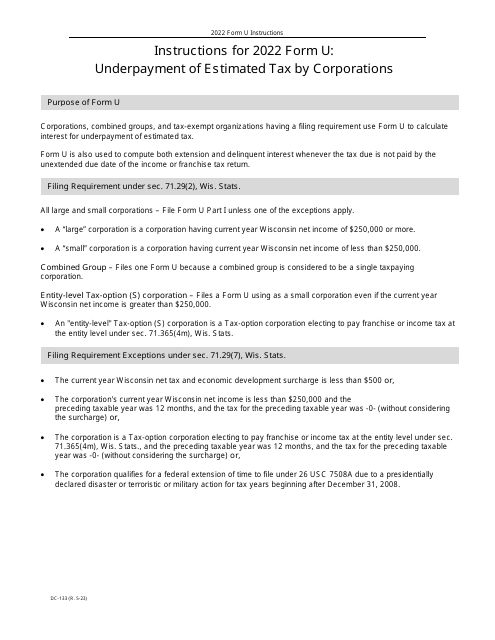

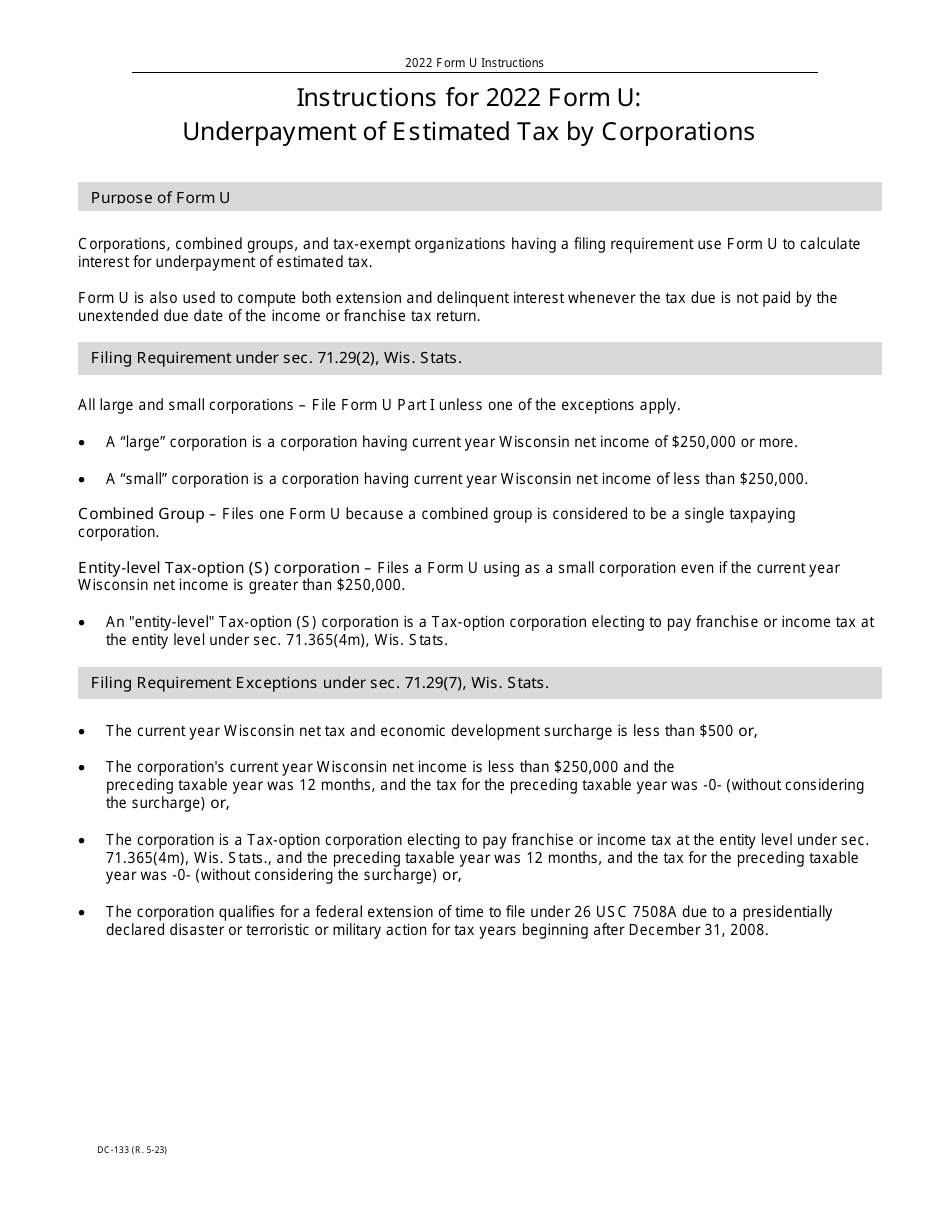

Instructions for Form U, DC-133 Underpayment of Estimated Tax by Corporations - Wisconsin

This document contains official instructions for Form U , and Form DC-133 . Both forms are released and collected by the Wisconsin Department of Revenue. An up-to-date fillable Form U (DC-033) is available for download through this link.

