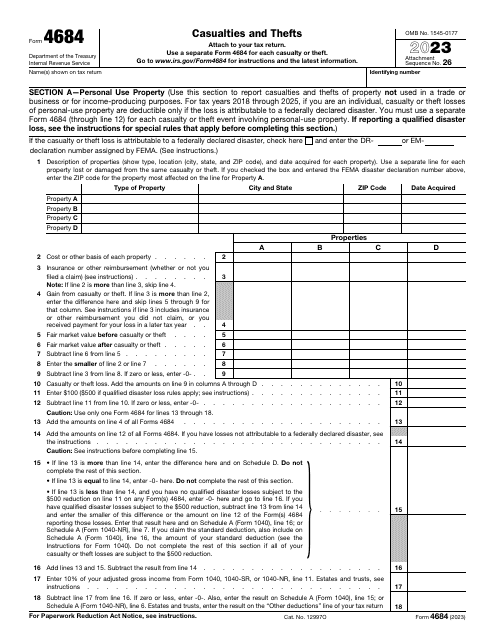

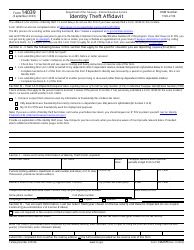

IRS Form 4684 Casualties and Thefts

What Is IRS Form 4684?

IRS Form 4684, Casualties and Thefts , is a formal statement prepared by a taxpayer who wants to confirm their right to receive a tax deduction upon property damage or loss they sustained if the reason for it was a casualty or theft.

Alternate Name:

- Tax Form 4684.

Appraise the property that was affected by those events and lower the amount of tax you owe to the government by listing itemized deductions.

This form was issued by the Internal Revenue Service (IRS) in 2023 , rendering older editions obsolete. An IRS Form 4684 fillable version is available for download through the link below.

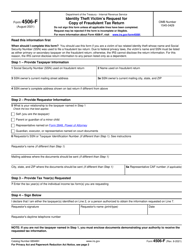

What Is Form 4684 Used For?

You may use Form 4684 if you suffered a casualty loss during the tax year or were a victim of a theft. It is possible to describe those events in a written form as itemized deductions. Note that the total loss you are reporting cannot exceed ten percent of the adjusted gross income - only this portion of the income can be deductible.

Casualties that qualify for this type of tax deduction are usually unanticipated and sudden - for instance, car accidents, floods, and fires. However, you may not file this form if certain objects were broken in an ordinary way or your pet has destroyed expensive items in your household. When it comes to theft, the definition includes various types of crimes that result in your financial loss be it extortion, robbery, or fraud.

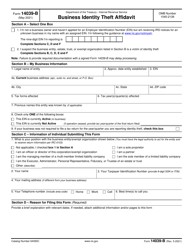

Form 4684 Instructions

Follow the Form 4684 Instructions to inform the fiscal authorities about unexpected events that led to a property loss or damage:

-

Indicate your full name (the same one you write on your tax return) and add your identifying number . Fill out the first part of the form only if you are an individual who suffered financial damages related to the property you personally use. If the theft or casualty you are outlining is a consequence of a disaster declared by the government, it is necessary to record the number assigned to the disaster by the Federal Emergency Management Agency.

-

Describe the property - different items must be listed in different boxes . Enter the state and city where the loss took place, the zip code pointing out the location of the event, and the date the objects came in your possession. Specify how much every item costs, elaborate on the insurance or alternative reimbursement you got for them, and calculate the value of the property taking into account a possible net gain or loss and the ability to qualify for a disaster loss.

