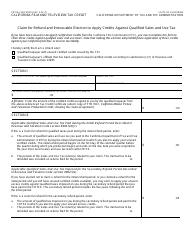

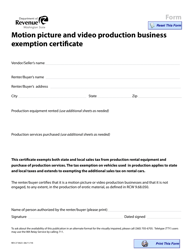

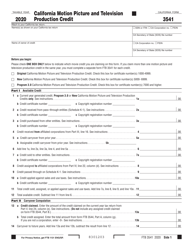

Instructions for Form FTB3541 California Motion Picture and Television Production Credit - California

This document contains official instructions for Form FTB3541 , California Television Production Credit - a form released and collected by the California Franchise Tax Board.

FAQ

Q: What is Form FTB3541?

A: Form FTB3541 is a tax form used to claim the California Motion Picture and Television Production Credit.

Q: What is the California Motion Picture and Television Production Credit?

A: The California Motion Picture and Television Production Credit is a tax credit available for qualifying film and television productions in California.

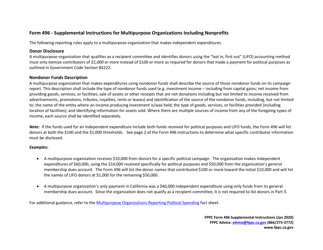

Q: Who can use Form FTB3541?

A: Form FTB3541 can be used by individuals, corporations, and partnerships who qualify for the California Motion Picture and Television Production Credit.

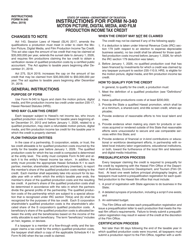

Q: What information is required on Form FTB3541?

A: Form FTB3541 requires information about the production, such as the title, the production company, and the dates of production.

Q: How do I claim the California Motion Picture and Television Production Credit?

A: To claim the credit, you must complete Form FTB3541 and submit it with your tax return.

Q: Are there any eligibility requirements for the California Motion Picture and Television Production Credit?

A: Yes, there are specific eligibility requirements, such as a minimum spending requirement and a certification from the California Film Commission.

Q: Is there a deadline to file Form FTB3541?

A: Yes, Form FTB3541 must be filed within 12 months of the production's completion.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Franchise Tax Board.