This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form CBT-150

for the current year.

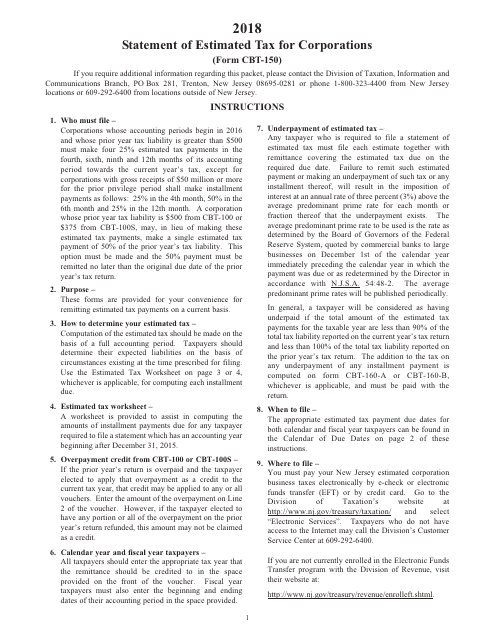

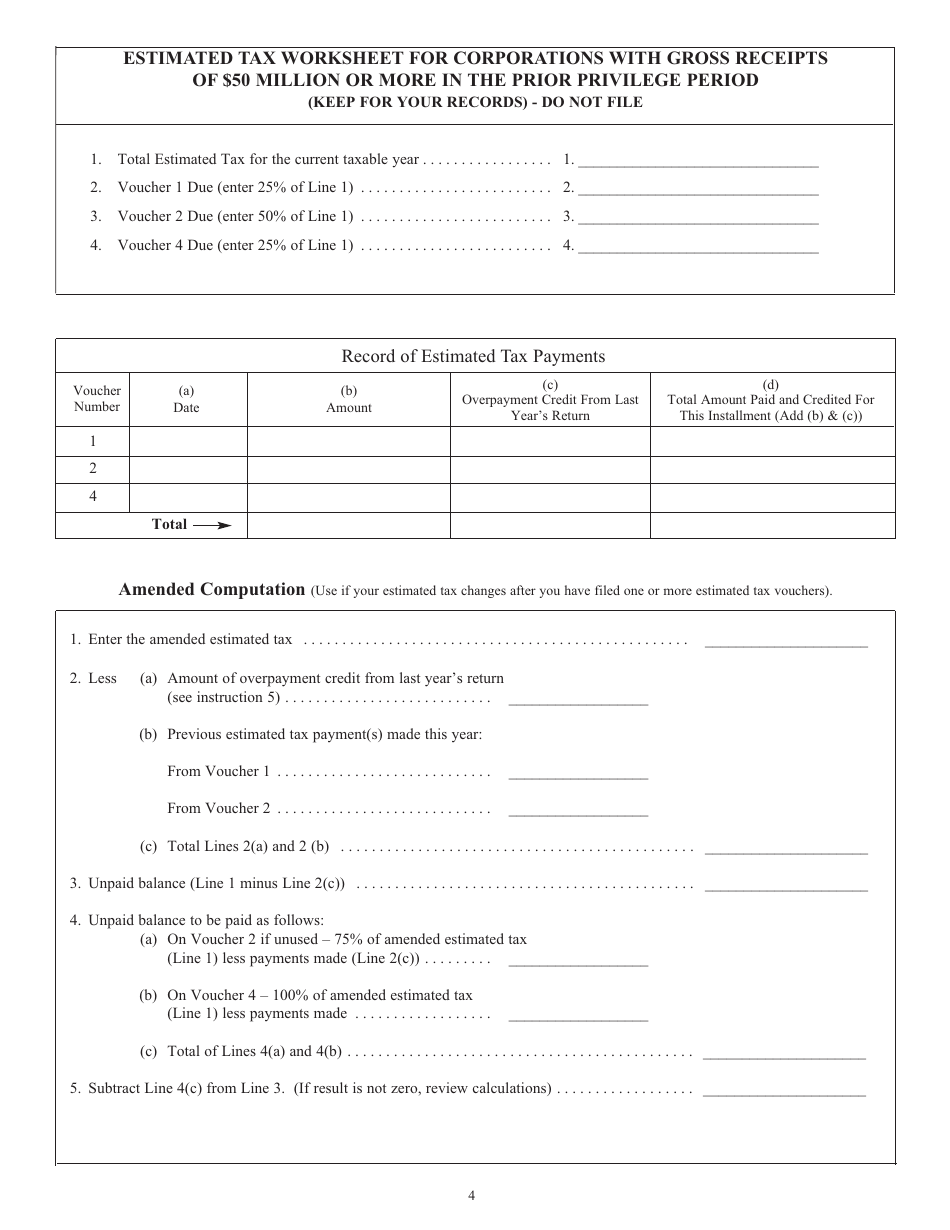

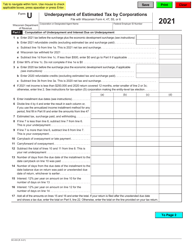

Instructions for Form CBT-150 Statement of Estimated Tax for Corporations - New Jersey

