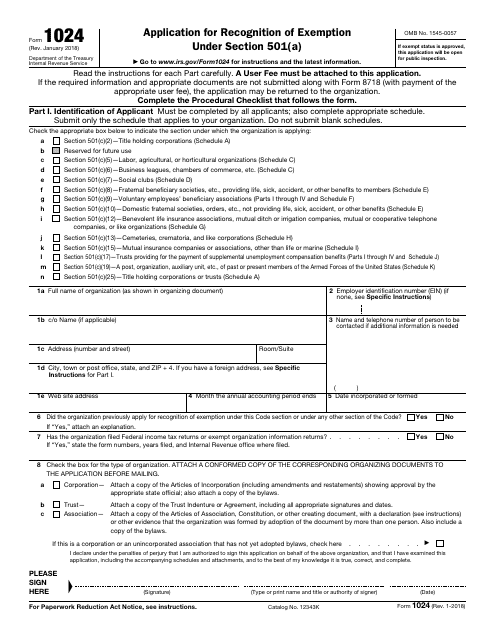

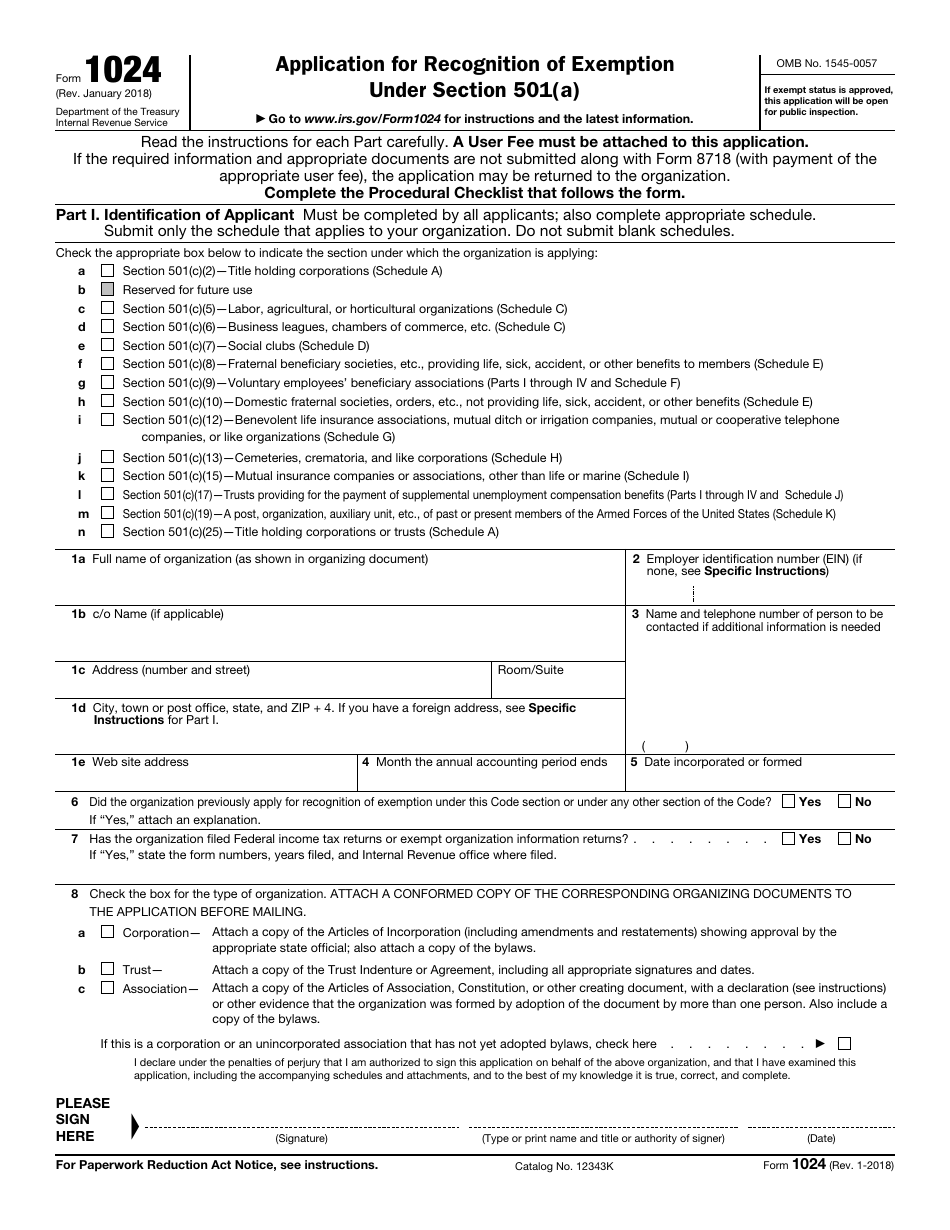

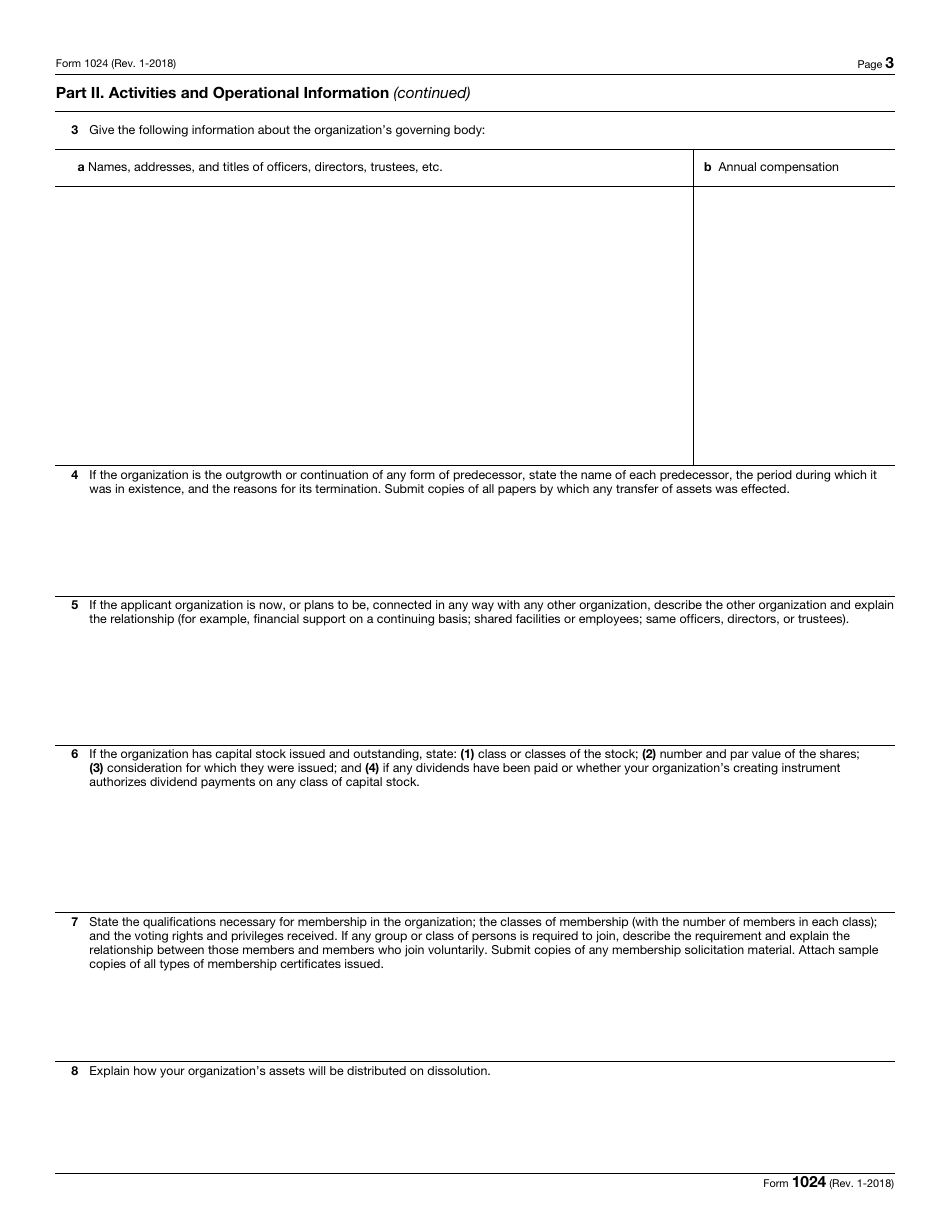

