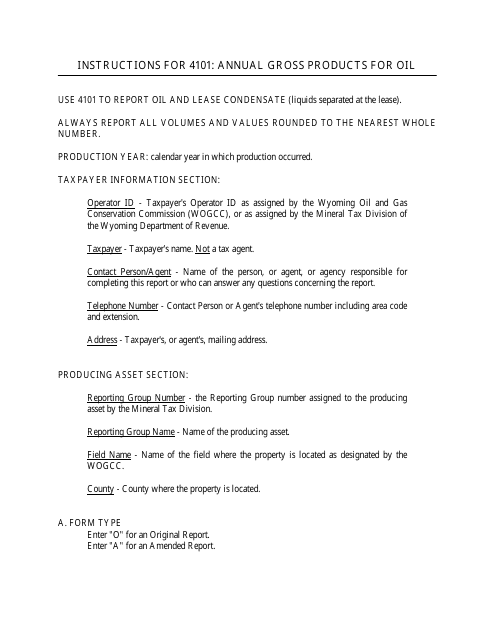

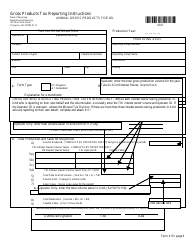

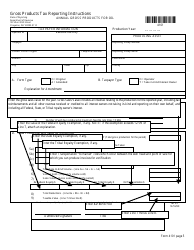

