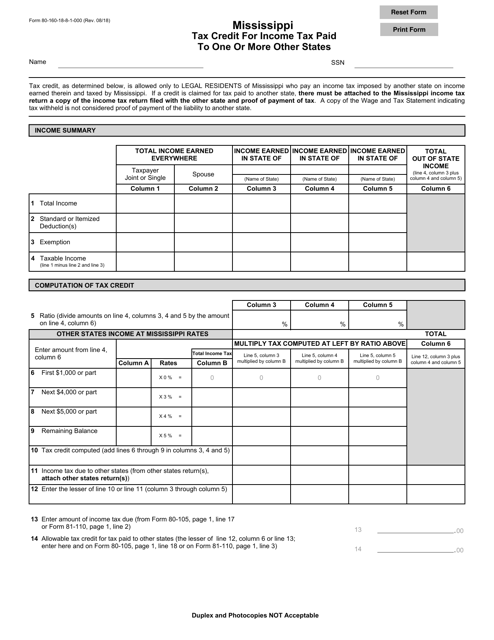

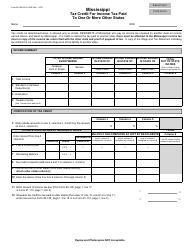

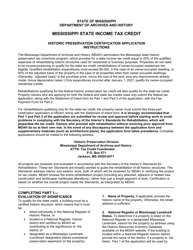

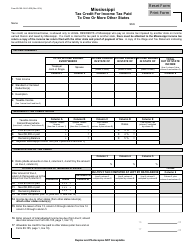

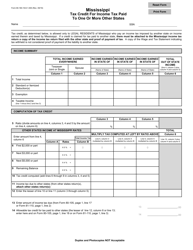

Form 80-160-18-8-1-000 Tax Credit for Income Tax Paid to One or More Other States - Mississippi

What Is Form 80-160-18-8-1-000?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 80-160-18-8-1-000?

A: Form 80-160-18-8-1-000 is a tax form related to tax credit for income tax paid to one or more other states in Mississippi.

