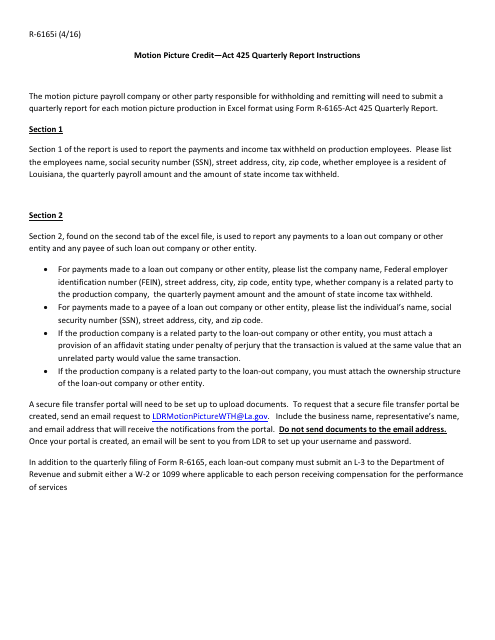

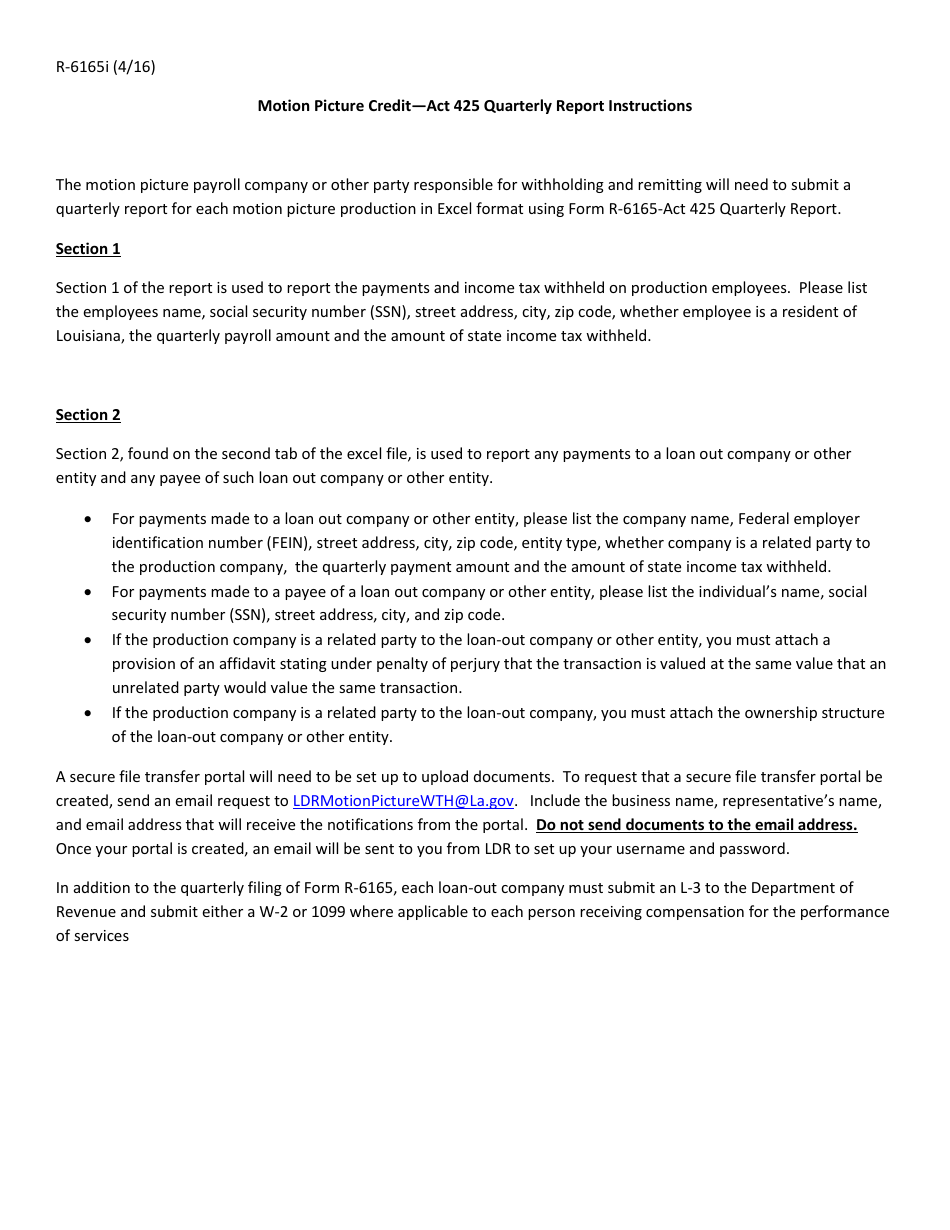

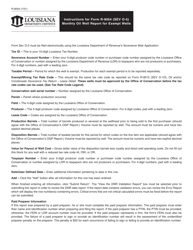

Instructions for Form R-6165 Motion Picture Credit - Act 425 Quarterly Report - Louisiana

This document contains official instructions for Form R-6165 , Motion Picture Credit - Act 425 Quarterly Report - a form released and collected by the Louisiana Department of Revenue.

FAQ

Q: What is Form R-6165?

A: Form R-6165 is the Motion Picture Credit - Act 425 Quarterly Report.

Q: What is Act 425?

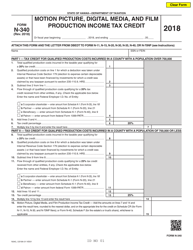

A: Act 425 is a tax incentive program for motion picture production in Louisiana.

Q: What is the purpose of the Form R-6165?

A: The Form R-6165 is used to report and claim the motion picture production tax credit provided by Act 425.

Q: Who needs to file Form R-6165?

A: Motion picture production companies that are eligible for the tax credit under Act 425 need to file Form R-6165.

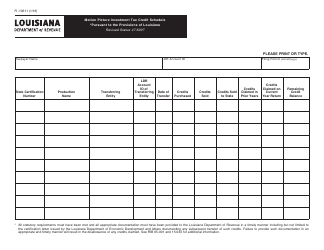

Q: What information is required on Form R-6165?

A: Form R-6165 requires information about the production company, the qualified motion picture production, and the expenses incurred.

Q: When is Form R-6165 due?

A: Form R-6165 is due quarterly, within 30 days after the end of each calendar quarter.

Q: Are there any penalties for late filing of Form R-6165?

A: Yes, there are penalties for late filing or failure to file Form R-6165. It is important to file the form on time to avoid penalties.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Louisiana Department of Revenue.