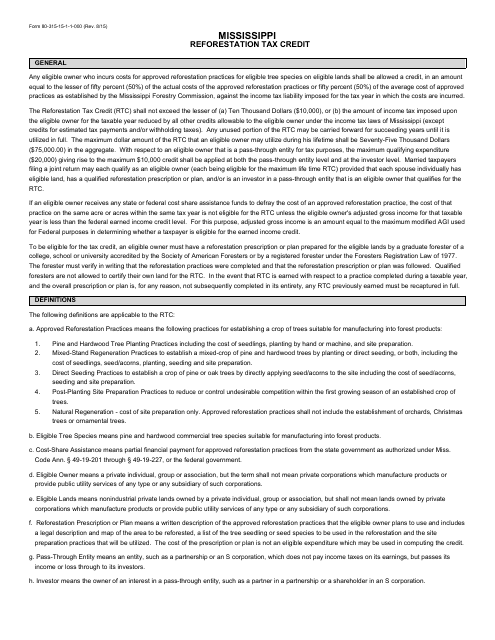

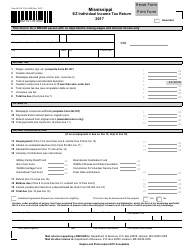

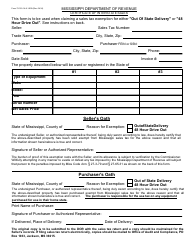

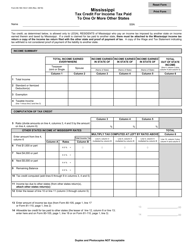

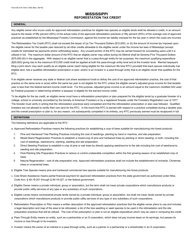

Instructions for Form 80-315-15-1-1-000 Mississippi Reforestation Tax Credit - Mississippi

This document contains official instructions for Form 80-315-15-1-1-000 , Mississippi Reforestation Tax Credit - a form released and collected by the Mississippi Department of Revenue.

FAQ

Q: What is Form 80-315-15-1-1-000?

A: Form 80-315-15-1-1-000 is the Mississippi Reforestation Tax Credit Form.

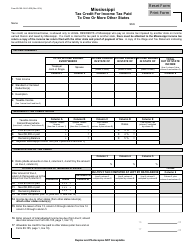

Q: What is the Mississippi Reforestation Tax Credit?

A: The Mississippi Reforestation Tax Credit is a tax credit program that incentivizes reforestation activities in Mississippi.

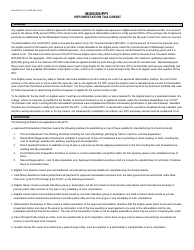

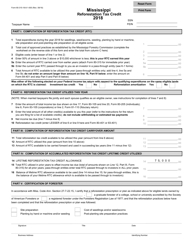

Q: Who can claim the Mississippi Reforestation Tax Credit?

A: Individuals, corporations, estates, and trusts engaged in reforestation activities in Mississippi can claim the tax credit.

Q: What activities qualify for the Mississippi Reforestation Tax Credit?

A: Activities such as planting, maintaining, and managing trees for commercial purposes may qualify for the tax credit.

