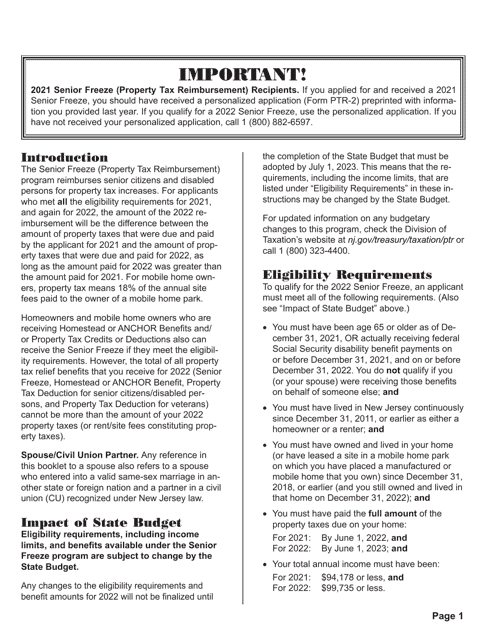

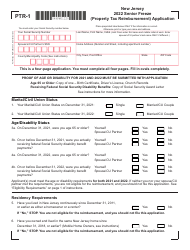

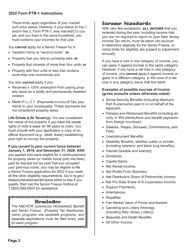

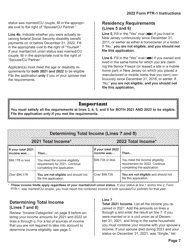

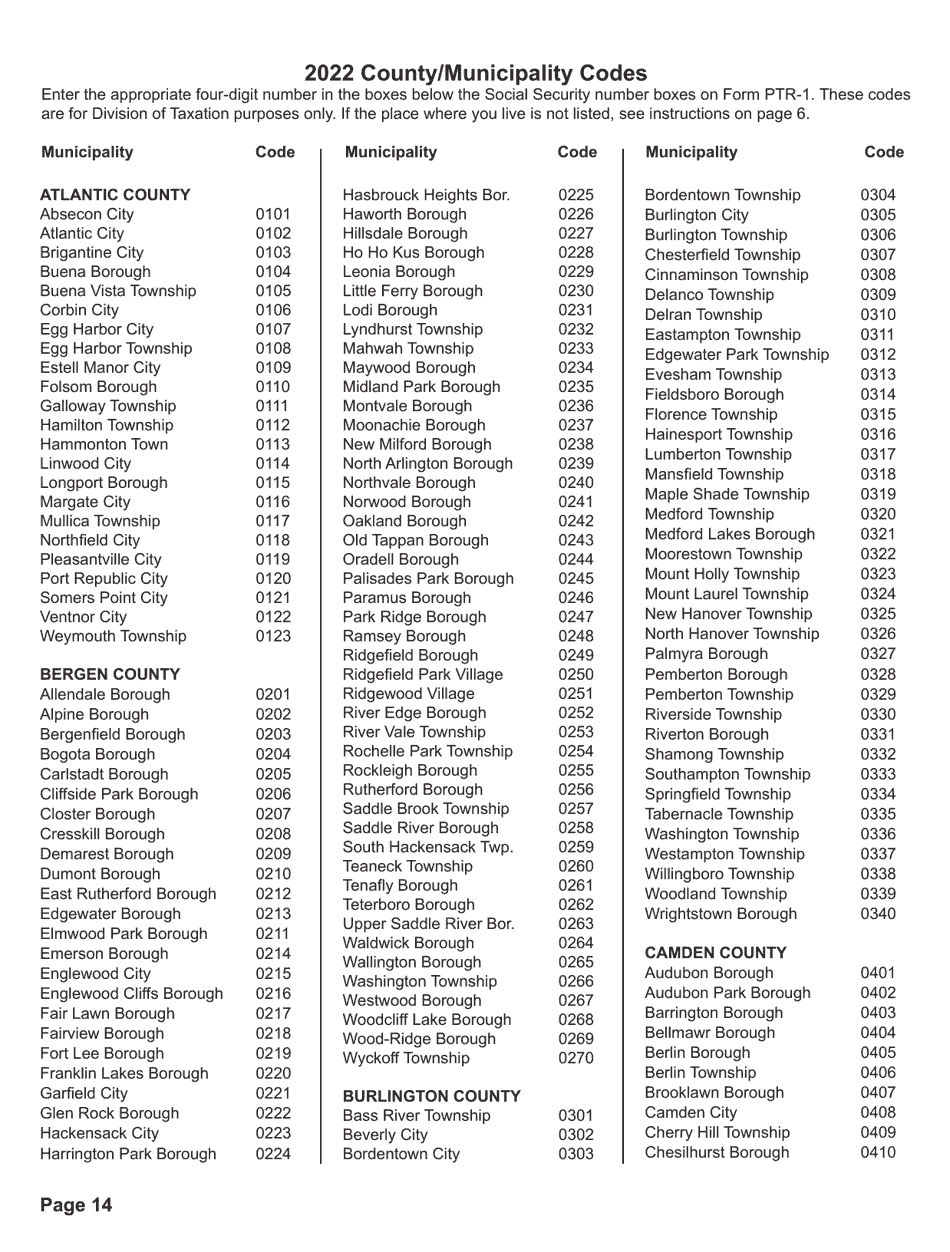

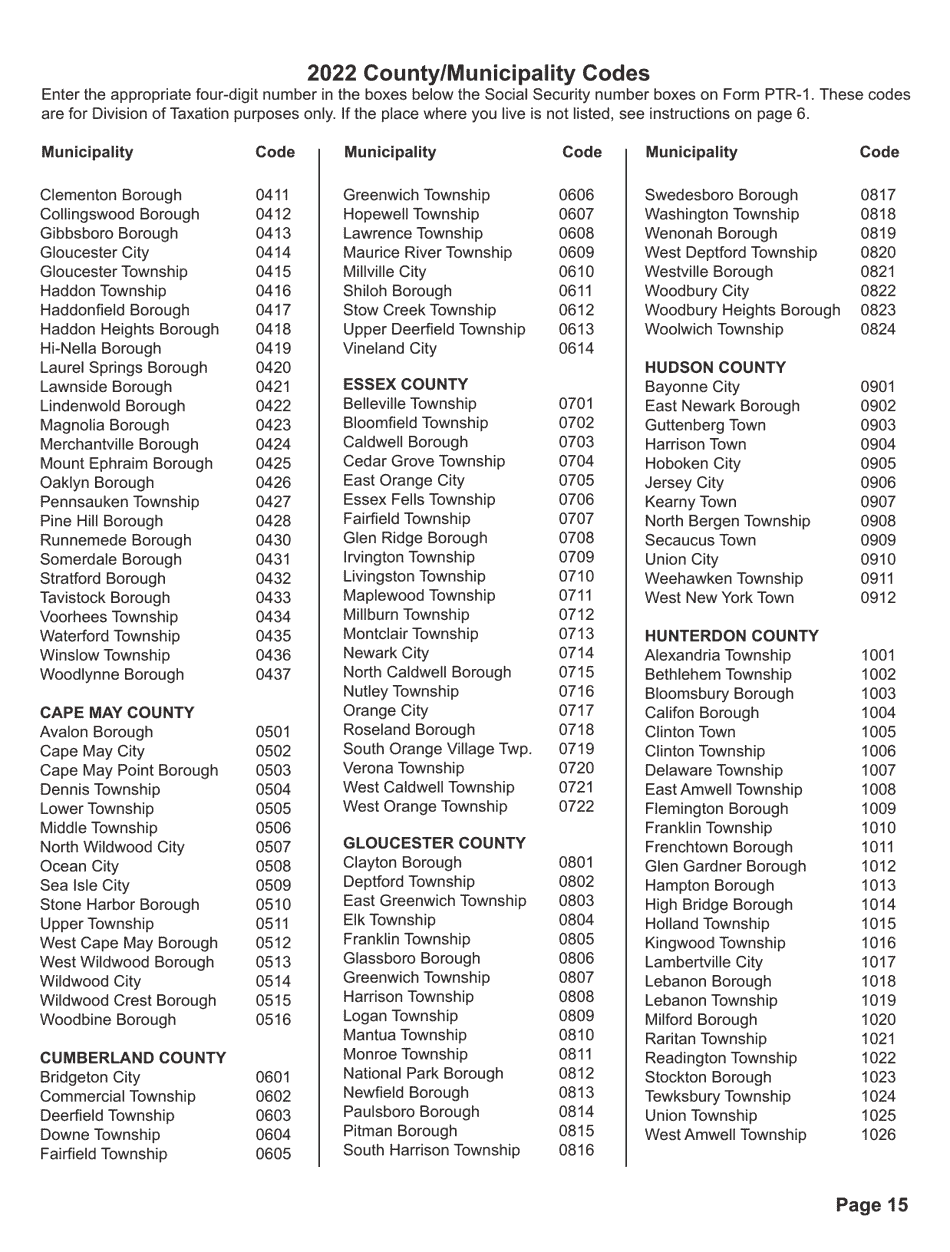

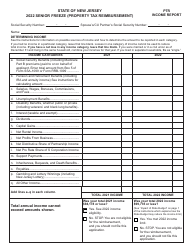

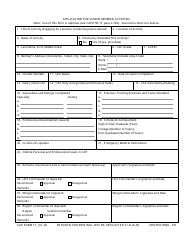

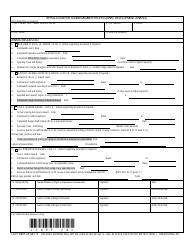

Instructions for Form PTR-1 Senior Freeze (Property Tax Reimbursement) Application - New Jersey

This document contains official instructions for Form PTR-1 , Senior Freeze (Property Tax Reimbursement) Application - a form released and collected by the New Jersey Department of the Treasury. An up-to-date fillable Form PTR-1 is available for download through this link.

FAQ

Q: What is Form PTR-1?

A: Form PTR-1 is the application for the Senior Freeze (Property Tax Reimbursement) Program in New Jersey.

