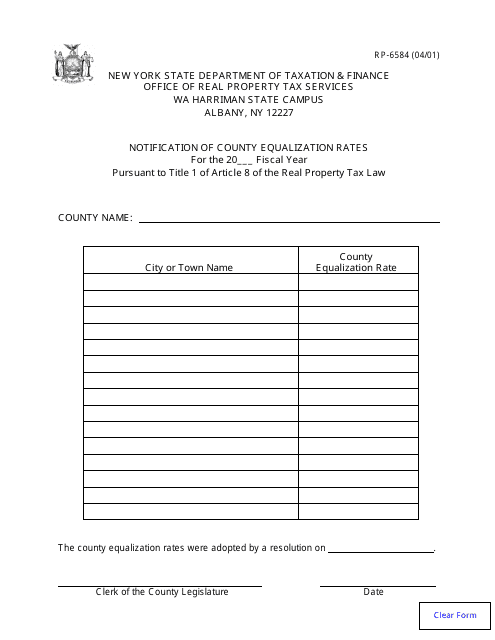

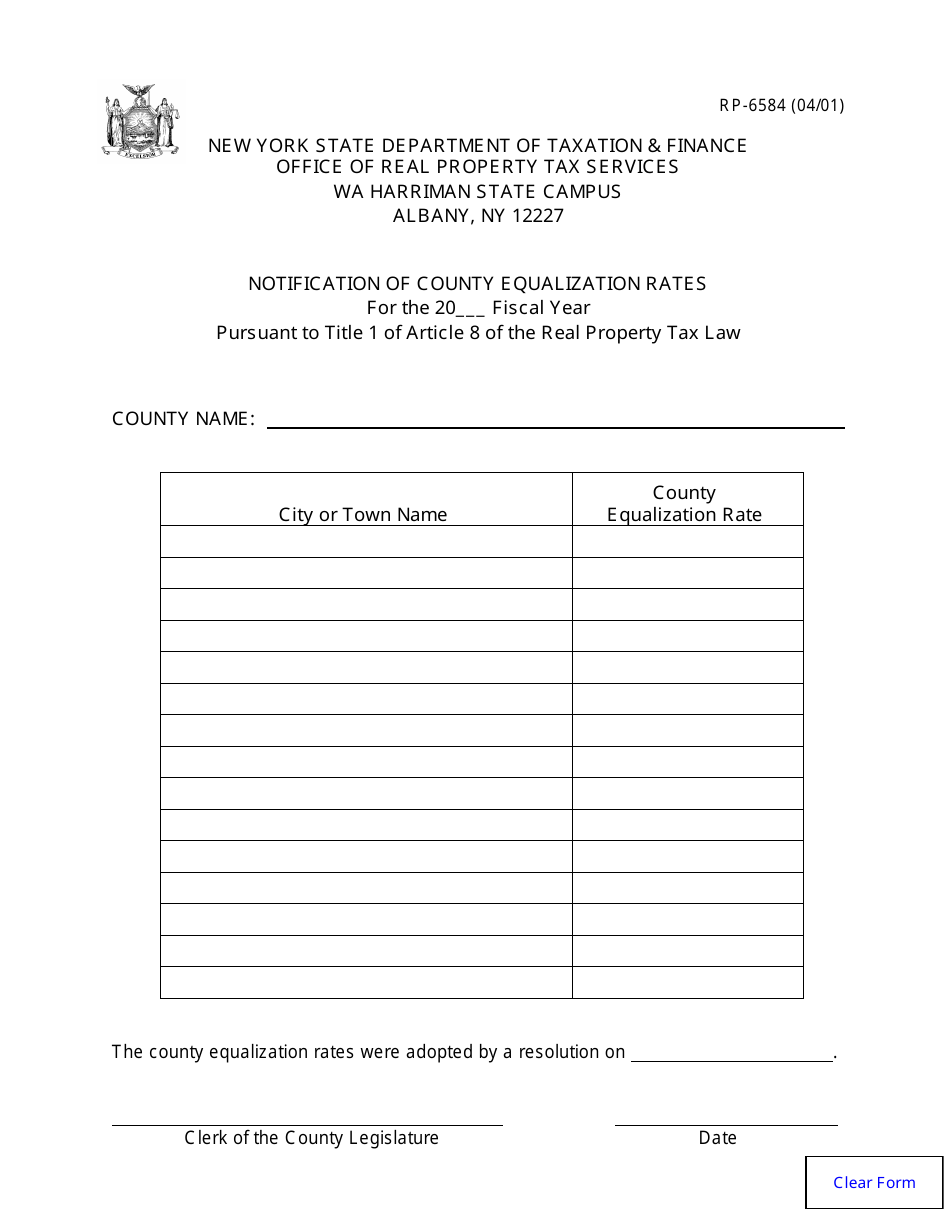

Form RP-6584 Notification of County Equalization Rates - New York

What Is Form RP-6584?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-6584?

A: Form RP-6584 is a notification of county equalization rates in New York.

Q: What is a county equalization rate?

A: A county equalization rate is a percentage used to determine property assessment values for tax purposes.

Q: Why is Form RP-6584 important?

A: Form RP-6584 provides information about county equalization rates, which can affect property taxes.

Q: When is Form RP-6584 typically issued?

A: Form RP-6584 is typically issued annually by the local assessor's office in each county.

Form Details:

- Released on April 1, 2001;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-6584 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.