This document contains official instructions for Form CBT-150 , Statement of Estimated Tax for Corporations - a form released and collected by the New Jersey Department of the Treasury.

FAQ

Q: What is Form CBT-150?

A: Form CBT-150 is the Statement of Estimated Tax for Corporations in New Jersey.

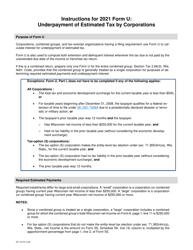

Q: Who should file Form CBT-150?

A: Corporations in New Jersey that need to make estimated tax payments should file Form CBT-150.

Q: What is the purpose of Form CBT-150?

A: The purpose of Form CBT-150 is to report estimated tax payments and calculate any underpayment penalties for corporations.

Q: How often should Form CBT-150 be filed?

A: Form CBT-150 should be filed on a quarterly basis.

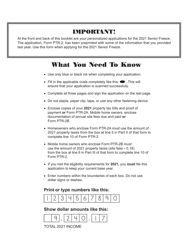

Q: What information is required to complete Form CBT-150?

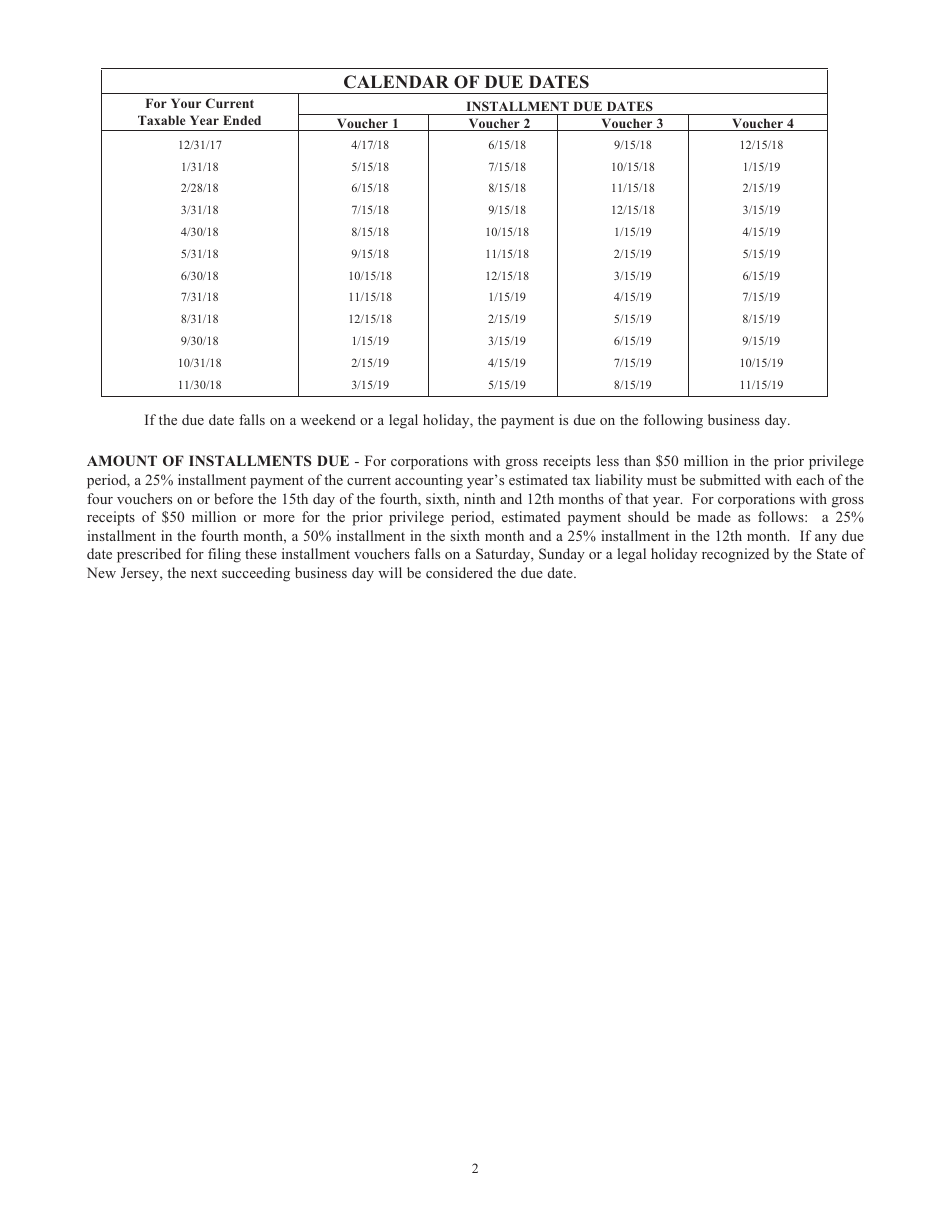

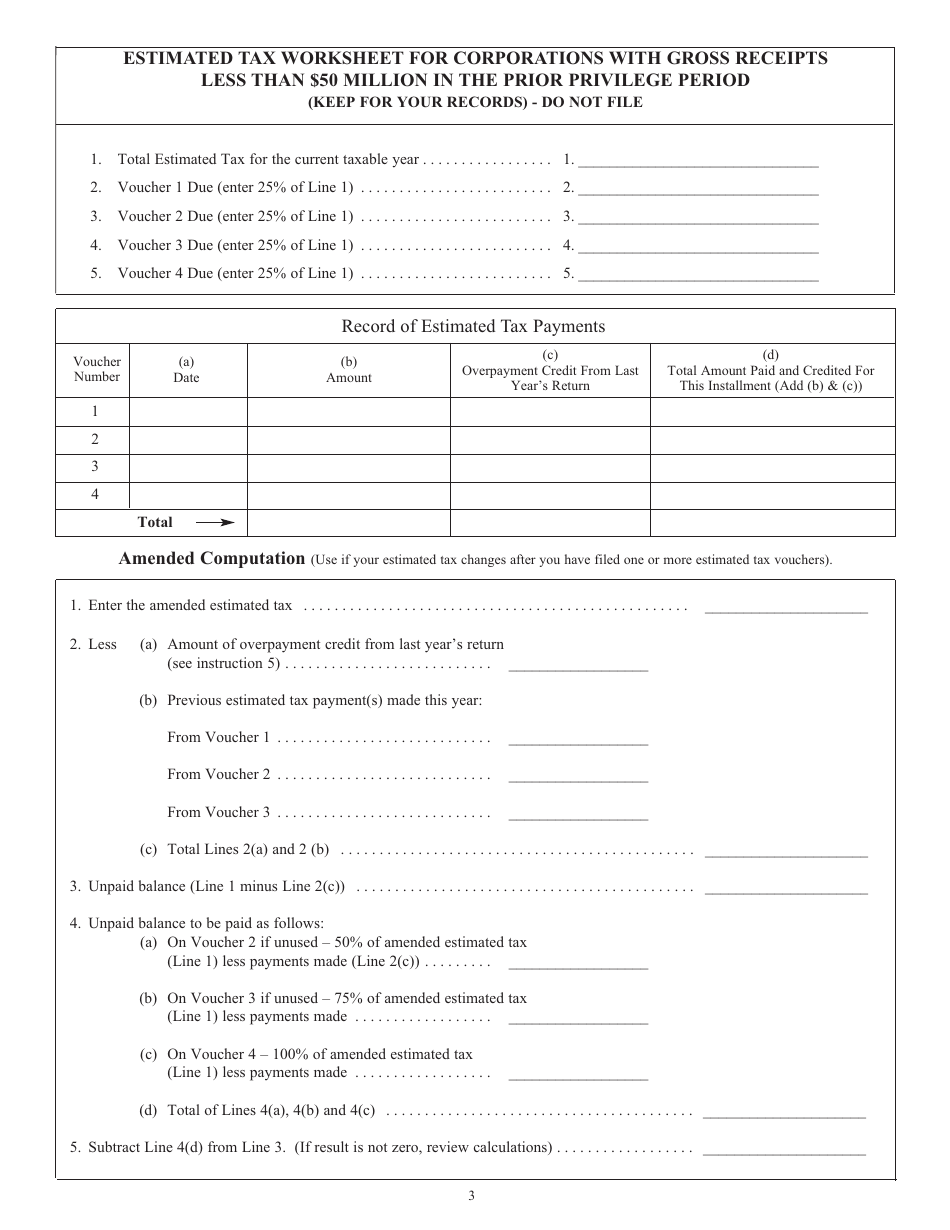

A: The form requires information such as the corporation's name, address, federal EIN, estimated tax liability, and payment amounts.

