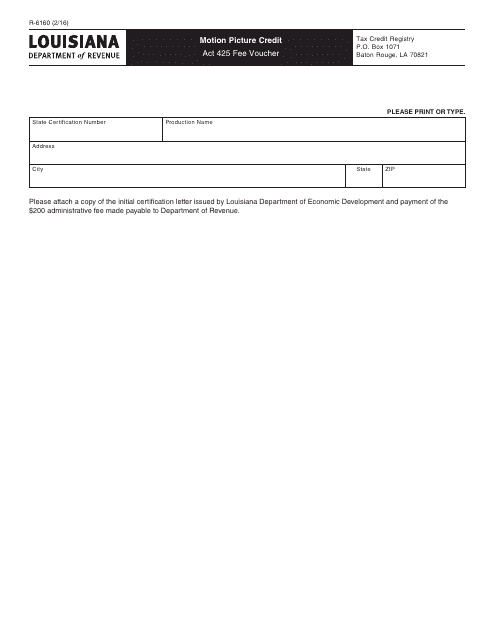

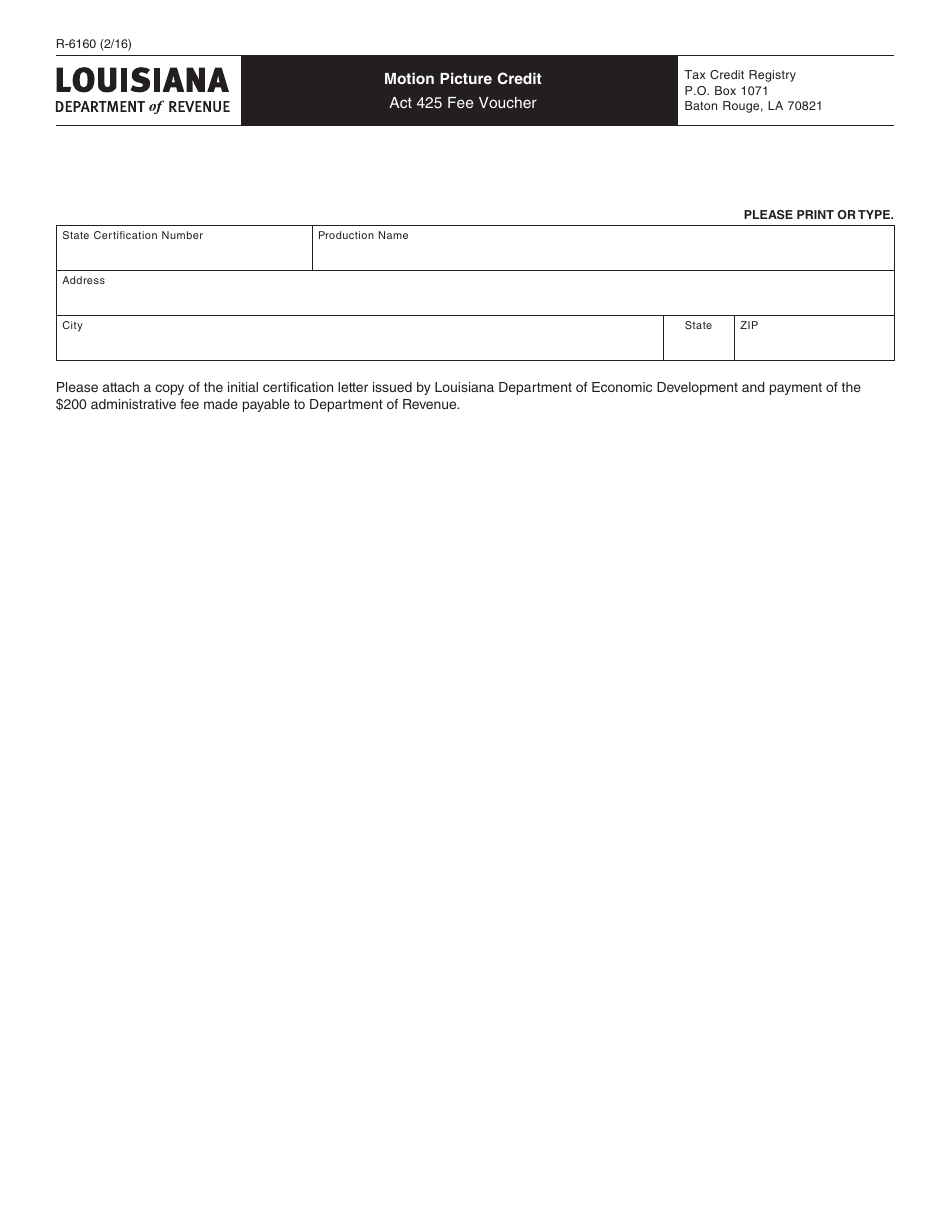

Form R-6160 Motion Picture Credit - Act 425 Fee Voucher - Louisiana

What Is Form R-6160?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-6160?

A: Form R-6160 is the Motion Picture Credit - Act 425 Fee Voucher for Louisiana.

Q: What is the purpose of Form R-6160?

A: The purpose of Form R-6160 is to report and pay the fees associated with the Motion Picture ProductionTax Credit in Louisiana.

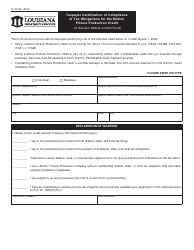

Q: Who needs to use Form R-6160?

A: Anyone claiming the Motion Picture Production Tax Credit in Louisiana needs to use Form R-6160 to report and pay the associated fees.

Q: What is the Motion Picture Production Tax Credit?

A: The Motion Picture Production Tax Credit is a tax incentive program offered by the state of Louisiana to attract motion picture production to the state.

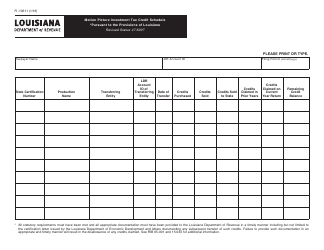

Q: What are the fees associated with the Motion Picture Production Tax Credit?

A: The fees associated with the Motion Picture Production Tax Credit include an annual certification fee, an application fee, and a per-project fee.

Q: Are there any deadlines for submitting Form R-6160?

A: Yes, there are specific deadlines for submitting Form R-6160. These deadlines vary depending on the type of fee being paid.

Q: Is there any penalty for late filing of Form R-6160?

A: Yes, there may be penalties for late filing of Form R-6160. It is important to submit the form and fees on time to avoid any penalties.

Form Details:

- Released on February 1, 2016;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-6160 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.