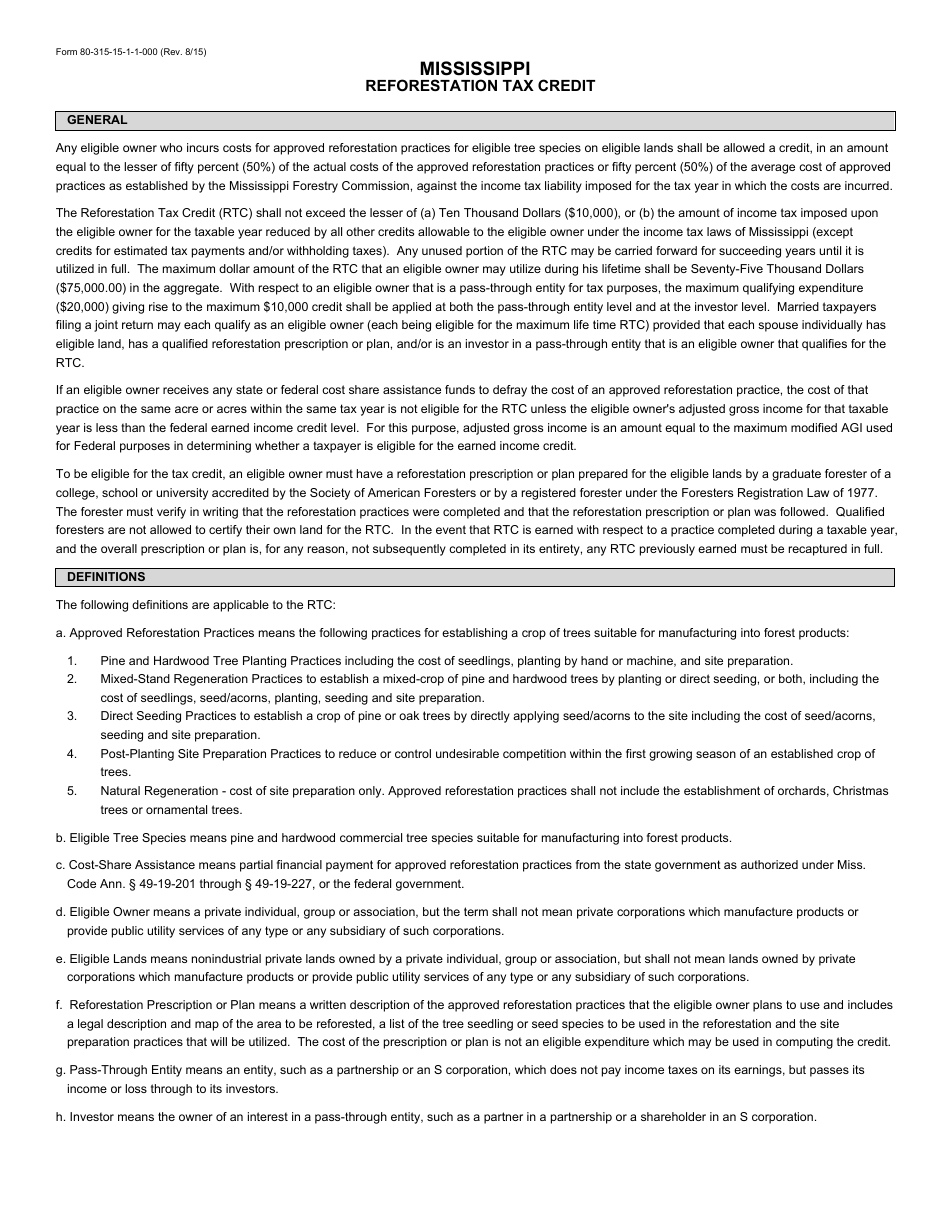

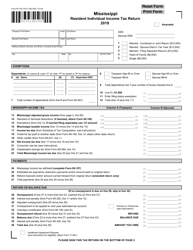

Q: How do I claim the Mississippi Reforestation Tax Credit?

A: To claim the tax credit, you need to fill out and submit Form 80-315-15-1-1-000 to the Mississippi Department of Revenue.