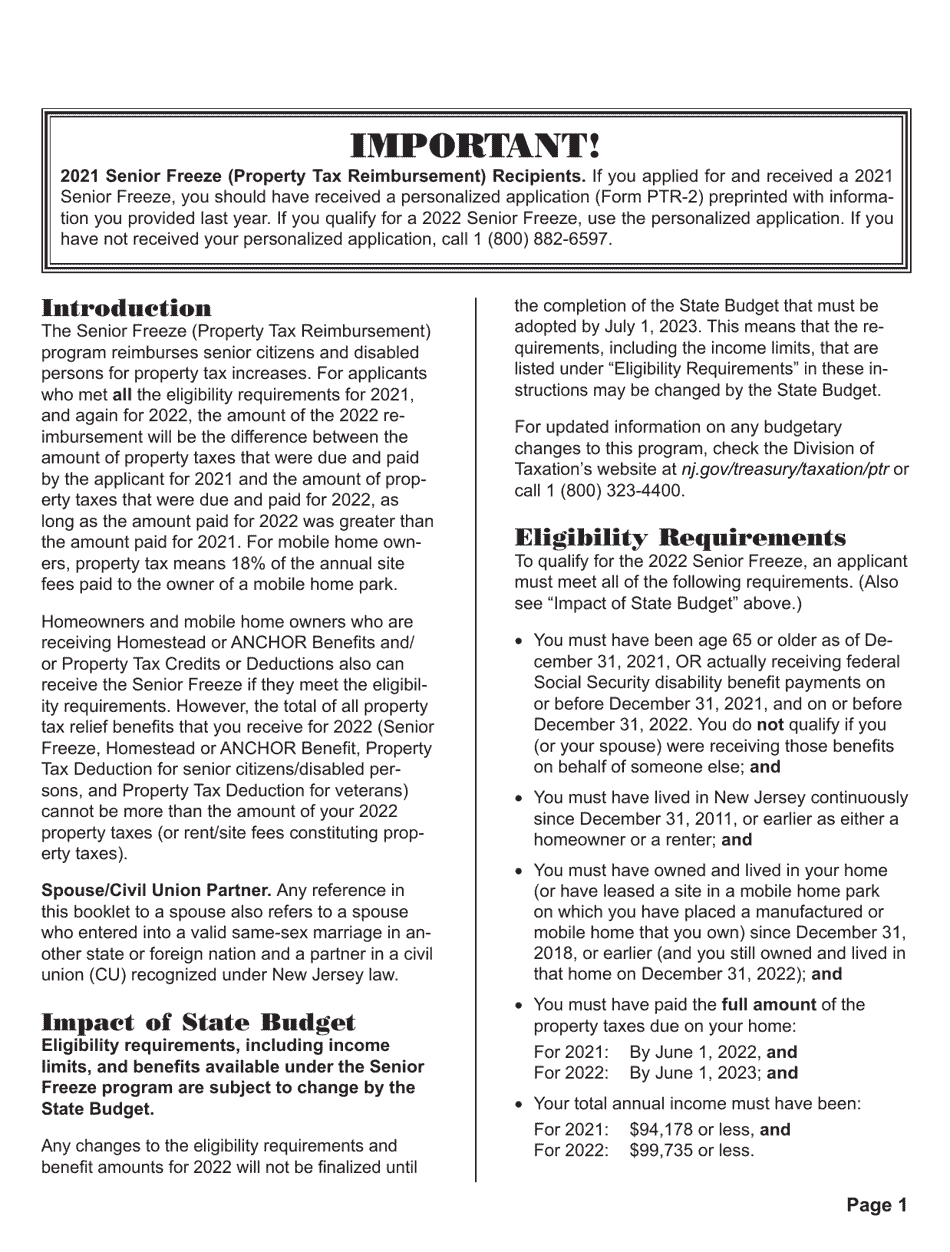

Q: Who is eligible to apply?

A: Senior citizens and disabled residents of New Jersey who meet certain income and residency requirements.

Q: What is the Senior Freeze Program?

A: The Senior Freeze Program provides property tax relief to eligible seniors and disabled residents by reimbursing them for any property tax increases.