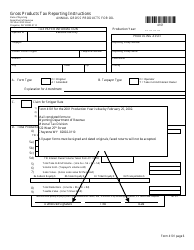

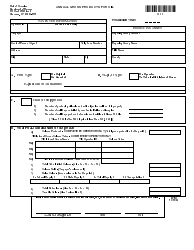

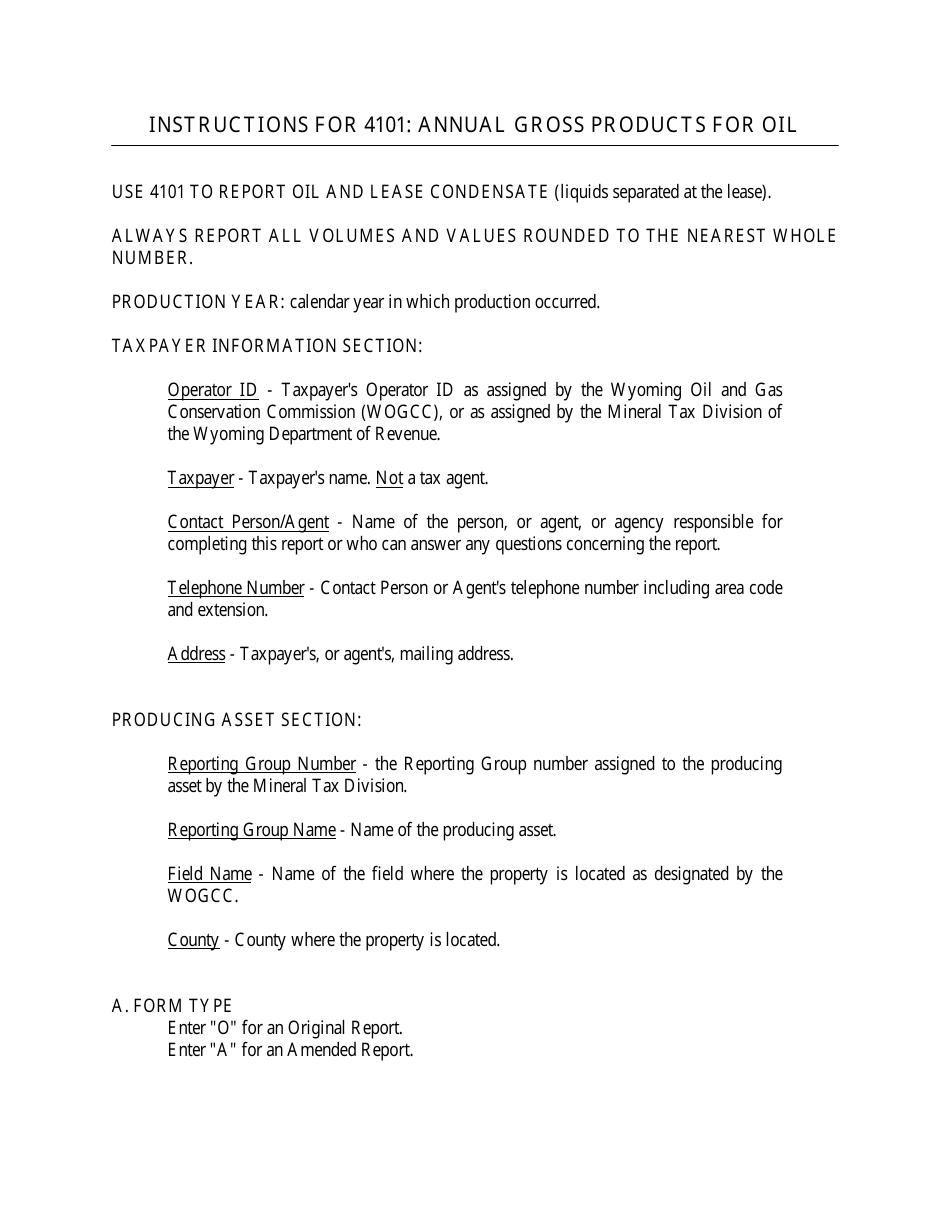