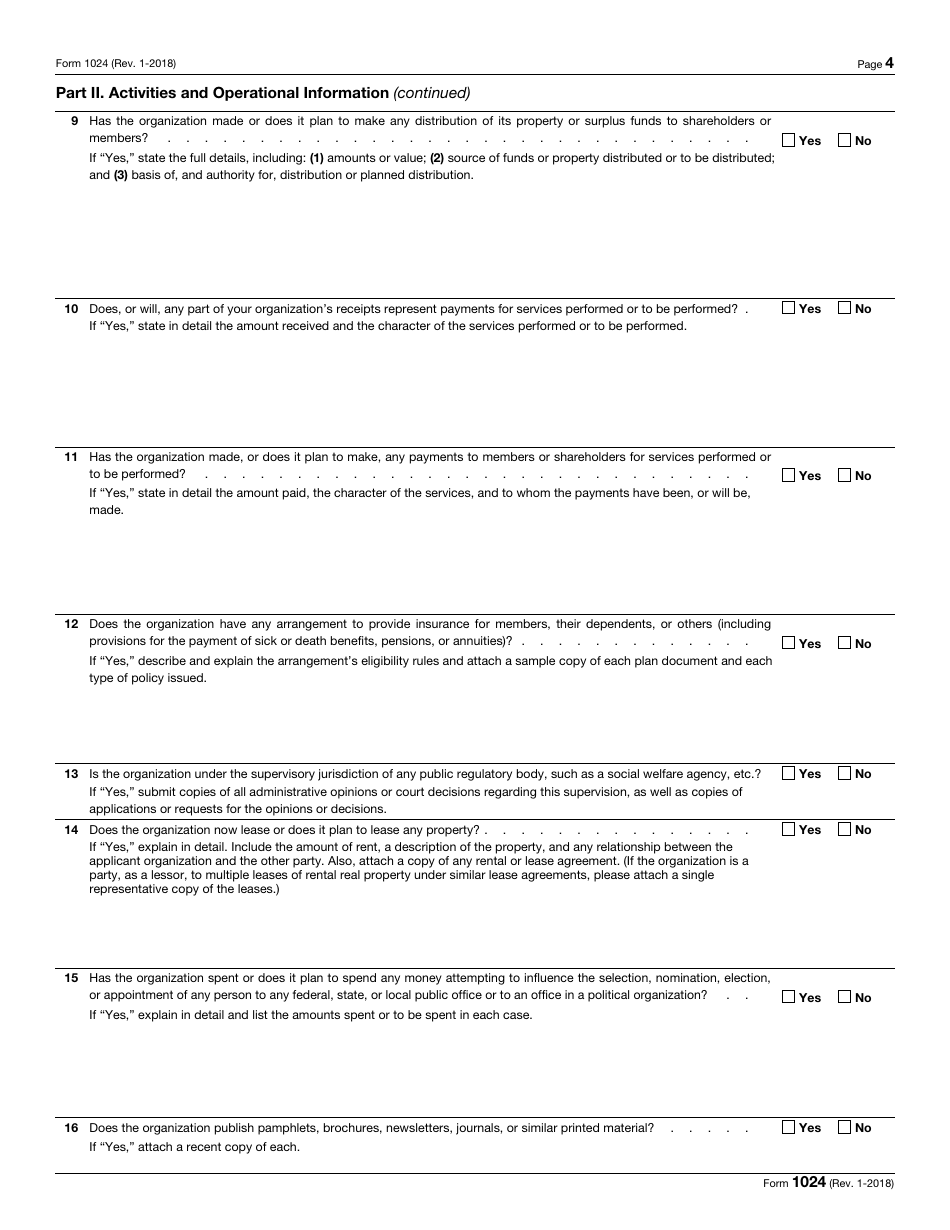

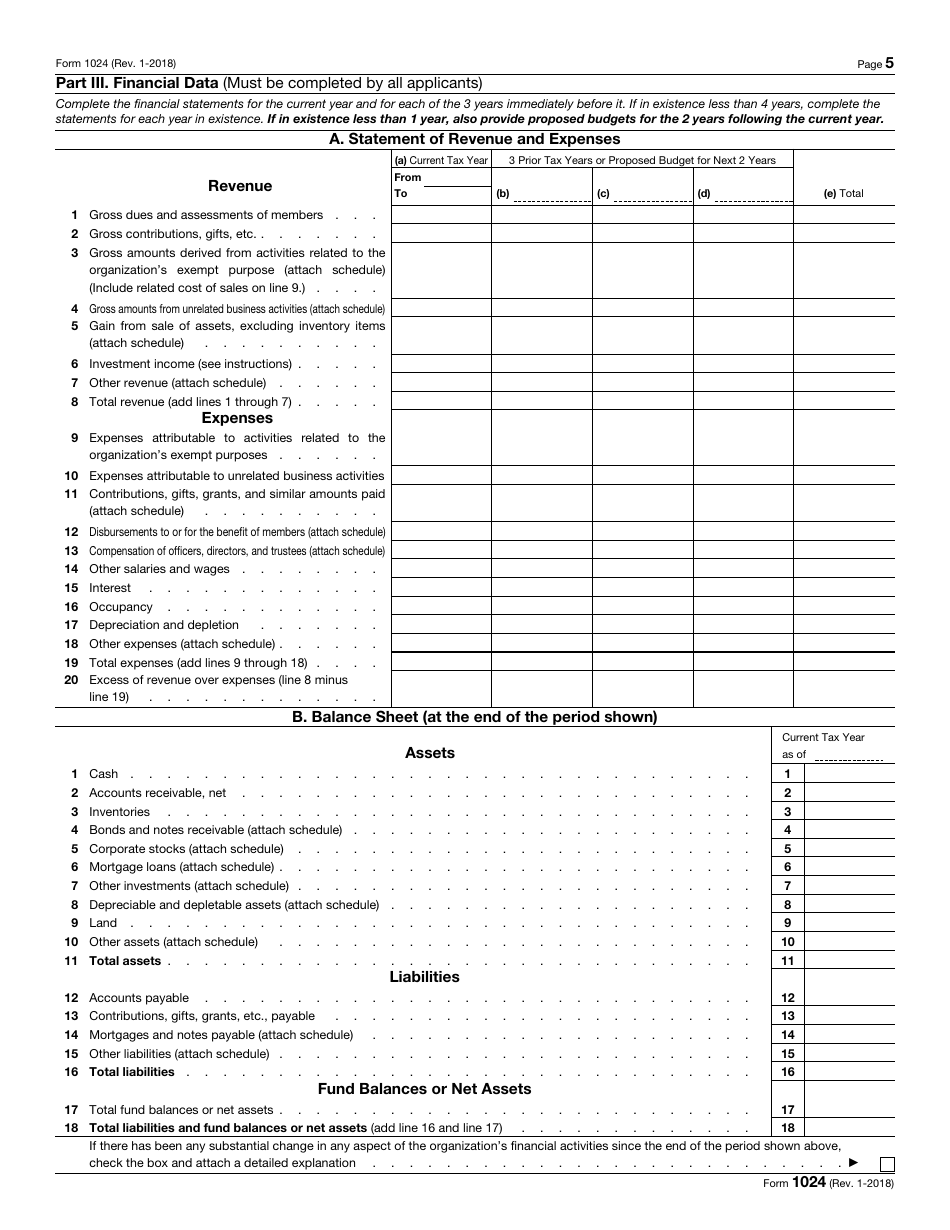

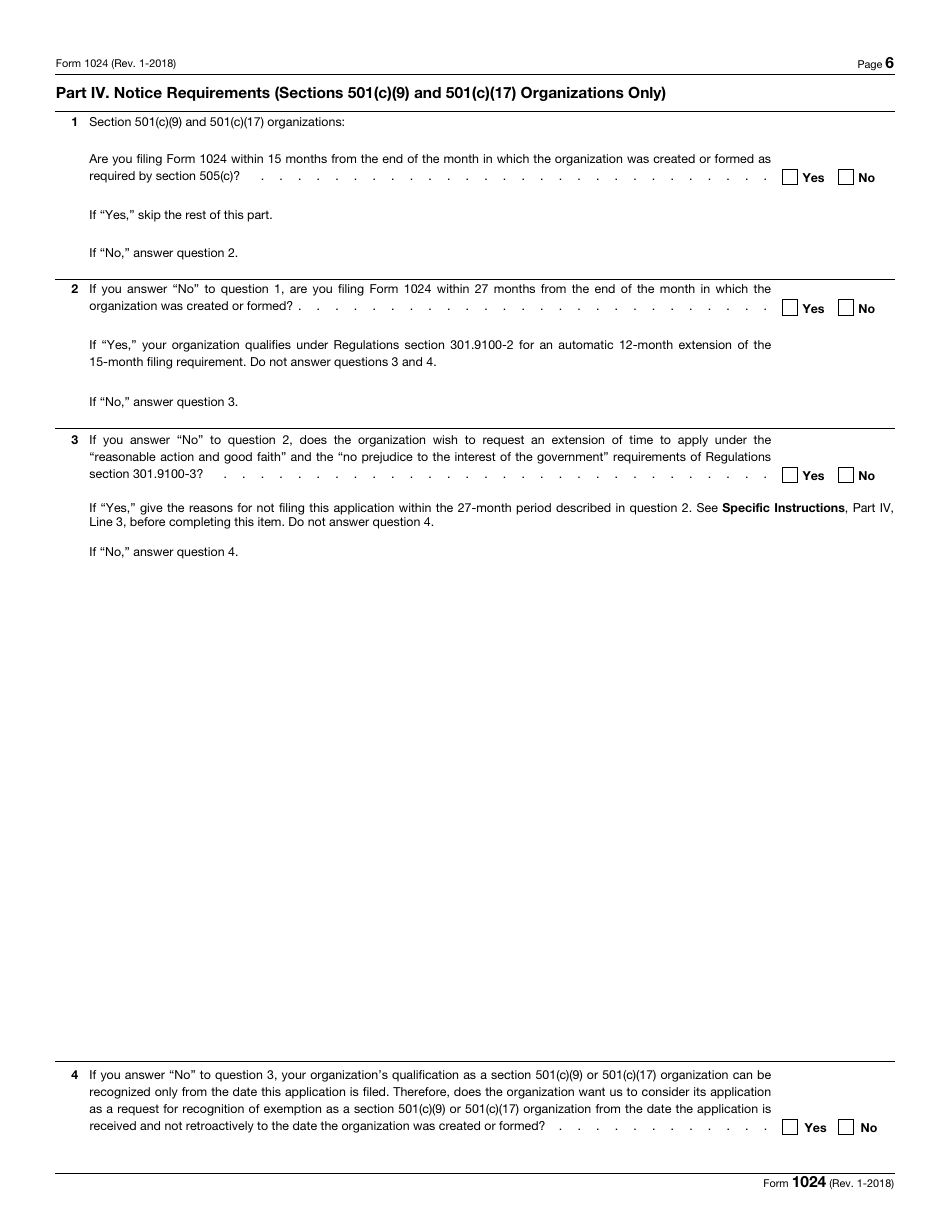

