Instructions for Form AR4684 Casualties and Thefts - Arkansas

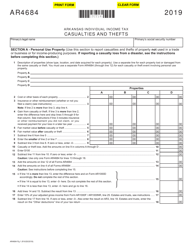

This document contains official instructions for Form AR4684 , Casualties and Thefts - a form released and collected by the Arkansas Department of Finance & Administration.

FAQ

Q: What is Form AR4684?

A: Form AR4684 is a tax form used in the state of Arkansas to report casualties and thefts for tax purposes.

Q: When should I use Form AR4684?

A: You should use Form AR4684 if you experienced a casualty or theft loss in Arkansas and need to report it on your state taxes.

Q: What is considered a casualty loss?

A: A casualty loss is the damage, destruction, or loss of property resulting from an identifiable event that is sudden, unexpected, or unusual.

Q: What is considered a theft loss?

A: A theft loss is the unlawful taking and removal of money or property with the intent to deprive the owner.

Q: What information do I need to fill out Form AR4684?

A: You will need to provide details about the casualty or theft, including the date, description, and amount of the loss.

Q: Are there any deadlines for filing Form AR4684?

A: Yes, Form AR4684 must be filed by the due date of your Arkansas state tax return, which is typically April 15th.

Q: Can I claim a casualty or theft loss on my federal taxes as well?

A: Yes, if you qualify, you can also claim a casualty or theft loss deduction on your federal income tax return using IRS Form 4684.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arkansas Department of Finance & Administration.