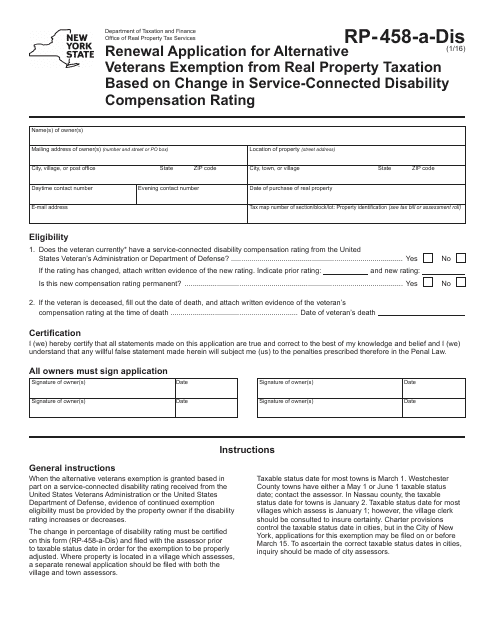

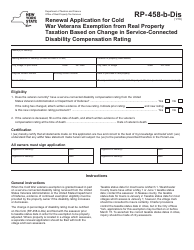

Form RP-458-A-DIS Renewal Application for Alternative Veterans Exemption From Real Property Taxation Based on Change in Service-Connected Disability Compensation Rating - New York

What Is Form RP-458-A-DIS?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

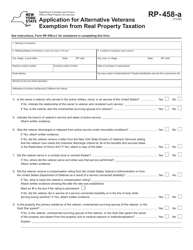

Q: What is Form RP-458-A-DIS?

A: Form RP-458-A-DIS is a renewal application for the alternative veterans exemption from real property taxation based on change in service-connected disability compensation rating in New York.

Q: Who is eligible to use Form RP-458-A-DIS?

A: Veterans who have previously been granted the alternative veterans exemption and have experienced a change in their service-connected disability compensation rating are eligible to use this form.

Q: What is the purpose of Form RP-458-A-DIS?

A: The purpose of Form RP-458-A-DIS is to renew the alternative veterans exemption for real property taxation based on a change in the veteran's service-connected disability compensation rating.

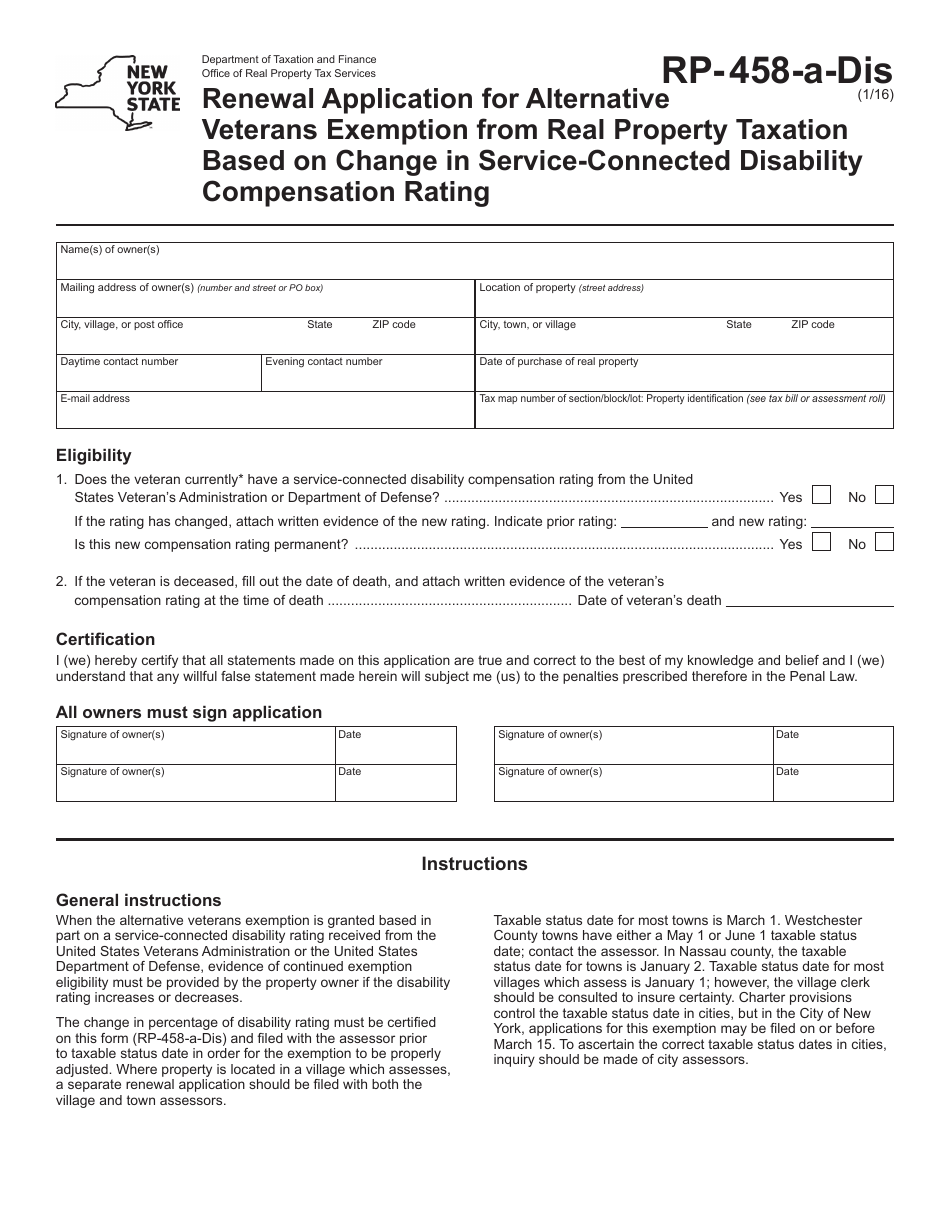

Q: What information is required on Form RP-458-A-DIS?

A: Form RP-458-A-DIS requires information such as the veteran's name, address, disability compensation rating, and proof of eligibility.

Q: Is there a deadline for filing Form RP-458-A-DIS?

A: Yes, there is a deadline for filing Form RP-458-A-DIS. It must be filed on or before the taxable status date of the town or city where the property is located.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-458-A-DIS by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.