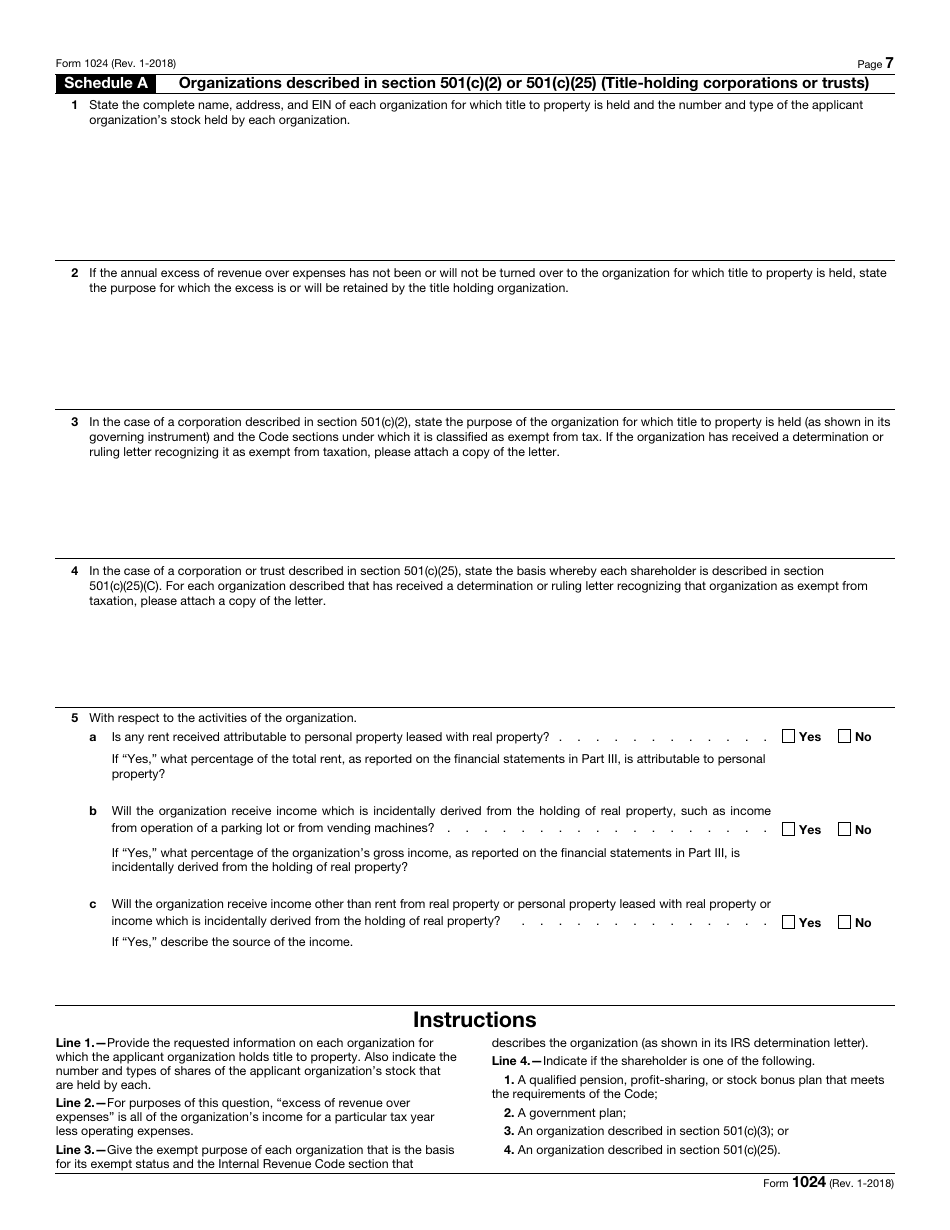

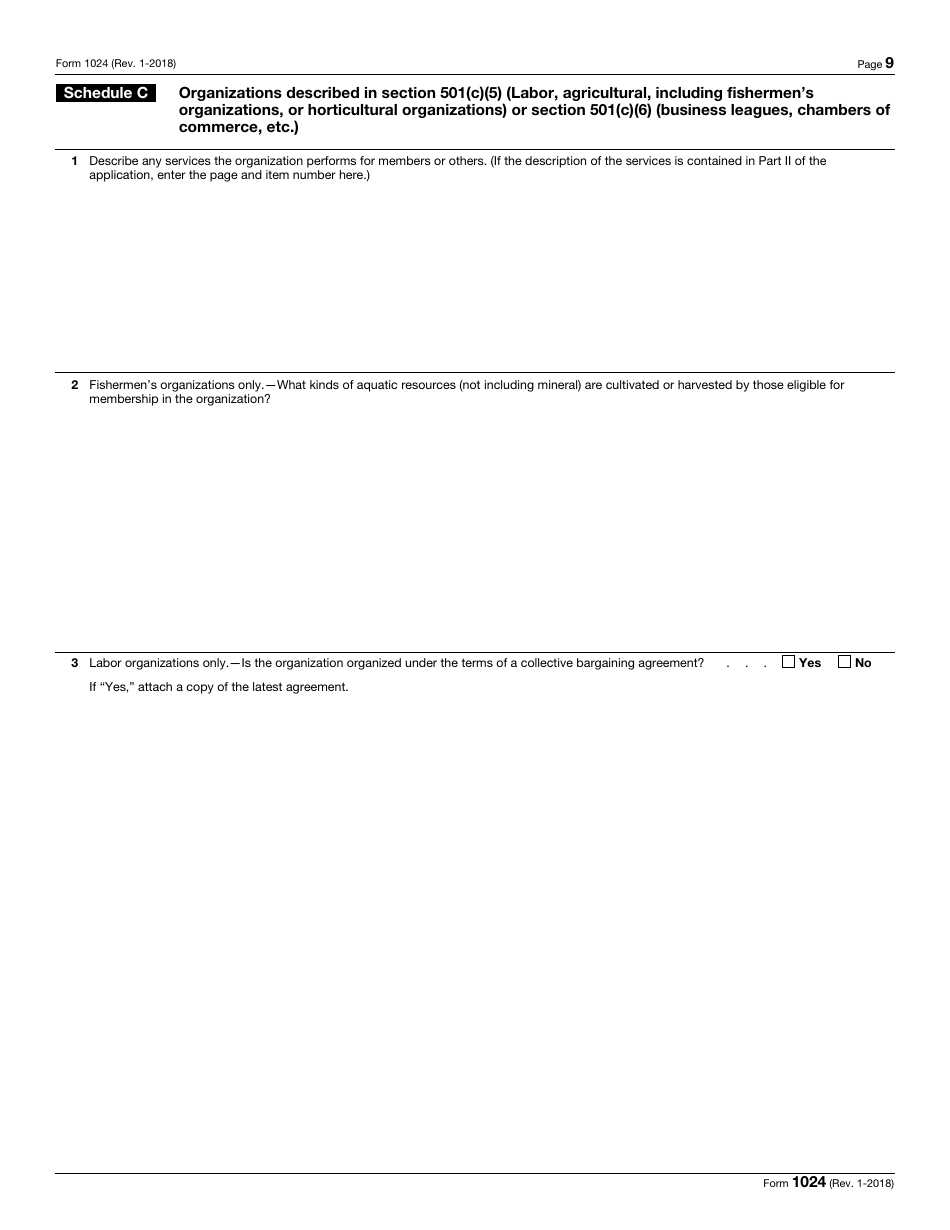

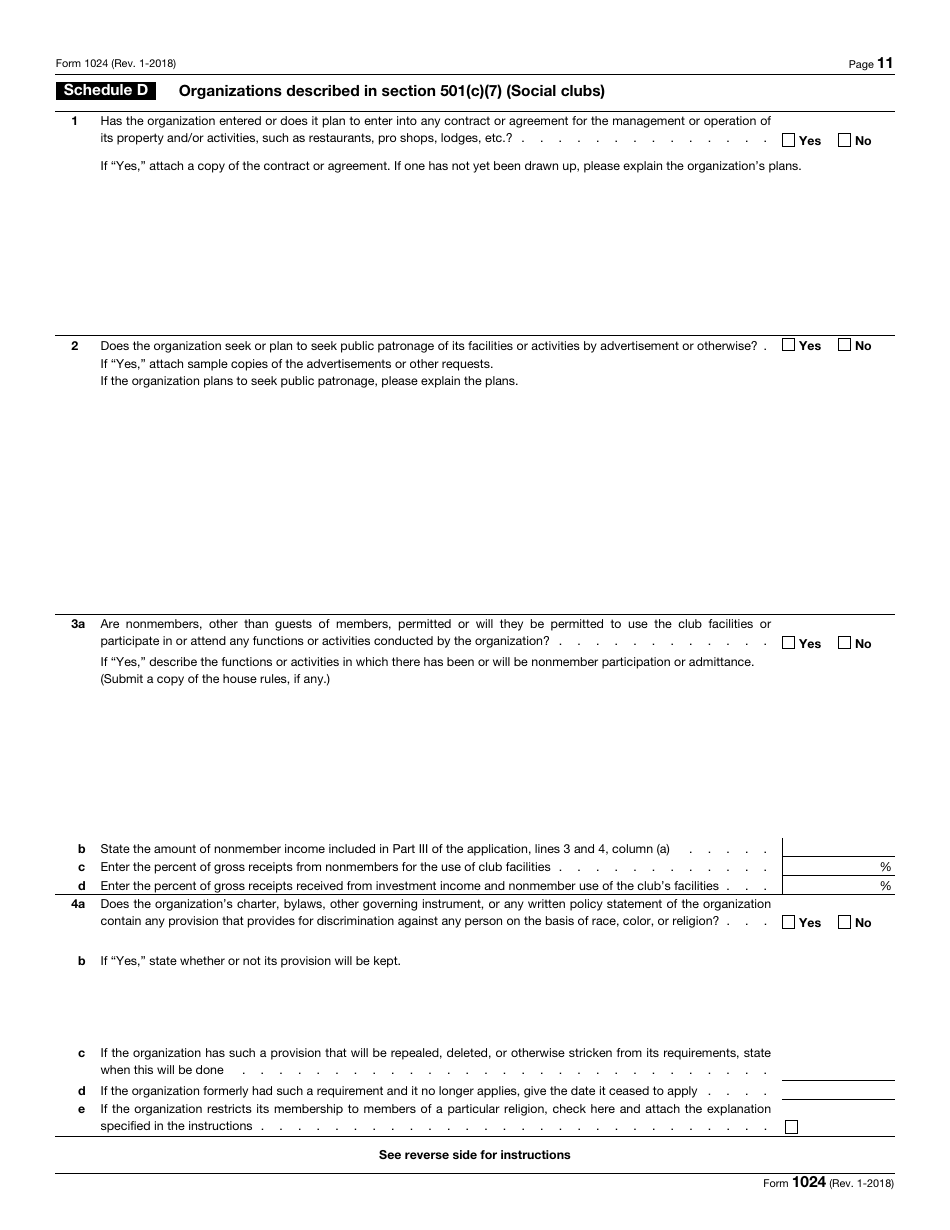

