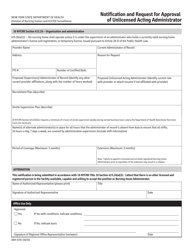

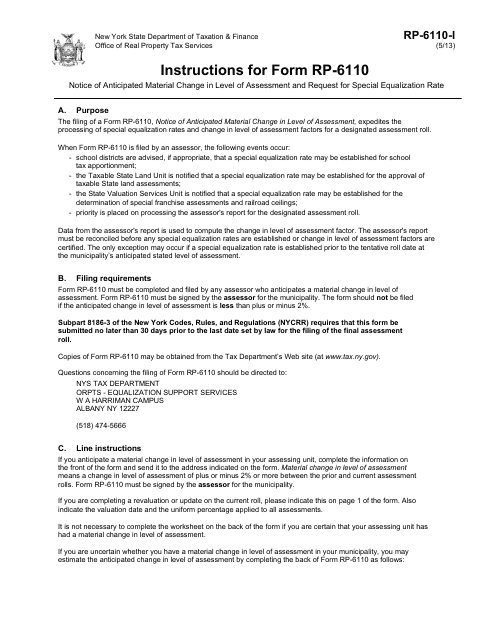

Instructions for Form RP-6110-I, RP-6110 Notice of Anticipated Material Change in Level of Assessment and Request for Special Equalization Rate - New York

This document contains official instructions for Form RP-6110-I , and Form RP-6110 . Both forms are released and collected by the New York State Department of Taxation and Finance.

FAQ

Q: What is Form RP-6110-I?

A: Form RP-6110-I is a document used in New York to notify the assessor of an anticipated material change in the level of assessment.

Q: What is the purpose of Form RP-6110-I?

A: The purpose of Form RP-6110-I is to request a special equalization rate from the assessor.

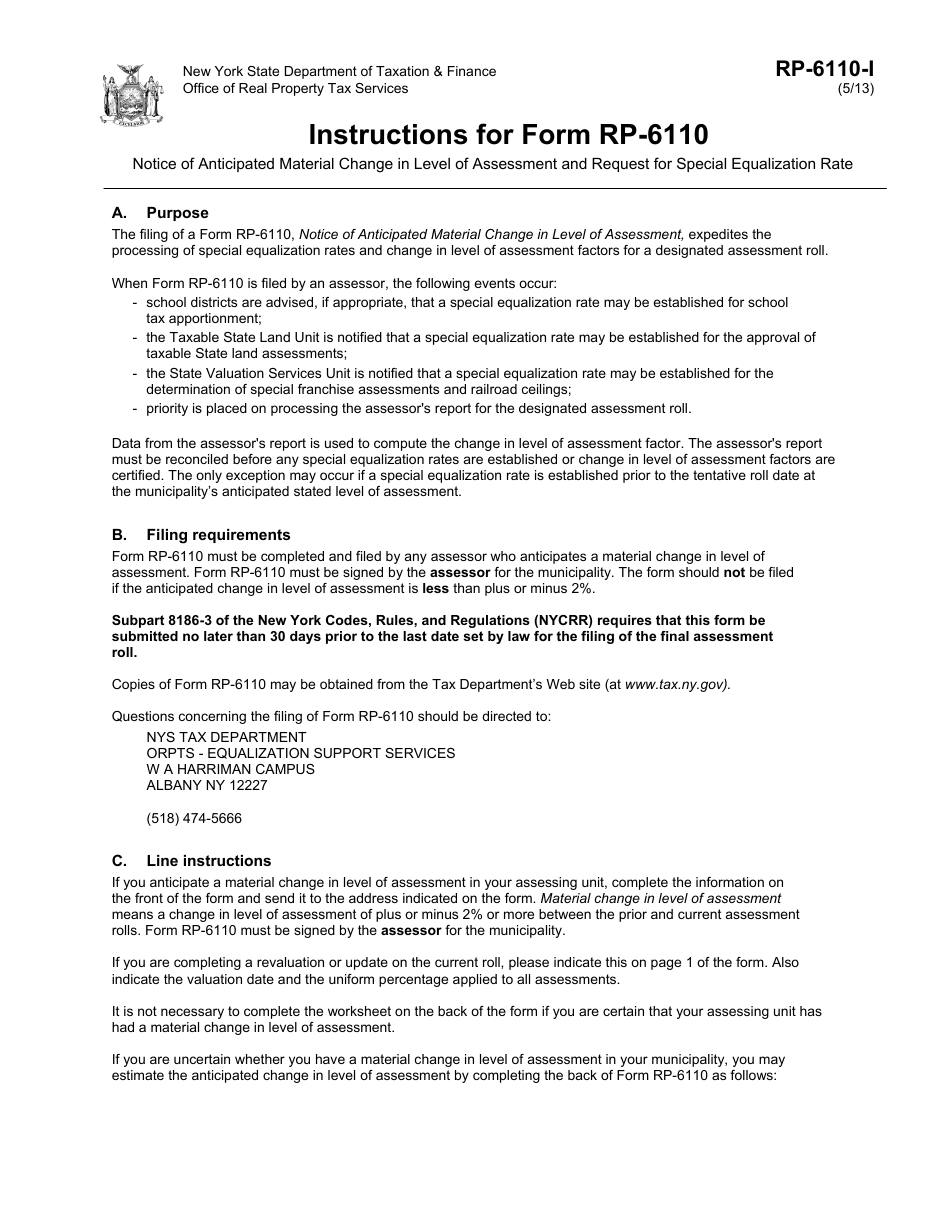

Q: When should Form RP-6110-I be filed?

A: Form RP-6110-I should be filed at least 90 days before the anticipated material change in the level of assessment.

Q: What information is required on Form RP-6110-I?

A: Form RP-6110-I requires information about the property, the anticipated change in assessment, and the reasons for the request.

Q: Are there any fees for filing Form RP-6110-I?

A: No, there are no fees for filing Form RP-6110-I.

Q: What happens after Form RP-6110-I is filed?

A: After Form RP-6110-I is filed, the assessor will review the request and determine if a special equalization rate is warranted.

Q: Is Form RP-6110-I mandatory?

A: No, Form RP-6110-I is not mandatory, but it is recommended to ensure proper notification of anticipated changes in assessment.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.

![Document preview: Instructions for Form RP-421-I [BUFFALO] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Buffalo, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349864/instruction-for-form-rp-421-i-buffalo-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-buffalo-new-york.png)

![Document preview: Form RP-421-I [BUFFALO] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Buffalo, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349865/form-rp-421-i-buffalo-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-buffalo-new-york.png)

![Document preview: Instructions for Form RP-421-I [ALBANY] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Albany, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349866/instructions-for-form-rp-421-i-albany-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-albany-new-york.png)