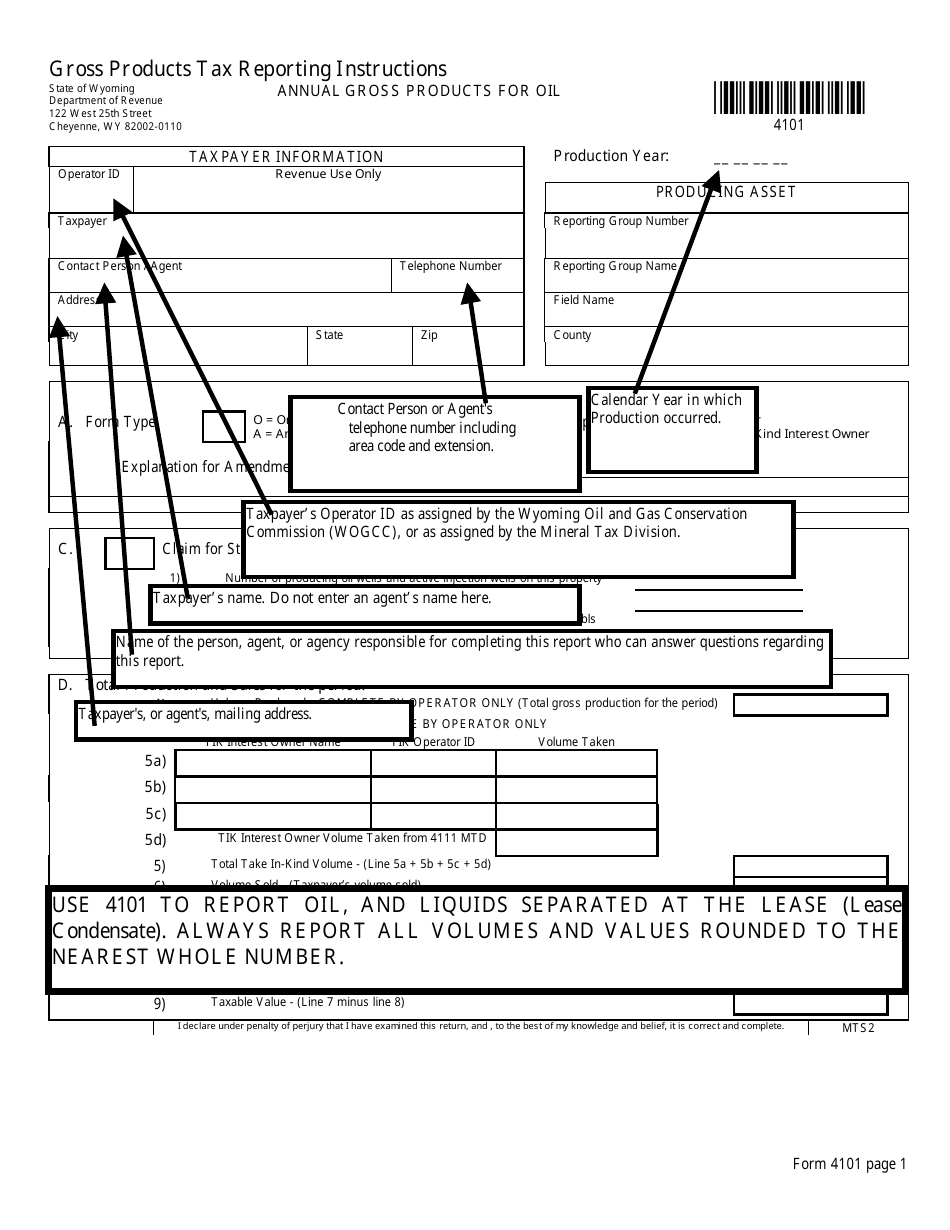

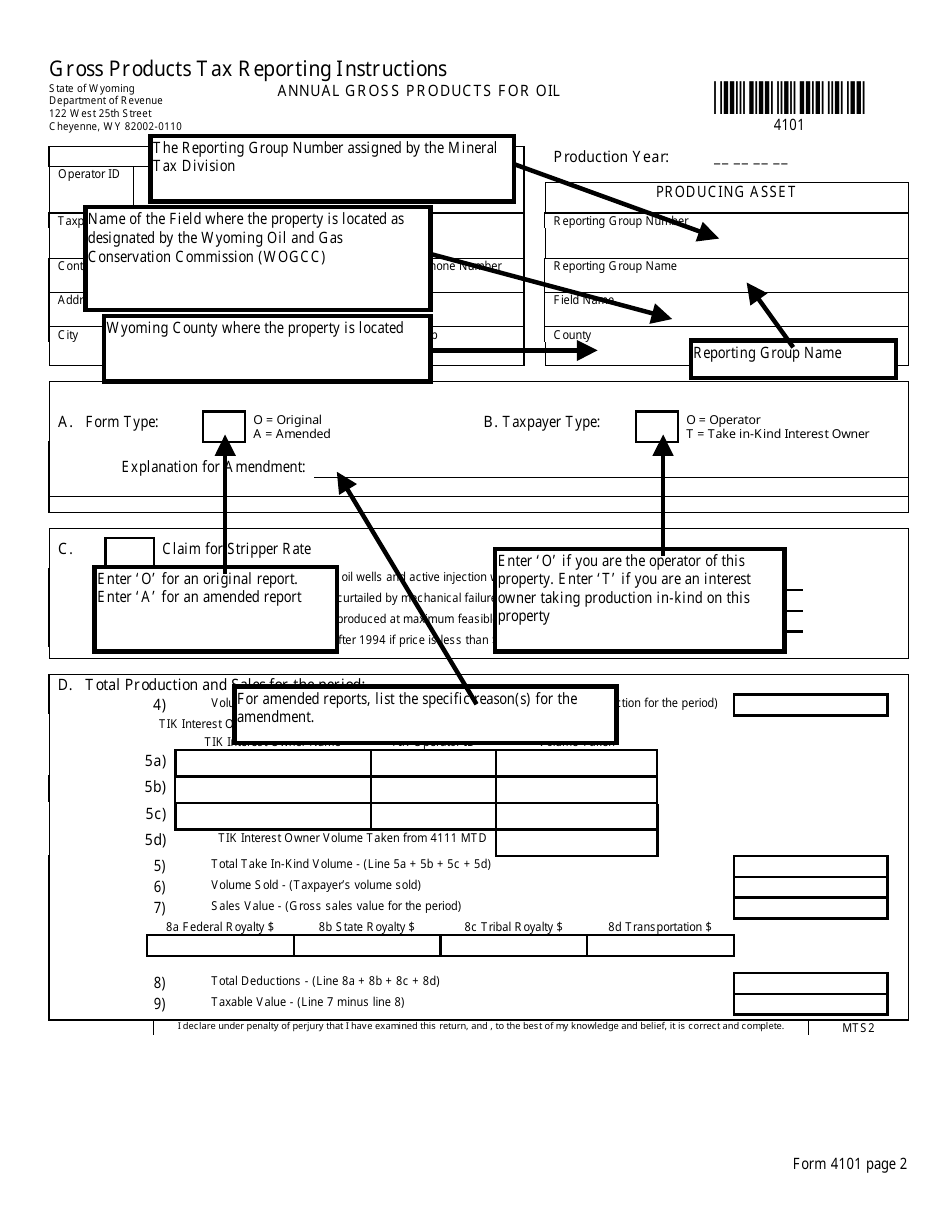

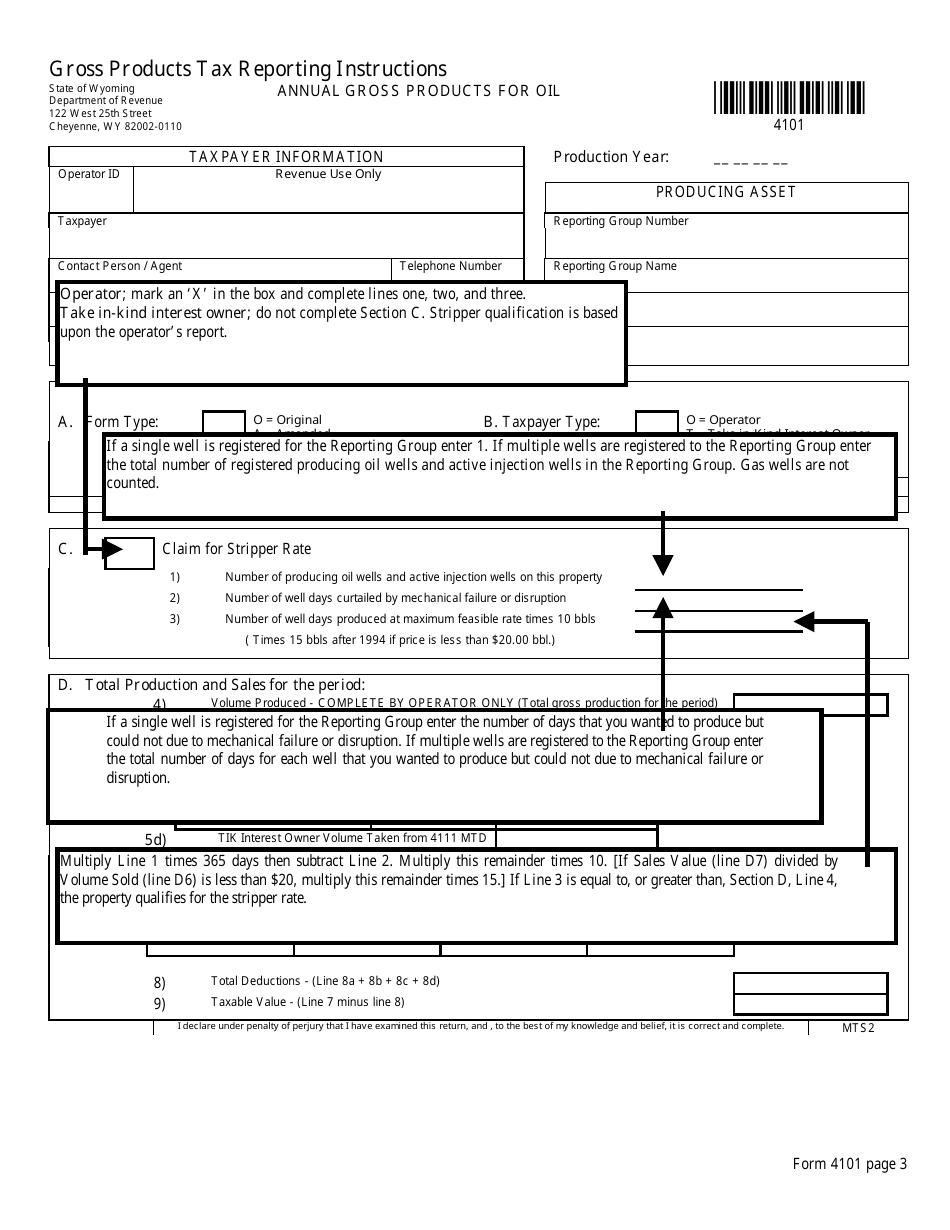

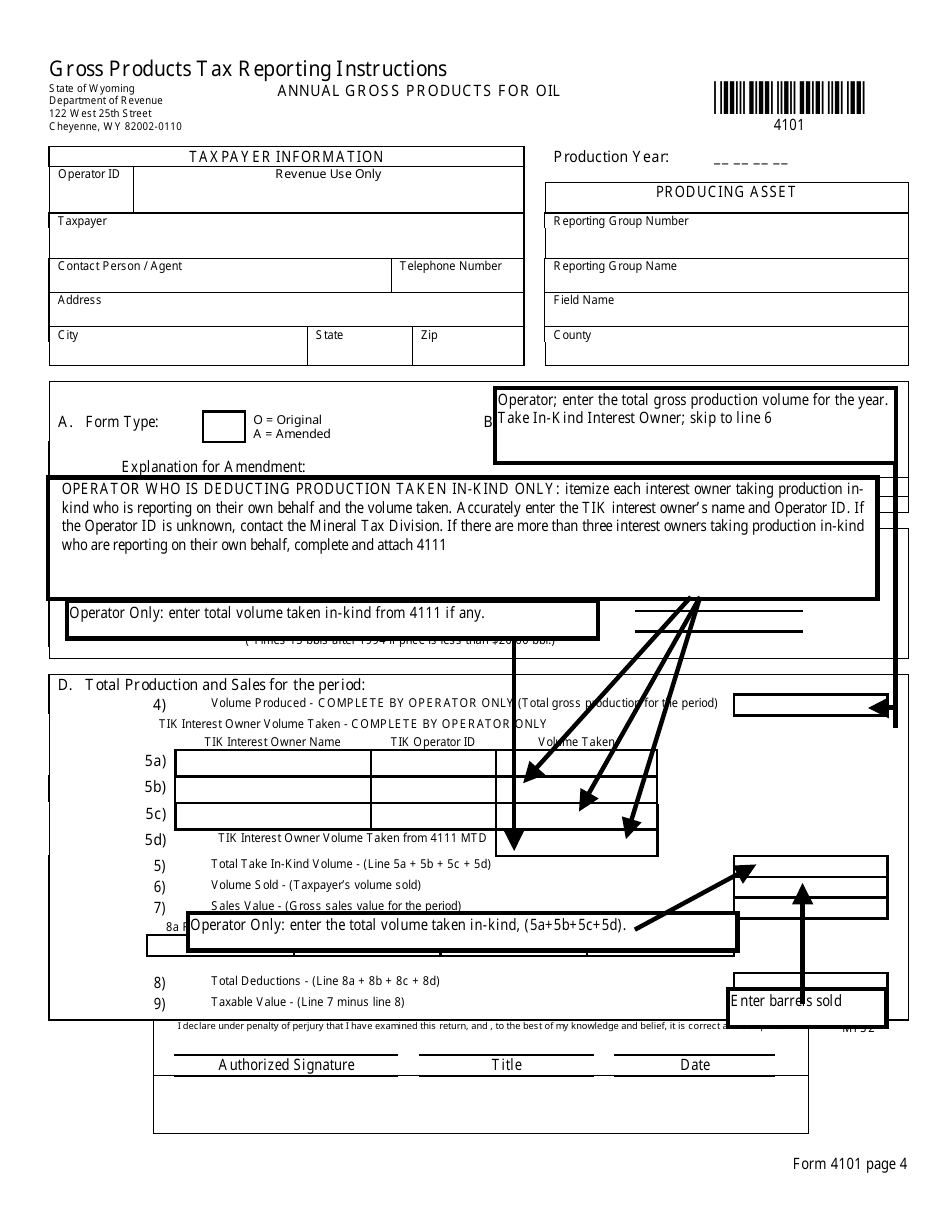