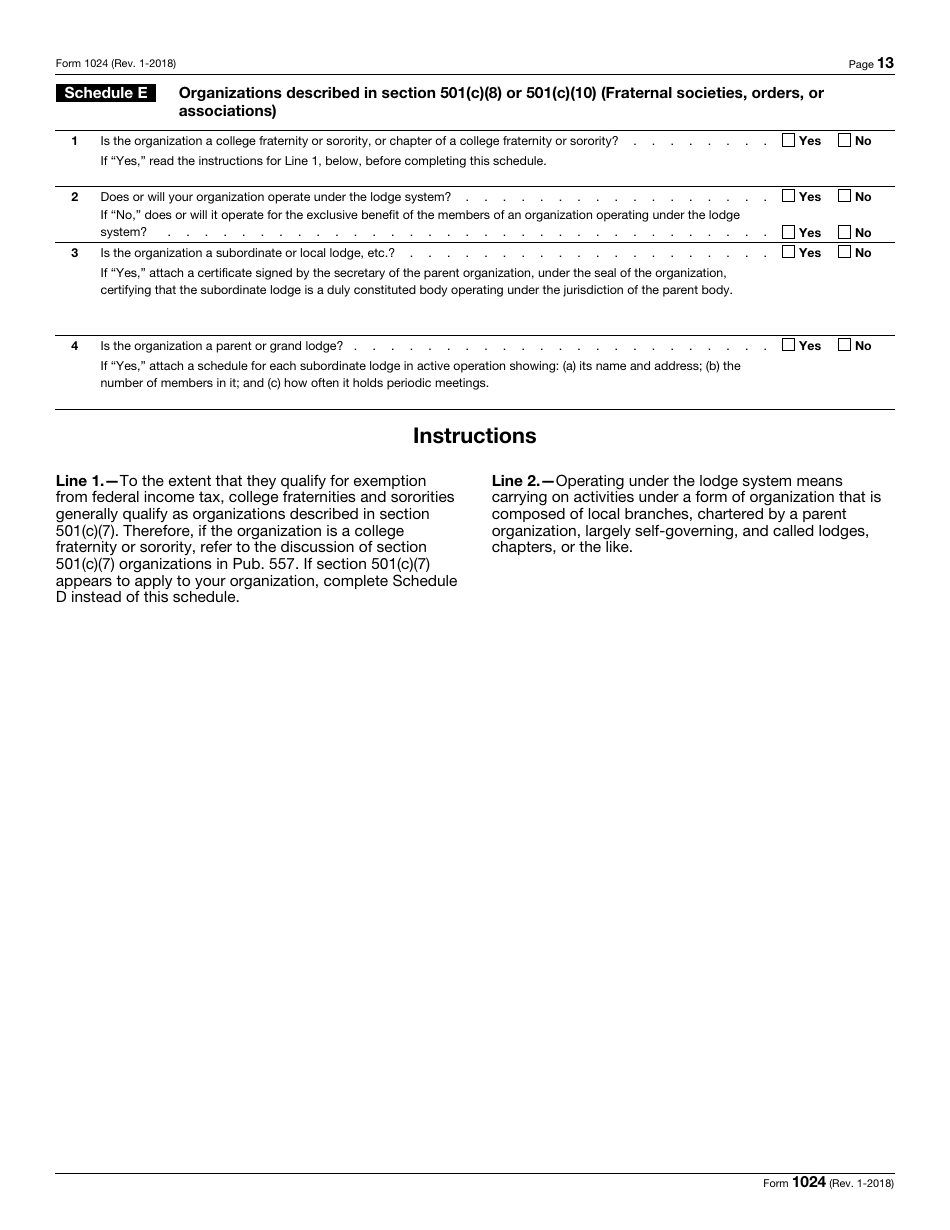

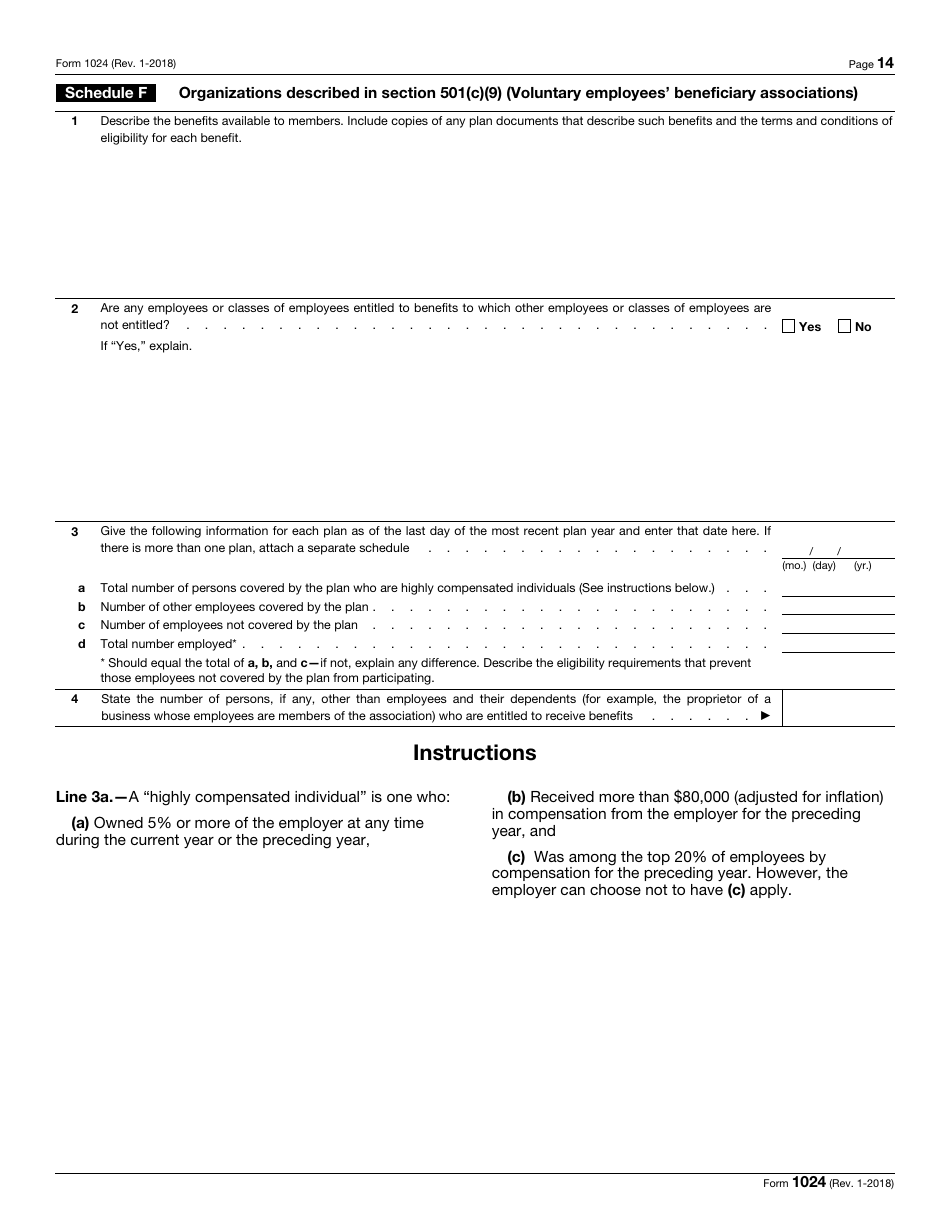

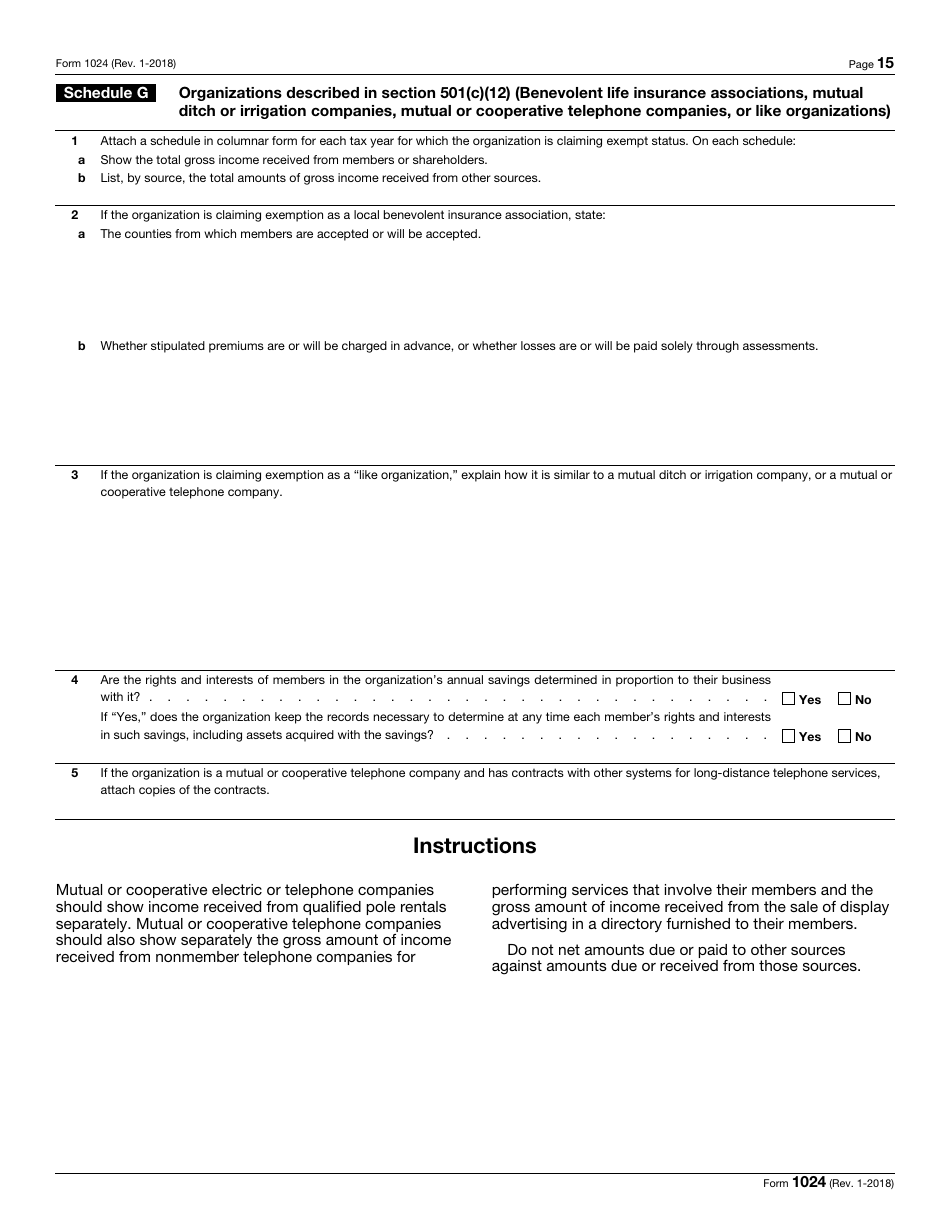

IRS Form 1024 Application for Recognition of Exemption Under Section 501(A)

What Is IRS Form 1024?

