This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 4684

for the current year.

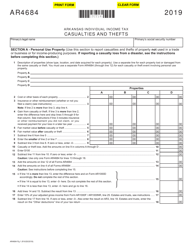

Instructions for IRS Form 4684 Casualties and Thefts

This document contains official instructions for IRS Form 4684 , Casualties and Thefts - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 4684?

A: IRS Form 4684 is used to report casualties and thefts.

Q: When should I use IRS Form 4684?

A: You should use IRS Form 4684 to report losses from casualties and thefts.

Q: What is considered a casualty?

A: A casualty is the damage, destruction, or loss of property due to an identifiable event that is sudden, unexpected, and unusual.

Q: What is considered a theft?

A: A theft is the unlawful taking and removal of money or property with the intent to deprive the owner of it.

Q: What information do I need to complete IRS Form 4684?

A: You will need to provide details about the property, the event that caused the loss, and any insurance or other reimbursements you received.

Q: How do I calculate the amount of loss to report on IRS Form 4684?

A: You generally calculate the loss by subtracting the adjusted basis of the property from the decrease in fair market value as a result of the casualty or theft.

Q: Are there any special rules or limitations for reporting casualty and theft losses?

A: Yes, there are limitations on the amount you can deduct, and certain types of losses may be subject to additional requirements or restrictions.

Q: Can I claim a casualty or theft loss if I have insurance coverage?

A: Yes, you can still claim a casualty or theft loss even if you have insurance coverage, but you must reduce your loss by any insurance or other reimbursements you received.

Instruction Details:

- This 8-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.