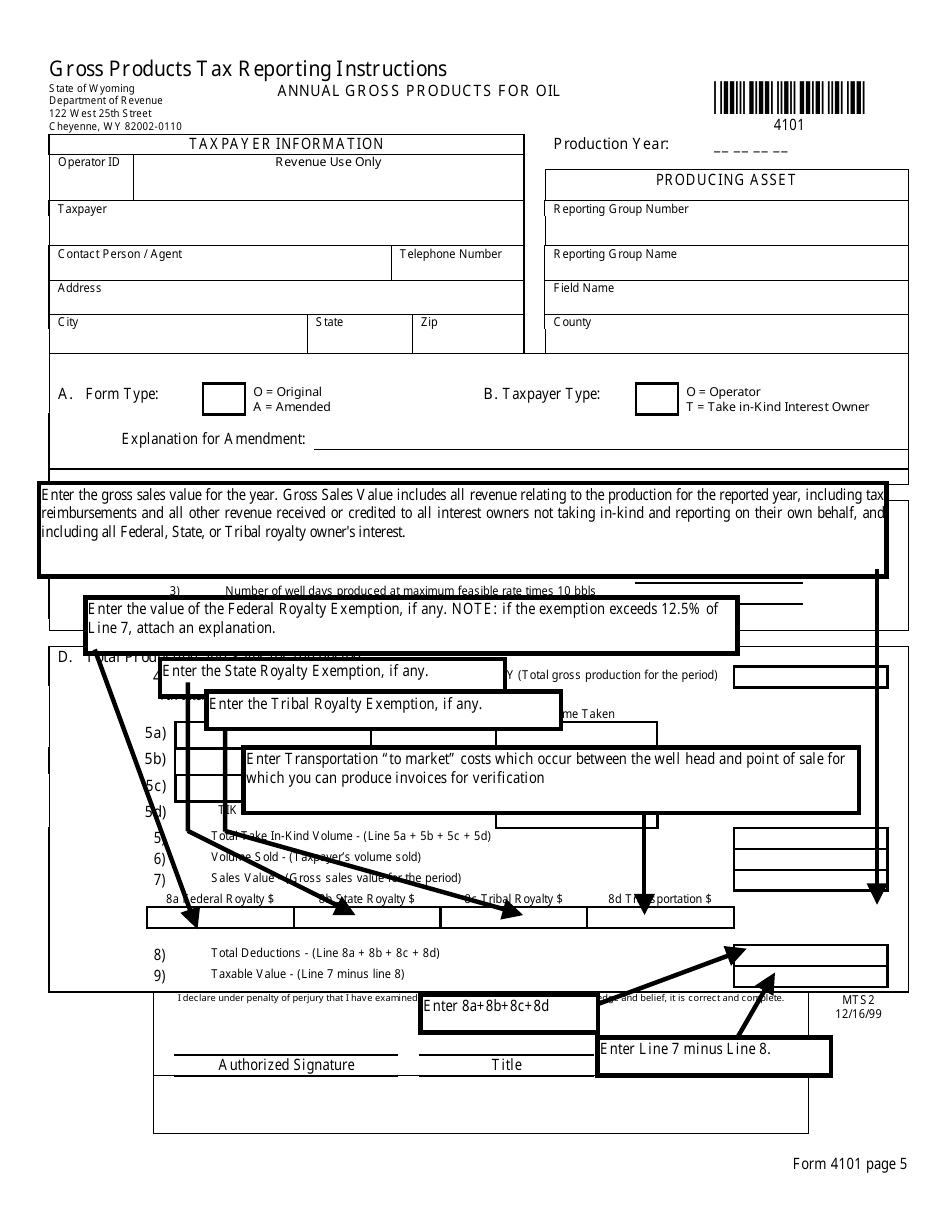

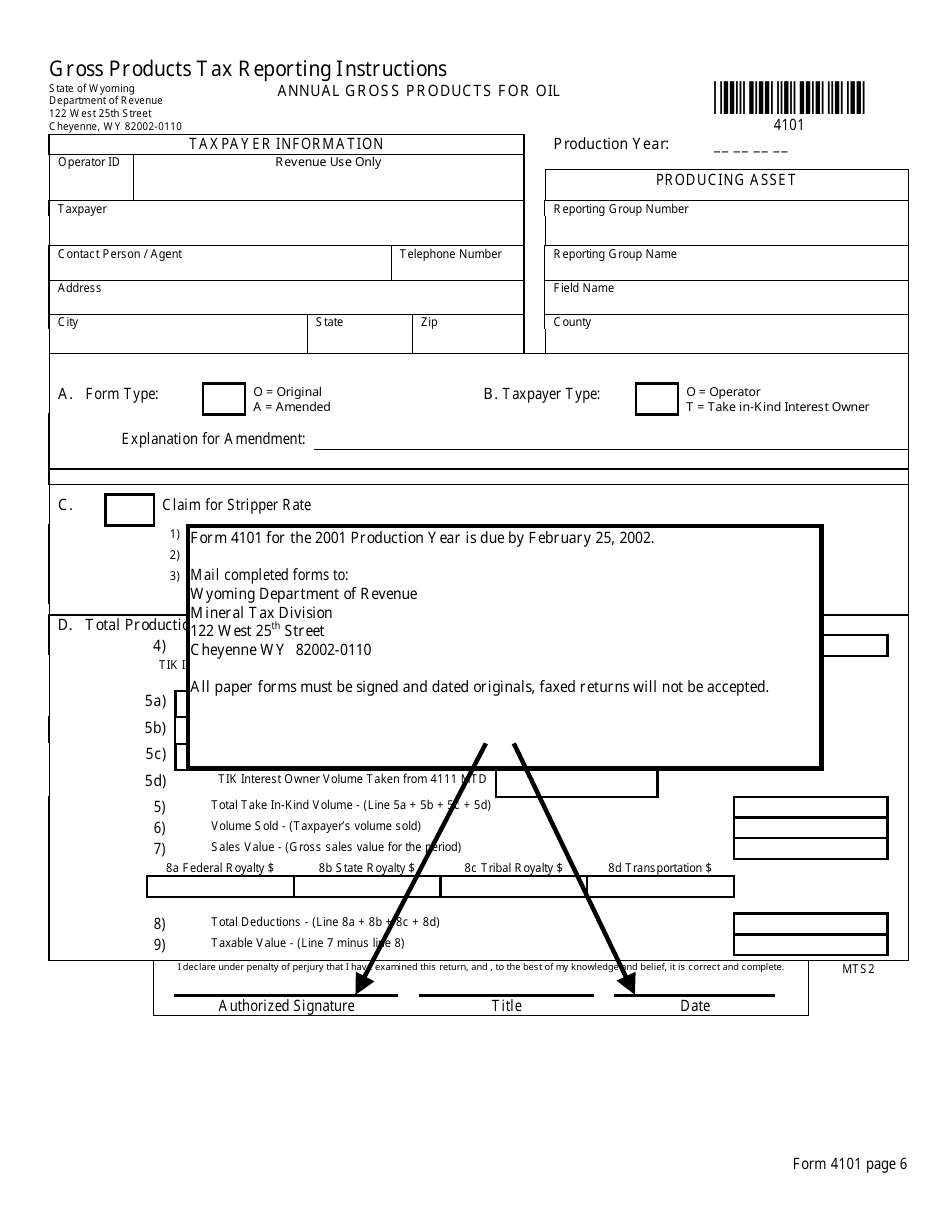

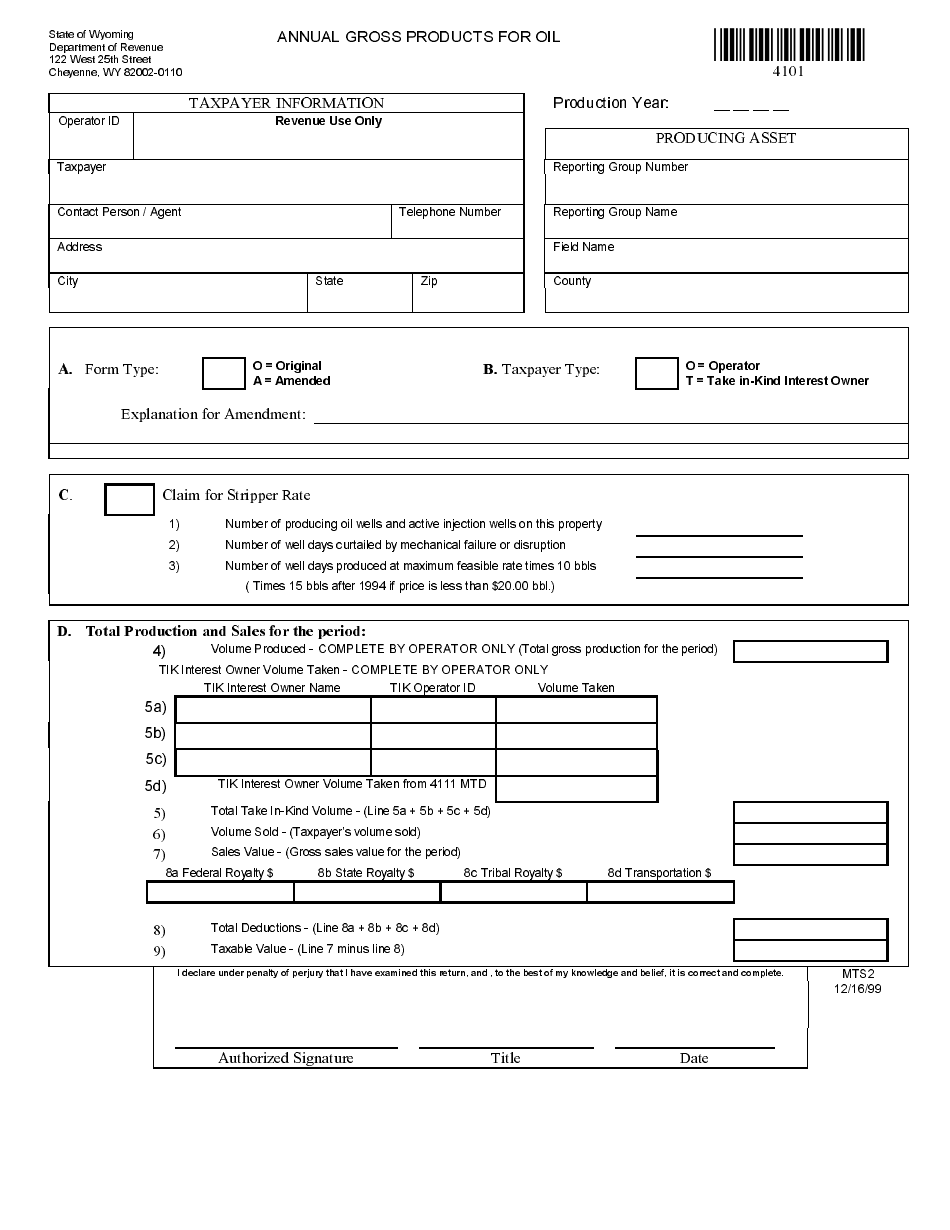

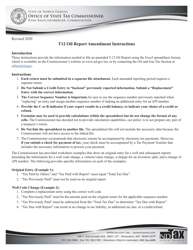

Instructions for Form 4101 Annual Gross Products for Oil - Wyoming

This document contains official instructions for Form 4101 , Annual Gross Products for Oil - a form released and collected by the Wyoming Department of Revenue.

FAQ

Q: What is Form 4101?

A: Form 4101 is a document used for reporting annual gross products for oil in Wyoming.