-

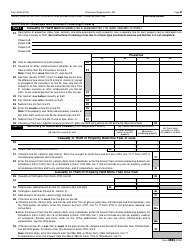

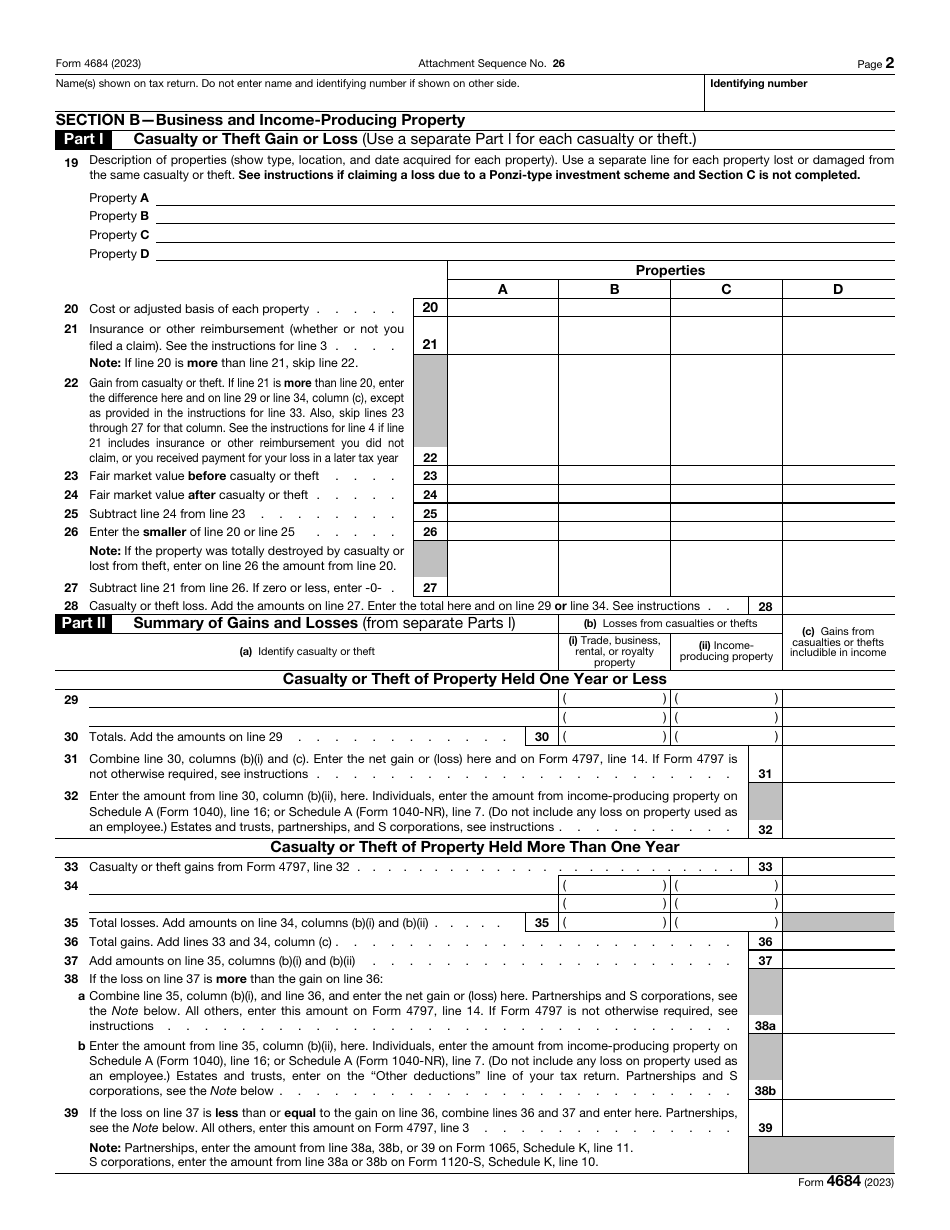

Inform the authorities about the theft or casualty that affected your business . Summarize the properties, state their cost, and compute the total amount of deduction you are claiming. You have to describe the casualty or theft that occurred, the property that produces income in case it suffered from those unfortunate events, and the gains if you filed an insurance claim or got a reimbursement.

