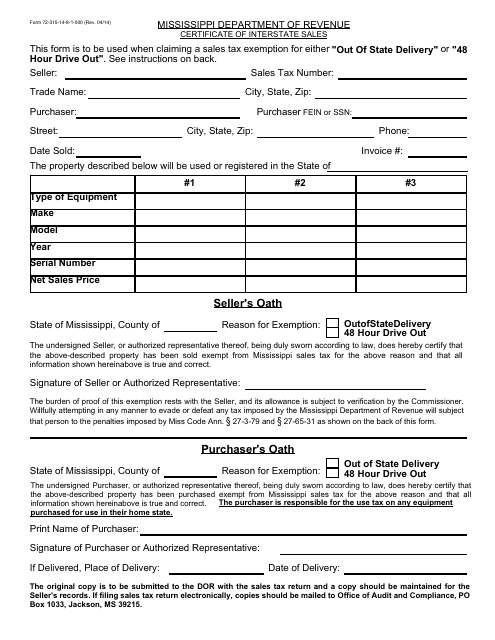

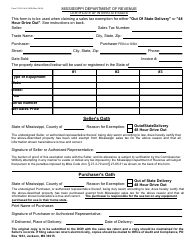

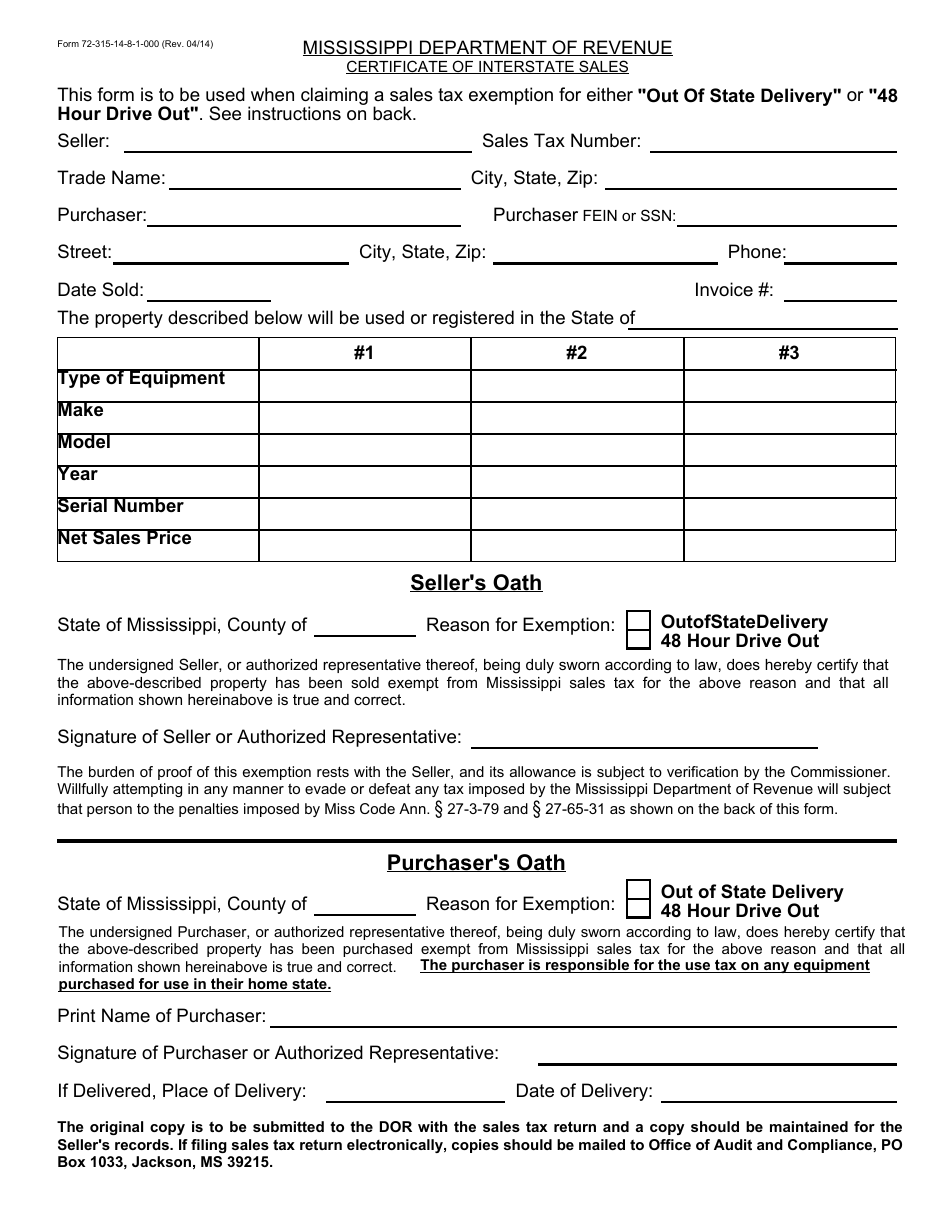

Form 72-315-14-8-1-000 Certificate of Interstate Sales - Mississippi

What Is Form 72-315-14-8-1-000?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 72-315-14-8-1-000?

A: Form 72-315-14-8-1-000 is the Certificate of Interstate Sales for Mississippi.