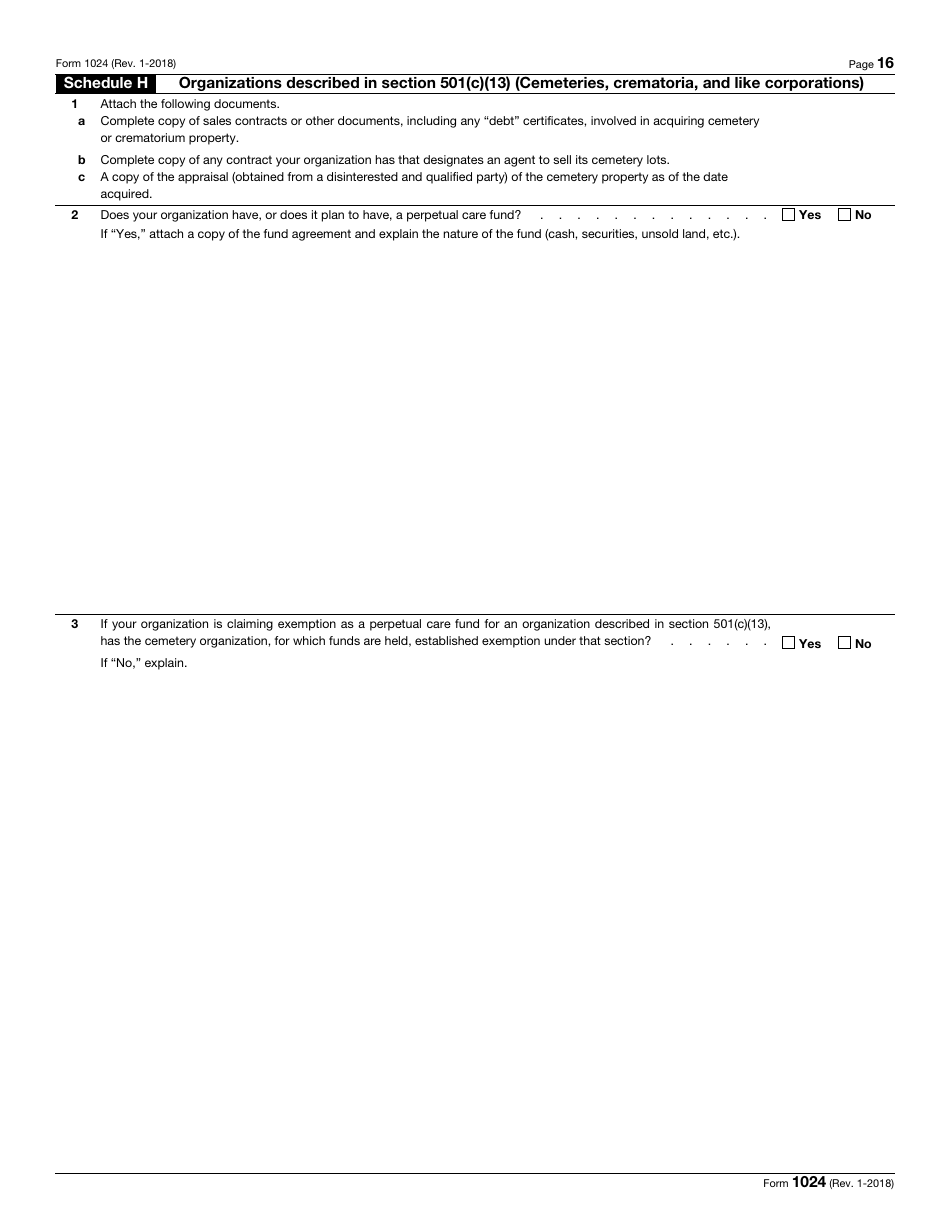

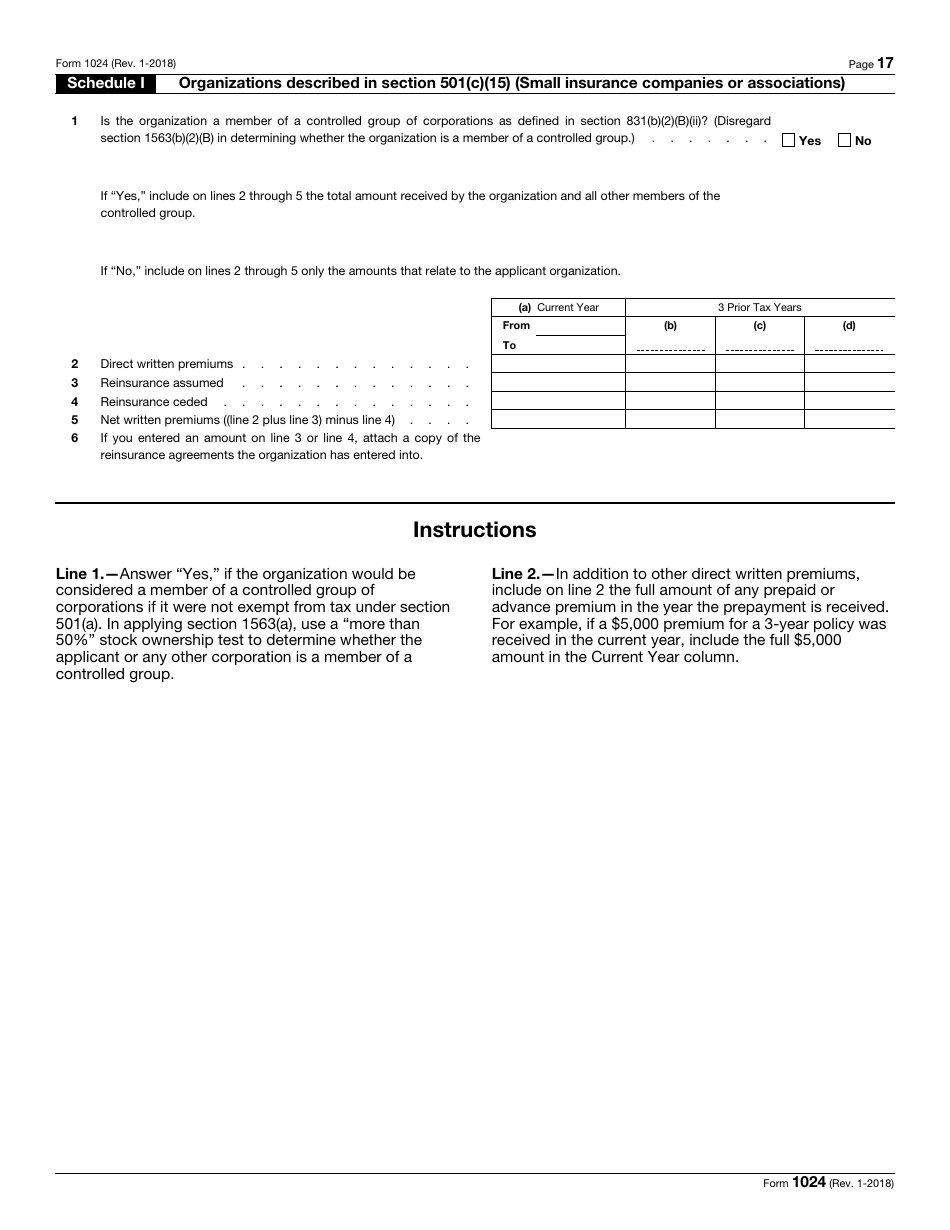

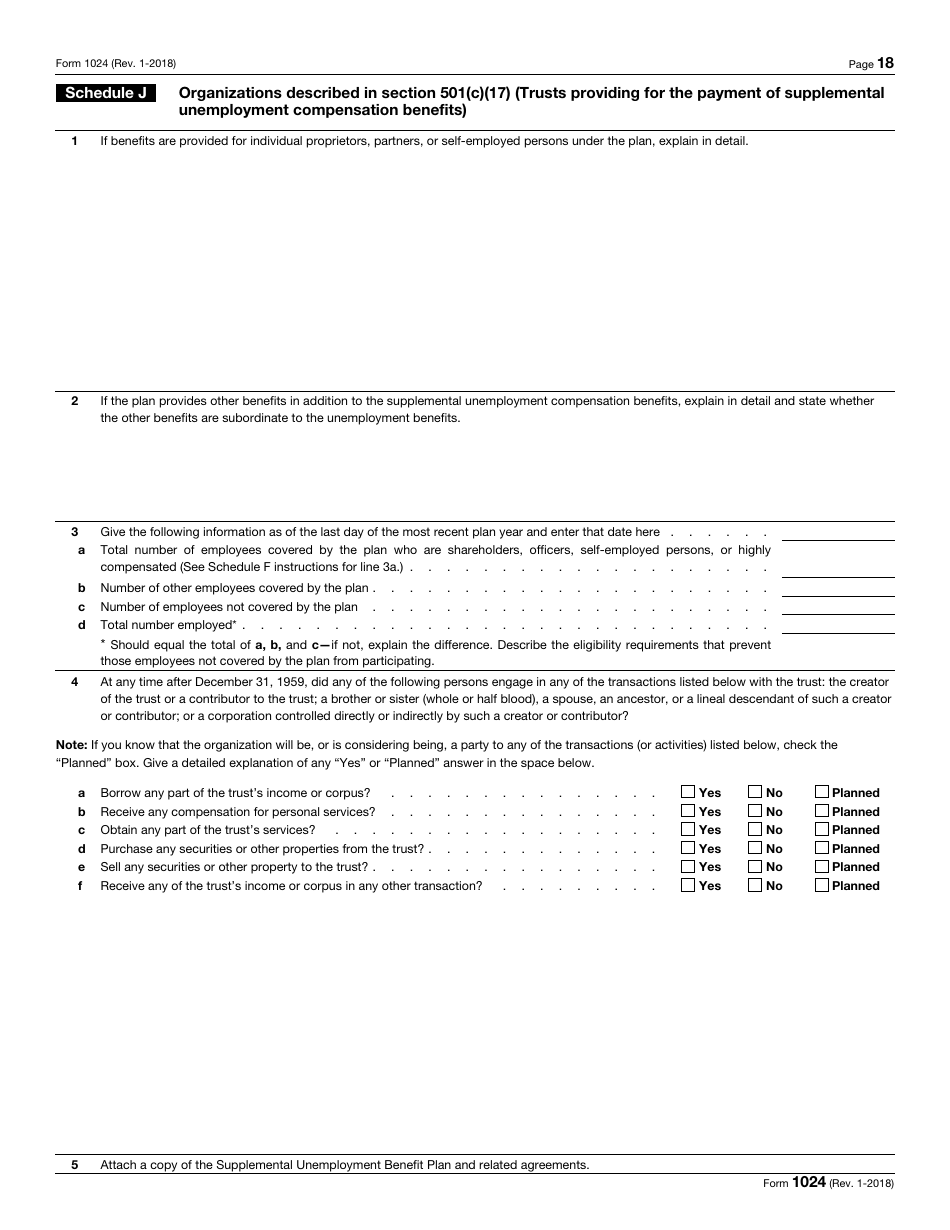

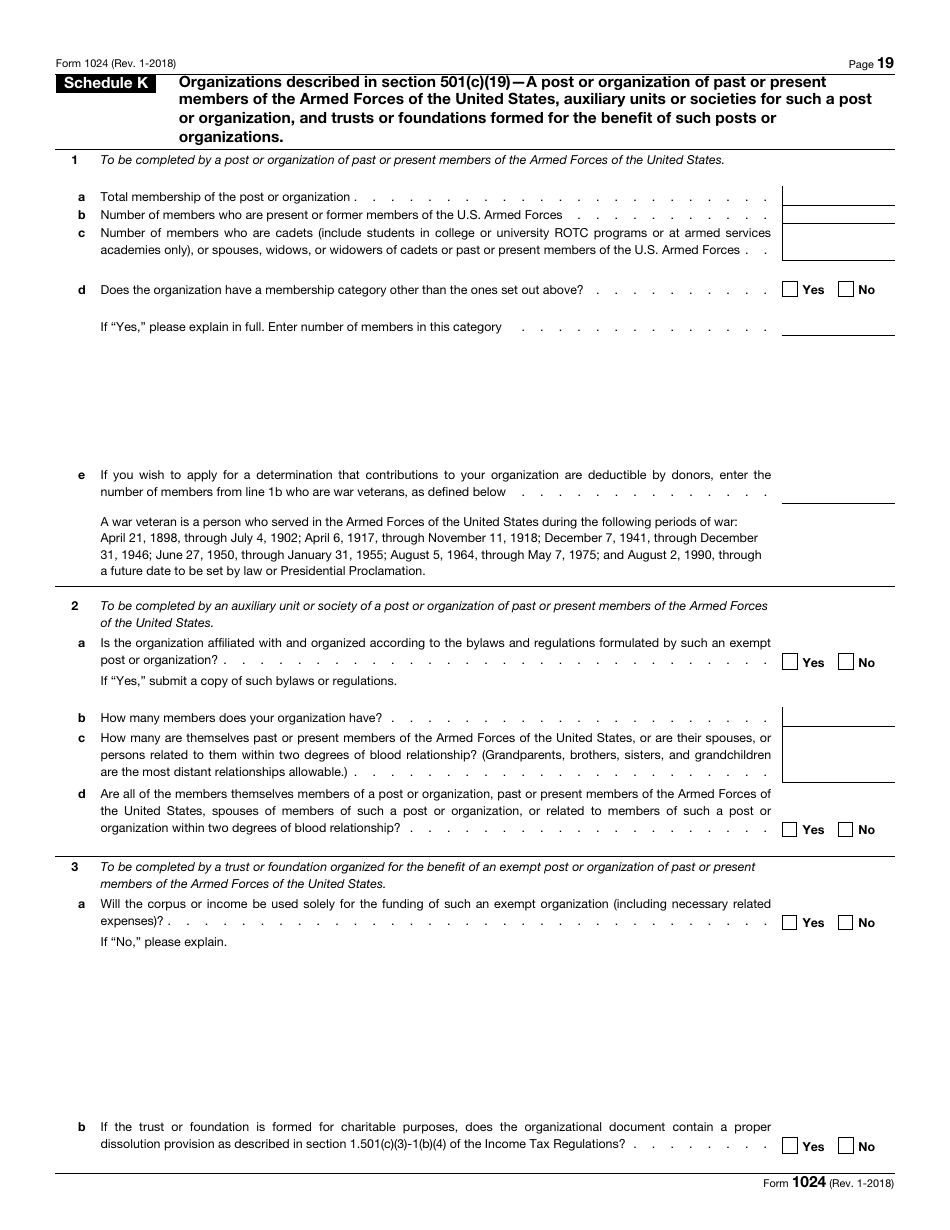

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1024?

A: IRS Form 1024 is the application for recognition of exemption under Section 501(a) of the Internal Revenue Code.

Q: What is the purpose of IRS Form 1024?

