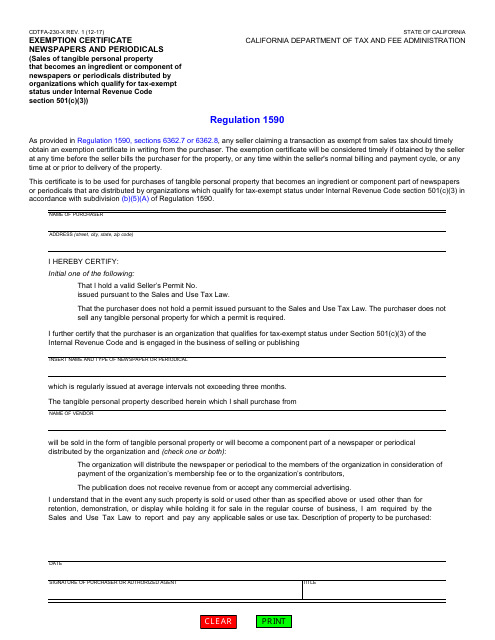

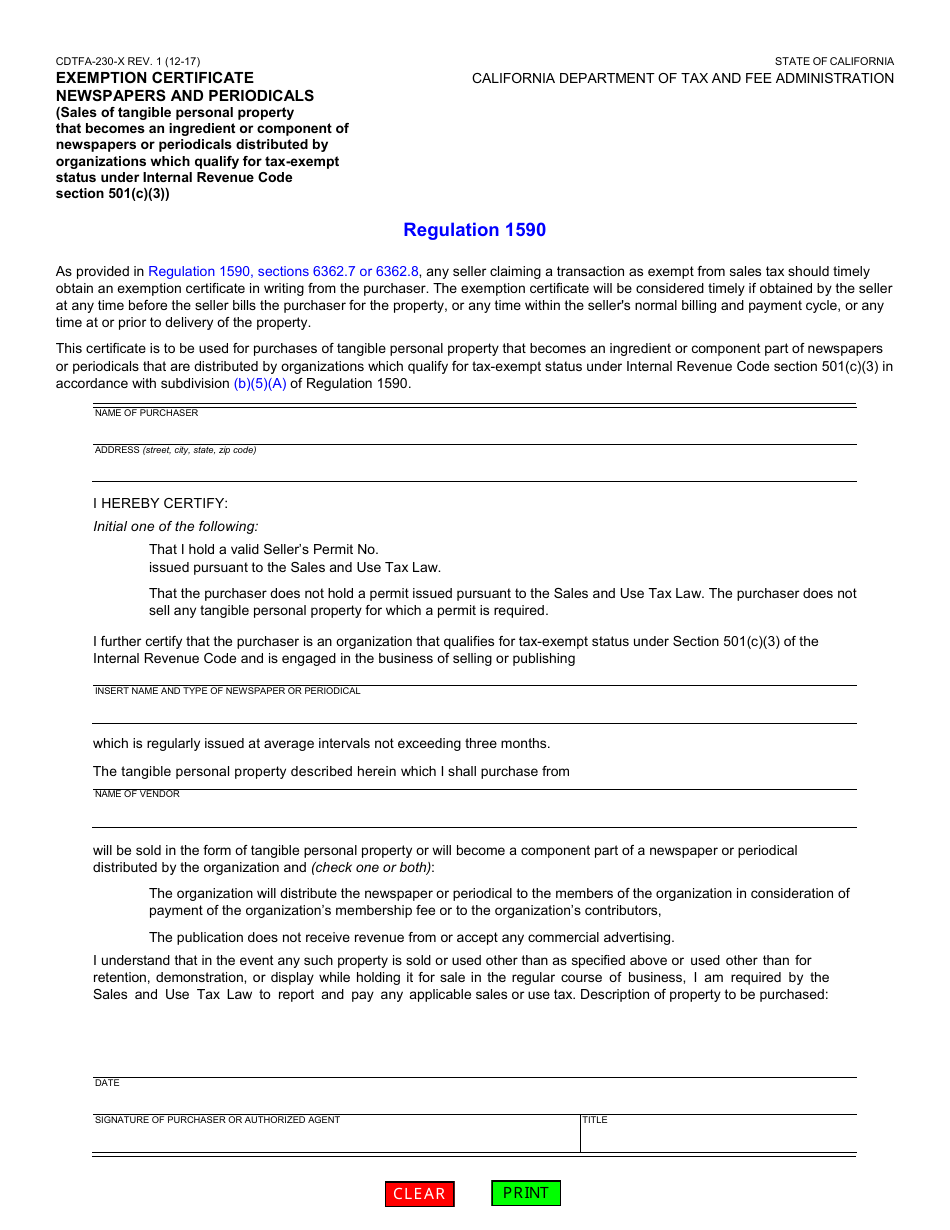

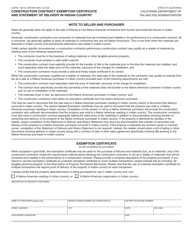

Form CDTFA-230-X Exemption Certificate Newspapers and Periodicals (Sales of Tangible Personal Property That Becomes an Ingredient or Component of Newspapers or Periodicals Distributed by Organizations Which Qualify for Tax-Exempt Status Under Internal Revenue Code Section 501(C)(3)) - California

What Is Form CDTFA-230-X?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-230-X?

A: It is an exemption certificate specifically for newspapers and periodicals.

Q: What does the form exempt?

A: The form exempts the sales of tangible personal property that becomes an ingredient or component of newspapers or periodicals.

Q: Who qualifies for tax-exempt status under Internal Revenue Code Section 501(C)(3)?

A: Organizations that qualify for tax-exempt status under Internal Revenue Code Section 501(C)(3) are eligible for this exemption.

Q: Which state is the form for?

A: The form is for the state of California.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-230-X by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.