Q: When is the deadline to file Form CBT-150?

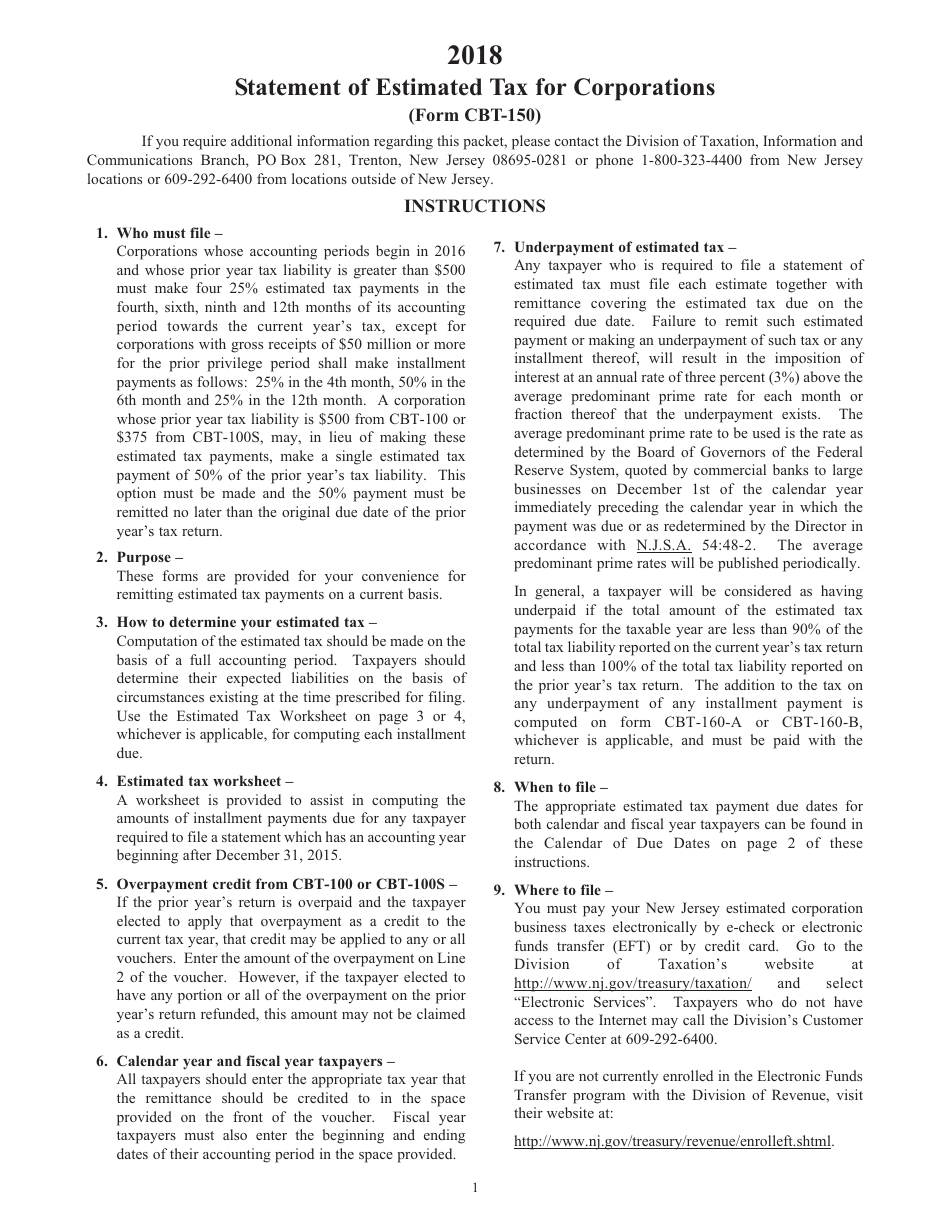

A: The deadlines for filing Form CBT-150 are April 15, June 15, September 15, and December 15 of each year.

Q: Are there any penalties for late or underpayment of estimated taxes?

A: Yes, there are penalties for late or underpayment of estimated taxes. The specific penalty amounts can be found in the instructions for Form CBT-150.

Q: Is Form CBT-150 required for all corporations in New Jersey?

A: No, not all corporations in New Jersey are required to file Form CBT-150. Certain exemptions and thresholds apply.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New Jersey Department of the Treasury.