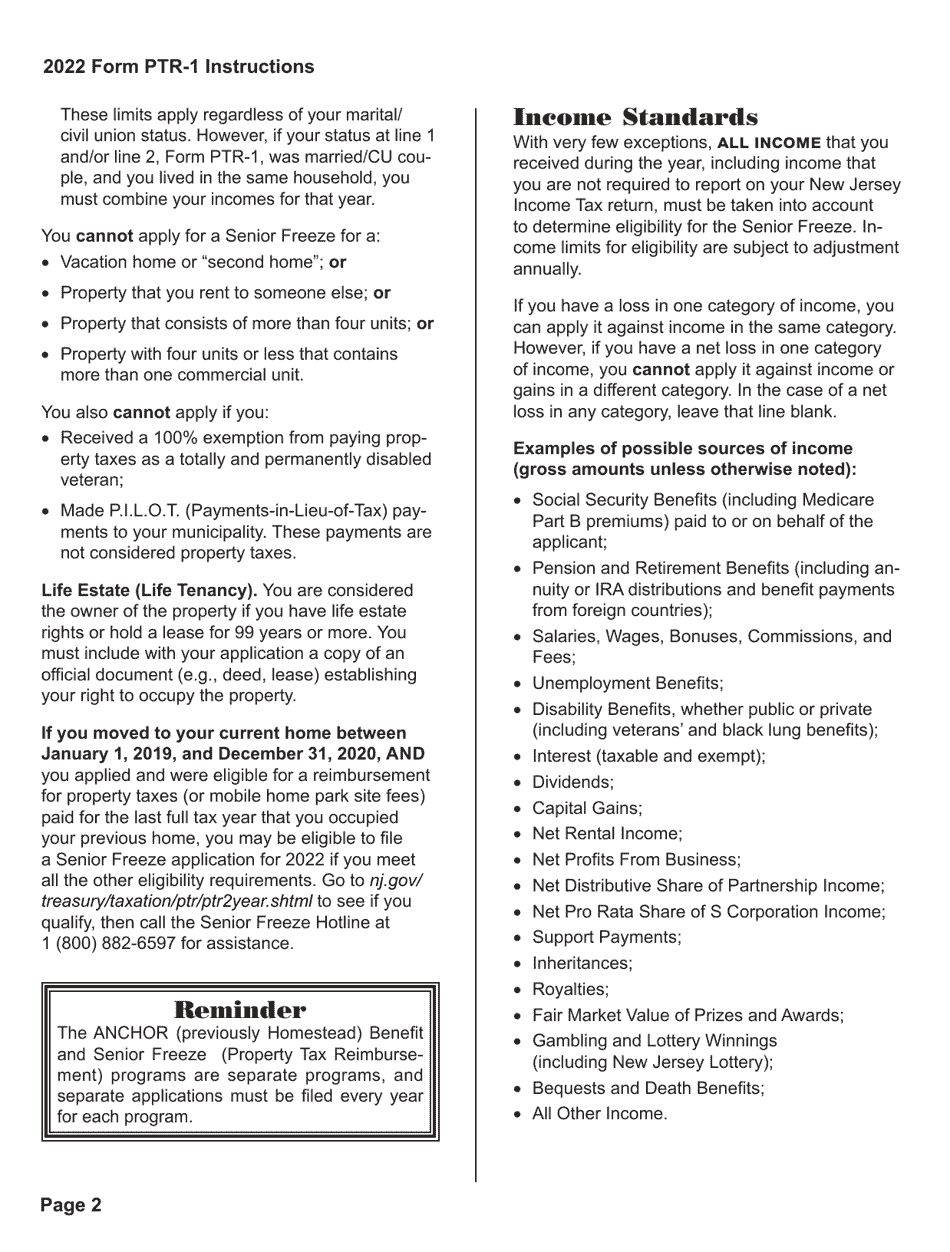

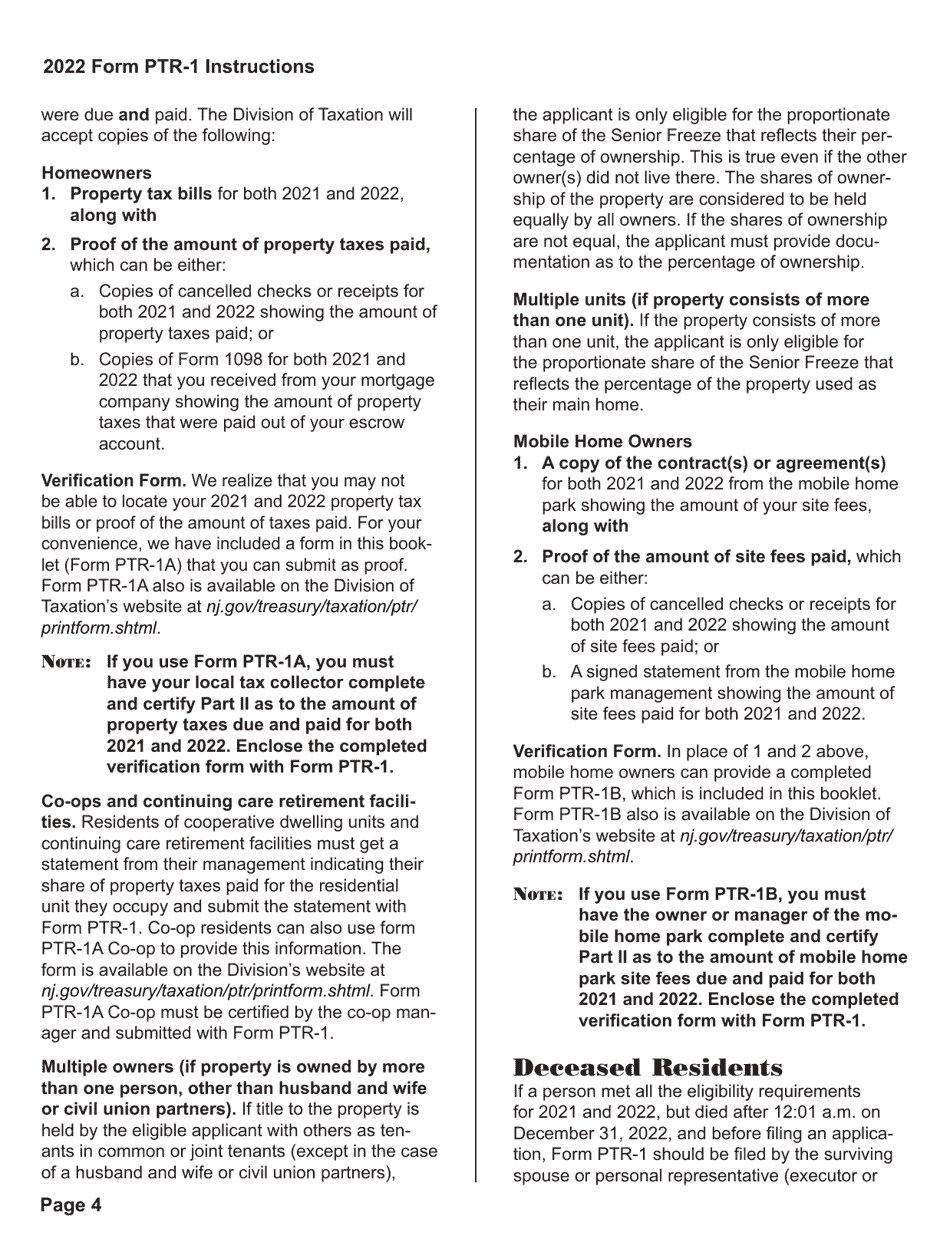

Q: What documents do I need to include with my application?

A: You will need to include proof of income, proof of age or disability, and proof of property taxes paid.

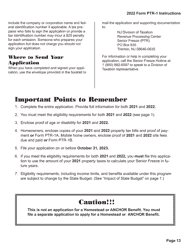

Q: What is the deadline for submitting the application?