FAQ

Q: What is Form U, DC-133?

A: Form U, DC-133 is a tax form used by corporations in Wisconsin to report and calculate any underpayment of estimated tax.

Q: Who needs to file Form U, DC-133?

A: Corporations in Wisconsin who have underpaid their estimated tax payments are required to file Form U, DC-133.

Q: What is considered underpayment of estimated tax?

A: Underpayment of estimated tax occurs when a corporation fails to pay enough in estimated tax throughout the year.

Q: When is the deadline to file Form U, DC-133?

A: Form U, DC-133 must be filed by the original due date of the corporation's Wisconsin income tax return, usually April 15th.

Q: What happens if I don't file Form U, DC-133?

A: If you don't file Form U, DC-133 or fail to pay the underpaid estimated tax, you may be subject to penalties and interest.

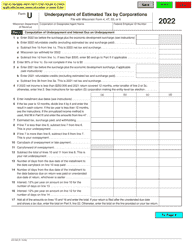

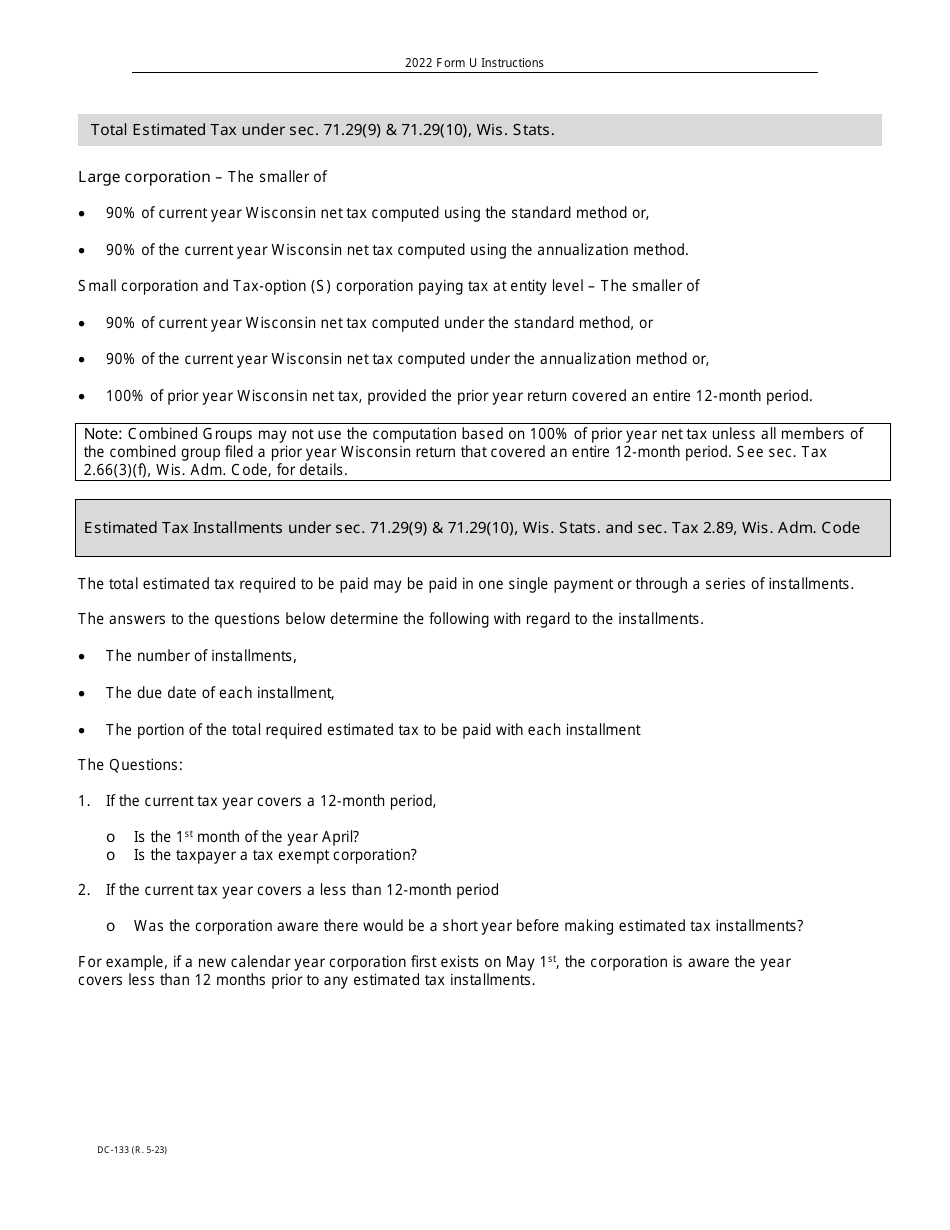

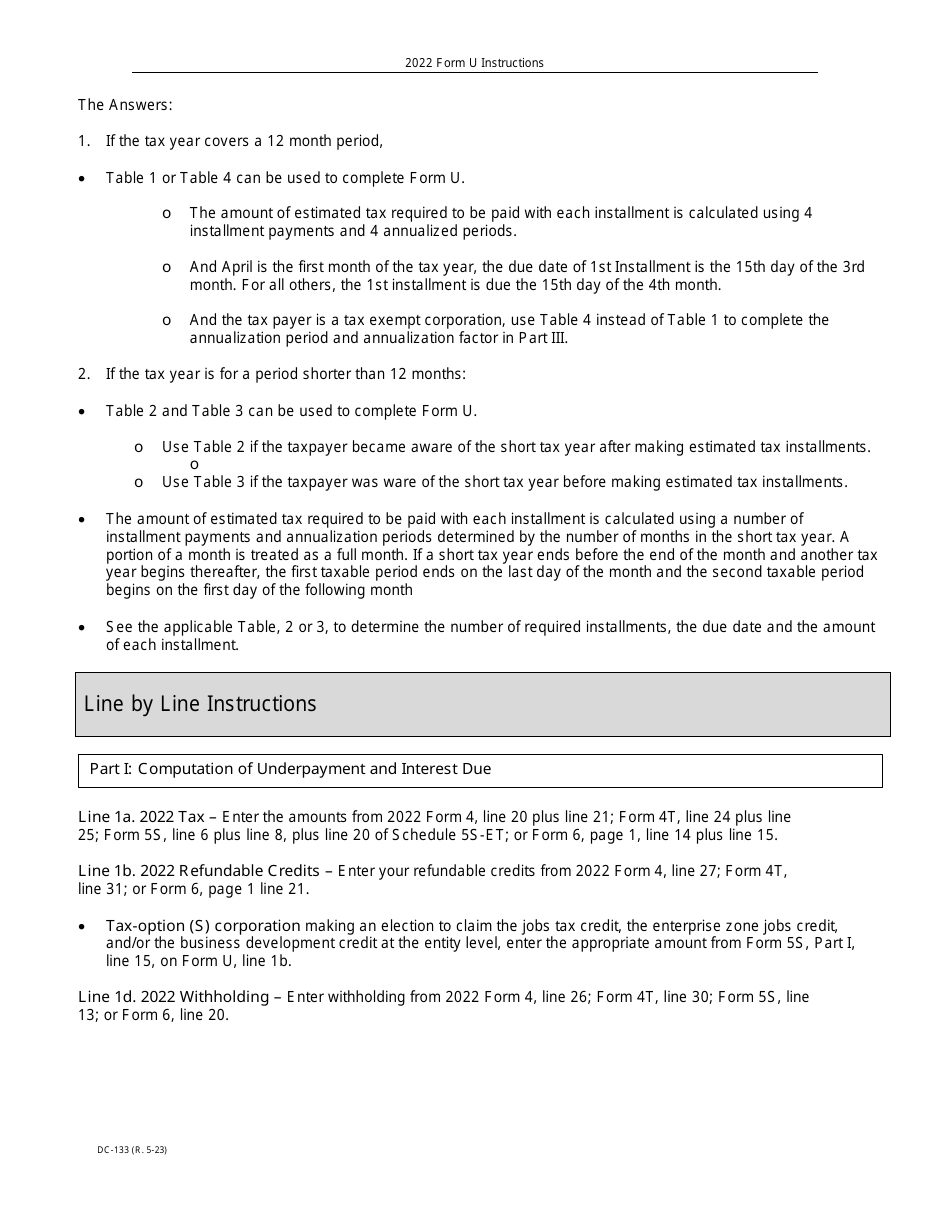

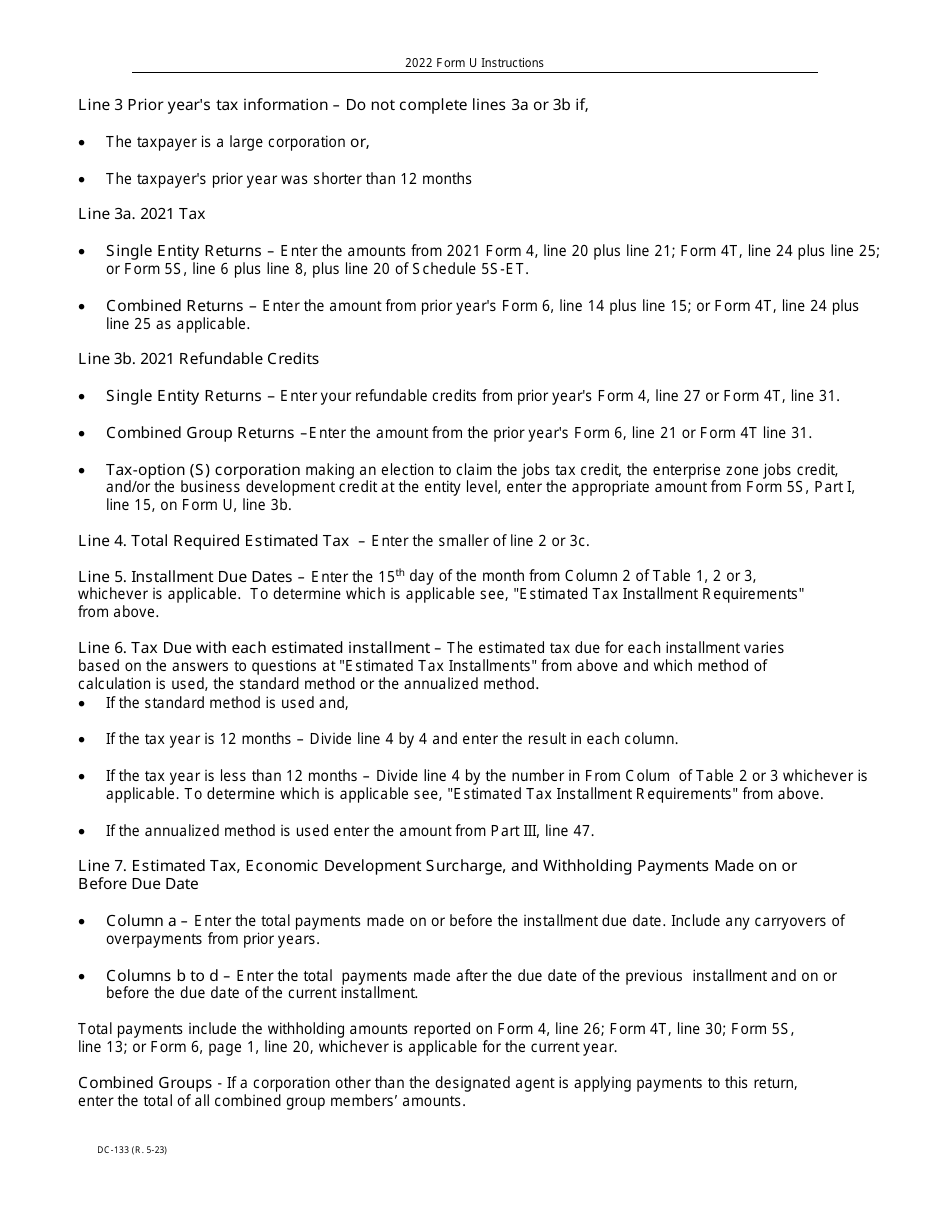

Q: How do I calculate the underpayment of estimated tax?

A: To calculate the underpayment, you will need to compare your actual tax liability to the total estimated tax payments made throughout the year.

Q: Are there any exceptions or exemptions for underpayment of estimated tax?

A: There may be exceptions or exemptions for underpayment of estimated tax based on certain circumstances. Consult the instructions provided with Form U, DC-133 for more information.

Instruction Details:

- This 12-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.