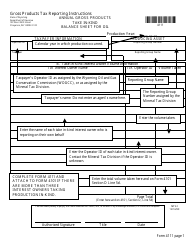

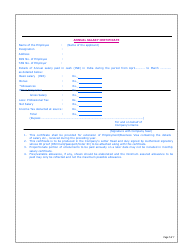

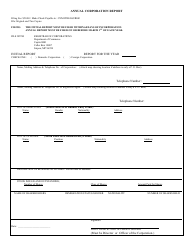

Form 4111 Annual Gross Products Take-In-kind Balance Sheet for Oil - Wyoming

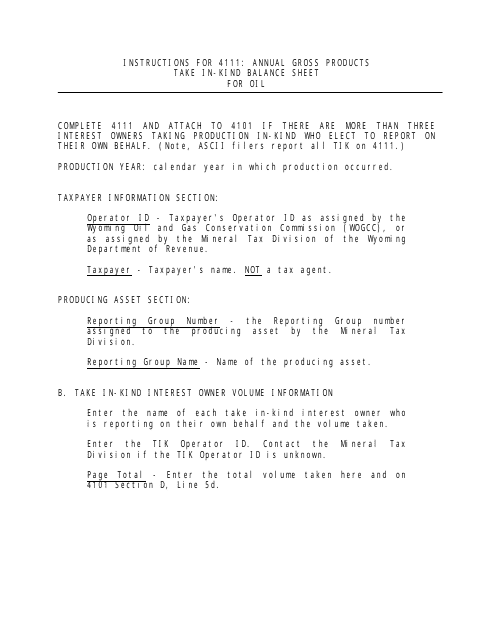

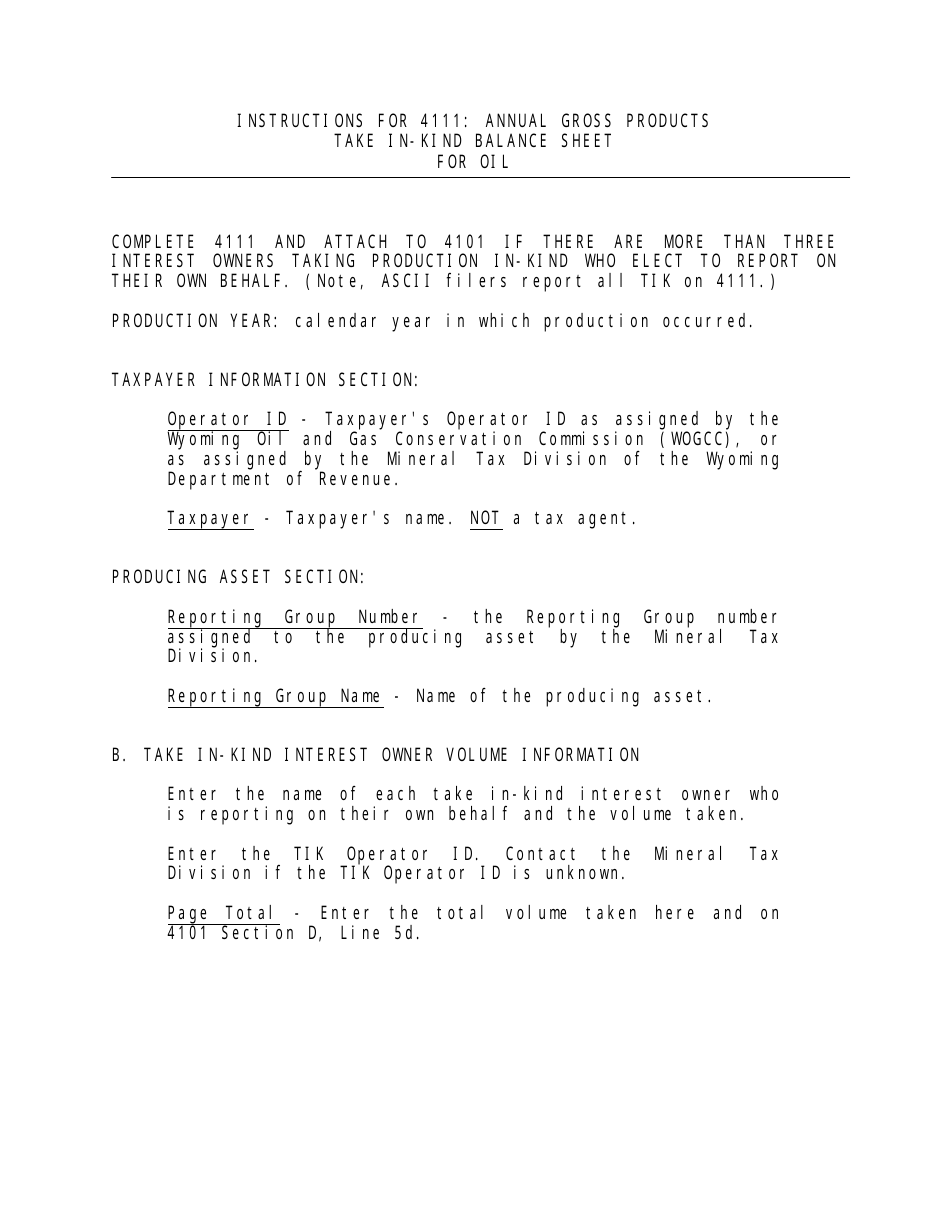

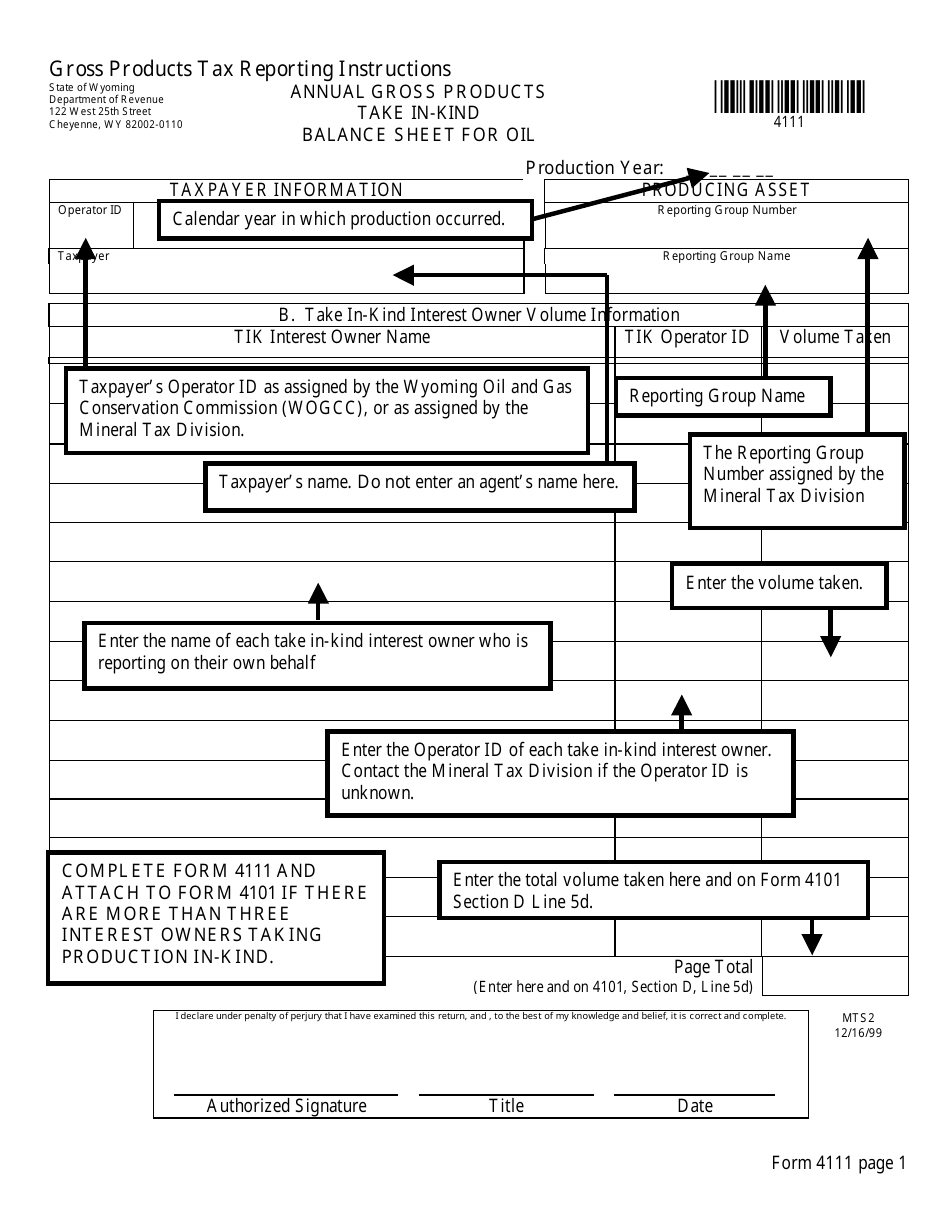

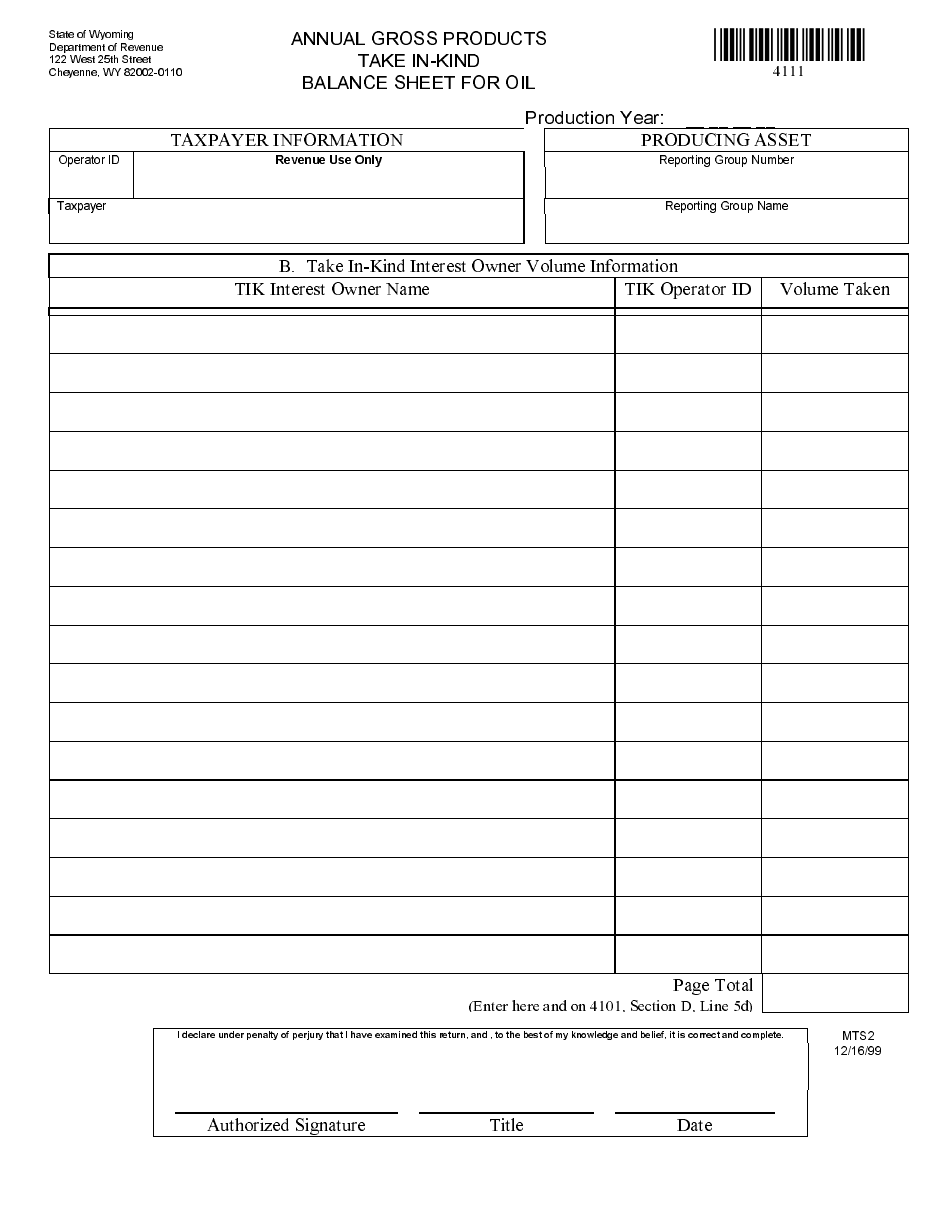

What Is Form 4111?

This is a legal form that was released by the Wyoming Department of Revenue - a government authority operating within Wyoming. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4111?

A: Form 4111 is an annual balance sheet for oil in Wyoming.

Q: What is the purpose of Form 4111?

A: The purpose of Form 4111 is to report the annual gross products take-in-kind balance sheet for oil in Wyoming.

Q: Who needs to file Form 4111?

A: Oil producers in Wyoming need to file Form 4111.

Q: What is the information required on Form 4111?

A: Form 4111 requires information about the annual gross products take-in-kind balance sheet for oil, including quantities, values, and related information.

Q: When is the deadline to file Form 4111?

A: The deadline to file Form 4111 is usually determined by the Wyoming Department of Revenue, and it is typically on an annual basis.

Q: Are there any penalties for not filing Form 4111?

A: Yes, there can be penalties for not filing Form 4111 or for filing it late, which may include financial penalties or other consequences.

Q: What should I do if I have questions about Form 4111?

A: If you have questions about Form 4111 or need further assistance, you should contact the Wyoming Department of Revenue or consult with a tax professional.

Form Details:

- Released on December 5, 2000;

- The latest edition provided by the Wyoming Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 4111 by clicking the link below or browse more documents and templates provided by the Wyoming Department of Revenue.