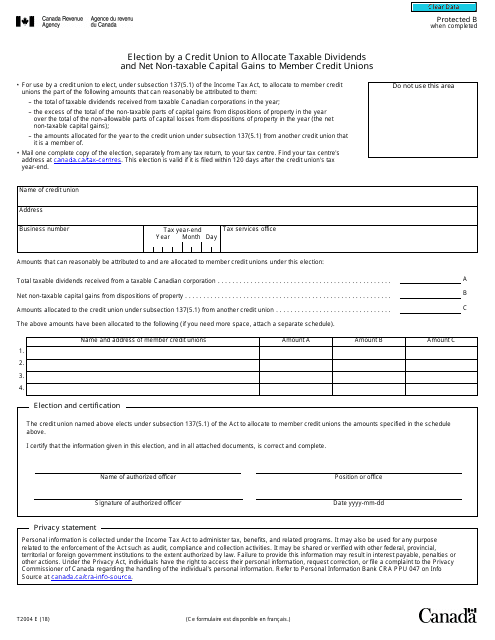

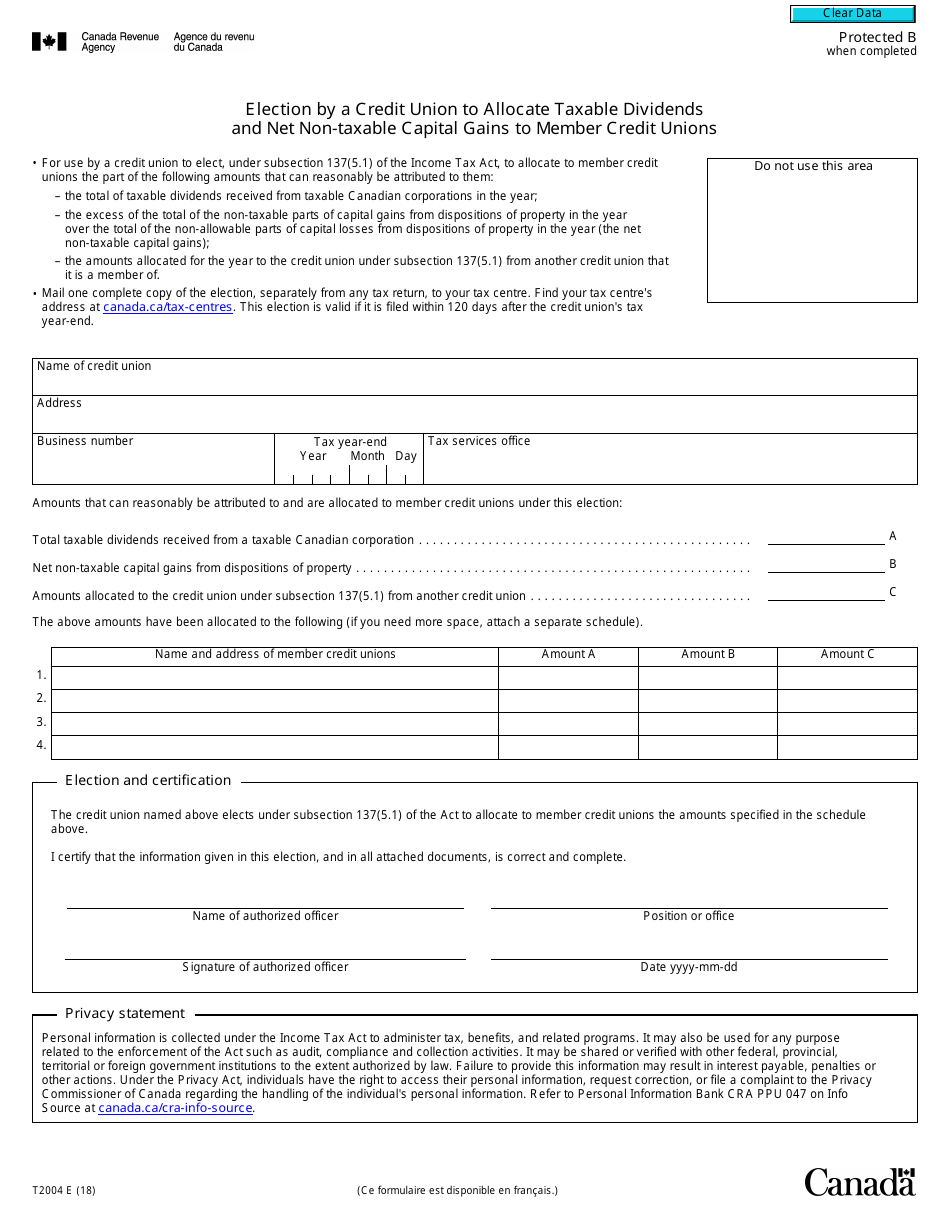

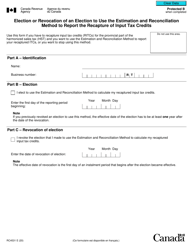

Form T2004 Election by a Credit Union to Allocate Taxable Dividends and Net Non-taxable Capital Gains to Member Credit Unions - Canada

Form T2004 is a Canadian Revenue Agency form also known as the "Form T2004 "election By A Credit Union To Allocate Taxable Dividends And Net Non-taxable Capital Gains To Member Credit Unions" - Canada" . The latest edition of the form was released in January 1, 2018 and is available for digital filing.

Download an up-to-date Form T2004 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2004?

A: Form T2004 is a form used by a credit union in Canada to allocate taxable dividends and net non-taxable capital gains to member credit unions.

Q: Who uses Form T2004?

A: Credit unions in Canada use Form T2004 to allocate taxable dividends and net non-taxable capital gains to member credit unions.

Q: What does Form T2004 allocate?

A: Form T2004 allocates taxable dividends and net non-taxable capital gains to member credit unions.

Q: Why is it important to allocate taxable dividends and net non-taxable capital gains?

A: Allocating taxable dividends and net non-taxable capital gains allows member credit unions to correctly report their income and tax obligations.

Q: How often is Form T2004 used?

A: Form T2004 is used on an as-needed basis when a credit union needs to allocate taxable dividends and net non-taxable capital gains to member credit unions.

Q: Is Form T2004 specific to Canada?

A: Yes, Form T2004 is specific to credit unions in Canada.