-

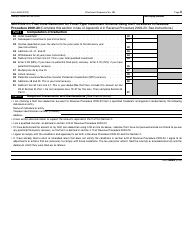

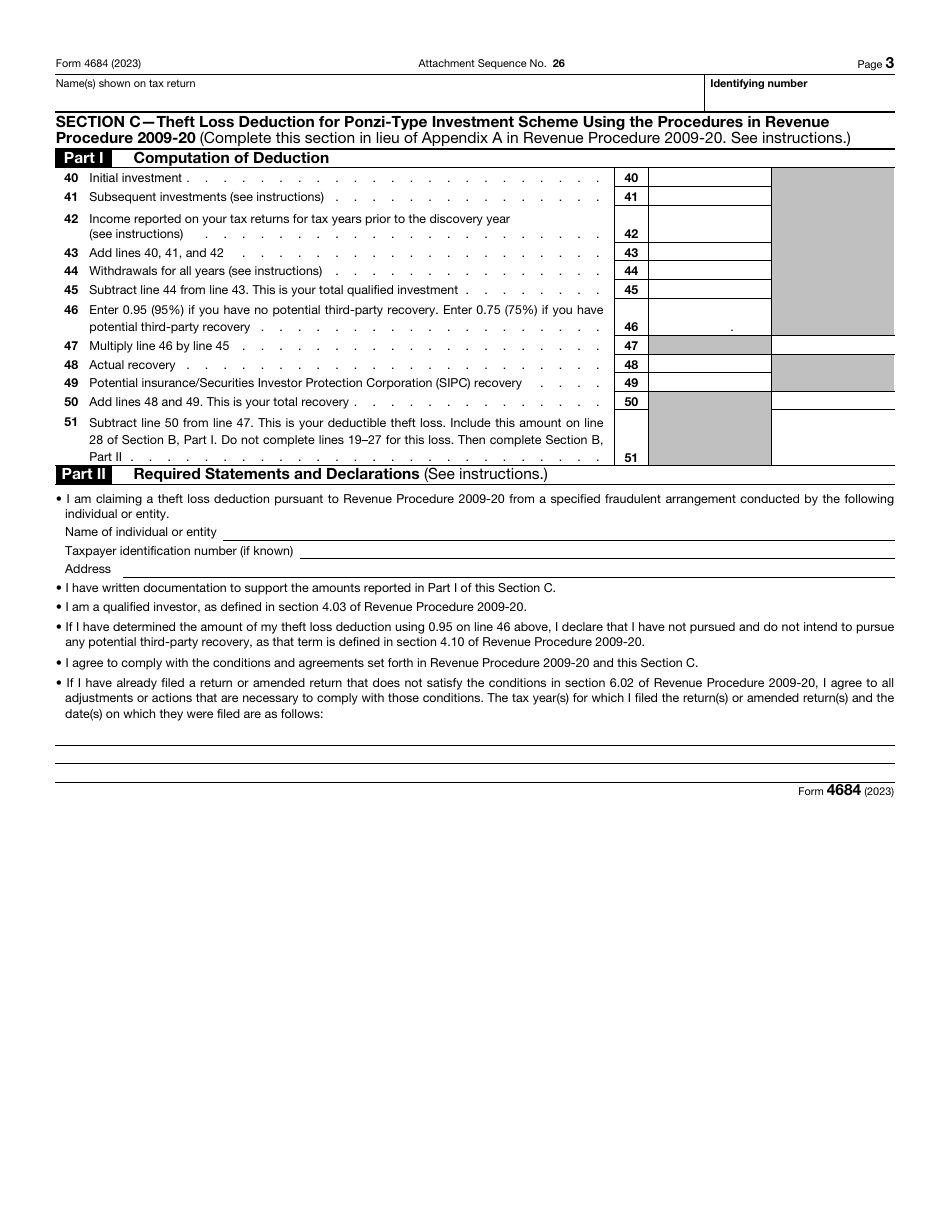

Complete the next section of the document if you participated in an investment scheme classified as a Ponzi scheme and you qualify to claim a loss deduction due to a theft taking place . Add up your original investment, follow-up investments, and the income you reported on previous tax returns. Subtract withdrawals for all the years you count, use the formulas from the form, and figure out the total amount of the deductible theft loss. Write down your name, taxpayer identification number, and mailing address to ask the IRS to investigate the fraudulent investment opportunity.