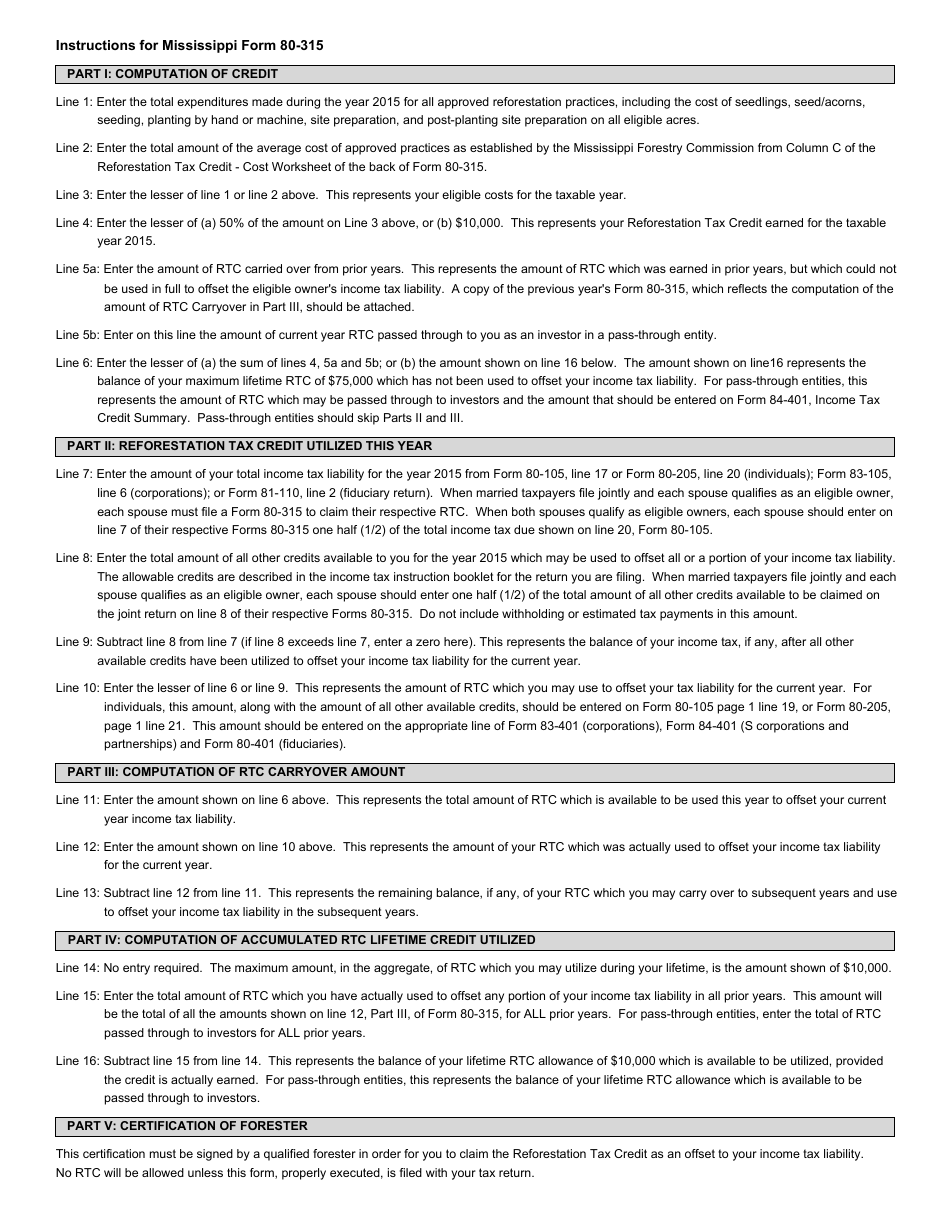

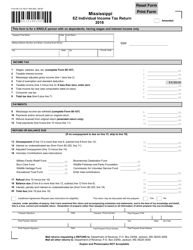

Q: What is the deadline for claiming the Mississippi Reforestation Tax Credit?

A: The deadline for claiming the tax credit is usually April 15th of the year following the tax year in which the reforestation activities were performed.

Q: What documentation do I need to provide with Form 80-315-15-1-1-000?

A: You may need to provide documentation such as a landowner agreement, tree planting details, and employer identification numbers with the form.

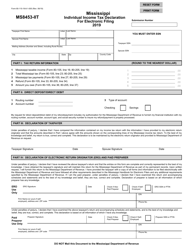

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Mississippi Department of Revenue.