Q: Who needs to fill out Form 4101?

A: Any individual, business or organization that owns or operates an oil well in Wyoming needs to fill out Form 4101.

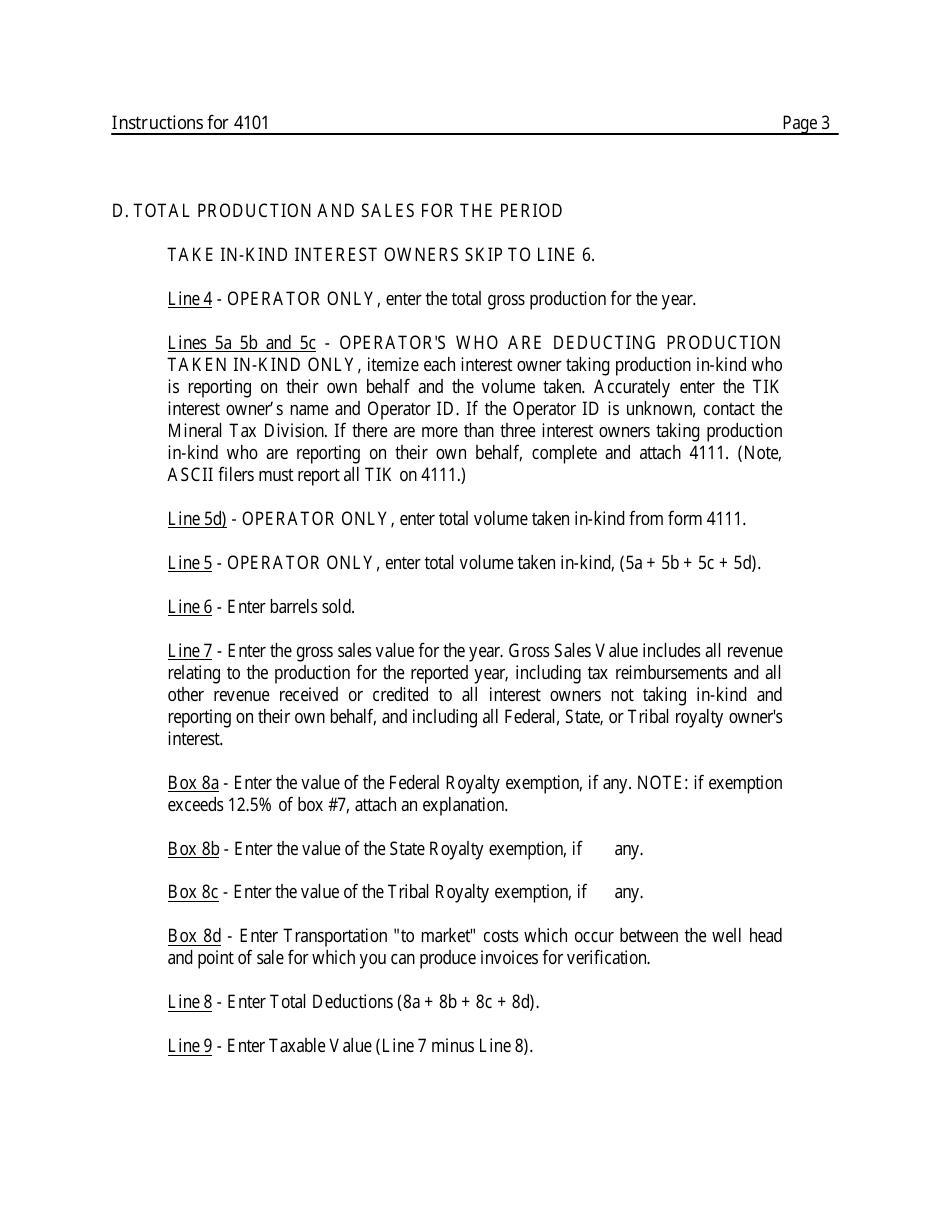

Q: What information needs to be provided on Form 4101?

A: Form 4101 requires information such as the operator's name, well identification number, gross oil production and sales information.

Q: When is Form 4101 due?

A: Form 4101 is due on or before March 15 of each year.

Q: Is there a fee associated with filing Form 4101?

A: No, there is no fee for filing Form 4101.

Q: What happens if I fail to file Form 4101?

A: Failure to file Form 4101 may result in penalties or fines imposed by the Wyoming Oil and Gas Conservation Commission.

Q: Are there any special instructions for completing Form 4101?

A: Yes, make sure to carefully review the instructions provided with Form 4101 to ensure accurate and complete reporting.

Instruction Details:

- This 11-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wyoming Department of Revenue.