Q: What is the purpose of Form 72-315-14-8-1-000?

A: The purpose of Form 72-315-14-8-1-000 is to document and report interstate sales in Mississippi.

Q: Who is required to file Form 72-315-14-8-1-000?

A: Businesses engaged in interstate sales in Mississippi are required to file Form 72-315-14-8-1-000.

Q: How often is Form 72-315-14-8-1-000 filed?

A: Form 72-315-14-8-1-000 is filed on a monthly basis.

Q: What information is required on Form 72-315-14-8-1-000?

A: Form 72-315-14-8-1-000 requires the reporting of the total sales amount and detailed information about each interstate sale.

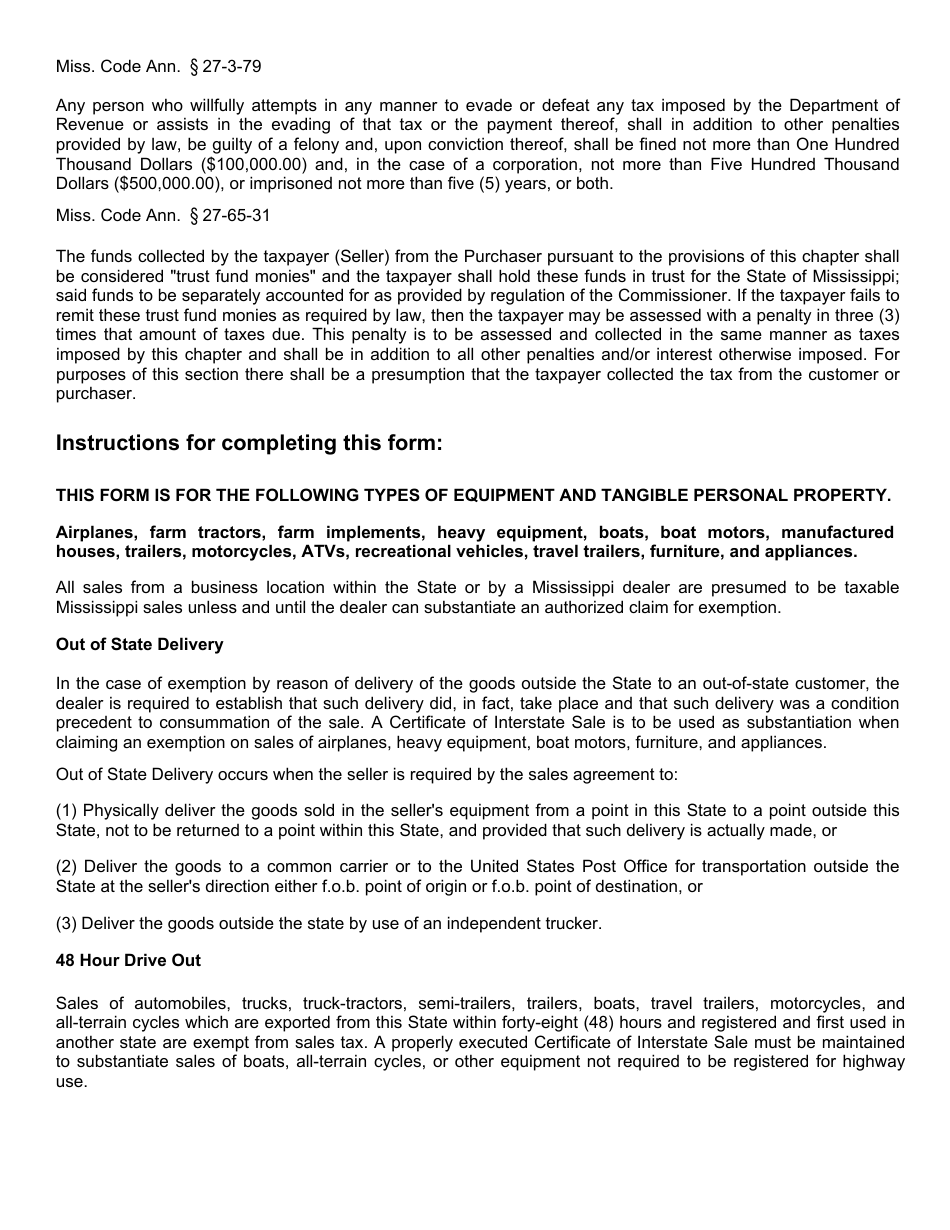

Q: What are the consequences of not filing Form 72-315-14-8-1-000?

A: Failure to file Form 72-315-14-8-1-000 may result in penalties and interest.

Q: Is Form 72-315-14-8-1-000 only applicable to businesses in Mississippi?

A: Yes, Form 72-315-14-8-1-000 is specific to businesses in Mississippi.

Q: Can I file Form 72-315-14-8-1-000 electronically?

A: Yes, the Mississippi Department of Revenue allows electronic filing of Form 72-315-14-8-1-000.

Q: Is Form 72-315-14-8-1-000 for sales tax purposes?

A: Yes, Form 72-315-14-8-1-000 is used to report interstate sales for sales tax purposes in Mississippi.

Form Details:

- Released on April 1, 2014;

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72-315-14-8-1-000 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.