-

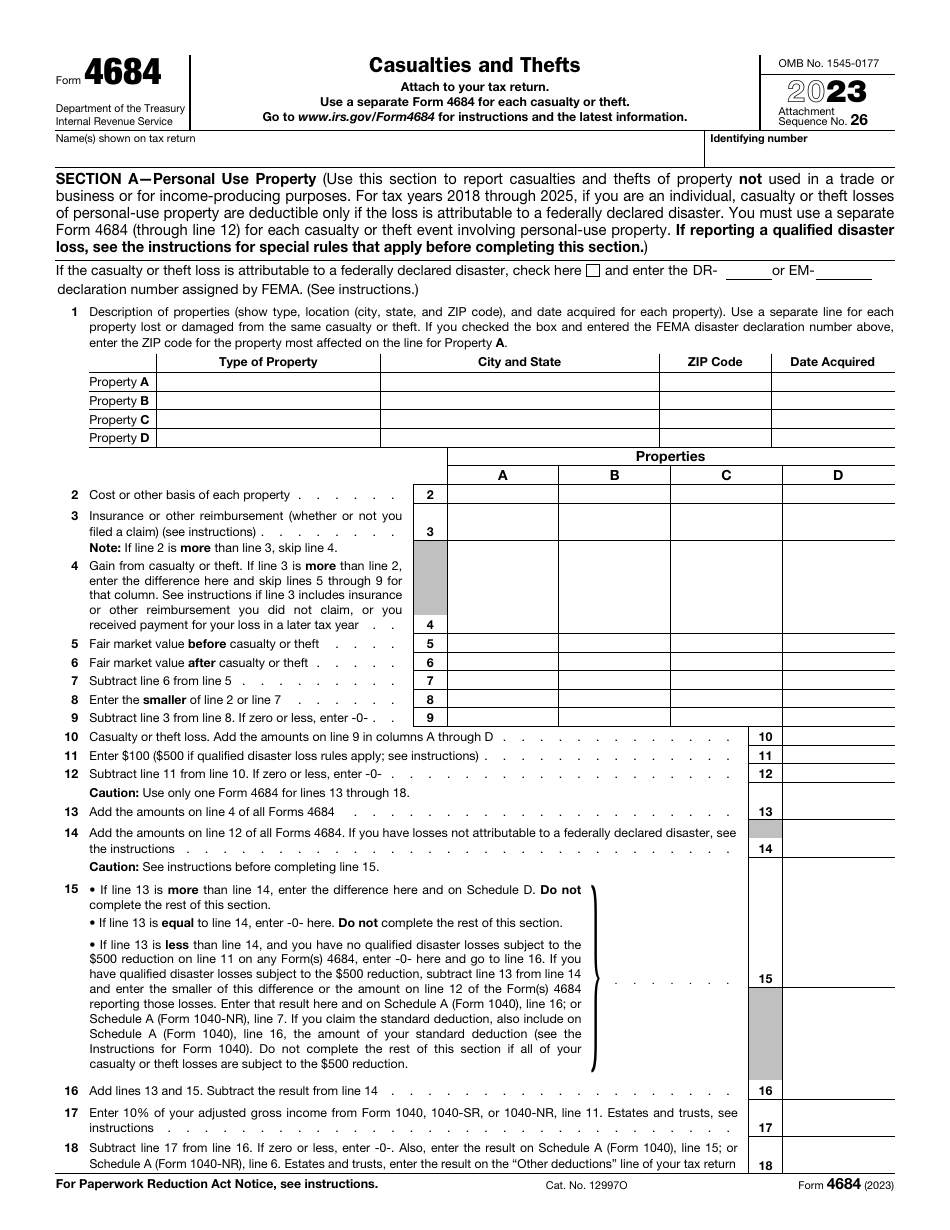

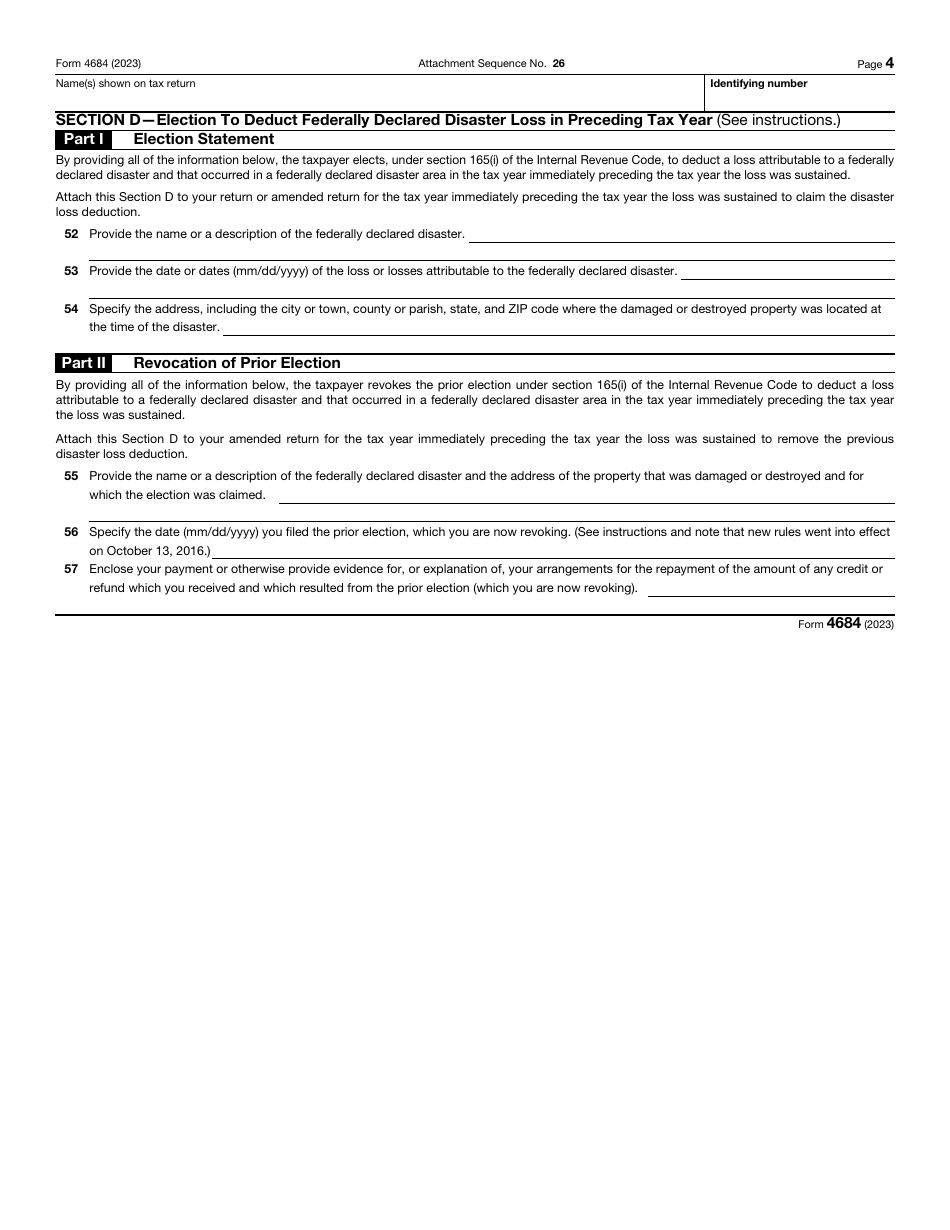

Fill out the last part of the instrument if you wish to deduct the disaster loss you described in the form for the previous year or remove the deduction from the return via filing an amended document . You will have to outline the details of the disaster in question and confirm you have paid or arranged a payment that will cover the refund or credit you received in the past. Refer to the instructions for IRS Form 4684 released by the tax authorities to ensure you complete the paperwork correctly.