A: The deadline for submitting the Form PTR-1 application is usually October 31st of each year, but it is important to check the current year's deadline for any changes.

Q: How long does it take to receive a reimbursement?

A: It can take several months for the Division of Taxation to process and approve applications. Reimbursements are typically issued in the following year.

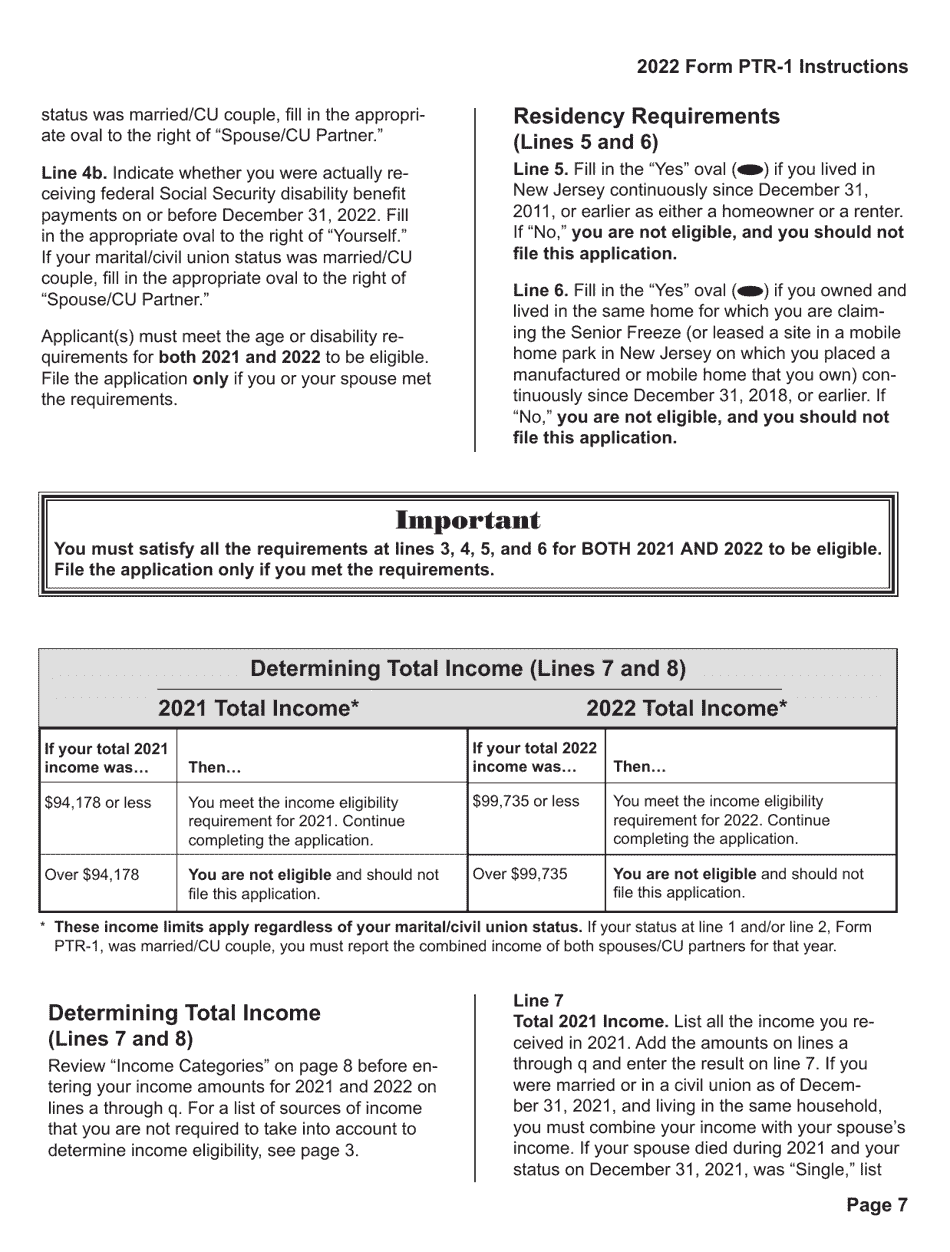

Q: Is there an income limit to qualify for the Senior Freeze Program?

A: Yes, there is an income limit based on the applicant's total income from all sources.

Q: Can I still apply if I rent my property?

A: No, the Senior Freeze Program is only available to homeowners who meet the eligibility requirements.

Instruction Details:

- This 20-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New Jersey Department of the Treasury.