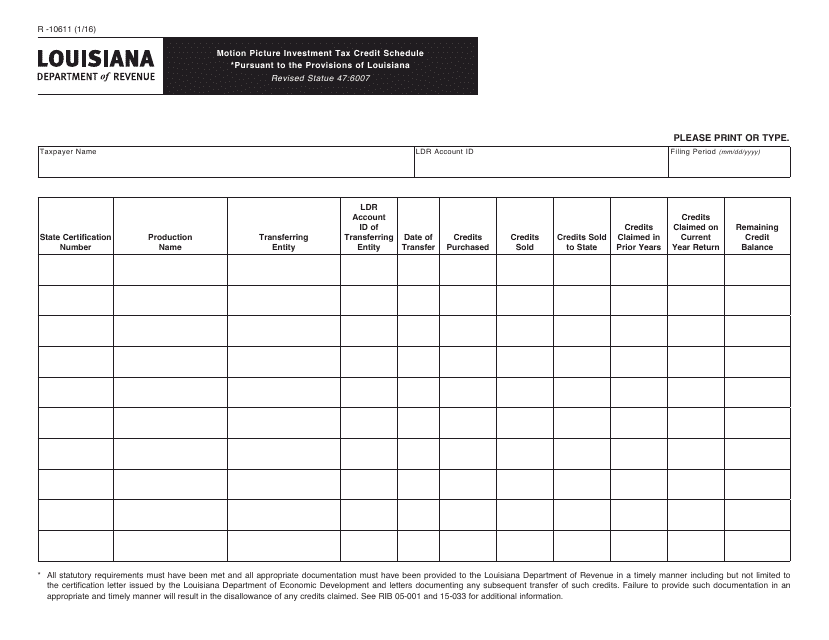

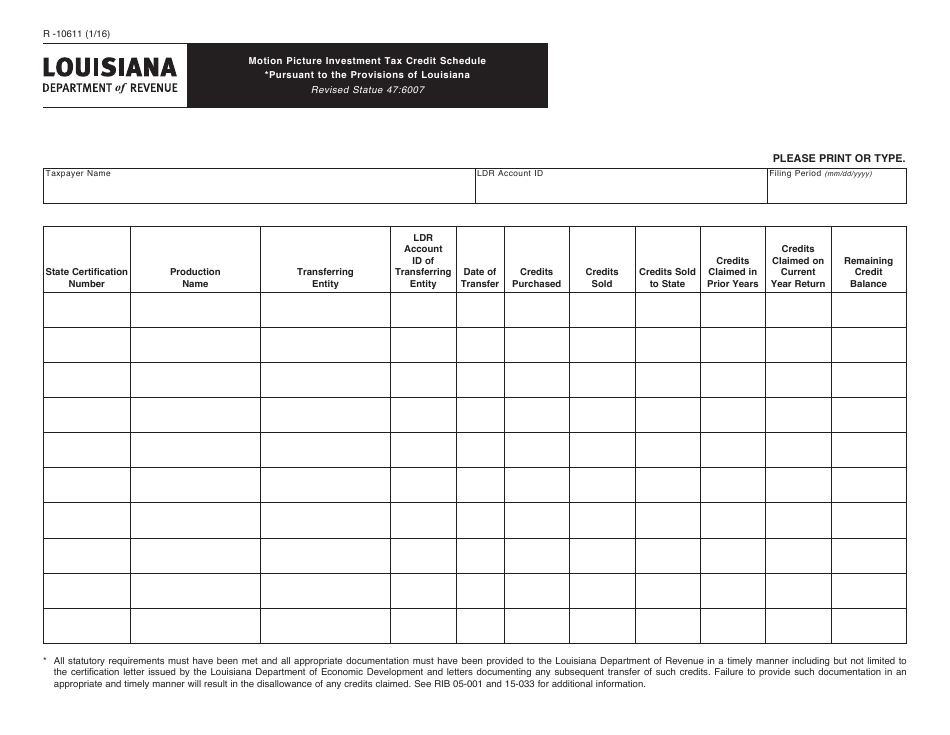

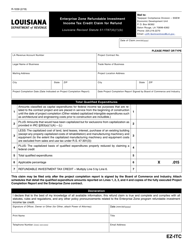

Form R-10611 Motion Picture Investment Tax Credit Schedule - Louisiana

What Is Form R-10611?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-10611?

A: Form R-10611 is the Motion PictureInvestment Tax Credit Schedule in Louisiana.

Q: What is the purpose of Form R-10611?

A: The purpose of Form R-10611 is to claim the Motion Picture Investment Tax Credit in Louisiana.

Q: Who is eligible to use Form R-10611?

A: Film production companies and investors in Louisiana are eligible to use Form R-10611.

Q: What information is required on Form R-10611?

A: Form R-10611 requires information about the film production, investment details, and qualifying expenses.

Q: When is the deadline to file Form R-10611?

A: Form R-10611 must be filed with the Louisiana Department of Revenue by the due date specified in the instructions.

Q: What is the benefit of using Form R-10611?

A: The benefit of using Form R-10611 is the ability to claim the Motion Picture Investment Tax Credit, which can help offset the costs of film production and attract investment in Louisiana.

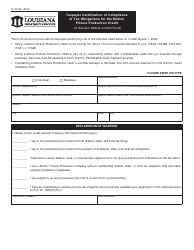

Q: Are there any limitations or restrictions on claiming the tax credit?

A: Yes, there are limitations and restrictions on claiming the Motion Picture Investment Tax Credit. These include a cap on the total amount of credits that can be claimed and requirements for qualifying expenses.

Q: What supporting documentation should be included with Form R-10611?

A: Supporting documentation for Form R-10611 should include proof of qualifying expenses and any other documentation required by the Louisiana Department of Revenue.

Q: Can I claim the Motion Picture Investment Tax Credit for previous years?

A: No, the Motion Picture Investment Tax Credit can only be claimed for the current tax year in Louisiana.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-10611 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.