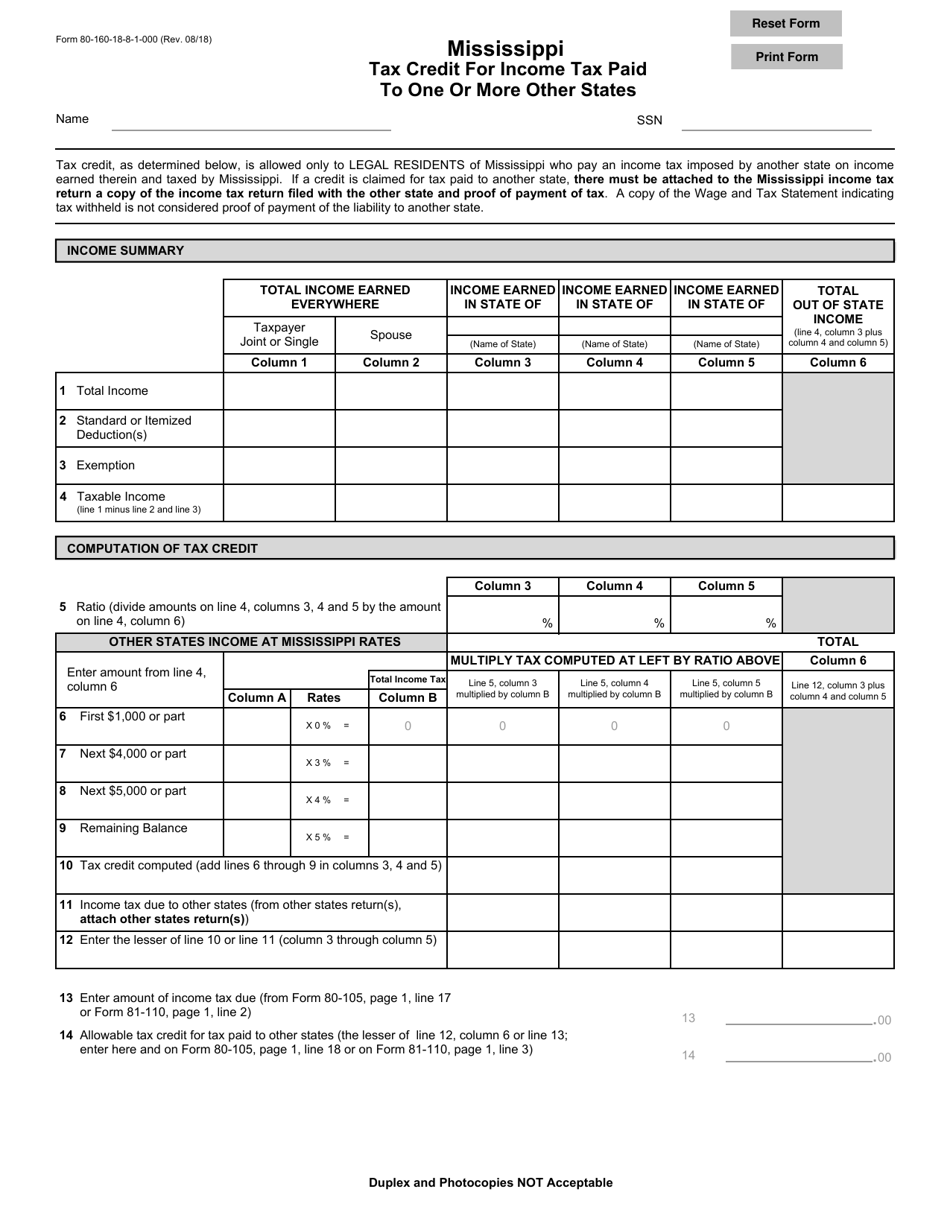

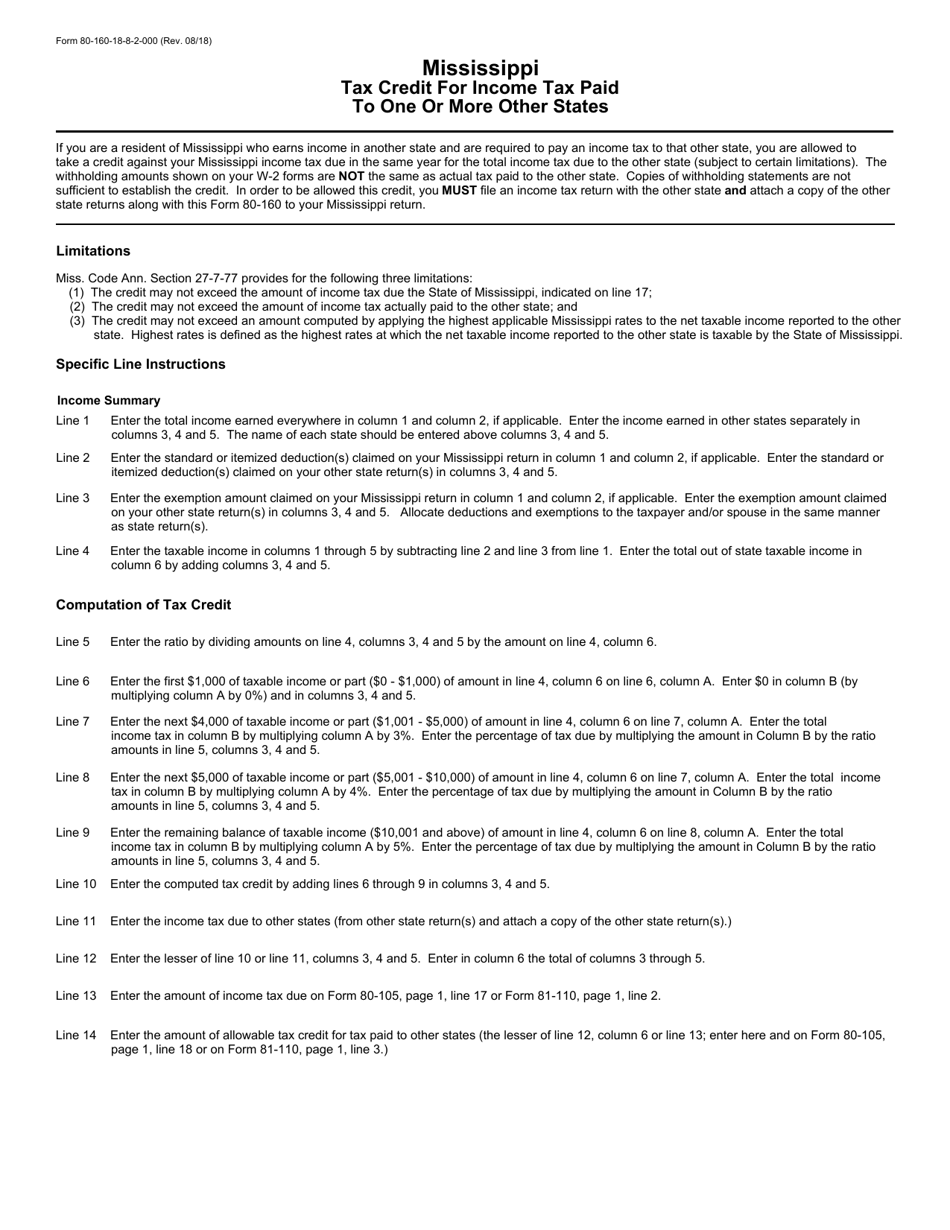

Q: What is a tax credit for income tax paid to other states?

A: A tax credit for income tax paid to other states is a provision that allows taxpayers to reduce their state tax liability by the amount of income tax paid to another state.

Q: Who is eligible for the tax credit for income tax paid to other states?

A: Taxpayers who have paid income tax to one or more other states and who are residents of Mississippi may be eligible for this tax credit.

Q: How do I claim the tax credit for income tax paid to other states?

A: To claim the tax credit, you need to complete and file Form 80-160-18-8-1-000 with the Mississippi Department of Revenue.

Q: Are there any limitations or restrictions for claiming the tax credit?

A: Yes, there may be limitations and restrictions, such as a maximum limit on the amount of credit that can be claimed or specific requirements for documentation. It is important to review the instructions and guidelines provided with the form.

Q: Is the tax credit for income tax paid to other states refundable?

A: No, the tax credit is non-refundable. It can only be used to offset your state tax liability.

Q: Can I claim the tax credit for income tax paid to other countries?

A: No, the tax credit is specifically for income tax paid to one or more other states within the United States. It does not apply to taxes paid to foreign countries.

Q: Is there a deadline for filing Form 80-160-18-8-1-000?

A: Yes, the form must be filed by the due date of your Mississippi state tax return, which is typically April 15th of each year.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 80-160-18-8-1-000 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.