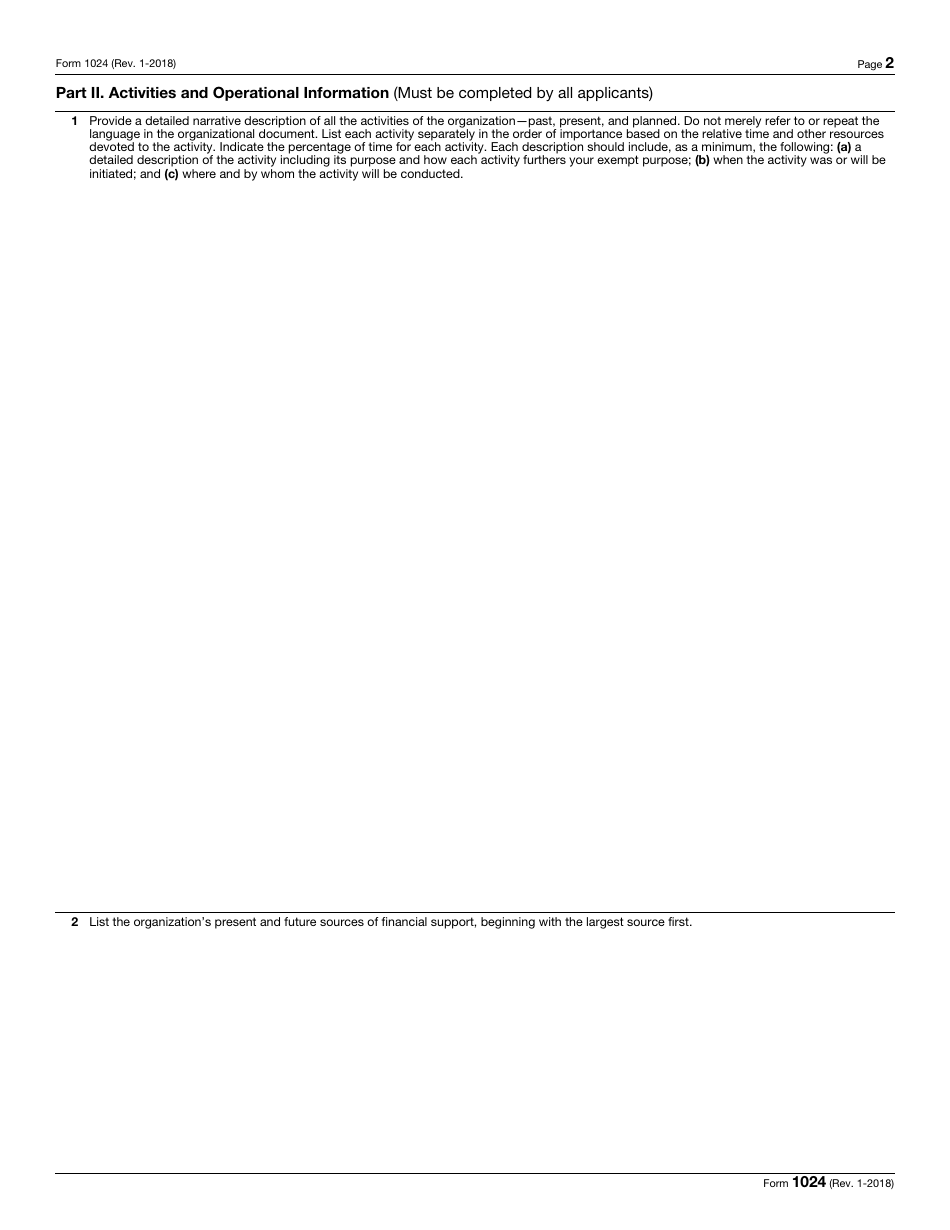

A: The purpose of IRS Form 1024 is to apply for tax-exempt status for organizations that do not qualify for automatic 501(c)(3) status.

Q: Who should file IRS Form 1024?

A: Organizations seeking tax-exempt status under Section 501(a) should file IRS Form 1024.

Q: What is Section 501(a) of the Internal Revenue Code?

A: Section 501(a) of the Internal Revenue Code provides for tax exemptions for certain types of organizations.

Q: Is filing IRS Form 1024 mandatory for all organizations seeking tax-exempt status?

A: No, filing IRS Form 1024 is not mandatory for organizations that qualify for automatic 501(c)(3) status.

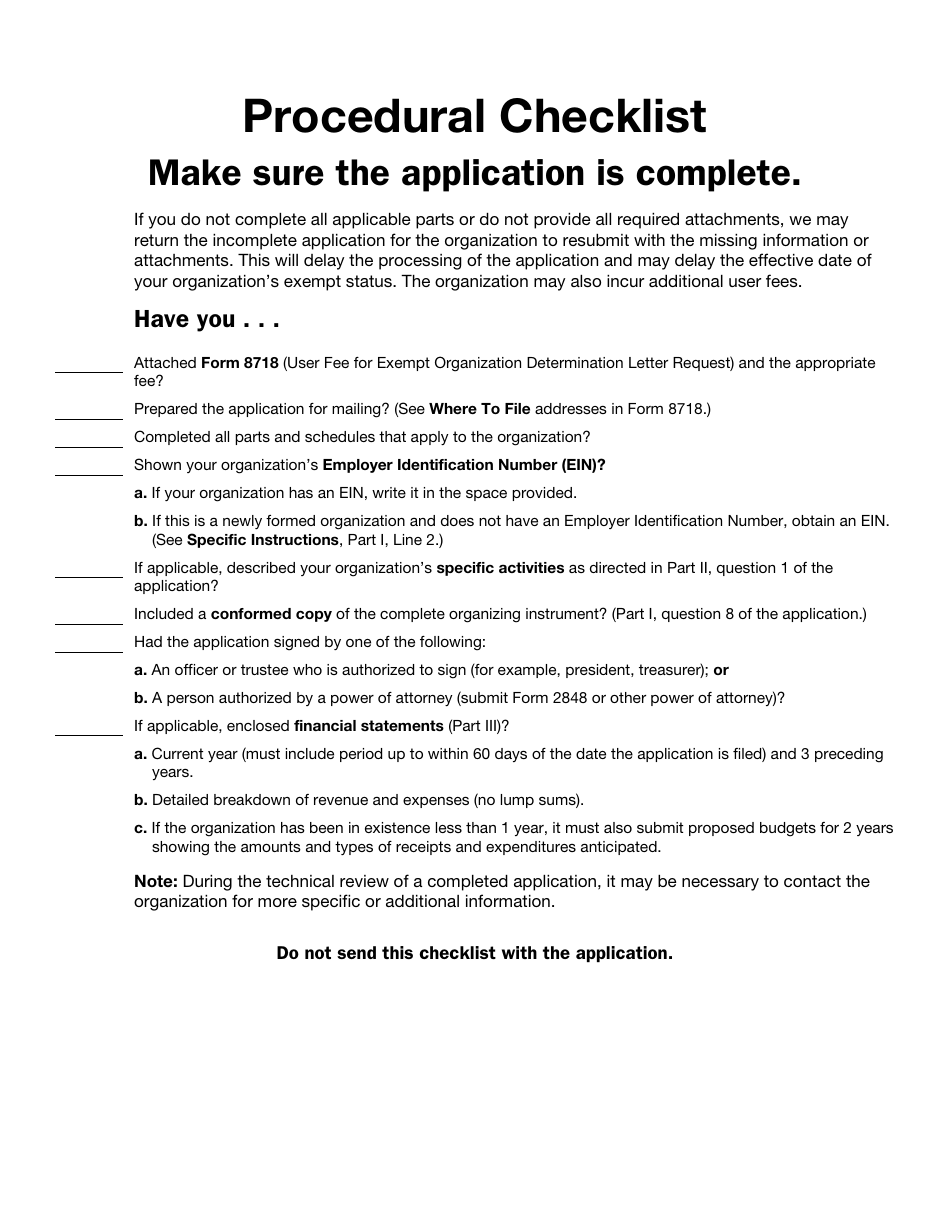

Q: What documents should be submitted along with IRS Form 1024?

A: The specific documents that need to be submitted vary depending on the nature of the organization. Refer to the instructions for IRS Form 1024 for the list of required documents.

Q: Who can help with completing IRS Form 1024?

A: Tax professionals or legal advisors with expertise in nonprofit organizations can help with completing IRS Form 1024.

Q: How long does it take for the IRS to process Form 1024?

A: The processing time for IRS Form 1024 can vary, but it generally takes several months for the IRS to review and make a determination.

Form Details:

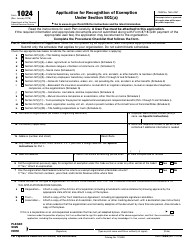

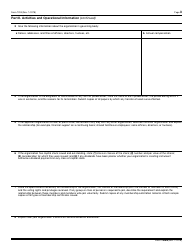

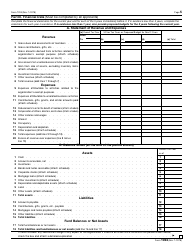

- A 20-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1024 through the link below or browse more documents in our library of IRS Forms.