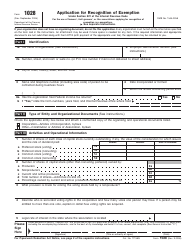

This version of the form is not currently in use and is provided for reference only. Download this version of

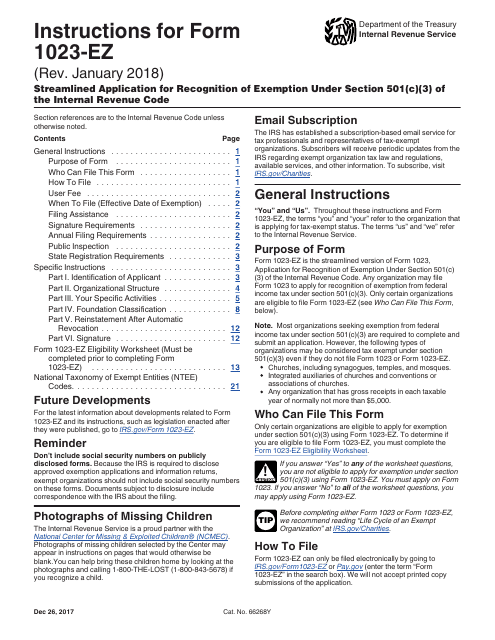

Instructions for IRS Form 1023-EZ

for the current year.

Instructions for IRS Form 1023-EZ Streamlined Application for Recognition of Exemption Under Section 501(C)(3) of the Internal Revenue Code

This document contains official instructions for IRS Form 1023-EZ , Streamlined Application for Recognition of Exemption Under Section 501(C)(3) of the Internal Revenue Code - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 1023-EZ?

A: IRS Form 1023-EZ is a streamlined application for recognition of exemption under section 501(c)(3) of the Internal Revenue Code.

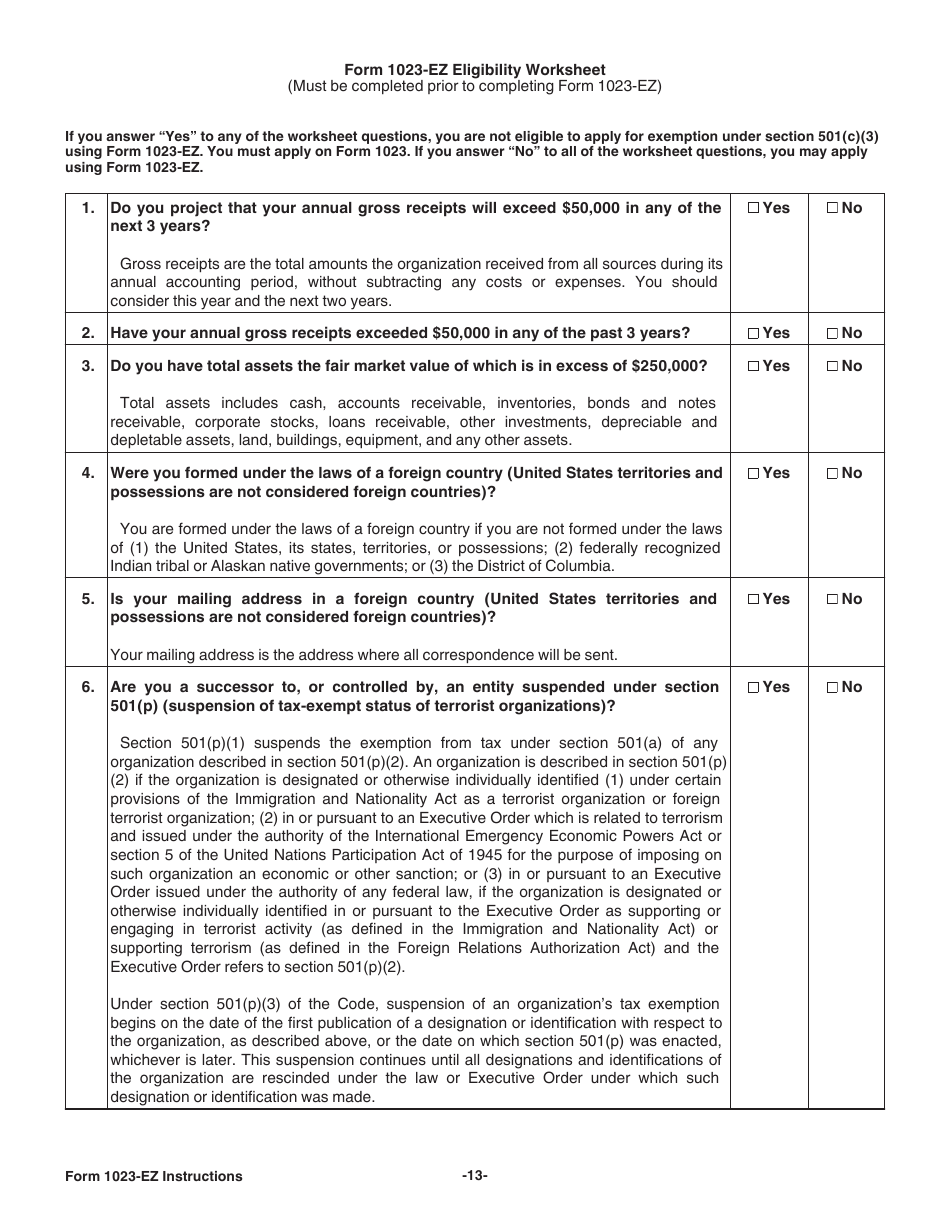

Q: Who is eligible to use Form 1023-EZ?

A: Certain small organizations with gross receipts of $50,000 or less and assets of $250,000 or less are eligible to use Form 1023-EZ.

Q: What is the purpose of Form 1023-EZ?

A: The purpose of Form 1023-EZ is to apply for tax-exempt status as a charitable organization.

Q: What information is required on Form 1023-EZ?

A: Form 1023-EZ requires basic information about the organization, its activities, and its governing documents.

Q: Are there any fees associated with Form 1023-EZ?

A: Yes, there is a user fee for submitting Form 1023-EZ. The fee amount varies depending on the organization's average annual gross receipts.

Q: How long does it take to process Form 1023-EZ?

A: The processing time for Form 1023-EZ is typically shorter compared to the regular Form 1023, but it can still take several weeks.

Q: What happens after submitting Form 1023-EZ?

A: After submitting Form 1023-EZ, the IRS will review the application and notify the organization of its tax-exempt status.

Q: Can Form 1023-EZ be amended?

A: No, once Form 1023-EZ is submitted, it cannot be amended. Any changes to the organization's information must be reported separately.

Instruction Details:

- This 23-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.