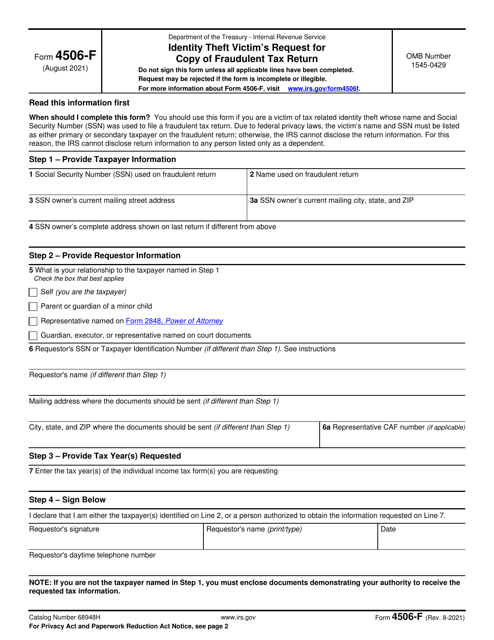

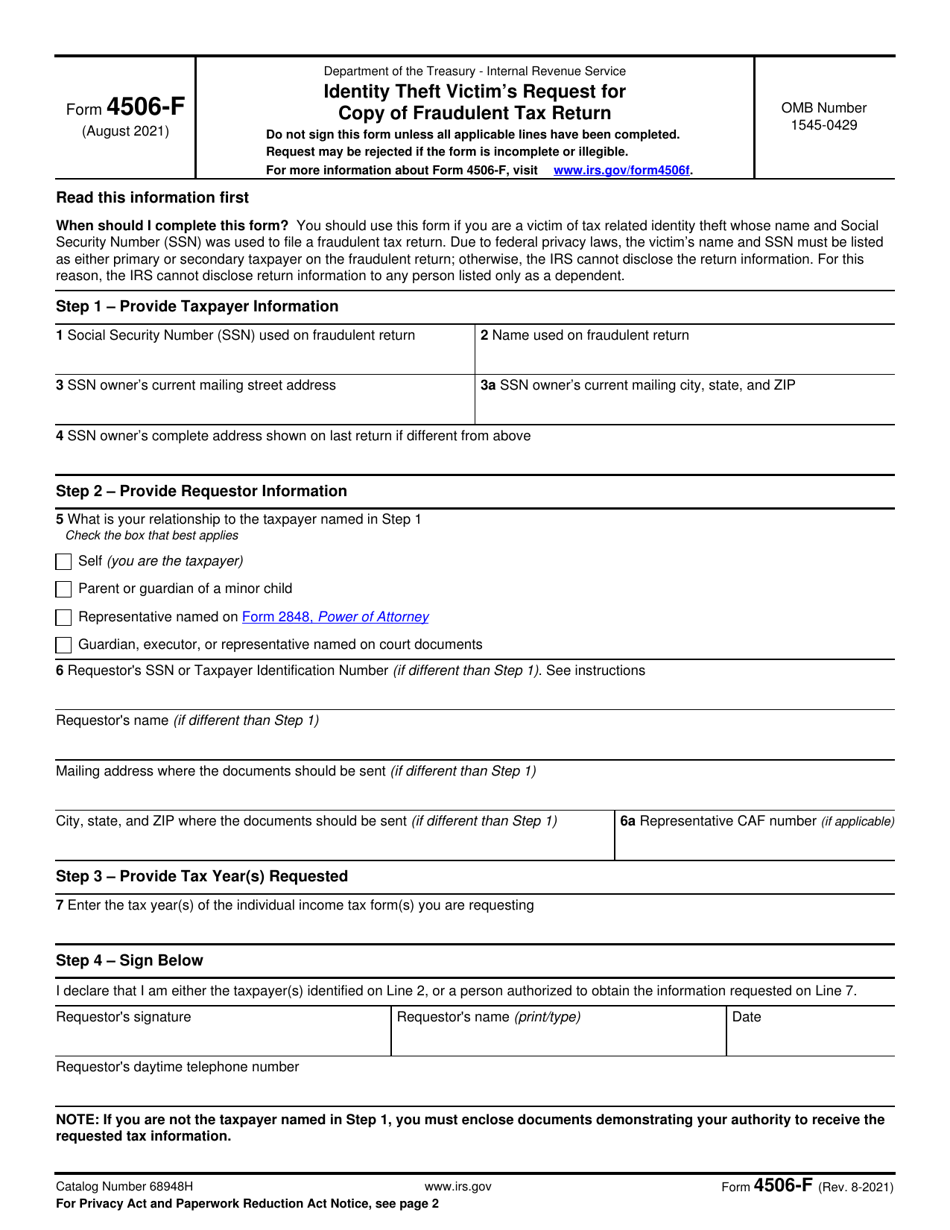

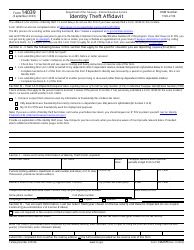

IRS Form 4506-F Identity Theft Victim's Request for Copy of Fraudulent Tax Return

What Is IRS Form 4506-F?

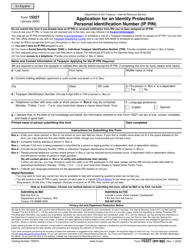

IRS Form 4506-F, Identity Theft Victim's Request for Copy of Fraudulent Tax Return , is a written instrument designed for a victim of identity theft to allow them to get a copy of the income statement that was submitted in their name. Alternatively, the information requested in this form may be disclosed to the spouse of the taxpayer in question, parent or guardian of a minor, authorized representative of the taxpayer, or person appointed to handle the estate of the taxpayer by the court.

This document was released by the Internal Revenue Service (IRS) on August 1, 2021 , rendering older editions of the request obsolete. You can download an IRS Form 4506-F fillable version through the link below.

Identify the taxpayer by their social security number, full name, correspondence address, and mailing address that was included on the previous tax return. Specify your relationship to the taxpayer and provide your personal details and add the authorization number in case a third party requests a copy of the document. Indicate the year of the tax form you want to get access to (the current tax year and six more years) and certify the papers - make sure you add your telephone number so that the IRS can reach out to you quickly. It is up to you to decide how to file Form 4506-F; however, you need to choose only one option - either send the form by traditional mail or by fax.