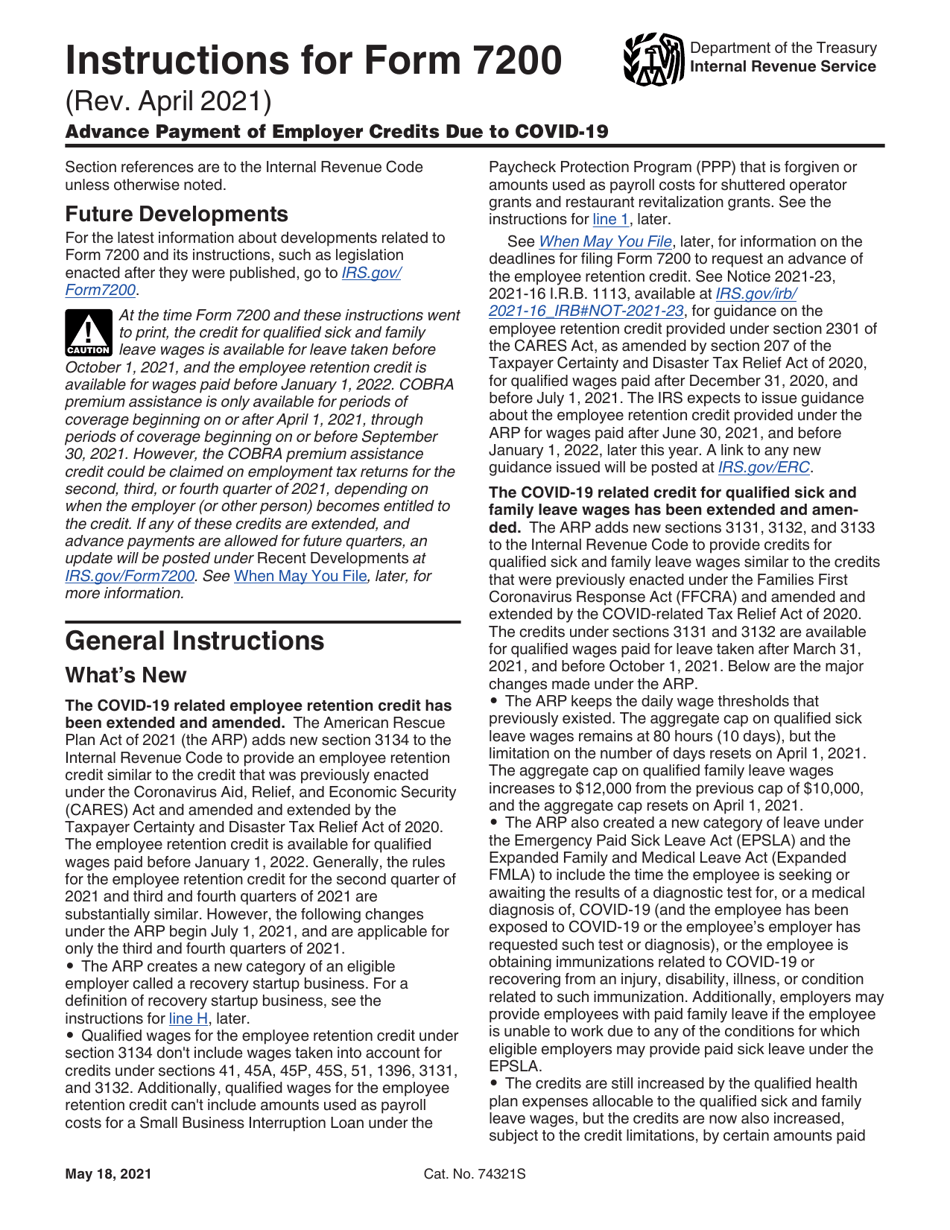

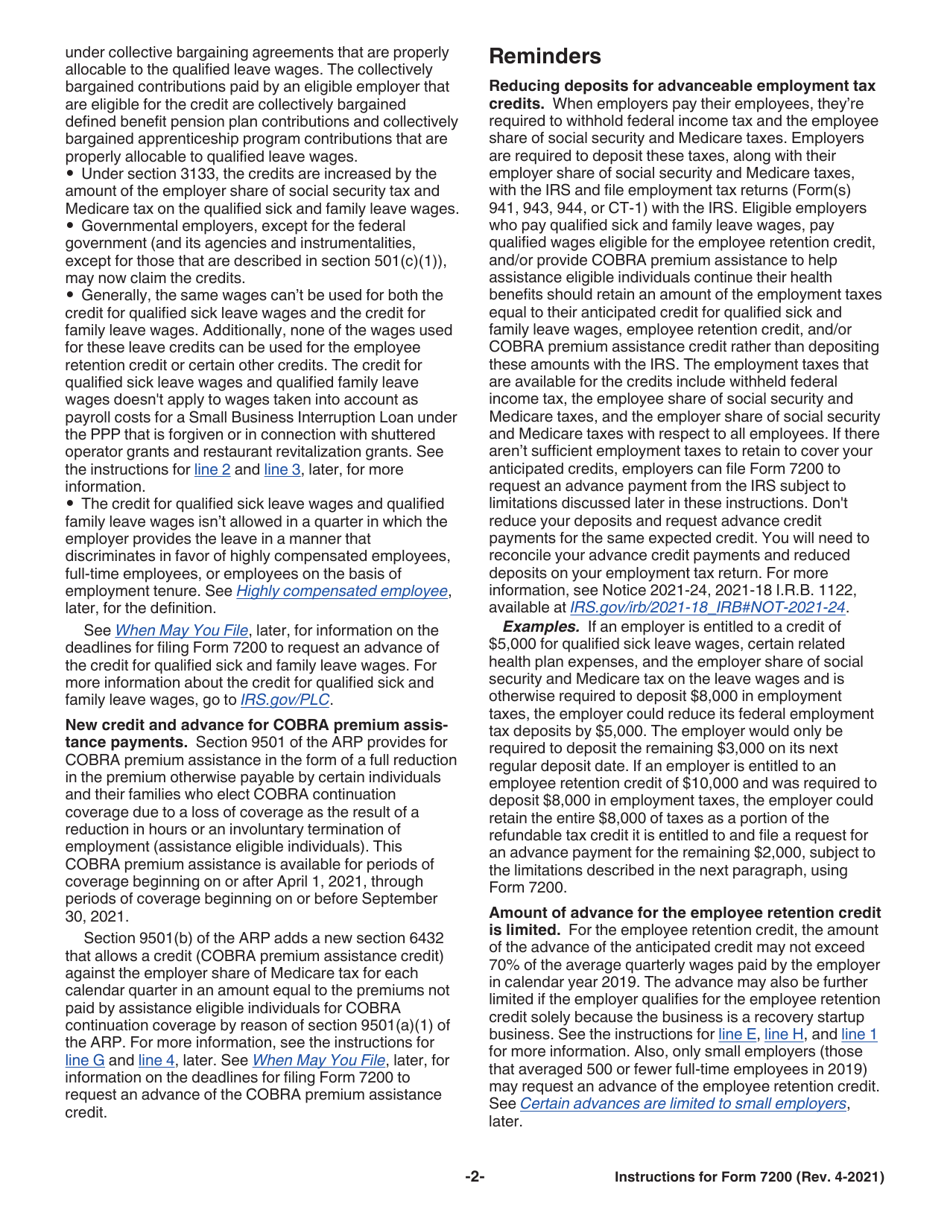

Instructions for IRS Form 7200 Advance Payment of Employer Credits Due to Covid-19

This document contains official instructions for IRS Form 7200 , Advance Payment of Employer Credits Due to Covid-19 - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 7200 is available for download through this link.

FAQ

Q: What is IRS Form 7200?

A: IRS Form 7200 is a form used to request advance payment of employer credits due to Covid-19.

Q: What is the purpose of IRS Form 7200?

A: The purpose of IRS Form 7200 is to request advance payment of employer credits, such as the Employee Retention Credit and credits related to paid sick and family leave.

Q: Who can use IRS Form 7200?

A: Employers who are eligible for employer credits due to Covid-19 can use IRS Form 7200.

Q: What are employer credits due to Covid-19?

A: Employer credits due to Covid-19 include the Employee Retention Credit, credits related to paid sick and family leave, and other credits provided under the CARES Act.

Q: How do I fill out IRS Form 7200?

A: To fill out IRS Form 7200, you will need to provide information about your business, the credits you are claiming, and the amount you are requesting as an advance payment.

Q: Is there a deadline for filing IRS Form 7200?

A: Yes, there is a deadline for filing IRS Form 7200. It should be filed by the end of the calendar quarter in which you are requesting the advance payment.

Q: How long does it take to process IRS Form 7200?

A: The processing time for IRS Form 7200 may vary, but it generally takes a few weeks to receive a response from the IRS.

Q: Can I file IRS Form 7200 electronically?

A: Yes, you can file IRS Form 7200 electronically. The form can be submitted electronically through the Electronic Federal Tax Payment System (EFTPS).

Q: Are there any restrictions on using IRS Form 7200?

A: Yes, there are certain restrictions on using IRS Form 7200. These include limitations on the amount that can be claimed and requirements for coordination with other credits and benefits.

Instruction Details:

- This 13-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.